92% of the electricity consumed by BBVA worldwide is of renewable origin

In 2022, 92% of energy consumption in BBVA's facilities worldwide came from renewable sources, way above the 70% set in its target for 2025. In Spain, Portugal, Colombia, Uruguay, Mexico and Turkey, 100% of the energy consumed by BBVA already comes from renewable sources.

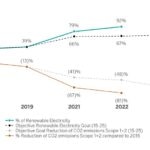

BBVA also continues to make progress in reducing its environmental footprint, to 52,967 tons of CO2 emissions Scope 1 and 2) in 2022. This means 43% less emissions than the 93,190 tons emited in 2021. To this end, BBVA managed to reduce these emissions by 81% last year compared to 2015, well above the target of 68% set for 2025.

Graph: Performance against 2025 Target

In addition, in line with the Global Eco-efficiency Plan, there has been a decrease of 14% in electricity consumption, 16% in energy consumption, 12% in water consumption, 31% in paper and 8% in net waste (all per employee) with respect to the base year 2019. The percentage of environmentally certified land reached 44%.

Global Eco-efficiency Plan

In 2021, BBVA drew up a new Global Eco-efficiency Plan for the period 2021-2025, defining more ambitious objectives, aligned with its climate strategy, focused on the reduction of direct impacts and the achievement of the 2025 Target. To carry out the plan, four lines of action have been defined:

1.Consumption

BBVA focuses on the use of renewable energies to contribute to the decarbonization of the markets in which the Group operates. Its target is to reach PPA (Power Purchase Agreement) agreements, such as those reached in Mexico, Spain and Argentina, and to acquire guarantees of origin or international renewable energy certifications (iRECs) in Mexico, Colombia, Peru and Turkey. Moreover, in Spain, Turkey and Uruguay, the bank is committed to the self-generation of renewable energy in its buildings, through the installation of photovoltaic and solar thermal panels.

BBVA also promotes a series of savings measures to control consumption. Thus, to guarantee a reduction in water consumption, the bank is committed to gray water recycling systems or the reuse of water for irrigation at its headquarters in Spain and Mexico, in addition to the installation of dry urinals in its buildings in Spain. Energy saving measures have also been implemented in the management of the buildings, and priority has been given to digitalization and centralization of printing to reduce paper consumption.

2. Circular economy

Another of the main problems contributing to the acceleration of climate change is the generation of waste due to linear consumption practices. BBVA therefore contributes to the transition towards circular consumption through sustainable construction standards and the implementation of Environmental Management Systems. With the goal of minimizing the amount of waste sent to landfills, the bank has set up differentiated and marked areas in its facilities that allow for the correct segregation and subsequent recycling of waste.

3. Carbon footprint

The carbon footprint and its reduction, one of the main goals established in the 2025 Target, is an indicator that measures the amount of greenhouse gases (GHG) that an organization emits into the atmosphere. It is measured in tons of CO2 equivalent (tCO2e). Since 2020, BBVA offsets residual emissions through the purchase of credits in the Voluntary Carbon Market.

BBVA's total emissions, excluding those of its customers, are composed and divided as follows:

- Scope 1 greenhouse gas emissions, comprising direct emissions from own-use property combustion facilities, vehicle fleet fuel and refrigerant gases: 41,395 tons of CO2e emitted in 2022.

- Scope 2 greenhouse gas emissions (market-based method), which includes indirect emissions related to electricity production, purchased and consumed by buildings and branches: 11,571 tons of CO2e.

- Scope 3 greenhouse gas emissions, comprising other indirect emissions. To date, this scope at BBVA includes emissions from business travel (by plane and train), emissions from waste management and emissions from the commuting of central services employees to the workplace (which account for 35.8% of the total number of employees covered by the report): 37,026 tons of CO2e.

BBVA is a neutral company in terms of CO2 emissions generated in the previously mentioned categories. To this end it compensates them through the purchase of credits in the Voluntary Carbon Market. In addition, in line with the recommendations of the Taskforce on Scaling Voluntary Carbon Markets (TSVCM), the Group has established requirements for selecting projects to offset its residual emissions. These requirements include the obligation for projects to be certified under the highest quality standards such as VCS (Verified Carbon Standard by Verra), Gold Standard, American Carbon Registry (ACR), Climate Action Reserve (CAR) and Plan Vivo; and that they should preferably be CO2 absorption or sequestration projects.

The projects selected in 2022 were four reforestation/afforestation projects (Carbioin, Scolette, Cumare, Guarané) and two wind projects (Manantiales Wind Farm and Rotor Elektrik).

4. Sustainable construction

Another of BBVA's commitments in its Global Eco-efficiency Plan is to guarantee the implementation of the best environmental and energy standards its buildings. To meet this goal, the bank aims to achieve a large percentage of environmentally certified floor space. BBVA already has building certifications in 16 buildings, including the Group's headquarters in Spain, Mexico, Argentina and Turkey. In addition, three of them have received the highest category of certification, LEED Platinum. In addition, the bank has seven WWF Green Office awards in Turkey and 20 Edge awards in Peru, certifications that promote the reduction of its ecological footprint and carbon emissions.

In terms of management certifications, BBVA has implemented the Environmental Management System in 86 buildings and 1,022 branches, to control and evaluate the environmental performance of the operations carried out in its facilities.

BBVA has been recognized as the most sustainable bank in Europe for the third consecutive year according to the Dow Jones Sustainability Index in 2022, the global benchmark index for sustainability, and has obtained the best score in the category of banks on a regional level (86 points out of 100) and the second highest on a global level.