We are immersed in an exciting era of unprecedented transformation in economic history. Two global macro trends will change the economy and industry as we know it in the coming years: first, technological disruption driven by advances in artificial intelligence; secondly, decarbonization. These emerging megatrends will transform business models in all sectors and provide an unprecedented opportunity for innovation and entrepreneurship.

First, we should consider the disruption brought about by technologies such as artificial intelligence, robotics, the internet of things, and 3D printing, among many others. Unlike other technological breakthroughs in history, these are not aimed at a single sector. Instead, they enable the development of new, far more productive business models, with huge potential to transform a wide range of industries. Moreover, these technologies are relatively affordable, which facilitates their rapid adoption and "democratizes" innovative entrepreneurship.

At BBVA, we have long been at the forefront of the technological disruption facing the financial sector, from the point of view of both the transformation of our business and investment. In this area we have made strategic investments in neobanks such as Atom in the United Kingdom or Neon in Brazil. We have also made many non-control investments in companies at earlier stages of development through funds such as Propel and Sinovation.

In this vertical BBVA has focused on promoting innovative companies with high growth potential in the markets where the bank operates. This is done both from the point of view of investing in capital, through specialized funds, and by providing them with financial solutions that are agile, flexible and adapted to their needs through BBVA Spark.

We invest in venture capital funds that focus on technology-based companies. Specifically, we have signed investment commitments in a total of 15 technology funds: distributed among Spain (Axon, Be Able, Extension Fund, Leadwind and Swanlaab, Bonsai and Life Extension), Latin America (ALLVP, Angel Ventures, Cometa, DILA, NAZCA and Rivwerwood); and Europe (Kreos Capital and Atomico).

Moreover, after less than two years of activity, BBVA Spark already operates in Spain, Mexico, Colombia and Argentina and has reached more than 1,000 clients. This demonstrates that BBVA can offer comprehensive banking for technology companies, which includes all of the bank's services and adapts to their specific needs at each stage.

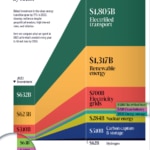

Meanwhile, the second macro trend, decarbonization, involves what is arguably the greatest disruption in economic history. Before the end of the 21st century, we must be able to reduce the global warming rate, which currently stands at 3ºC, to 1.5ºC. To this end, the energy transition and the goal of 'net zero emissions' by 2050 must be prioritized as a matter of urgency. Fortunately, these two goals are already high on the agendas of the main government and business leaders.

At BBVA, we have stepped up our investment commitment by broadening our scope, specifically to position ourselves at the forefront of climate action.

The Next Generation funds in the European Union and the Inflation Reduction Act in the United States are examples of the strong tailwind for everything related to this macro trend. This also implies a huge disruptive challenge for all industries. We need to develop new materials, design new ways of manufacturing products, change energy sources from fossil fuels to renewables, adopt new business models and also change consumption habits... all of this to become much more energy efficient and stop emitting greenhouse gases.

Estimated adaptation costs and needs for developing countries are in the range of $215 billion to $387 billion per year this decade, according to the UN.

At BBVA, we have stepped up our investment commitment by broadening our scope, specifically to position ourselves at the forefront of climate action. Within this framework we have made a range of investments directly focused on supporting technological solutions for decarbonization. In 2022, BBVA bought into three key funds: Hy24, which seeks to invest in industrial projects that bring green hydrogen-based solutions to a commercial scale; Lowercarbon, which is investing in companies developing technologies to absorb carbon directly from the atmosphere; and Fifth Wall Climate, a leader in proptech that launched a fund seeking to decarbonize the construction and real estate value chain. In 2023, in addition to reinforcing its commitment to Lowercarbon in its nuclear fusion funde, BBVA announced its investment in Just Climate, which focuses on solutions for industries that are difficult to abate, such as steel and cement; Suma Capital, which focuses on biogas and circular economy; and the investment in the Decarbonization Partners I climate fund, which invests in companies in the industrial scaling phase of their climate solutions.

All these climate funds have a total investment amount of more than €100 million. Through our involvement in these types of funds, we expect to generate a financial return on our investments and to gain valuable insights into companies, business models and projects that address high-impact solutions to current processes that emit carbon dioxide and other greenhouse gases. These investments will enable us to pioneer the financing of innovative companies and business models in this field. Thanks to these initiatives, BBVA is actively contributing to the decarbonization of the economy.

These investments are in addition to our goal of mobilizing €300 billion in sustainable business by 2025 to contribute to achieving the United Nations Sustainable Development Goals.

Exciting years lie ahead for these new companies that will change the future. We want to support them in the long term with the tools and agility they need to grow successfully.