Experts warn about the spike in household financial vulnerability triggered by the pandemic

Many families are struggling under the economic impact of the pandemic, especially those affected by joblessness. Financial vulnerability refers to the ability of individuals or households to cope with a 'shock' that entails the loss of their main source of income.

To control the COVID-19 pandemic, many governments were forced to adopt exceptional measures and confine the population, bringing many economic activities to a standstill and many countries are still struggling under the consequences of these lockdowns.

Confinement measures affect the population differently: those who’ve been able to continue with their economic activity working from home have fared far better than those who, not being able to perform their duties from home, have faced temporary or permanent furloughs. As a result, social inequalities are spiking. "The pandemic is causing the number of people in situations of financial vulnerability to increase and has caused household inequality to grow," said Lidia del Pozo, Head of BBVA Community Investment programs, during a webinar on financial inclusion lessons to build resilient communities against COVID-19, organized by Euromoney.

Vulnerability and digital skills

In Spain, 33% of households are in a highly vulnerable financial situation, which means that they don’t have enough money saved to cover three months’ worth of expenses in absence of their main source of income, according to a BBVA Research paper. And only 23% of households have enough savings to cover for three to nine months’ worth of expenses.

“The pandemic has made certain people very visible. In the age of digitization, with banks offering more and more digital services and products, the lack of digital skills also excludes people, so it is essential for banks to also work to fight against this type of exclusion” Lidia del Pozo explained.”In recent months we have witnessed how unbanked people struggled more under the crisis, and for this reason we need to make an effort to include these people in the system, but we must not forget those who, due to a lack of financial education or digital financial skills, are at risk of exclusion," she said.

The savings problem

There is a huge difference between those who have a steady source of income and those who don’t or have lost it. Among the latter, we need to pay special attention to those lacking a cash buffer. "Not only those who’re already living in poverty, but those who now are at risk of falling out of the middle class because they don’t have a financial cushion to face the crisis," says del Pozo. For some, income from unemployment or layoff compensation schemes may not be able to fully cover for their rent or mortgage expenses, meaning they would have to rely on their savings.

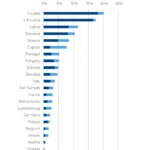

The situation is similar in the rest of Europe. According to the Center for Economic and Political Research (CEPR), 12.2 percent of the population does not have enough money saved to cover for more than two months’ worth of food and utility expenses. In a work published on its website VoxEU.org, the institution acknowledges that “millions of Europeans could not endure a two-month income shock without generous, targeted, government policies.” Keeping 50% of their gross privately earned income, 4.4 million people wouldn’t be able to cover their food and utility expenses for more than one month, and 5.5 million (1.6%) for more than two months. Taking housing-related expenses into account, these numbers grow dramatically, with 57.5 million people becoming financially vulnerable in a two-month period in absence of their privately earned income, 41.1 million in just one month.

Guaranteeing 50% of the gross privately earned income, these figures decrease considerably, but remain significant. In this case, 11.3 million people would not be able to afford these expenses for more than two months and 8.4 million for more than one month. Housing expenses would remain a significant burden in this case. "Both rent and mortgage expenses substantially increase the number of vulnerable individuals, but tenants are more vulnerable than mortgage holders," according to the article.

Immigrants, the most exposed

Statistics are particularly stark for immigrants, especially for those of non-EU origin. While 16.3% of those living in their country of birth would not be able to cover such expenses for two months without any privately earned income, the percentage for those born elsewhere, both in the EU and outside of Europe, would be 24.7% and 29.6%, respectively. In other words, those born in other places of the EU are 1.5 times more at risk of becoming financially vulnerable, while individuals born outside the EU are 1.8 times more at risk.

In this scenario, it is necessary to implement support measures and policies for the most vulnerable population. "Employment protection plans around the EU are essential," says the CEPR study. Financial difficulties become evident after just one month without privately earned income, so it is essential to ensure the quick channeling of support to families. "Even in a two-month horizon, savings and pre-existing public transfers do not provide enough cover for 57.5 million individuals."

The problem gets even worse for those working in the informal job market, a circumstance that can see them excluded from any government support scheme. "Without targeted policies, these pockets of vulnerability will remain," says the report. In the case of Spain, according to a report by United Nations Special Rapporteur on Extreme Poverty and Human Rights Philip Alston, after his visit to the country, these measures are pressing. "The benefits of the economic recovery have largely flowed to corporations and the wealthy, while people in poverty have been largely failed by policymakers," he says in an interview, published in Ethic magazine.

“it is not adequately funded, and it is not reaching those people who need it the most," and, on top of that, it is so complex that, according to Alston, "it is impossible not to get lost in it.”

Financial inclusion and digital transformation

The economic crisis has changed consumer behavior patterns and laid bare the need to foster financial inclusion while expediting the digital transformation of banks. "The scenario caused mobile banking to turn into one of the most widely-used banking channels among financial consumers and proven that financial inclusion must go hand in hand with digital transformation," said Lidia del Pozo. “For example, in Colombia, with an unbanked population of 6.2 million, delivering state aid is a real challenge. This situation led many Colombians to enroll digitally with banks or 'fintech' startups. Del Pozo pointed out two major factors of financial inclusion. On the one hand, “working on low cost financial products” that the most vulnerable population segments can get access to, and on the other, “promoting financial education programs, especially digital ones, that allow people to really understand how to use the products and how to optimize them.”

Speaking at the Euromoney panel, she underscored that BBVA has been working on financial inclusion for more than 10 years. BBVA Microfinance Foundation, established in 2007, supports more than 2.2 million people in five Latin American countries, where it has mobilized over $14.5 billion in loans to low-income entrepreneurs. "84% of entrepreneurs start from a situation of vulnerability, poverty or extreme poverty," explained Del Pozo."And 34% are able to pull out of poverty after two years with the entity." And commitment to digitization plays a key role in this progress. "These entrepreneurs are offered access to a variety of solutions specially designed for them, which not only allow them to avoid unnecessary branch visits, but also contribute to bridging digital gaps," he explains.

In the bank as a whole, "we have been promoting financial education across our footprint for more than 10 years, during which we have invested €89 million and provided training to more than 15 million people,” added Lidia del Pozo. “In recent years, concurrently with BBVA’s digital transformation journey, we have made a great effort to develop digital programs. We have also integrated financial education and training into our digital products.” Precisely, BBVA was recently named best sustainable finance bank in Latin America by Euromoney.

In Latin America, the inclusion of millions of people depends on these digitization and innovation efforts. “The percentage smartphone-users reached 70% of the population in 2019. Given that approximately 70% of the Latin American population lacks access to banking services or a bank account, digitization is a key element to guarantee their financial inclusion. Banks and fintech players are rolling out innovative solutions to bring this informal economy online.”

One of the ways to support this group is through the financial services that the banking sector can provide. In developing countries, where a majority of people remain unbanked, new technologies can reach more people who need it. “Digitization has helped banks deepen and move ahead with their financial inclusion efforts. Digital products are capable of reaching places that brick and mortar branches aren’t. Financial products, such as digital payments and loans, have an impact on people's well-being,” concludes Lidia del Pozo.