Francisco González calls for “joining forces” to improve financial education

BBVA Global Executive Chairman Francisco González, together with Queen Maxima of the Netherlands and OECD Secretary General Ángel Gurría, presented the 2015 PISA Report on Financial Literacy. According to the conclusions of the study, Spain sits below the OECD average. BBVA’s Global Executive Chairman called for “everyone to join forces to make progress in an issue that is so significant to people’s well-being” like financial education.

Spanish youth failed in finance for the second time in a row according to the conclusions of the OECD’s Programme for International Student Assessment (PISA) Report, sponsored by BBVA. It seeks to find out what level of knowledge and skills young people have to make financial decisions. 48,000 15 year old students in 15 countries participated in the study – a sample that represents 12 million youth.

Although Spain has moved up in the ranking from 12th in the 2012 PISA to 13th in the 2015 PISA with a score of 469 compared to the OECD average of 489.

Francisco González: "These results have to serve to encourage everyone to join forces to make progress in an issue that is so significant to people’s well-being

These results “have to serve to encourage everyone to join forces to make progress in an issue that is so significant to people’s well-being,” said Francisco González, BBVA Global Executive Chairman at the presentation of the 2015 PISA Report in Paris.

Francisco González underscored that “all public and private institutions are relevant in this regard. That’s why BBVA continues to invest in financial education programs.” “In 2016 alone, more than two million children and youth and 400,000 adults received training in the countries where BBVA operates,” he added.

China, Russia and Belgium lead the OECD ranking on financial education. And some countries that were added to the second edition of this report, like Canada and the Netherlands, also made it to the top positions. Countries like Italy and Russia have made remarkable progress, significantly improving their results and falling above participating countries’ average.

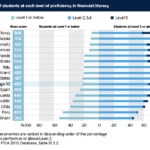

The PISA Report on Financial Literacy puts students into five different levels, from the most basic to the most advanced. According to the study, in 2015, 22% of surveyed students were not able to make simple decisions about their daily expenses (level 1) and only 12% were capable of understanding complex financial products like calculating compound interest (level 5).

In Spain, 5.6% of surveyed students fall into the highest level, an improvement from 3.2% in 2012. Although this is good news, the downside is that the number of students in level 1 or below has increased from 16.5% to 24.7%.

The study calls attention to three key components to obtaining better financial knowledge: the student’s socio-economic level, their academic performance and parents’ participation in their children’s financial education. Students living in homes where the household economy is discussed get better scores.

Francisco González and Queen Maxima of the Netherlands at the presentation of the 2015 PISA Report on Financial Literacy.

The PISA Report also indicates that direct experience using money gives students greater knowledge and better financial skills. In this regard, the study concludes that there is a positive correlation between having a checking account and getting a better score on the financial education test. In the countries with higher scores, 70% of surveyed students have a checking account. In Spain, the students with checking accounts (52%) also obtained better scores – up to 28 points above average.

The OECD recommends strengthening financial education initiatives in schools, but more than anything, stresses the need to provide educational opportunities that are complementary to the classroom, with hands-on learning through innovative formats like video channels, videogames or simulators.

The study also emphasizes the importance of applied knowledge over merely disseminating the information. And it also promotes training for parents, who are the main sources of financial knowledge for their children.

For BBVA, financial education is one of the strategic priorities for responsible business, and the bank is working in line with the recommendations made by the OECD. In 2016, more than two million children and young people and 400,000 adults received training inside and outside of the school environment in the countries where BBVA has a presence. Over the past nine years, BBVA has invested more than €67 million in development programs that have given more than nine million people from all social classes the opportunity to receive financial education in all countries where the bank has a presence.

At the Center for Financial Education and Capability you will find all relevant information on financial education in the world.