What are mortgage points and do you need them?

Whether it’s your first home or your fourth, the whole mortgage process can be confusing and stressful… so many decisions to make, so much jargon to decipher, so many boxes to initial.

One simple word you may hear is “points”. It sounds like such a simple word, but do you really know what points are? A point is technically one percent of your mortgage amount, or $1,000 for every $100,000 you finance.

The first type of points -- origination points -- cover the lender’s cost of processing the loan. They are a way to pay closing costs, and they can be negotiable, but they typically aren’t optional. The number of origination points varies by lender, so be sure to ask about them when you’re shopping for a mortgage lender.

The second type of points -- mortgage points or discount points -- are fees paid directly to the lender at closing in exchange for a reduced interest rate. This is your opportunity to “buy down” your interest rate, which may lower your monthly mortgage payments.

Since discount points are purely voluntary, it’s up to you to determine whether it’s worthwhile to spend the extra money upfront in order to reduce your monthly payments. Fortunately, estimating your break-even point is fairly simple, and buying down your rate makes more sense the longer you plan to live in your home.

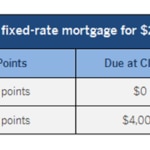

For example, based on the chart below, buying down the rate would cost $4,000 at closing and save $63 each month. It would take more than five years to recoup that upfront expense, so if you’re not planning to stay in that home for at least five years, buying discount points wouldn’t make sense.

You may choose to finance your points rather than paying cash at closing -- you can roll that additional $4,000 into your total mortgage amount. Then, based on this same example, you’d be financing $204,000 for 30 years. That increases your monthly payments at 5.5% to $1158, still saving you $41 each month, plus another $15,000 in interest expense over the 30-year life of the loan.

So, should you buy points? There is no one-size-fits-all answer, but the decision to buy discount points on your next mortgage can be relatively straightforward. Have your mortgage banker help you crunch the numbers today.

Compass Bank is a Member FDIC and an Equal Housing Lender.