The evolution of card spending improved in Spanish regions where reopening is most advanced

The relaxation of pandemic restrictions has given consumption a boost in those Spanish regions that first moved into phase two of the country’s reopening. BBVA Research's weekly analysis measuring debit and credit card spend reveals that for regions remaining in phase one, previous consumption improvements (coming out of the transition from phase zero to one) stalled, with declines last week of May standing firmly at between 10 and 15 percent.

During the first half of April, the lockdown reduced weekly card spend by about -60 percent, year-on-year. May, however, saw a recovery in consumption, driven by various regions moving into new phases and the easing of restrictions. Specifically, progress in the reopening process has moderated the contraction in spend, moving from -47 percent the week ending May 10th to -37 percent the week ending May 17th, then moving up to -21 percent the week ending May 24th, and to -14 percent from May 25th to the close of the month.

In other words, Spanish provinces that advanced to phase two of the reopening on May 25th continued to show positive trends through May 31st. In those regions,consumption saw an 8 percent year-on-year increase. In those provinces that remained in phase 1, the improvements in consumption were hampered and saw falls of between 10 and 15 percent in the last week of May.

Spending increased in 32 provinces the week of May 25th through May 31st, compared to the same period in 2019. Of those 32 provinces, 28 are now in phase two of Spain's reopening. In these regions, the spending growth impact of advancing to a new phase reached 16 points. This is a similar impact to that which occurred when these same regions previously transitioned from phase zero to phase one.

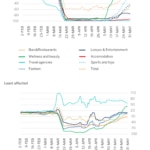

Which sectors are leading the consumption recovery?

The rebound in card spending has occurred for the most part in sectors related to food products, household equipment, health, books and mass media, and large-scale retail outlets. In contrast, spending on recreation and travel showed no signs of improvement, since they are sectors highly affected by the restrictions still in force.

As Spain's reopening has progressed, the easing of restrictions has driven face-to-face purchasing, which has inverted the growth differential compared to online purchases. Online spending has dropped to 15 percent of the total compared to 18 percent a year ago.

A sector analysis shows that online spending has increased in categories related to household consumption, whereas it has seen a decline in areas related to travel, transportation, commuting, and accommodation. If we analyze the spend by region, Internet purchases have grown more in those regions that started off with lower e-commerce penetration. Madrid, Catalonia, and the Balearic Islands — the areas with the most developed pre-pandemic online commerce — have negatively skewed the online spending figures for the whole of Spain.

Increased spending, by province

In all the provinces that advanced to phase two, except Teruel, the Balearic Islands, and La Rioja, purchasing increased. The Mediterranean provinces that continued in phase one from May 18th (Girona, Lleida, Granada, Malaga and the region of Valencia) have weighed down the spending trend in the last week of May.

Melilla has shown the greatest consumption rebound, alongside Cuenca, Pontevedra, Ceuta, and Navarra. País Vasco and Asturias are other regions where spending increased significantly last week. Navarra, Asturias, Galicia, Extremadura, País Vasco, Cantabria, Castilla-La Mancha, Aragon and Murcia moved into positive territory. By contrast, Madrid and the Balearic Islands experienced a weaker recovery in consumption.

Performance in the rest of the world

Internationally, the end of some mobility restrictions explains the improvement in consumption indicators, always measured as a function of debit/credit card spending. This trend is plainly evident in the U.S., but can also be seen in Turkey, Mexico, and Spain. Countries in South America, however, like Colombia, Peru, and Argentina where the pandemic is currently having a greater impact, are lagging behind in consumption recovery.

Globally, industries related to foodstuffs continue seeing the greatest benefits, but other sectors such as healthcare and transportation have been improving in recent weeks.

Spending on tourism, entertainment, and hotels, where the economic impact of the pandemic hit earlier and deeper, is beginning to show some slight signs of improvement in some countries.