Why will banks pay increasingly close attention to nature and water?

The protection of nature and its sustainable management is a matter of the very survival of the planet. Moreover, a growing number of financial institutions are becoming aware that this field offers a real opportunity. The deployment of long-term strategies, the role of investors and shareholders, and increasingly stringent regulation paint a brighter picture.

Forests supply food, timber, medicine and jobs. They are a natural regulator of water, a major atmospheric filter and the best containment barrier against torrential rains and erosion. They are also home to millions of people and constitute the largest redoubt of the Earth's biodiversity. And forests are our best ally in capturing some of the greenhouse gases (GHGs) that are driving climate change. Yet we continue to destroy our forests at an alarming rate.

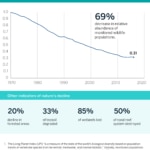

Since the turn of the 21st century, 7% of the Earth's remaining primary forest, meaning forest stands that are considered untouched by human influence, have been lost. In 2022 alone, 4.1 million hectares vanished, according to data from the World Resource Institute and the University of Maryland. Deforestation is driven by the expansion of agriculture (particularly soybean and oil palm cultivation) and cattle ranching, mining and timber harvesting, among other activities.

Top five reasons to pay attention to nature

Effectively protecting 30% of land, ocean, coastal zones and inland waters; reducing by more than $500 billion annually the government subsidies that lead to destruction of nature; and cutting food waste by half. These are some of the priority targets set by the Kunming-Montreal Framework for Global Biodiversity signed last year by nearly 200 countries. And all this before 2030.

Living planet report 2020: Bending the curve of biodiversity loss, World Wildlife Fund (WWF), 2020.

Protecting biodiversity means bolstering human food and water security, caring for the largest reservoir of medical resources we possess, shielding some of the world's strongest natural defenses against the effects of climate change, protecting human and animal health, and strengthening the myriad economic activities that depend on the environment. Against this background of growing concern for biodiversity, the consulting firm McKinsey & Company points out in its paper 'Nature, water and banking' five main reasons why the banking and finance sector is paying increasing attention to nature:

- Competitive pressure. The world's leading banks have undertaken risk mitigation related to nature. Some financial institutions have now started to build their long-term strategies around its protection.

- The role of investors, shareholders and other pressure groups. A growing number of organizations are lobbying in a similar way to long-standing efforts to reduce the impact of climate change, but now with a focus on nature protection. Pressure is also emerging from the industry itself, through platforms such as Share Action, Nature Action 100 or Portfolio Earth.

- Increasingly stringent regulations. From the end of 2024, banks operating in the European Union will be required to publicly report on their impact (and their plans to mitigate it) on topics such as pollution, water use and biodiversity loss. In addition, by the same date, the European Central Bank will require banks to have in place frameworks for the management of natural risks.

- The losses and risks are real. Close to 75% of loans in the euro area go to companies that rely heavily on at least one ecosystem service, meaning a service that is generated by the natural functioning of an ecosystem itself and that benefits society and improves people's health, economy and quality of life. Ecosystem services range from the sourcing of wood and food to the regulation of the water cycle. The potential losses arising from the destruction of nature in the medium term are similar, in some sectors, to those caused by climate change.

- Business opportunities. The transition to a nature-friendly economy calls for major changes and a considerable financial effort. For banks, this represents opportunities to develop new products such as nature-linked funds, for example, trading and advisory platforms, and support for change-enabling businesses.

Nature in the balance: What companies can do to restore natural capital. McKinsey & Company

Opportunities arising from stewardship of nature

The opportunity brought by the transition is highly significant, according to McKinsey's analysis. "The capital needed for nature and biodiversity-related activities exceeds $6 trillion per year from now until 2030," notes David Gonzalez, a senior partner at McKinsey & Company. "Beyond agriculture, investment opportunities with a positive impact on nature include infrastructure-related actions, mining impact mitigation, industrial mineral materials processing, ecotourism and biodiversity protection, to name a few," he adds.

These opportunities encompass sustainable building retrofitting; nature-based infrastructure development; water management; enhancing the sustainability of trade and logistics; recycling and waste reduction; sustainable agriculture and food; land and forest management; extractive industry reform; nature-friendly renewable energy development; and sustainable management of marine resources.

Water is a priority

The upcoming United Nations Climate Change Conference (COP28) in the United Arab Emirates will largely revolve around the implementation of the Paris Agreement. But the summit will also devote considerable time to discussing water: the protection and restoration of freshwater ecosystems, the water resilience of cities and the management of this resource in agriculture.

According to our analysis, the annual value of investments in the global water market will reach $1.2 trillion by 2030, with an estimated annual growth of 3-4% until then. The biggest opportunities are in urban management, industry and agriculture," says Santiago Fernández, a partner at McKinsey & Company. According to the consulting firm, the most attractive opportunities for the financial sector in particular are in:

- Technology that provides access to alternative water sources, wastewater recycling and efficient water use to support the energy transition, among other topics.

- Physical and digital infrastructure to reduce losses, improve efficiency and strengthen wastewater management.

- Nature-based solutions. Many of the defenses against the shocks of climate change revolve around water: aquifer regeneration, flood management and erosion reduction.

Climate change mitigation and adaptation will continue to be a priority in the coming years. But an increasing number of sectors, and the financial sector in particular, are realizing that the environmental crisis goes far beyond climate. The destruction of nature and water scarcity translate into serious risks. So banks and other institutions will continue to realign their strategies to cope with these new sources of risk and embrace the opportunities of the transition to an environmentally friendly economy.