Sustainability types speak in PowerPoint, and investors speak in Excel

Investors, customers and society in general are demanding increasingly higher levels of transparency. There is also regulation accompanying these new demands, as illustrated by the EU directives on non-financial information that will become applicable in 2017.

The recent study on corporate sustainability published by MIT Sloan Management Review and The Boston Consulting Group (BCG) is the latest report on this issue. The study includes an in-depth analysis of investors’ new ability to unite corporate performance with sustainability. The report analyzes how investors use sustainability as a key criterion when investing and identifies what corporate leaders can do to remain relevant.

Sustainability creates value

For a decisive majority of surveyed investors — more than 70% — sustainability is central to their investment decisions. “In the last two or three years, sustainability has been gaining momentum among mainstream investors”, says Antoni Ballabriga, Global head of Responsible Business at BBVA. “In the past, we might have received a few inquiries from socially responsible investors. Now there are many more events focused on socially responsible investment, and attendance by mainstream investors has gone up considerably”.

Source: MIT Sloan Management Review.

Integrating ESG (Environmental, Social y Governance) indicators into investment models is the crux of these inclusionary performance indicators. The integration has been difficult in the past because, as BBVA’s Ballabriga puts it, “Sustainability types speak in PowerPoint, and investors speak in Excel”.

Ballabriga at BBVA established a close working relationship between his sustainability group and IR to help develop a succinct sustainability story. The effort began as an information exchange, in which IR would reach out to Ballabriga’s group when investors asked specific questions. As confidence built and investor demands increased, IR starting asking Ballabriga to join earnings calls and other meetings with investors. Today, the relationship is a partnership, and the groups have jointly developed a process to create and update the story of how sustainability creates value and should be reflected in its share price.

“It’s been an evolution”, says Ballabriga. “We started as information suppliers. And now we really are a partner and the company looks at communicating sustainability as a real opportunity”.

"Successful companies have a sustainability strategy and build a business case around it" explains Gregory Unruh contributor to the Harvard Business Review

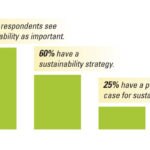

For The Boston Consulting Group, it’s completely clear: “The perception that investors don't care has always been a barrier for sustainability initiatives, but his research reveals an emerging new trend - investors do care and executives need to factor this into corporate strategy”, explains Gregory Unruh, author of the previously mentioned report and regular contributor to the Harvard Business Review. “Successful companies have a sustainability strategy and build a business case around it. Then they innovate and change their business model. Companies that do this are twice as likely to report returns from sustainability initiatives”.

To download the full report, please register here.