Results: BBVA earns €3.45 billion in first nine months of the year (+23%)

- Operating income: Recurring revenues continued their upward trend, growing 4.2% between January and September. This, together with cost containment efforts (expenses dropped 1.7% in the year to September), drove operating income to a record €9.52 billion

- Risks: The NPL ratio continued to improve, reaching 4.5% in September (vs. 4.8% in June), the lowest level in the past five years. Coverage increased to 72%

- Capital: The fully-loaded CET1 ratio rose to 11.2% in September, reflecting a capital generation of 30 basis points in the first nine months of the year

- Transformation: The digital customer base grew 24% y-o-y to 21.1 million in September. Of these, the number of customers banking with their smartphones surged 43% to 15.8 million

The BBVA Group posted a net attributable profit of €3.45 billion during the first nine months of 2017, nearly equal to its profit for the whole of 2016 and an increase of 23.3% from the same period a year earlier (+28.7% at constant exchange rates). A solid performance in terms of recurring income, cost containment and a drop in impairment losses on financial assets were the main factors driving this growth.

BBVA CEO Carlos Torres Vila pointed out that “quarter after quarter, BBVA keeps posting solid, recurring and sustainable results. We are already seeing the results of our transformation, with new banking features that have a positive impact on our customers’ lives, while prompting an exponential growth in digital sales.”

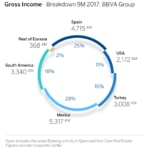

The Group’s net interest income for the January-September 2017 period stood at €13.2 billion, up 4.2% y-o-y (+9.5% in constant terms). Adding fees and commissions (e.g. recurring revenues), this item came to €16.91 billion, an increase of 4.2% compared to the first nine months of 2016 (+9.3% after stripping out currency impact). The good evolution of recurring revenues was the main driver of gross income, which reached €18.91 billion between January and September (+2.6% y-o-y, and +7.2% at constant exchange rates).

Between January and September, operating expenses fell 1.7% compared to the same period of the previous year (+1.8% in constant terms). This positive performance was more evident in Q3-17, with expenses declining 4.4% y-o-y (+1.3% not considering currency impact). Cost discipline continued to yield positive results, prompted by the realization of some of the synergies from the integration of Catalunya Banc, as well as the transformation advances.

The performance of income and costs generated ‘positive jaws’ allowing the efficiency ratio to remain, yet another quarter, below 50% (49.6%), well below from the same period a year earlier. This also drove the Group’s net operating income to a record €9.52 billion, up 7.2% y-o-y, (+13.1% at constant exchange rates).

As for risk indicators, the NPL ratio improved. At the end of September, it stood at 4.5% (vs. 4.8% in June), the lowest in the last five years. The coverage ratio also improved to 72% (compared to 71% in June), while the cost of risk remained stable at 0.9%.

In terms of solvency, BBVA showcased its strong capital generation capacity. Between January and September, the Group generated 30 basis points, driving the fully-loaded CET1 capital ratio to 11.2%, above the Group’s target (11%). On the other hand, the fully-loaded leverage ratio at the end of September came to 6.7%, ranking BBVA first among its European peers.

Regarding funding, BBVA successfully completed its first issue of non-preferred senior debt, for a total of €1.5 billion, with a coupon of 0.75%. This new liability category, with loss-absorption capacity, allows EU financial institutions to meet the regulatory requirements established by MREL regulation.

Banking activity remained in line with the two previous quarters, with increasing volumes in emerging markets and further deleveraging in Spain. On the other side, the U.S. saw a slight recovery in lending during Q3-17. In this context, gross lending reached €416.24 billion at the end of September, down 1.6% from the previous year. In contrast, customer deposits increased over the past twelve months (2.0%) to reach €392.87 billion.

Banking Activity in Spain continued to deleverage, leading to a 1.2% decline in loans (performing loans under management) during Q3. However, new loan production was very positive in some segments such as companies (+12.3% y-o-y) and consumer finance (+30.7% y-o-y). Furthermore, activity in consumer finance through digital channels increased 64% y-o-y. On the other hand, customer deposits increased 1.4% over June, with notable growth in current and savings accounts.

The bank’s transformation

BBVA’s transformation is accelerating. At the end of September, the Group’s digital customer base stood at 21.1 million, up 24% in y-o-y terms. Of these, 15.8 million were customers that bank using mobile devices, up 43% from last year.

In Q3-17 alone, the Group sold more than 3.5 million units through digital channels, marking a milestone in BBVA’s transformation. The bank is seeing exponential growth across all franchises. At a global level, digital sales accounted for 25.4% of the total between January and September, compared to 16.8% in 2016. In Spain, digital sales accounted for 26.5% of the total between January and September, compared to 17.1% in 2016; in the U.S. they accounted for 23.3% (vs. 19.4% in 2016); in Mexico 18.3% of the total (vs. 11.9% in 2016), in Turkey 31.8% of the total (vs. 25.2% in 2016); and in South America 32.8%, a notable increase from 2016 (15.4%).

The key developments in each business area are detailed below:

Once again, Banking Activity in Spain proved its resilience in a context of interest rates at all-time lows. In fact, net interest income between July and September remained at similar levels as in the second quarter. Fees and commissions continued to increase (+4.3% y-o-y in cumulative terms). Gross income between January and September reached €4.73 billion, down 4.3% from the same period of the previous year. The decline can be largely attributed to the increased sales of wholesale portfolios, and to capital gains resulting from the VISA operation, all of them recorded in 2016. One of the area’s drivers was its solid performance in terms of operating expenses, with a cumulative drop of 5.4% y-o-y as of the end of September. The realization of synergies from the integration of Catalunya Banc and the transformation process are becoming more evident. The second key driver was the drop in impairment losses on financial assets (-40.5% y-o-y in the year to September). Risk indicators saw a positive performance: the NPL ratio closed at 5.6% in September (5.7% in June) while coverage stood at 52%. The area's net attributable profit for the first nine months of the year stood at €1.06 billion, up 13.7% in y-o-y terms.

In the Non-Core Real Estate area, wholesale operations and the recovery of the real estate market helped to speed up divestments. As of September 30, net exposure to the real estate business stood at €7.83 billion, down 23.3% from December 2016. The net attributable loss for the first nine months of 2017 was €281 million, an improvement over the €315 million in losses in the same period of the previous year.

To better explain the business trends in the areas that use a currency other than the euro, the variation rates described below refer to constant exchange rates.

In the United States - an area that is still focusing on growth in the most profitable segments and portfolios - loan activity picked up during the quarter (0.6% vs. Q2-17). A relevant factor was the growth in net interest income (+14% y-o-y in the year to September), driven by solid management of customer spreads and rising interest rates. The positive trend in this item, together with cost containment efforts (+1.6% y-o-y) - which grew at a rate below the inflation rate - contributed to the growth of operating income (+22.5% y-o-y). Impairment losses on financial assets saw a slight decline between January and September, but increased during Q3-17, as a result of the sums allocated to account for the impact of Hurricanes Harvey and Irma. On the other hand, risk indicators continued to improve during Q3-17: the NPL ratio as of the end of September stood at 1.2% (compared to 1.3% in June), while coverage rose to 119% (105% in June). The net attributable profit for the year to September increased 42% in y-o-y terms, to €422 million.

Mexico continued to post solid activity ratios: As of September 30, loan activity increased 8.9% y-o-y, while customer resources grew 10.5%. As for profits, recurring revenues performed strongly, growing at almost double-digit rates y-o-y. Net trading income grew 31.5% y-o-y, on the back of a strong performance from the global markets unit. On top of solid income growth, the area’s cost containment efforts yielded positive results, with expenses growing 4.9% in the year to September, below inflation levels. This resulted in operating income growth of 13.5% compared to the first nine months of 2016. Risk indicators remained stable: the NPL ratio was 2.3%, while coverage stood at 126%. The area’s net attributable profit between January and September 2017 came at €1.62 billion, up 15.3% from the same period of the previous year.

A buoyant activity in Turkey prompted solid rates in lending (+18.4%) and customer resources (+17.5%). Recurrent revenue growth was one of the key drivers of the P&L account. Net interest income grew 16.5% in y-o-y terms, while fees and commissions grew 13.6%. Cost discipline (costs grew 8.8% in the same period of the previous year, below inflation levels) was a key element in the area’s results. Operating income between January and September grew 15.5% compared to the same period of the previous year. The positive evolution of impairments losses on financial assets and provisions helped to boost profits. Risk indicators also continued to perform better than the sector’s average. The NPL ratio as of September was 2.5%, while the coverage ratio stood at 138%. Turkey posted a net attributable profit for the year to September of €568 million, up 49.6% y-o-y.

In South America, activity increased at almost double-digit rates: lending activity was 9.5% higher than in September 2016, while customer resources grew 10.8%. Recurring revenues saw a solid performance: Net interest income grew 12.9% in y-o-y terms, while fees and commissions grew 15.9%. Operating income grew 15%, driven not only by revenue headings, but also by cost containment efforts. Risk indicators remained stable compared to June: the NPL ratio as of September 30 stood at 3.5%, while coverage reached 94%. The net attributable profit for the first nine months of the year was €616 million, with y-o-y growth of 5.4%.

About BBVA

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico, it has leading franchises in South America and the Sunbelt Region of the United States; and it is also the leading shareholder in Garanti, Turkey’s biggest bank for market capitalization. Its diversified business is focused on high-growth markets and it relies on technology as a key sustainable competitive advantage. Corporate responsibility is at the core of its business model. BBVA fosters financial education and inclusion, and supports scientific research and culture. It operates with the highest integrity, a long-term vision and applies the best practices.