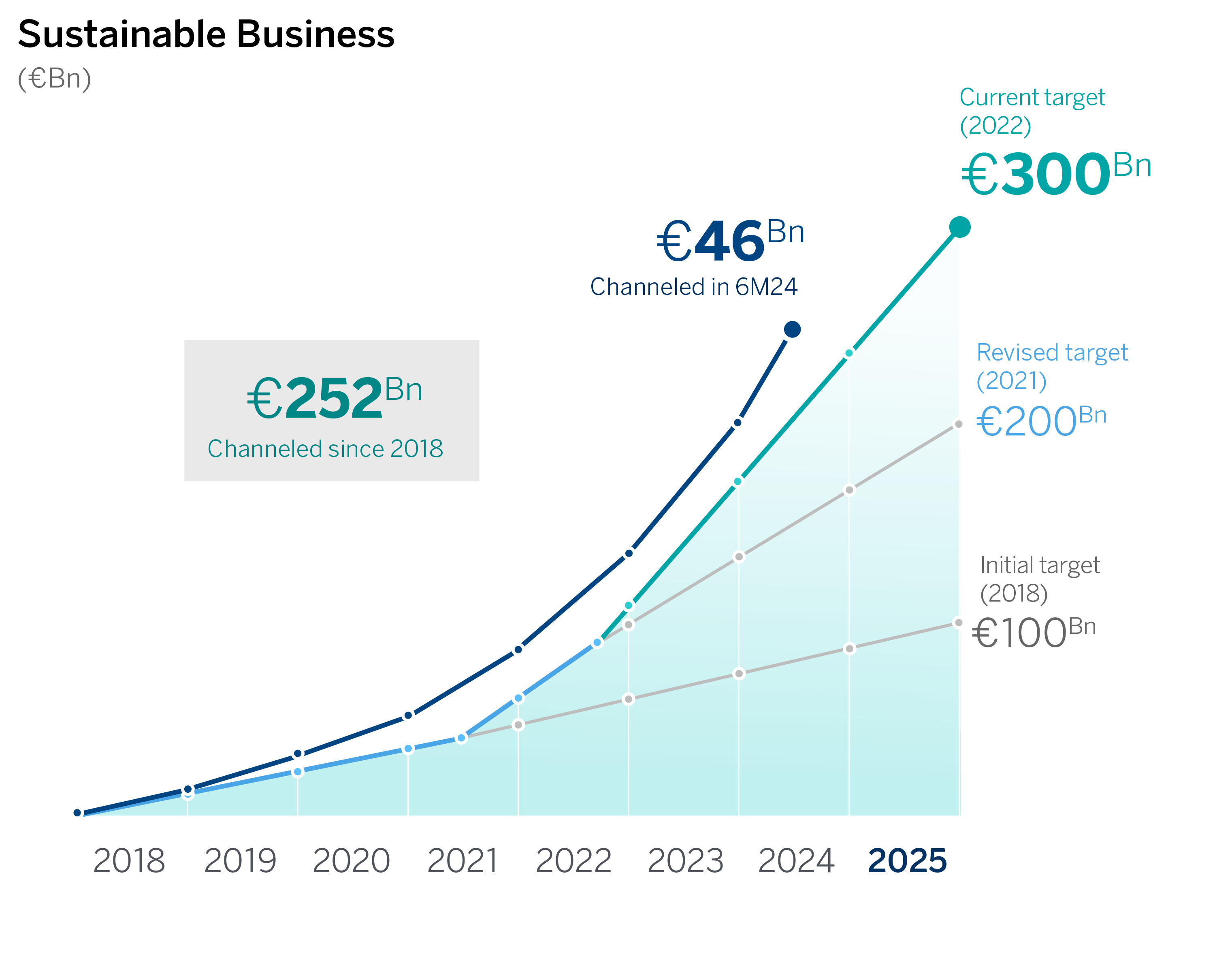

BBVA channelled €26 billion in sustainable business in the second quarter of 2024, a new quarterly record for the Group. Furthermore, the total amount mobilized in the first half of 2024 reached €46 billion, 37 percent more than the same period of 2023.

"An important catalyst of this record figure was the significant momentum in project finance, which saw triple digit growth (+149 percent in the first six months of the year over the same period in the previous year). This was driven by financing for renewable energy and cleantech” said Javier Rodríguez Soler, Global Head of Sustainability and CIB at BBVA.

From January 2018 to June 2024, BBVA mobilized a total of €252 billion in sustainable business, ahead of pace to meet the goal of €300 billion in eight years (2018 - 2025). Of this amount, 77 percent corresponds to the fight against climate change and preservation of natural capital, and 23 percent to promoting inclusive growth.

The corporate banking unit has channeled around €15.8 billion between January and June 2024, 57 percent more than the same period the previous year. It is the business segment with the greatest percentage increase. In the second quarter of 2024, the bank channeled approximately €9 billion, while it continued advising business clients on solutions that enable potential savings with a focus on energy efficiency, vehicle fleet renovation and reduction of their water footprint. In this area, financing to agrobusiness, water and the circular economy stand out, with around €655 million in the second quarter, which represents an increase of 74 percent over the same period previous year.

Corporate and Investment Banking (CIB) channeled around €25 billion in the first half of 2024, which represents 32 percent growth compared to the same period of 2023. In the second quarter, the bank channeled around €13.8 billion. In this wholesale segment, BBVA continued promoting the financing of clean technologies, or ‘cleantech’, and renewable energy projects, as well as the ‘confirming’ associated with sustainability, among other strategic lines. Financing for renewable energy projects stands out, contributing around €402 million in the quarter. This represents more than double the amount from the same period last year.

Between January and June 2024, the retail business channeled around €5.3 billion, up 12 percent from the same period last year. In the second quarter, the bank channeled around €2.8 billion. In the period, BBVA continued to promote personalized digital solutions, designed for the mass market, showing retail customers their potential savings from adopting energy saving measures in their homes and transportation. In this sense, performance related to purchases of hybrid and electric vehicles stands out, with a total of approximately €164 million. This represents 130 percent growth over the same period last year.

Significant quarterly developments in the sustainability field

In May, BBVA added two new sectors to its intermediate emission reduction targets for 2030: the real estate sector in Spain and the global aluminum industry. They join the list of eight sectors with emission reduction targets previously set by the bank (oil and gas; power generation; the automotive industry; steel; coal; aviation and shipping).

Furthermore, in May 2024, BBVA Colombia and the International Finance Corporation (IFC) announced the issuance of the finance sector’s first biodiversity bond. BBVA Colombia will issue up to $70 million and the resources will be used to finance projects related to reforestation, the regeneration of natural forests on degraded land, mangrove conservation or rehabilitation, climate-smart agriculture and habitat restoration for wildlife, among other things.