BBVA posts profit of €6.42 billion in 2022 (+38 percent), its highest ever

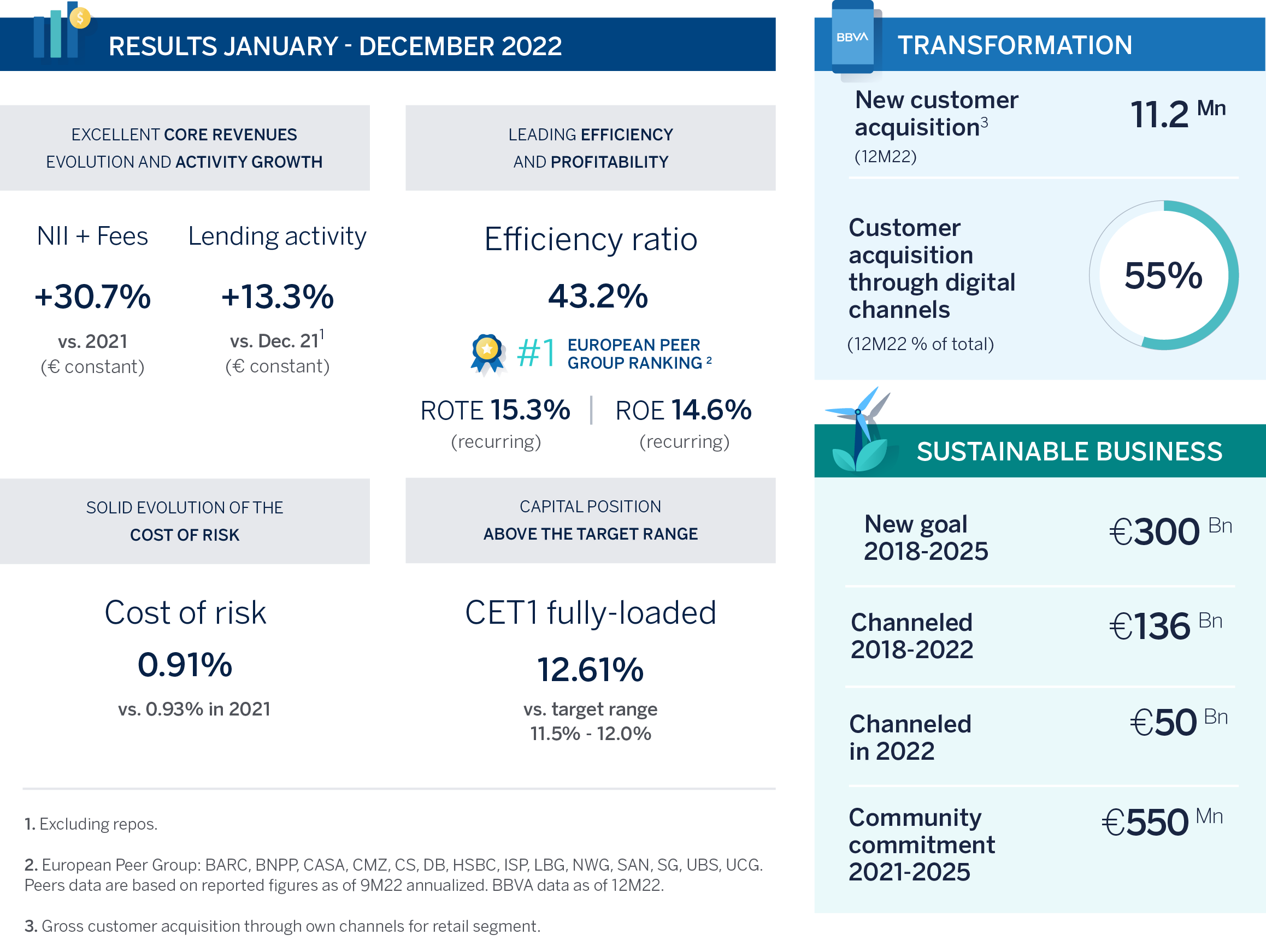

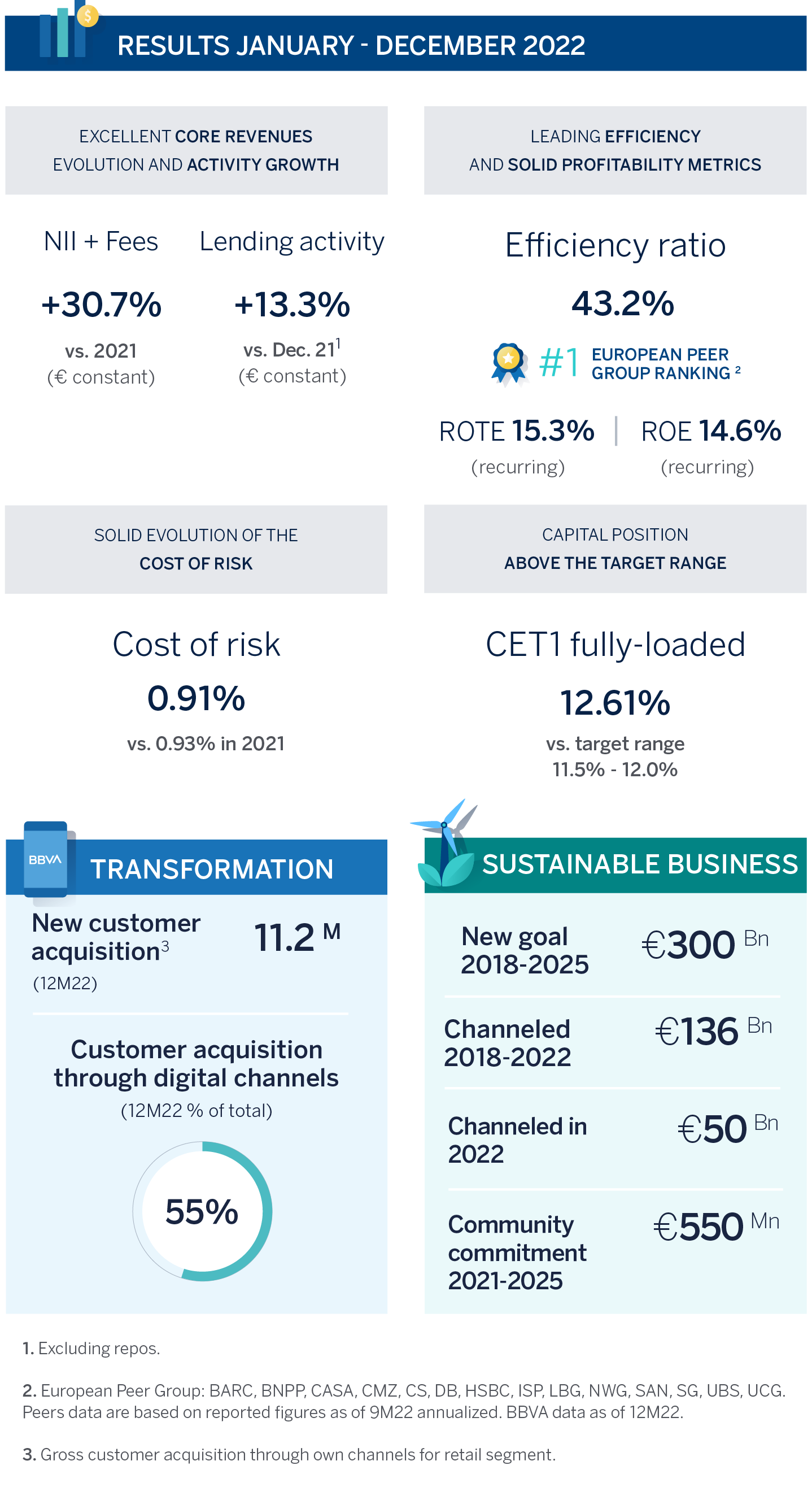

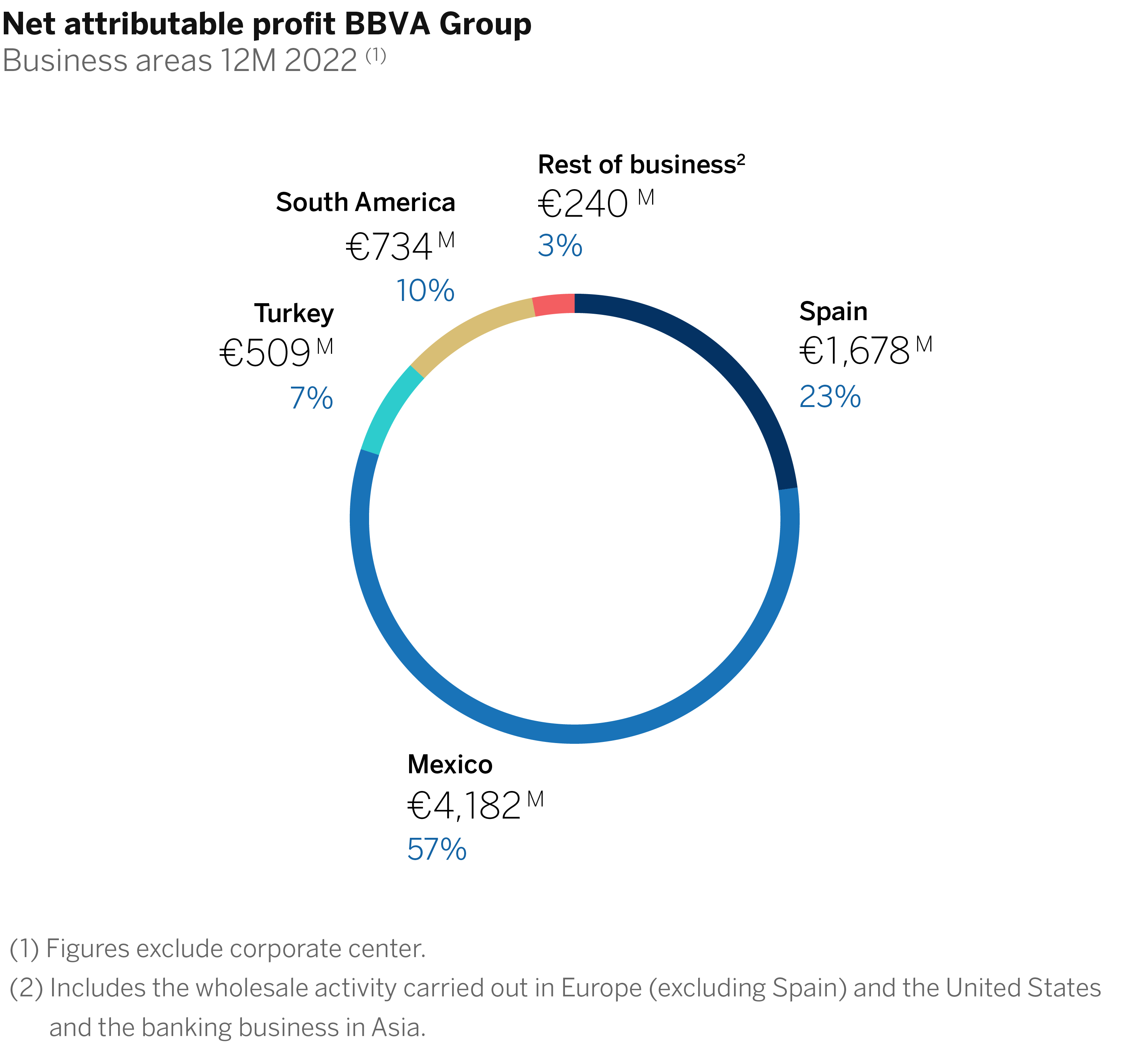

In 2022, BBVA had major advances in its strategy: It added more than 11 million new customers and continued to increase its digital sales, which already account for nearly 80 percent of the total. Furthermore, the bank channeled €50 billion in sustainable business. These achievements led to a net attributable profit of €6.42 billion in 2022, up 38 percent compared to the previous year (+39 percent at constant exchange rates), its highest to date. This figure is the result of solid income growth, bolstered by a double-digit increase in lending (+13.3 percent in constant euros). Operating income also posted a record (€14.13 billion). With these results, the bank will distribute more than €3 billion through a significantly higher dividend, which will reach €0.43 per share, and a new €422 million share buyback program¹.

Press kit Results 4Q2022

- Quarterly Report 4Q22 (PDF)

- Results Presentation Analysts 4Q22 (PDF)

- Download video (WeTransfer)

- Download video - resource images BBVA (WeTransfer)

- Statement on BBVA 4Q22 earnings from Carlos Torres Vila (Text) (PDF)

- BBVA Chair Carlos Torres Vila (JPG)

- BBVA Chair Carlos Torres Vila and BBVA CEO Onur Genç (JPG)

“2022 was a year of growth for BBVA. We had the highest profit in our history, with significant growth in lending and major advances in our strategy, focused on digitization, innovation and sustainability. Looking ahead, and despite the uncertainty, in 2023 we will continue to create opportunities for everyone and to contribute to the economic and social growth of the countries in which we have a presence,” BBVA Chair Carlos Torres Vila said.

Despite the uncertainty surrounding the war in Ukraine and its impact on the global economy, BBVA produced very strong results in 2022. Net attributable profit and operating income reached record highs.

Except where otherwise stated, in order to better understand the evolution of each of the main headings, changes in the income statement described below refer to constant exchange rates. In other words, they do not take currency fluctuations into account.

At the top of the P&L account, net interest income stood at €19.15 billion, up 35.8 percent from 2021. All geographical areas contributed to the increase on the back of double-digit loan growth² (+13.3 percent from last year, more than double the previous year), and better customer spreads. Net fees and commissions grew 15.3 percent yoy, reaching €5.35 billion. Performance for this item particularly stood out in Mexico, Turkey and South America. The sum of net interest income and net fees and commissions, which make up core revenue from the banking business, rose 30.7 percent to €24.51 billion.

Net trading income (NTI) stood at €1.94 billion (+9.4 percent yoy). The line for ‘other operating income and expenses’ accumulated a result of €-1.56 billion, mainly due to the negative adjustment for hyperinflation in Argentina and Turkey.

In short, gross income reached €24.9 billion, up 22.9 percent compared to the previous year.

In an environment of higher prices at a global level, operating expenses reached €10.8 billion, which is a 15.5 percent increase from 2021. However, this figure is below the average inflation rate in BBVA’s footprint (19.1 percent yoy). Thanks to a good performance of gross income, jaws remained positive. The efficiency ratio stood at 43.2 percent in 2022, which represents an improvement of 277 bps over the previous year. BBVA is a leader in efficiency among comparable European peers.

Due to all of the above, operating income reached a record €14.1 billion, up 29.2 percent from 2021.

At the end of December, impairments on financial assets were 12.9 percent higher than the year before. This increase is in line with growth in lending activity (+13.3 percent yoy). Consequently, the cost of risk ended the year at 0.91 percent, in line with expectations, yet below the pre-pandemic levels (1.04 percent in 2019). The NPL ratio improved to 3.4 percent at the end of 2022, compared to 4.1 percent a year earlier; and the NPL coverage ratio also increased to 81 percent vs. 75 percent in December 2021. Meanwhile, provisions and other results improved slightly, dropping 4.6 percent to €-261 million.

BBVA’s net attributable profit set a new record of €6.42 billion in 2022, up 39 percent from 2021. In 4Q22 alone, net attributable profit rose to €1.58 billion, up 29.8 percent compared to the same quarter a year earlier.

Excluding non-recurring impacts³, profit stood at €6.62 billion, which represents an increase of 32.3 percent from 2021. This last figure translates into a profit per share of €1.05. This is 48 percent higher than the previous year (in current euros) due to the impact of the share buyback program, which ended in August. At €3.16 billion, it was one of the largest in Europe, equivalent to 9.6 percent of the social capital at the time.

These results helped to propel the BBVA Group’s profitability, ending the year with ROTE of 15.3 percent --excluding non-recurring impacts. This is well above the average for comparable European peers (7.4 percent⁴). ROE was 14.6 percent, also without non-recurring impacts. Furthermore, the solid results are reflected in the Group’s CET1 fully-loaded ratio, which stood at 12.61 percent as of December 31, higher than the Group’s target range (11.5-12 percent).

BBVA will devote over €3 billion of these results (47 percent of reported attributable profit) to shareholder distributions. On the one hand, it is proposing to raise the cash dividend for the year to €0.43 (gross) per share (the highest in 14 years and up 39 percent from 2021). Following the €0.12 paid in October, the bank will submit to the Annual General Meeting the approval of a final dividend of €0.31 per share, expected to be paid in April. The bank will also launch a new €422 million share buyback program⁵. This is consistent with the Group's shareholder distribution policy, which considers a pay-out of between 40 and 50 percent of the annual profit, with the option to combine cash payments and share buyback programs.

Another figure reflecting value creation is the tangible book value per share plus dividends, which stood at €7.79 per share as of Dec. 31, 2022⁶. This represents an increase of 19.5 percent in the year, vs. an average of 3.8 percent for comparable European peers.

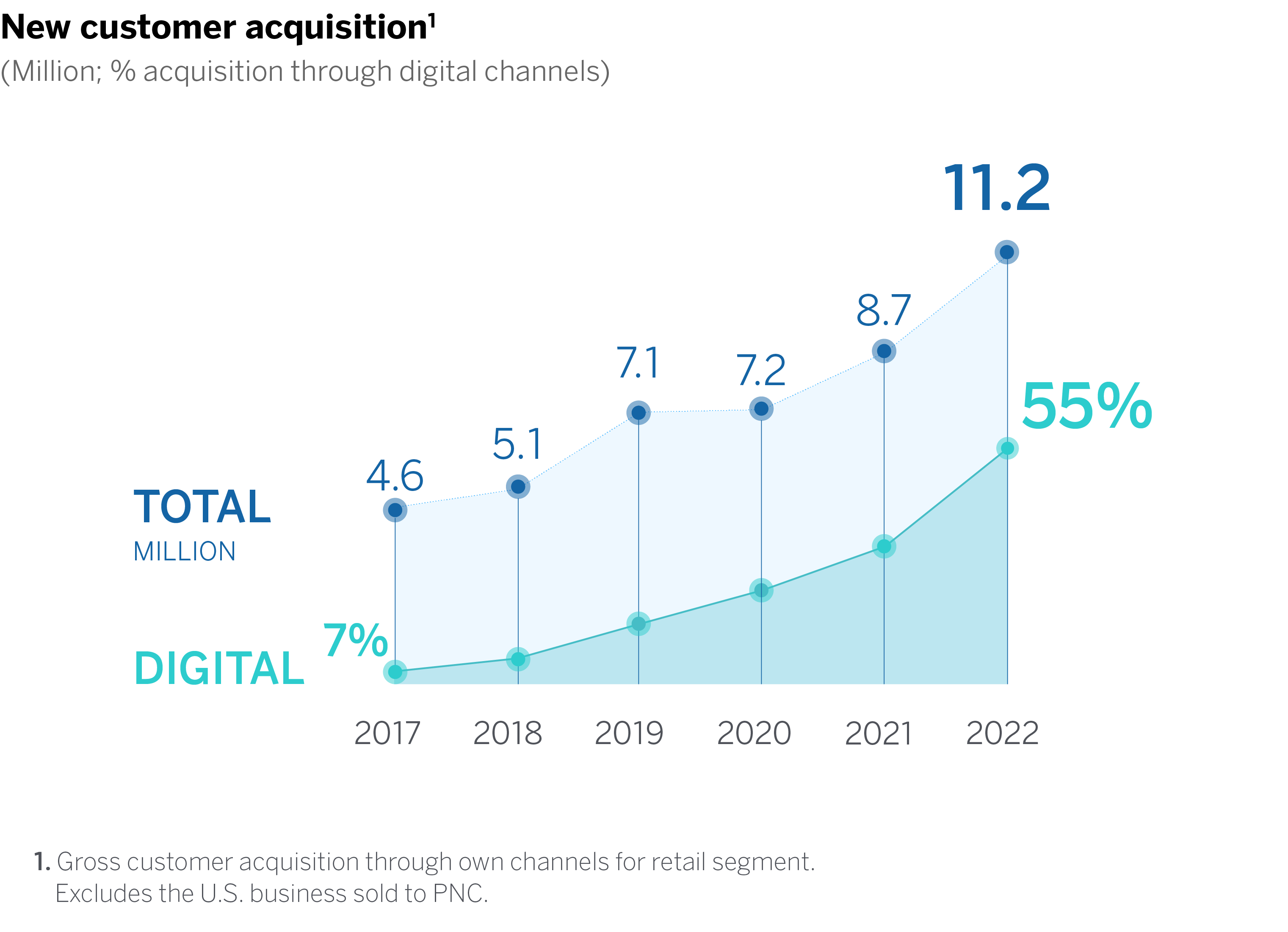

11.2 million new customers

BBVA continues to see major advances in the execution of its strategy. In 2022, the bank acquired 11.2 million new customers, 55 percent through digital channels. Mobile customers now total 47.4 million, compared to 18 million in 2017. During this same period, digital sales have grown from 40 percent to 78 percent of all units sold. Moreover, BBVA customers are increasingly satisfied with the bank, as reflected in the NPS (Net Promoter Score), which has increased 5 percentage points over the past 12 months.

€50 billion in sustainable business

Regarding sustainability, BBVA remains firm in its commitment to net zero emissions by 2050. The bank has mobilized €136 billion in sustainable business since 2018 as part of its goal to reach €300 billion in 2025. The bank channeled €50 billion in 2022 alone, a figure that has been on the rise, year after year. BBVA also set intermediate decarbonization targets for six sectors (power, automobile manufacturing, steel, cement, coal, oil and gas). Furthermore, BBVA was singled out as the best bank in Europe in the Dow Jones Sustainability Index for the third year in a row.

Commitment with society

BBVA works to promote a more sustainable and inclusive society, leaving no one behind. Its social contribution starts with the bank's own activity. It channeled more than €9 billion in loans to entrepreneurs, sustainable infrastructure, social bonds, and products such as mortgages and insurance for social-related purposes. Furthermore, the bank and its foundations have already devoted more than €230 million to social initiatives, 43 percent of its community commitment for the period 2021-25.

Business areas

In Spain lending activity increased 1.8 percent over the year, boosted by the most profitable segments: businesses, consumer and credit cards. Customer funds grew 2.1 percent, mainly on the back of demand deposits. Spain posted the highest net attributable profit of the past 12 years, with €1.68 billion in 2022 (+8.4 percent from the previous year), thanks to the momentum in net interest income and higher NTI. Lower operating expenses and provisions also stood out in the year. These results include a net impact of €-201 million from the acquisition of offices from Merlin, recorded in 2Q22. Excluding this impact the attributable profit would stand at €1.88 billion, up 21.4 percent from a year earlier. As for risk indicators, performance of the NPL ratio stood out, improving to 3.9 percent, compared to 4.2 percent in 2021. The NPL coverage ratio declined slightly from 62 percent to 61 percent, while the cost of risk fell to 0.28 percent, compared to 0.30 percent a year ago.

In Mexico activity showed great performance, with lending growing at a pace of 15.5 percent during the year and improvements in all business segments. Customer funds increased 8.7 percent, boosted by growth in demand deposits, as well as off-balance sheet funds. BBVA posted a record net attributable profit of €4.18 billion in 2022, up 44.8 percent from a year earlier, mainly due to strong growth in core revenue (net interest income and commissions) from significant momentum in business activity. This more than offset the increase in operating expenses amid a context of higher inflation. In fact, the efficiency ratio improved significantly (-361 bps over the past 12 months), reaching 31.7 percent. Risk indicators continued their trend of improvement. The NPL ratio dropped to 2.5 percent vs. 3.2 percent a year earlier. The NPL coverage ratio increased from 106 percent to 129 percent in 2022. The cost of risk stood at 2.47 percent compared to 2.67 percent the previous year.

Chair BBVA Carlos Torres Vila and CEO Onur Genç, during the presentation of the results. - BBVA

In Turkey lending in Turkish lira grew strongly (+79.5 percent), amid a context of high inflation and supported by retail segments such as consumer, credit cards and commercial loans. The loan portfolio in foreign currency shrank 16.3 percent in 2022. Customer deposits in Turkish lira also showed great evolution (+136.5 percent), on the back of demand and time deposits, while funds deposited in foreign currency continued to decline (-22.8 percent yoy). Although hyperinflationary accounting has been applied since January 1, 2022, Turkey posted a net attributable profit of €509 million in the year, thanks to good business performance and FX trends. As for risk indicators, the NPL ratio stood out, dropping to 5.1 percent from 7.1 percent at the end of 2021. The NPL coverage ratio increased from 75 to 90 percent and the cost of risk ended the year at 0.94 percent, which is a significant improvement from 1.33 percent in 2021.

In South America, lending increased 13.7 percent, with growth in all segments, particularly in corporates, consumer and credit cards. Customer funds grew 14 percent compared to the closing balances at the end of 2021, with a greater contribution from time deposits amid rising interest rates, and to a lesser extent, from off-balance sheet funds. In the P&L account, solid performance of net interest income (+57.7 percent) and fees and commissions (+38.7 percent) helped to boost results for the main franchises in the region. South America posted a net attributable profit of €734 million, up 80 percent from the previous year, with a balanced contribution of the leading countries: €238 million in Colombia, €206 million in Peru and €185 million in Argentina. Furthermore, risk indicators also improved, with the NPL ratio standing at 4.1 percent vs. 4.5 percent in 2021. The NPL coverage rate increased to 101 percent, compared to 99 percent at the end of the previous year. The cost of risk increased by 4 bps, reaching 1.69 percent.

¹Subject to the approval of BBVA governing bodies and the corresponding regulatory authorizations.

²Performing loans under management excluding repos.

³Include: (I) the net impact from the purchase of offices from Merlin in Spain in 2022 for €-201m; (II) the net costs related to the restructuring process in 2021 for €-696m; and (III) the profit (loss) generated by BBVA USA (€+280 m) and the rest of the companies in the U.S. sold to PNC on June 1, 2021.

⁴Peers data are based on reported figures as of 9M22 annualized.

⁵Subject to the approval of BBVA governing bodies and the corresponding regulatory authorizations.

⁶Includes April 2022 dividend per share €0.23 (gross) and October 2022 dividend per share €0.12 (gross).

About BBVA

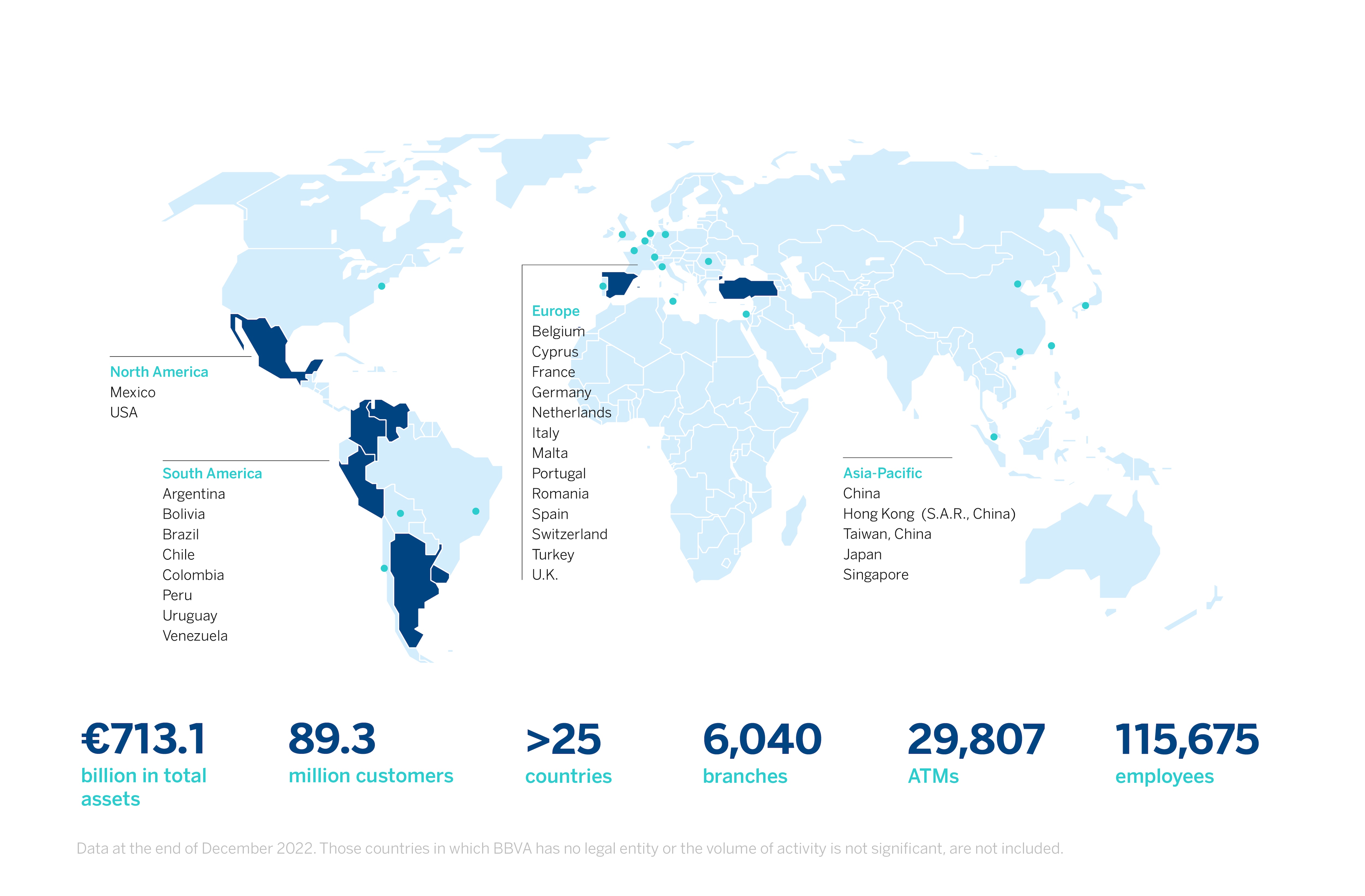

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America. It is also the leading shareholder in Turkey’s Garanti BBVA and has an important investment, transactional and capital markets banking business in the U.S. Its purpose is to bring the age of opportunities to everyone, based on our customers’ real needs: provide the best solutions, helping them make the best financial decisions, through an easy and convenient experience. The institution rests on solid values: Customer comes first, we think big and we are one team. Its responsible banking model aspires to achieve a more inclusive and sustainable society.