Which venture capital investors are most successful?

The very concept of venture capital makes clear the possibility of losing everything invested in projects that don’t go ahead. However, there are investors with an almost flawless track record. Who are they?

2018 is turning out to be a good year for the stock market listings of technology companies. At the start of the spring Dropbox and Spotify grabbed the headlines with successful public offerings that increased the amount raised by these types of companies in the first four months of the year to $7 billion. This figure is above those for 2015 and 2016 and is within arm’s length of the figure for the whole of 2017–$13 billion–, according to figures from the market analysis company Dealogic, cited by The New York Times.

The listing of Dropbox, Spotify and Snapchat last year was the culmination of a long road on which the once small startups had set out. Beyond their founders’ vision, their metamorphosis would not have been possible without venture capital investment. These professional investors made million-dollar bets in a series of financing rounds, some of them with a good eye as witnessed by the success of their investments.

Who has the Midas touch in venture capital investment? In conjunction with The New York Times, The specialized consultant CB Insights published for the third year in a row a table of the 100 most successful venture capitalists. The study analyzes investments made between 2009 and March 2018 taking into account, among other factors, the current value of investors’ holdings and the outcome of their divestments, known in sector jargon as “exits.”

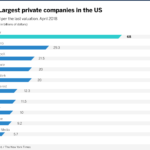

At the top of the table is Bill Gurley. Member of a long list of management boards, an engineer by training and former market analyst, the 51-year-old Gurley tops the rankings as a result of successful wagers such as Uber, the private company with the biggest valuation in the world. Gurley and his venture capital firm, Benchmark, were among the first to invest in Uber and in January of this year sold part of its stake for $900 million.

The high valuation of Uber, which is expected to list in 2019, is responsible for the top rankings of other investors such as Josh Kopelman, in third position, and Alfred Lin, in fourth. Lin, who is a member of the top management of Sequioa Capital, one of the best-known venture capital firms, also bet on Airbnb, as did Brian Singerman, who is fifth in CB Insights’ rankings and who has also invested in eye-catching companies such as SpaceX and Lyft, probably Uber’s main rival.

Most of these investors are members of venture capital firms, but Steve Anderson, who stands second in the rankings, works alone to the extent that in 2016 he declared to Forbes: “My partnership meetings are really short. Me, myself and I have a long debate". In 2017 Anderson closed a big deal with the listing of ecommerce firm Stitch Fix, of which he was the main shareholder with a stake of 28.1%. He was also one of the first investors in Instagram, which Facebook bought in 2012 for $1 billion.

CB Insights’ rankings, which are available in full here, clearly point to the United States as the home of venture capital investment. This is the home of Propel, the independent firm through which BBVA channels its investment in startups with disruptive potential in financial services. Propel and BBVA started up in 2016 with a global outlook. The company opened a second office in London and its investments include Brave Software or Guideline.