Companies and individuals boost BBVA’s sustainable business mobilization in the first nine months of 2023

BBVA mobilized €15.6 billion in sustainable corporate business between January and September 2023 (up 95 percent from the same period the previous year) and €7.3 billion in retail banking (up 69 percent). Both segments have consolidated growth in the mobilization of sustainable business.

“We are continuing to expand our sustainable business for all customers and clients. We are starting to see the results of the specialized teams, as well as the expansion of our catalog of sustainable products - not only for large CIB clients, like in the past, but also for the corporate and retail sectors,” BBVA CEO Onur Genç explained.

The creation of specialist product teams and salespeople in all geographies continued to reinforce the capillarity of sustainability throughout the bank’s entire commercial network, boosting business in these segments.

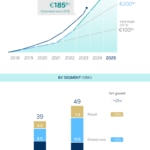

BBVA has been deploying its sustainable business since 2018. The total amount mobilized as of September 2023 stood at €185 billion, representing 62 percent of the €300 billion target set for the 2018–2025 period. 77 percent has gone into climate action, while the remaining 23 percent has been channeled into promoting inclusive growth, which are the two strategic focus points of BBVA as it supports and accompanies customers in their transition toward a more sustainable world.

In the third quarter of 2023, the bank mobilized €16 billion in sustainable business, up 13 percent from the same period last year.

Furthermore, in the first nine months of 2023, BBVA mobilized roughly €49 billion (+25 percent compared to the same period the previous year), thanks to the expansion of the sustainable business across all segments and the diversity of industries with which the bank works.

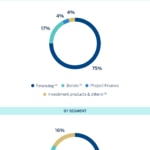

By customers—cumulatively from 2018 through to September 2023—62 percent was channeled through the Corporate Investment Banking (CIB) area, 22 percent through corporate banking, and 16 percent via the retail segment.

By product, from 2018 to September 2023, 75 percent of the sustainable business corresponds to corporate finance; 17 percent to brokered third-party bonds in which BBVA acts as bookrunner; 4 percent to project finance; and 4 percent mainly to investment products managed, brokered or marketed by BBVA.

Outstanding growth in the corporate business

Corporate banking mobilized around €5.4 billion in the third quarter. In cumulative terms, fund mobilization in the first nine months of 2023 came to nearly €15.6 billion (+95 percent year-on-year), with more than 16,000 transactions.

As in the previous quarter, financing to promote or improve the energy efficiency of buildings stood out at €1.09 billion. This represents an increase of 21 percent from the same period the previous year (+55 percent if compared to the cumulative amount for the first nine months of 2023 with the same period of the previous year).

The corporate business has been making an increasing contribution to BBVA’s sustainable business, on the back of three strategic drivers::

- Development of a simple yet scalable value proposition and a two-pronged industry dialog with each customer. The first, through sustainable solutions that enable economic savings and focus on cross-cutting issues such as energy efficiency, fleet renewal, water, circularity, social infrastructure and entrepreneurship; and the second, relying on advanced data analytics to develop consulting tools, such as the carbon footprint calculator for customers.

- Integrating sustainability into the business models of the commercial network of companies present within the countries, through sound commercial planning, the incentive model and the network management model. In tandem, further progress has been made toward a risk model that will allow us to analyze customers and transactions with environmental, social and corporate governance (ESG) parameters in mind.

- Creating teams of product specialists and salespeople across all geographies.

This strategy has allowed us to reinforce a capillarity of sustainability throughout the network. At the end of September 2023, 63 percent of bankers and 88 percent of bank branches had been involved in sustainable transactions, either targeting sustainability directly or incorporating sustainability-related indicators.

Strong performance (+69 percent) of the retail business

In the third quarter of 2023, retail business funds of around €1.7 billion were mobilized, thus bringing the total for the year to date to €7.3 billion (+69 percent compared to the same period last year).

A key highlight was the excellent performance in channeling funds into the purchase of hybrid or electric vehicles, which was up 78 percent compared to the same period in the previous year.

The BBVA Microfinance Foundation (BBVAMFF) is part of this segment, although it does not form part of the BBVA Group. It mobilized around €400 million to support vulnerable entrepreneurs with micro-loans this quarter.

Corporate business exceeds €8 billion in the third quarter

Meanwhile, the Corporate and Investment Banking unit (CIB) channeled around €8.1 billion this quarter and around €26.2 billion in the first nine months of 2023 (-3 percent).

The strong performance of short-term financing and sustainable transaction banking activity (whether specifically targeting sustainability or otherwise linked to sustainability indicators) stand out, contributing around €4.4 billion. This represents more than half of the total amount channeled this quarter by the corporate segment, and an increase of 34 percent compared to the same period the previous year. The sustainable bond market, in which BBVA acts as bookrunner, has been rallying since the start of 2023.