BBVA sets a new target of €700 billion in sustainable business

BBVA is set to channel €700 billion in sustainable business between 2025 to 2029, more than double the previous target of €300 billion set for the 2018–2025 period, which it reached in December 2024, one year ahead of schedule. This new, more ambitious objective will also run for a shorter period (five years as opposed to eight).

“At BBVA we continue to view sustainability as a strategic priority and a key driver of differential growth. We believe that the business opportunity in the second part of the decade will be driven by solid investment in infrastructure and by the maturity of certain new clean technologies, which will make them ―many of those that are not yet― profitable,” remarked BBVA’s Global Head of Sustainability and Corporate and Investment Banking, Javier Rodríguez Soler.

The bank has made this announcement during the presentation to its employees of its new strategic plan for the coming five years.

For BBVA, it is essential to support its customers and clients by financing their investments and advising them throughout this transition process, which will be accompanied by a strong focus on innovation and expertise in new technologies.

The channeling of sustainable business at BBVA includes aspects related to climate change and natural capital (which includes activities related to water, agriculture and circular economy), as well as the promotion and financing of social initiatives, such as social, educational and health infrastructure; support for entrepreneurs and fledgling companies; and the financial inclusion of the most underprivileged segments of society.

Strategic approach to sustainability

In 2019, BBVA set sustainability as a priority in its strategy to help customers and clients transition to a sustainable future, focusing on climate change and inclusive social development.

In 2018, the bank announced that it would channel €100 billion in sustainable business over the 2018–2025 horizon; a figure it then raised on two occasions to ultimately reach €300 billion. From January 2018 to December 2024, BBVA channeled a total of €304 billion in sustainable business, thus reaching its target one year early.

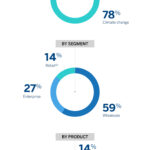

Of this amount, 78 percent was channeled into climate change mitigation and adaptation projects and the preservation of natural capital, while the remaining 22 percent went to inclusive growth initiatives.

By business lines, the bulk of the figure comes from the Corporate and Investment Banking area (investment and corporate banking transactions for large clients) with 59 percent, followed by companies with 27 percent and retail customers with 14 percent.

(1) In those cases where it is not feasible or sufficient information is not available to allow an exact distribution between the categories of climate change and inclusive growth, internal estimates are made based on available information. Climate change: Also includes Natural Capital. (2) Includes the activity of the BBVA Microfinance Foundation (FMBBVA), which is not part of the consolidated Group and which has channeled around 9 billion euros in the period from 2018 to 2024, mainly to support vulnerable entrepreneurs with microcredits. (3) Green, social, sustainable or sustainability-linked bonds (in accordance with both internal and market standards, existing regulations and best practices) in which BBVA acts as bookrunner. (4) Fundamentally includes (i) products, both long and short term, whose funds are destined to activities considered sustainable (according to internal and market standards, existing regulations and best practices), (ii) generalist products, both long and short term, (ii) generalist products, both long and short term, aimed at customers considered sustainable based on their revenues from sustainable activities (in accordance with existing regulations and/or internal standards) or in accordance with company-level certifications of recognized prestige in the market, as well as (iii) products, both long and short term, linked to sustainability (in accordance with internal and market standards and best practices), such as those linked to environmental and/or social indicators. (5) Green and/or social projects in accordance with internal and market standards, existing regulations and best practices. (6) Art. 8 or 9 investment products under the Sustainable Finance Disclosure Regulation (SFDR) or similar criteria outside the EU managed, brokered or marketed by BBVA. “Other": includes deposits under the Sustainable Transaction Banking Framework until such time as it was replaced by the CIB Sustainable Products Framework (both Frameworks published on the bank's website), insurance policies related to energy efficiency and inclusive growth, and electric vehicles auto renting, mainly.comm