BBVA channeled €19 billion in sustainable business in the second quarter of 2023 - 30 percent more and a new quarterly record

From April to June 2023, BBVA channeled around €19 billion in sustainable business. This figure, showing growth of around 30 percent compared to the same period of the previous year, sets a new quarterly record. In total, BBVA channeled €169 billion in sustainable business from 2018 to June 2023, well over half of the €300 billion target laid down for the 2018-2025 period.

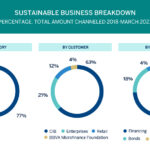

"We continue to grow and break quarterly records by extending sustainable criteria to all our business segments across the wide range of industries we work with. From 2018 to June 2023, 77 percent of our sustainable business was allocated to climate action, while 23 percent was used to promote inclusive growth. Both these topics are strategic focuses for supporting our clients in their plans for the transition to a more sustainable world," said BBVA's Global Head of Sustainability, Javier Rodríguez Soler.

"Our core business has a positive impact on society by promoting and financing projects for the energy transition and inclusive growth, including entrepreneurship, inclusive infrastructure and financial inclusion initiatives," the senior executive explained.

In cumulative growth since 2018, the standout market segment is sustainable corporate finance

By client segment, cumulatively from 2018 to June 2023, 63 percent was channeled through the Corporate & Investment Banking (CIB) area, 21 percent through Business Banking, 12 percent through retail banking, and 4 percent through the BBVA Microfinance Foundation.

By product, from 2018 to June 2023, 74 percent of sustainable business consisted of corporate finance, 18 percent was in the form of brokered third-party bonds where BBVA acted as bookrunner, 4 percent was project finance, and 4 percent comprised investment products managed, brokered or marketed by BBVA.

Second quarter of 2023

In the second quarter of 2023, the corporate business channeled around €10.8 billion (57 percent of the total). The corporate bond market, in which BBVA acts as bookrunner, was particularly buoyant, contributing €3.56 billion (25 percent more than in the same period last year). Of this amount, €2.63 billion was accounted for by green bonds, which saw a 91 percent volume increase compared to the same quarter of the previous year.

From April to June 2023, the business banking area channeled around €6.5 billion (34 percent of the total). One of the main purposes to which finance was allocated was the implementation or improvement of energy efficiency in buildings, accounting for €1.25 billion channels in the quarter, thus showing growth of 114 percent versus the same period last year. Spain's contribution in this area was key, with a 125 percent increase.

During the quarter, the retail business channeled around €1.3 billion (9 percent of the total). Channeling related to financial and social inclusion performed particularly well, with finance and access to the financial system for vulnerable segments of the population growing by 85 percent compared to the same period of the previous year.

Inclusive growth

BBVA's sustainability strategy is to drive the energy transition and support inclusive growth--toward this latter goal, the bank made especially good progress in recent quarters.

The bank channeled €4.34 billion in the second quarter of 2023 (€7.40 billion over the first half). Within this strategic focus, one of the key activities is mobilization for financial and social inclusion, which grew by 85 percent compared to the same quarter last year. Mexico's contribution channels more than a third of that amount, while Colombia doubled its mobilization volume.

BBVA actively contributes to the economic and social development of its host communities

From 2018 to June 2023, BBVA channels €38 billion to inclusive growth projects. The bank actively contributes to the economic and social development of its host communities, seeking to benefit people and strengthen the social fabric by fostering a fairer, more cohesive and more resilient society, where everyone has the opportunity to thrive.

In the area of inclusive growth, BBVA offers its customers products and solutions designed to achieve five core goals: support for inclusive infrastructure to boost the development of key social sectors such as education, health, housing and telecommunications, while enabling vulnerable people to access these services; finance--via social bonds, for example--for projects with a positive social impact; loans to companies and entrepreneurs to strengthen the business fabric and support job creation; financial inclusion of people at risk of exclusion; and financial solutions for vulnerable segments of the population.

BBVA is the most sustainable bank in Europe for the third consecutive year according to the Dow Jones Sustainability Index in 2022, the global benchmark for sustainability. It obtained the second-highest score in the worldwide category of banks.