Earnings: BBVA earns €1.23 billion in third quarter of 2019

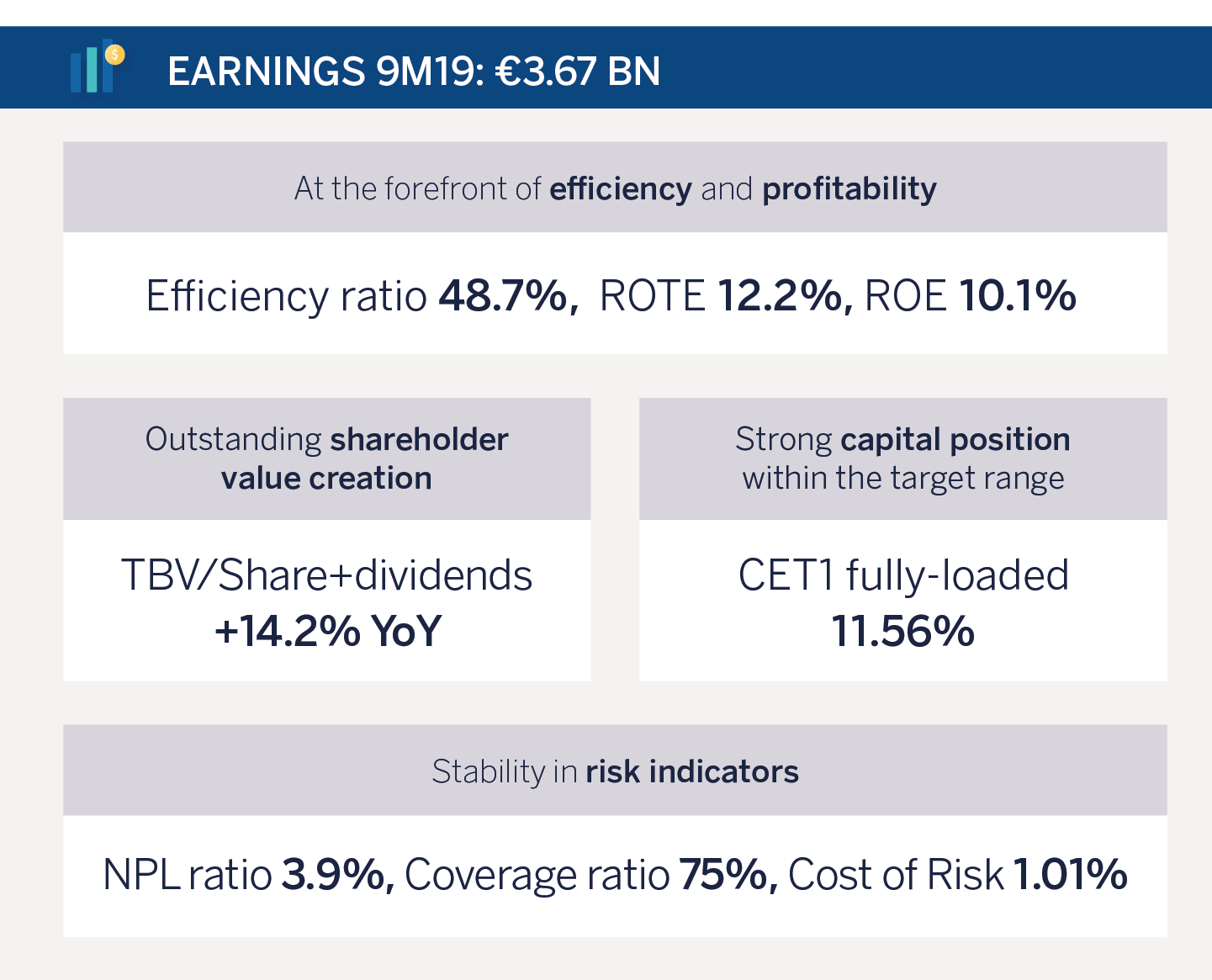

BBVA earned €1.23 billion in the third quarter, +6.1 percent yoy, excluding capital gains from the sale of BBVA Chile and this franchise’s earnings in 2018. The net attributable profit for the first nine months of 2019 reached €3.67 billion, +1.2 percent yoy (+0.5 percent in constant euros), on a comparable basis. The result was driven mainly by growth in recurring revenues and containment in operating expenses.

Materiales Results 3Q19

- 3Q19 Results Presentation Press

- Statements from Onur Genç regarding 3Q19 BBVA Results

- 3Q19 Quarterly Report

- Statements from Onur Genç - TV

- 3Q19 Results Presentation Analysts

- Statements from Onur Genç - Webs

- Series Results 3Q19

- Statements from Onur Genç - Radio

- 'La Vela', main building in the 'Ciudad BBVA'

- Onur Genç, the CEO of BBVA

- Statement on BBVA 3Q19 earnings from Group CEO Onur Genç

The bank reaffirmed its position in efficiency and profitability, as well as its strength in risk indicators and capital position. BBVA remains at the forefront of digital transformation, with positive impact on growth, efficiency and customer engagement.

To better understand the yoy comparison, all figures below exclude BBVA Chile’s earnings through July 2018, date on which BBVA sold this franchise.

BBVA Group’s net interest income reached €13.48 billion from January through September 2019, +6.3 percent yoy at current rates (+7.1 percent in constant terms, i.e. excluding exchange rate fluctuations). Mexico, South America and Turkey all showed a positive performance. Income on net fees and commissions reached €3.74 billion, +3.4 percent at current exchange rates (+3.8 percent at constant exchange rates). In 3Q19 this item reached €1.29 billion (+6.4 percent in constant euros), the highest figure in the past 10 quarters. Both lines combined, considered the recurring revenue items of the banking business, increased 6.3 percent at constant rates, to €17.22 billion for the January-September period.

The Group’s net trading income stood at €893 million through September (+2.6 percent at current exchange rates, +3.9 percent at constant rates), mostly thanks to capital gains on the sale of Prisma in Argentina during 1Q19 and positive contributions from the U.S. and Mexico. Gross income reached €18.12 billion, a 4.8 percent growth at current terms (+5.5 percent in constant euros).

The income statement confirms the solid trend in containing operating expenses, which grew 2.9 percent yoy through September (+3.2 percent at constant rates), significantly below the average inflation rate across BBVA’s footprint (6.0 percent). A positive performance in operating expenses and growth in recurring revenues allowed the Group to deliver positive jaws, improving the efficiency ratio, which stood at 48.7 percent at the end of September, 75 basis points below the 2018 year-end figure at constant exchange rates). This ratio remains well below the average of its European peer group (63.5 percent as of June 2019).

Operating income reached €9.3 billion during the first nine months of the year, +6.6 percent yoy (+7.9 percent at constant exchange rates).

BBVA Group’s attributable profit reached €3.67 billion through September, +1.2 percent (+0.5 percent at constant rates) excluding capital gains on the sale of BBVA Chile in July 2018. In 3Q19, the Group’s net attributable profit reached €1.23 billion, up 6.1 percent from the same quarter of the previous year (again, excluding corporate transactions). The net attributable profit between January and September was 15.2 percent lower yoy, if BBVA Chile is included in the comparison.

In terms of value creation for the shareholder, tangible book value per share plus dividends was €6.51 in the first nine months of the year, a figure that represents a 14.2 percent increase compared to the same period a year earlier. BBVA also continued to post double-digit profitability metrics, with ROTE of 12.2 percent, well above the average of European peers (8.3 percent, as of June 2019) and ROE of 10.1 percent (compared to a 7.0 percent average for European peers, also as of June 2019). The Group maintains its shareholder remuneration policy, which envisages a pay ratio in cash of 35 to 40 percent of profit. In this sense, on October 15, BBVA paid a gross interim cash dividend of €0.10 per share.

The fully loaded CET1 capital ratio stood at 11.56 percent in September, within the Group’s 11.5-12 percent range, thanks to its organic capital generation capacity (22 basis points ytd, after absorbing 24 basis points on the back of regulatory impacts).

Asset quality indicators remained solid during 3Q19, in line with previous quarters. Coverage ratio stood at 75 percent at the end of September, the NPL ratio at 3.9 percent and the cost of risk at 1.01 percent.

As for lending activity, customer loans and advances grew 1.3 percent compared to December 2018, to €378.78 billion, with growth in Mexico, and, to a lesser extent, in South America and Rest of Eurasia business areas. Customer funds grew 0.9 percent between January and September to €379.33 billion, and off-balance sheet resources increased 7.8 percent, driven by the performance of both mutual and pension funds.

The world’s best app

BBVA continues to lead the digital transformation. Consulting firm Forrester Research named BBVA’s banking app in Spain the world’s best for the third year running.

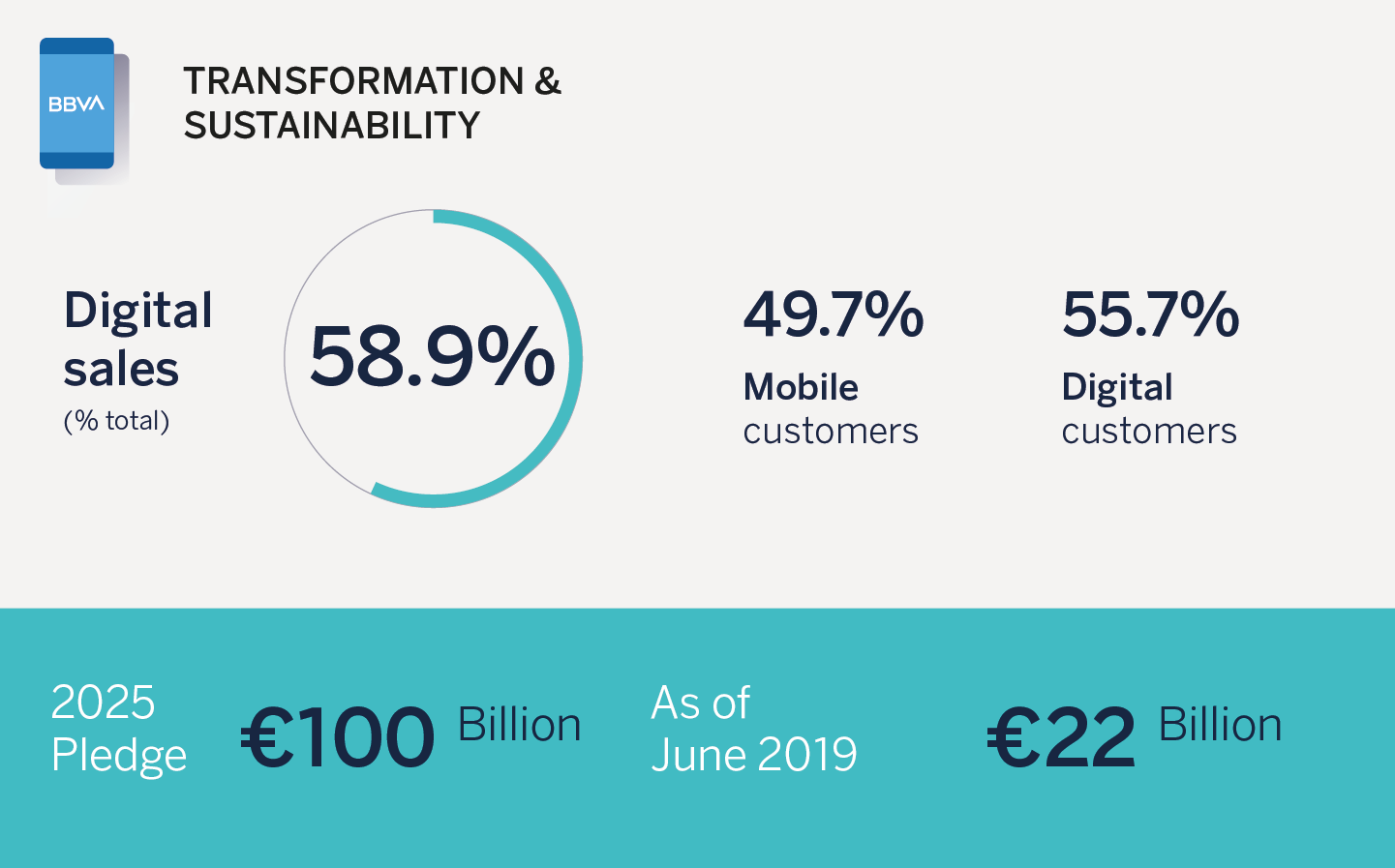

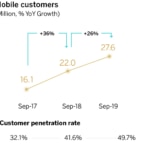

The number of digital customers increased 17 percent over the past 12 months to 31 million, accounting for 55.7 percent of the customer base. Within this group, mobile customers grew 26 percent to 27.6 million, or 49.7 percent of the total customer base, inching closer to the 50 percent target set for the year. Finally, digital sales accounted for 58.9 percent of total unit sales and 44.8 percent in terms of economic value (PRV), in line with the target to surpass the 50-percent threshold in 2020.

Thanks to its transformation, BBVA has grown its customer base as well as its sales. For instance, in Mexico, from September 2017 through the same month of 2019, the number of active customers increased by more than two million. Consequently, total sales through September grew 14 percent compared to the same period of 2017, driven by digital sales (which grew 131 percent over the same period). Also, the transformation process is driving customer satisfaction and retention rates. BBVA obtained the highest Net Promoter Score (NPS) of the Mexican banking industry. The customer attrition rate is 54 percent lower among those who interact with the bank via digital channels. The use of digital channels also drives efficiency, lowering operating expenses.

Sustainability

In September 2019, BBVA signed the Principles for Responsible Banking, promoted by the United Nations Environment Programme Finance Initiative (UNEP FI) during the General Assembly of the United Nations. Additionally, the bank joined the Collective Commitment to Climate Action launched by 31 international financial institutions.

BBVA is also included in the Dow Jones Sustainability Index (DJSI), the market’s leading benchmark index, which measures the financial, environmental and social performance of the world’s most valuable companies. In the 2019 edition, BBVA achieved the highest possible score in financial inclusion and occupational health and safety, and high scores in other areas such as climate strategy, environmental reporting and corporate citizenship and philanthropy.

Business Areas

The main highlights of each business area are detailed below.

In Spain, lending remained relatively stable (-0.8 percent yoy, with significant growth in the most profitable retail segments, i.e. consumer loans and cards, +15.6 percent). Growth in these segments helped to offset deleveraging in mortgages (-3.9 percent) and institutions loans (-8.0 percent). Customer resources grew 1.8 percent in the last 12 months, driven by demand deposits (+7.2 percent). Off-balance sheet funds had a positive performance, in both pension and mutual funds (+3.5 percent since December). At €1.06 billion, Spain’s net attributable profit from January to September 2019 declined 2.5 percent yoy. This drop is mostly due to a lower NTI contribution (-62.5 percent) amidst market behavior in 2019. Net interest income reached €2.72 billion (-1.9 percent), in line with expectations. Net fees and commissions increased 1.3 percent. Positive trends in operating expenses continued (-3.0 percent yoy), thanks to cost-reduction efforts. The sharp decline in NPL balances (-63.0 percent yoy) was mainly driven by the sale of non-performing and bad mortgage loan portfolios during 2Q19. Since June, the coverage ratio increased to 59 percent and the NPL ratio improved to 4.6 percent, the lowest level of the past ten years.

In the United States, lending grew 1.4 percent yoy (at constant exchange rates). Customer deposits increased 4.0 percent yoy and are progressively benefitting from a change in their composition: demand deposits grew 6.6 percent yoy and already represent 77 percent of total deposits, offsetting the decline in time deposits over the same period (-3.4 percent). The net attributable profit in the U.S. for the first nine months of 2019 stood at €478 million, down 11.8 percent from a year earlier at current exchange rates (-17 percent at constant rates), as a result of higher impairments in financial assets, mainly linked to provisions for specific customers in the commercial portfolio and write-offs in the consumer portfolio in 1Q19. Operating income grew 21.9 percent yoy (+14.7 percent at constant exchange rates), thanks to the increase in revenue lines and stability in operating expenses. Risk indicators performed favorably, with an increase of the coverage ratio from 91 percent in June to 102 percent in September, while the NPL ratio improved from 1.3 to 1.1 percent.

Lending in Mexico grew 5.4 percent yoy, thanks to the increase in mortgages (+10.3 percent) and consumer lending (+14.2 percent). In a complex environment, with low economic growth, BBVA managed to retain its leading position, with a market share of 22.5 percent in performing loans. Customer resources also grew by 6.9 percent yoy, with special emphasis on time deposits (+18.4 percent) and mutual funds (+6.6 percent). The net attributable profit between January and September reached €1.97 billion, a 6.9 percent increase yoy at current exchange rates (+1.7 percent in constant euros), with net interest income acting as the main driver (+11.9 at current exchange rates, +6.5 percent at constant rates). Gross income grew 10.7 percent on a yoy basis (+5.3 in constant euros) and operating income 11 percent (+5.6 percent in constant euros). As for risk indicators, the coverage ratio stood at 136 percent and the NPL ratio increased slightly, from 2.2 percent to 2.4 percent during the quarter.

In Turkey, lira-denominated loans fell 1.9 percent compared to September 2018, while lending in foreign currency dropped 22.0 percent. Deposits in both lira and foreign currencies declined in the 12-month period (-1.4 percent and -1.0 percent, respectively). However, demand deposits in both currencies grew significantly over the same period (+15.5 percent and +22.8 percent yoy). Turkey’s net attributable profit was €380 million, down 21.8 percent from the same period of 2018 (-10.0 percent in constant euros). The net interest income performance was particularly solid, growing 6 percent yoy (in constant euros), thanks to a good price management and the contribution of inflation-linked bonds, although it fell 7.9 percent at current terms, due to the Turkish lira’s depreciation during this period. Fees and commissions grew by 6.2 percent (+22.3 percent in constant euros), thanks to the good performance of those linked to payments. The solid behavior in recurring revenues together with cost containment efforts –with growth significantly below the average inflation rate for this period (+11.3 percent vs. +18.3 percent)-, helped operating income to grow 1.5 percent at constant exchange rates (-11.8 percent including currency evolution). As for risk indicators, the coverage ratio remained stable at 75 percent in the last quarter, while the NPL ratio grew from 6.3 percent to 7.2 percent.

In South America, excluding BBVA Chile from the comparison, customer lending grew 7.7 percent compared to September 2018, thanks to solid results in Colombia (+5.6 percent), Peru (+7.9 percent) and Argentina (+19.7 percent). Customer funds also grew 7.1 percent in yoy terms. The area’s net attributable profit for the first nine months of the year reached €569 million, up 45 percent yoy (+62 percent in constant euros), thanks to positive trends in recurring revenues (net interest income plus fees and commissions, which grew a combined 15.4 percent in current euros, 22.3 percent in constant euros) and the higher contribution of NTI. Regarding risk indicators, the region’s coverage ratio stood at 97 percent, while the NPL ratio reached 4.4 percent.

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico, it has leading franchises in South America and the Sunbelt Region of the United States. It is also the leading shareholder in Turkey’s Garanti BBVA. Its purpose is to bring the age of opportunities to everyone, based on our customers’ real needs: provide the best solutions, helping them make the best financial decisions, through an easy and convenient experience. The institution rests in solid values: Customer comes first, we think big and we are one team. Its responsible banking model aspires to achieve a more inclusive and sustainable society.