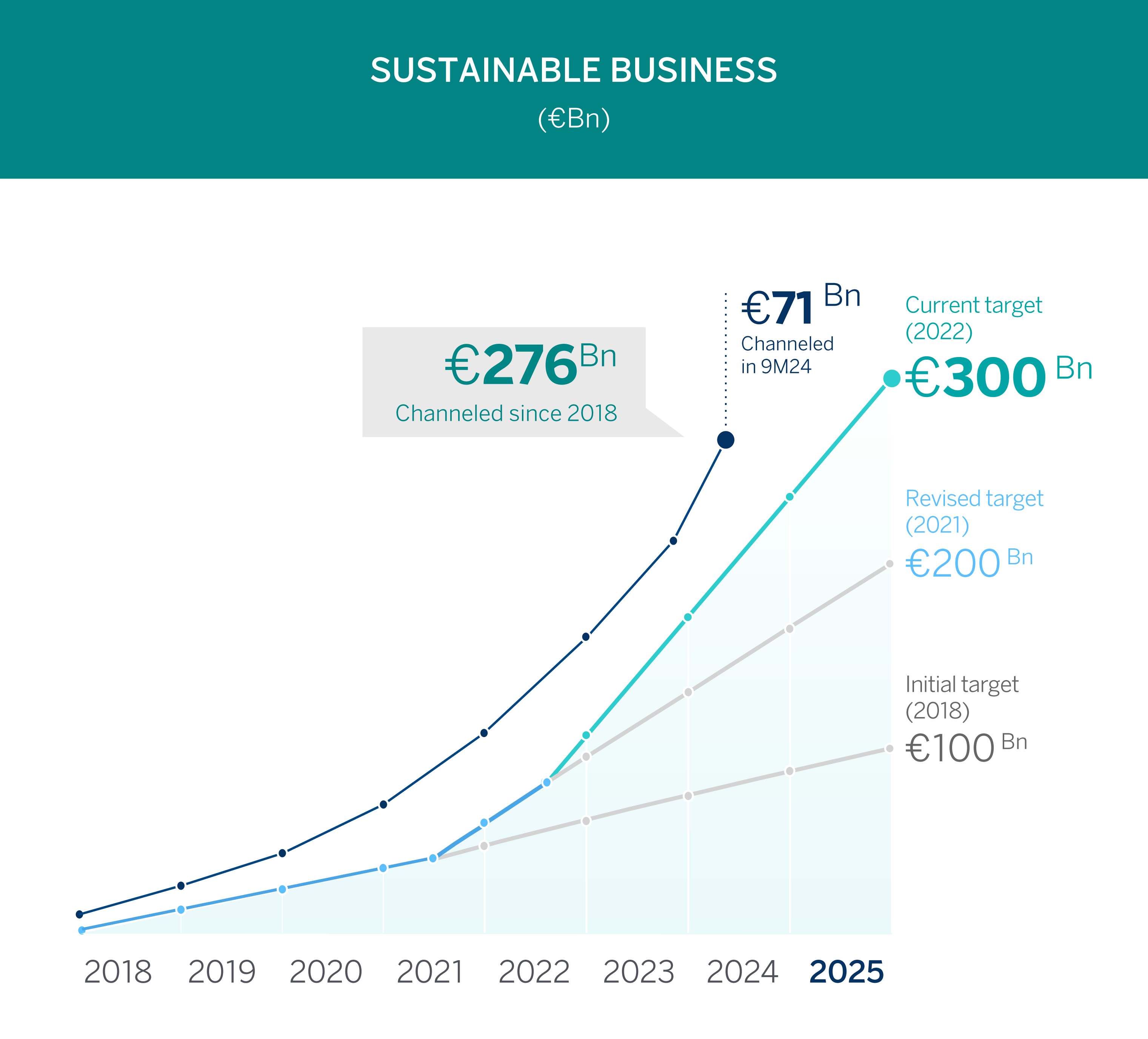

BBVA channeled €71 billion in sustainable business from January to September

BBVA has channeled €26 billion in sustainable business in the third quarter of 2024, reaching a total of €71 billion for the first nine months of the year, a 44 percent increase over the same period last year.

“BBVA has mobilized €276 billion for climate action and inclusive growth from 2018 to September 2024. This means we are ahead of our initial projections to reach the €300 billion target for the 2018-2025 period. We are very close and if we keep up this pace, we will achieve our goal earlier than expected,” said Javier Rodríguez Soler, Global Head of Sustainability and CIB at BBVA.

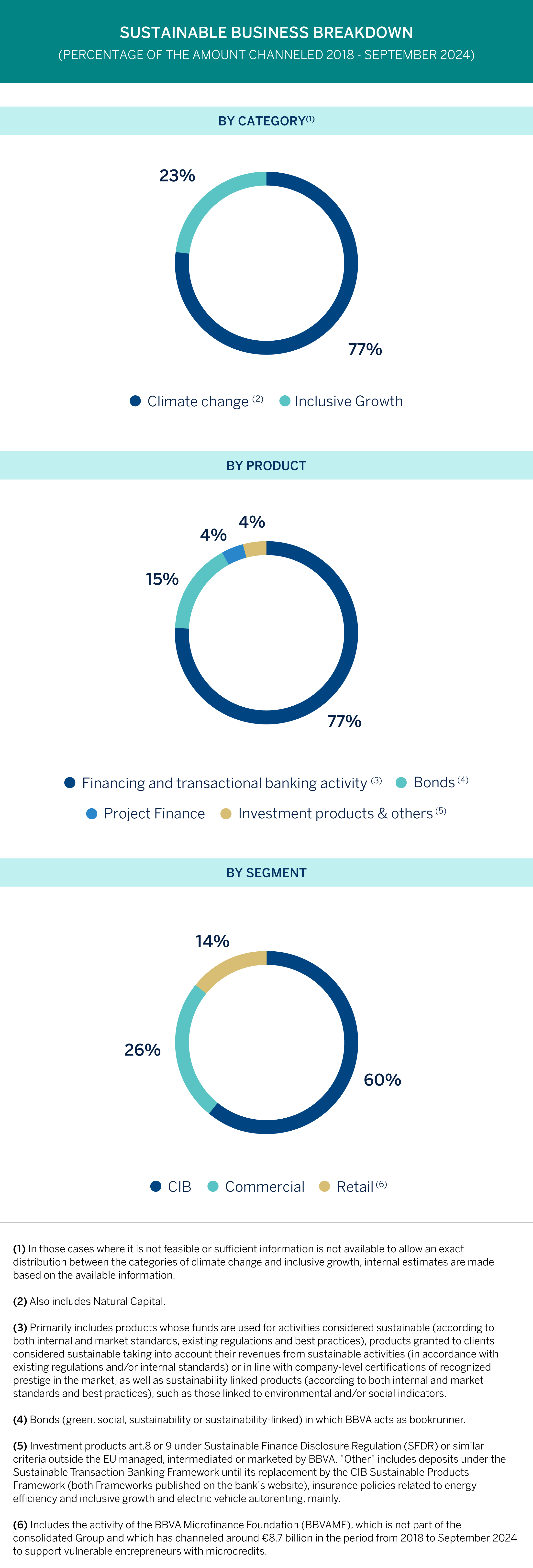

Of the €276 billion, 77 percent correspond to the fight against climate change and conservation of natural capital, while the remaining 23 percent was allocated to inclusive growth.

CIB increases sustainable business by 38 percent

The Corporate and Investment Banking (CIB) area mobilized approximately €37 billion from January to September, which represents a 38 percent increase over the same period last year. This quarter, the area mobilized around €13 billion.

In the wholesale segment, BBVA has continued to promote financing for clean technologies (cleantech), renewable energy projects, as well as confirming services related to sustainability, among other strategic areas. In terms of funding allocation in the third quarter of 2024, financing for renewable energy projects stands out, with around €690 million. This more than doubles the figure from the same period last year, with the U.S. being a critical component, mobilizing over half of this amount.

Companies, the sustainable business with the highest growth (55 percent)

BBVA’s company banking unit channeled approximately €24 billion in sustainable business between January and September. This represents 55 percent growth compared to the same period the previous year, making it the segment with the greatest increase. In the third quarter of 2024 alone, this segment of the bank channeled around €9 billion.

This business unit continued to advise business clients on the sustainable solutions that allow for potential economic savings, with a focus on cross-cutting issues, such as energy efficiency, vehicle fleet renewal, and the reducción of water footprints. In this regard, financing for natural capital is particularly relevant (agrobusiness, water and the circular economy) with nearly €600 million in the third quarter of 2024. This represents a 59 percent increase over the same period last year.

Financing for hybrid and electric vehicles boosts retail business

The retail business channeled €9 billion in the first nine months of 2024, a 41 percent increase compared to the same period the previous year. In the third quarter, BBVA’s retail unit channeled around €4 billion.

BBVA has continued to provide customized digital solutions for the mass market, offering retail customers a look at their potential savings if they took measures to save energy in their homes and transportation. The bank’s strong performance related to financing for the purchase of hybrid or electric vehicles stands out, with €192 million in the third quarter. This represents 106 percent growth over the same period last year.

Significant progress in the sustainability area

In the third quarter of the year, BBVA created a sustainability hub in Houston with the aim of leading the financing of the energy transition in the United States, making sustainability a driver of growth, and promoting decarbonization in the country.

BBVA’s sustainability strategy in the U.S. focuses on supporting businesses in the energy sector and those that promote sustainable development, including traditional renewable technologies - like wind and solar - as well as clean technologies, or cleantech. Some of these clean technologies include electricity storage systems, hydrogen or carbon capture, and sectors such as electric vehicles, energy efficiency and the circular economy.

BBVA’s new office in Houston joins its teams in New York, London and Madrid focusing on financing innovation in clean technologies.

In addition, BBVA offers support, financing solutions and advice for companies transforming their business model toward more sustainable alternatives.

These plans will help BBVA achieve its overall sustainable business target.