Tipping with a card: How much goes to the service provider?

Say you go into a hair salon and want to pay your stylist a tip, but you don’t have any cash on hand. Instead, you use your credit card and pencil in a tip amount. Given the fees merchants have to pay for the ability to accept debit or credit card payments, perhaps you’ve asked yourself how much of the tip will actually make it to the stylist. Will the merchant take a cut of it in order to help pay those fees?

Here’s the good news: By and large, the answer is no and all of that tip will make it to where it was intended to go – in the stylist’s pocket. But that’s based more on a new accord between employee/employer that’s taking hold in this new age of transparency. You’ll see that at play in Uber’s acquiescence to demands that it allow riders to tip its drivers. Not only did it build such capability into the app, but it also made a point to spell out that 100 percent of those tips will go to the drivers. Uber, in other words, is absorbing all fees associated with the payment of those tips so that the driver gets the full amount.

Uber isn’t legally bound to do that. According to this fact sheet on tips by the Department of Labor’s Wage and Hour Division, when a tip is charged to a credit card and the merchant has to pay the company card a percentage of each sale, the merchant is fully within its rights to deduct that percentage from the tip. A merchant can pay the tipped employee 97 percent of the tips, for example, if the credit card company charges 3 percent to process that sale. But merchants who do that risk alienating their employees.

Any employee who earns a significant portion of their wages through tips should make sure they understand where an employer stands on the issue

“No, it’s not absolutely guaranteed that a merchant will give 100 percent of those tips to the employee,” said Adam Spencer, director of Merchant Acquiring for BBVA Compass. “But it’s definitely a powerful value-added benefit that a merchant can offer, and any employee who earns a significant portion of their wages through tips should make sure they understand where an employer stands on the issue.”

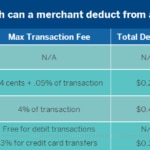

If merchants do choose to deduct transaction fees on tips before disbursing them to their employees, they can only deduct the amount they’re charged. They can’t tack on an extra surcharge, in other words. If they’re charged 2.75 percent by the credit card company, then they can deduct only 2.75 percent from the tip. And that’s where different forms of payment actually do make a difference.

The chart above is a vastly simplified snapshot of how the different forms of payment can affect the final tip amount that a service provider would get if the merchant does deduct transaction fees. There are a number of factors that can affect the amounts -- there are different fees for a debit-card purchase made using a PIN versus a signature, for instance, and different credit-card companies charge different fees -- but all would generally fall in these ranges.

If your primary concern is making sure as much of the tip as possible goes to the employee, then you have a few options but they all start with one thing: Asking the merchant if it takes a cut of the tips to pay for transaction fees.

“Once you get your answer to that, then you can adjust accordingly,” said Spencer.

There is an important caveat to consider: Even if a merchant does not deduct transaction fees from tips, there may be other ways it’s recouping those costs, whether it’s through marginally lower hourly wages or some other manner.

“It’s never going to be 100 percent cut and dry,” Spencer said. “But this is about understanding where some of the answers lie so that consumers feel empowered when they’re making their choices.”

It’s never going to be 100 percent cut and dry. But this is about understanding where some of the answers lie so that consumers feel empowered when they’re making their choices