How financially literate are you?

How financially literate are you?

People with a high level of financial literacy are able to make informed decisions using the financial information they possess.

Financially literate people are able to organize the money they have to meet future goals - regardless of what these goals may be - through effective money management.

Financial literacy is becoming increasingly essential in today’s evolving financial context. A lack of financial literacy could lead to financial difficulties for people, and have a negative impact on their mental and emotional health. In other words, financial skills provide benefits that go beyond mere financial awareness.

How does financial literacy contribute to daily life?

Those who are financial literates have more successful and peaceful minds. Financial skills generally lead to an improvement of personal well-being.

To understand what financial literacy means is important in taking correct steps. Financial literacy amounts to the values, skills and self-confidence necessary to come up with quality decisions, even in accordance with our, our families’ and our society’s values.

Although becoming financially literate is not easy, it can greatly improve people’s quality of life. Therefore, financial education at an early age helps not only to gain knowledge about a specific issue but also putting them in practice and turning them into a habit.

Financial literacy helps people understand relevant concepts, and use this information to make better financial decisions. It is therefore very important to start financial education from an early age.

What is the current level of financial literacy in Turkey and around the world?

Companies and manufacturers tend to consider young people as their target group due to the size of this generation and their specific role in overall consumption. This fact makes it particularly important for youth to acquire financial skills, and gives us an idea about the relevance of financial literacy.

By analyzing data from different countries around the world, we observe that youth generally acquires financial literacy and financial decision making skills from their families, who pass their experience to their children. Unfortunately, the level of financial literacy among adults worldwide is not very promising, as shown in Standard & Poor’s Ratings Services’ Global FinLit Survey.

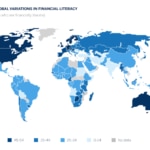

Below you can see the financial literacy levels of adults in countries around the world.

Financial literacy levels around the world.

The table shows that the financial literacy level of adults in Turkey moves in a range of 0 percent to 24 percent. These figures are problematic if Turkey’s youth depends on these adults to acquire their financial education.

For this reason, financial literacy programs are essential to raise financial literacy levels. The 5 Pebbles Social and Financial Leadership Program run by Öğretmen Akademisi Vakfı (Teachers Academy Foundation) is one example of a program working to address this need in Turkey.

How do you know if you are financially literate?

There are many different resources describing the knowledge, skills and behaviors of a financially literate person, all of which mention a number of common qualities.

If you have the skills listed below, you can consider yourself financially literate.

Financially literate people:

- Set goals and make plans to achieve these goals.

- Set aside savings for emergencies.

- Keep their financial obligations under control and do not borrow money if they are unable to repay it.

- Monitor their spending patterns.

- Understand concepts such as loans, credit cards, and debt.

- Are aware of the services banks provide.

- Are knowledgeable about investment options.

- Do not spend more than they earn.

- Set aside part of their income on a regular basis.

- Make plans for the future.

- Have a good understanding of tax-related issues.

- Use their credit cards in a way that allows them to afford the monthly payments, if any.

- Ask the right questions. (‘What is the value of this purchase for me?’, ‘Is this really a need or a want?’)

- Ask to be informed sufficiently when they spend money.

- Do sufficient research before shopping.

- Are aware of the reasons behind their decisions.

- Do the necessary research before making investments.