BBVA posts underlying profit of €2.33 billion in first half of 2021

The BBVA Group’s attributable profit reached €2.33 billion between January and June 2021, excluding non-recurring impacts from the results generated by the sale of BBVA USA and the net costs of the restructuring plan in Spain. This figure is 146 percent higher than the one from 1H20 (+183 percent at constant exchange rates). Including these non-recurring impacts, the attributable profit stood at €1.91 billion, a figure that compares very favorably with the €1.16 billion loss recorded in the same period of the previous year amidst the pandemic breakout. These earnings were made possible thanks to revenue strength, particularly those linked to the bank’s core activity (net interest income and fees and commissions), as well as lower impairments vs. 1H20. Following the sale of the U.S. subsidiary, BBVA maintains a solid capital position, with a fully loaded CET1 ratio of 14.17 percent. The Group has also set the date for its Investor Day, on November 18, 2021, an online meeting where it will share its strategy and goals with the investment community.

Press kit Results 2Q21

- Quarterly Report 2Q21 (PDF)

- Statement on BBVA 2Q21 earnings from BBVA CEO (Text) (PDF)

- 2Q21 Results Presentation Press (PDF)

- Statements from Onur Genç (YouTube)

- Download audio (WeTransfer) (Radio)

- 'La Vela', main building in 'Ciudad BBVA' (JPG)

- BBVA CEO Onur Genç (JPG)

- Download resource images from BBVA (WeTransfer) (We Transfer)

“Our results have had a very positive evolution in the second quarter of 2021. Our underlying net attributable profit stood at €1.29 billion, even above pre-COVID levels, on the back of a strong operating income. We continue to advance at a solid pace in some key areas of our strategy: We have doubled our commitment to sustainable finance, and we have reported a record in digital customer acquisition,” BBVA CEO Onur Genç said.

One of the relevant milestones of the quarter was the closing of the sale of the BBVA subsidiary in the U.S. to The PNC Financial Services Inc (from now on, PNC). The accounting of both, the results generated by BBVA USA since the announcement of the transaction in November 2020, and the closing of the sale on June 1, 2021, account for a result net of taxes of €582 million. Of this amount, €302 million were recorded in the 4Q20 financial statement, with the remaining €280 million being recorded in 1H21. (€177 million in the first quarter, and €103 million in the second one).

As for the restructuring process in Spain, following the agreement between the Group and the legal workers’ representatives on June 8, 2021,a net cost of €696 million has been recorded in 2Q21.

Information related to the P&L account below excludes these non-recurring impacts. The results generated by the sale of the BBVA USA are reported under a single line: Profit/(loss) after tax from discontinued operations. Also, the impact related to the restructuring process in Spain is reported under net costs linked to the restructuring process. Both items are reported in the Corporate Center.

Also, and unless expressly otherwise stated, to better understand the changes under the main headings of the Group's income statement, the yoy percentage changes provided below refer to constant exchange rates.

Following a significant effort in impairments and provisions in 1H20, BBVA’s earnings, excluding non-recurring items, have recovered pre-pandemic levels, primarily driven by the net interest income and fees and commissions, and the high contribution of net trading income (NTI), mainly thanks to the performance of the Global Markets unit in Spain.

On the top of the P&L statement, net interest income reached €6.96 billion between January and June, up 0.9 percent yoy, driven by a significant contribution of Mexico (+3.9 percent yoy). Net fees and commissions grew strongly during the first half of 2021 across key business areas, with yoy growth of 19.7 percent to €2.32 billion, on the back of an increase in activity. Overall, the recurring revenues of the banking activity grew 5.0 percent yoy, to €9.27 billion. As for NTI, it grew a noteworthy 14.8 percent yoy, to €1.08 billion. All this prompted gross income to grow 4.9 percent yoy in 1H21, to €10.26 billion.

Operating expenses increased 5.1 percent yoy to €4.6 billion, a growth below the average inflation rate of BBVA’s footprint (5.4 percent). The efficiency ratio stood at 44.8 percent as of June 30, 2021, after improving 73 basis points since December 2020.

Operating income closed the first half of the year at €5.66 billion, after growing 4.7 percent vs. the same period of the previous year.

It is worth noting the significant drop in impairments on financial assets and provisions vs. 1H20 (-52.3 percent and -68.4 percent, respectively), when the bank made a huge provisioning effort to brace for the pandemic’s impact.

BBVA’s attributable profit during the first half of 2021 stood at €2.33 billion, excluding non-recurring impacts. This figure is 183 percent higher than that of the same period of 2020. Of the total, €1.29 billion were generated between April and June (+166 percent yoy).

Factoring in the non-recurring net impacts (the Group’s U.S. business sold to PNC and the costs linked to the restructuring process in Spain), the attributable profit of the Group in 1H21 reached €1.91 billion (€701 million during the second quarter). As for the restructuring plan in Spain, BBVA estimates gross savings of about €250 million per year from 2022.

In line with the positive evolution of the attributable profit, the Group’s profitability indicators also improved: ROE stood at 10.4 percent and ROTE closed at 11 percent¹.

In terms of shareholder value creation, this increase in profitability translated into a tangible book value per share plus dividends of €6.40 (+9 percent yoy, +4`percent in 2Q21). It is worth mentioning that on April 29, BBVA distributed a cash amount of €0.059 per share, which represents a 15 percent payout on the Group's 2020 earnings, the maximum allowed by the European Central Bank (ECB) for that year.

Regarding capital, the fully loaded CET1 ratio as of June 30, 2021, reached 14.17 percent, which represents a new level of capital that provides an ample strategic optionality. This ratio includes the positive impact of 260 bps from the sale of the U.S. subsidiary (from a total of 284 bps generated since the deal was announced) and the negative impact of 25 bps from Spain’s restructuring plan. This comfortable capital position will allow BBVA to increase shareholder distributions. After the ECB announced a lifting of restrictions starting on Sept. 30, the Group’s intent is to resume its dividend policy in 2021, i.e. a cash payout of 35-40 percent of the profit. Likewise, BBVA has initiated the necessary steps for a share buyback program of up to 10 percent of its share capital, which it expects to be able to start implementing in 4Q21, once it receives the approval from the supervisor². The pro forma fully loaded CET1 ratio, including this share repurchase program, stands at 12.89 percent³.

As for risk indicators, the NPL ratio stood at 4.2 percent as of the end of June 2021, slightly below the previous quarter’s ratio (4.3 percent). The NPL coverage ratio reached 77 percent, while the cost of risk (in cumulative terms) performed better than expected, to reach 1.00 percent as of 30 June 2021. These figures exclude the balances corresponding to the U.S. business sold to PNC.

Regarding the balance sheet and activity, the gross figure for loans and advances to customers grew 1.3 percent vs. the end of 2020, to €327.37 billion, driven mainly by dynamic activity in Turkey, Spain and Mexico. Customer funds grew slightly – 0.6 percent – vs. 2020 year-end, to €448.40 billion, thanks to the positive trends in mutual funds, pension funds and other off-balance sheet funds (+6.5 percent during the 1H21), which managed to offset the decline in deposits (-1.1 percent in the same period).

Progress in digitization

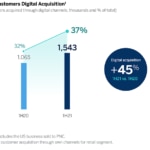

Figures for the first half of 2021 confirmed that digitization is accelerating and gaining traction across BBVA. Digital customers account for 66.1 percent of the total, to 38.5 million (+36 percent since June 2019). Mobile customers have increased 44.6 percent in the same period, to 36.3 million, and represent 62.4 percent of the total. Customer acquisition through digital channels grew a record 45 percent in the past 12 months.

New commitment to sustainability

BBVA has given a new boost to its strategy, promoting sustainability to the highest level of the organization, with the creation of a new global area of Sustainability, led by Javier Rodríguez Soler. The new area aims to make BBVA the leading bank for clients in sustainability solutions. The bank has also doubled its target of sustainable financing, and will channel €200 billion through 2025. Between 2018 and the end of the first half of 2021, the Group had already channeled €67 billion, of which €8 billion materialized in 2Q21.

In order to learn more about BBVA plans in sustainability, digitization, as well as for the overall strategy, the bank has set a date for its Investor Day, on November 18, 2021, in an online meeting with investors.

Business Areas

Significant lower impairments on financial assets and other provisions in 1H21 vs. the same period of 2020 explain to a large extent the relevant growth of attributable profit across the Group’s main business areas. This also explains the significant drop in the cumulative cost of risk across virtually all geographies, after the peak reached in 1Q20.

In Spain, it is worth highlighting the strength of new loan production in the second quarter, both in wholesale and retail segments, increasing lending activity by 1.1 percent compared to Dec. 2020. Net interest income decreased 2.2 percent through June to €1.76 billion due to low interest rates. Net fees and commissions grew strongly (+16.5 percent to €1.06 billion), driven by the asset management and insurance segments, and NTI (+71.3 percent to €283 million). The decline in operating expenses (-2.2 percent yoy) underpinned operating income growth (13.2 percent) vs. 1H20, to €1.56 billion. Spain's attributable profit reached €745 million in the first half of 2021, well above the €108 million posted in the same period of the previous year. The NPL and coverage ratios as of June 30, 2021, stood at 4.2 percent and 64 percent, respectively. The cumulative cost of risk dropped slightly from March 31 to 0.41 percent at the end of June.

In Mexico, lending increased 2.1 percent compared to the end of 2020, on the back of new loan production in all segments. The retail portfolio showed dynamism, benefiting from the economic recovery. In the P&L account, it is worth noting the growth of net interest income (+3.9 percent yoy) to €2.77 billion, as well as the solid performance of fees and commissions, which increased 15.7 percent vs. 1H20. The unit’s attributable profit stood at €1.13 billion, up 75 percent from the same period a year earlier. The NPL and coverage ratios as of June 30, 2021, stood at 3.1 percent and 118 percent, respectively. The cumulative cost of risk continued declining to 2.83 percent.

In Turkey, lending activity in local currency increased 23.7 percent yoy, while that in foreign currency declined 11.3 percent. Net interest income dropped 10.1 percent yoy in 1H21, due to the interest rates environment, although it is starting to see a pickup in 2Q21 (+9 percent). Fees and commissions saw a solid growth yoy (+49.7 percent), as well as NTI (+88.9 percent). The area’s attributable profit stood at €384 million, up 92.1 percent from the same period of the previous year. The NPL ratio stood at 7.3 percent, while the NPL coverage ratio reached 69 percent. The cumulative cost of risk declined to 0.97 percent.

In South America, excluding the sale of BBVA Paraguay from the comparison, lending increased 8.6 percent vs. June 2020, with growth in both the wholesale and retail portfolios. Net interest income grew 12.3 percent while net fees and commissions rose 43.2 percent. Driven by this solid behavior in recurring revenue, the attributable profit for 1H21 reached €218 million, 110 percent more than in the first half of 2020.

¹Figures excluding the non-recurring impacts.

² Any decision on a repurchase of ordinary shares would require supervisor and governing bodies authorization. The final percentage of shares subject to the buyback (up to a maximum of 10%) will be determined depending on different factors, including BBVA share price during the buyback period.

³ CET1 Pro-forma calculated considering a buyback of 10% of ordinary shares with a share price of €5.25 as of 22 July 2021.

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America. It is also the leading shareholder in Turkey’s Garanti BBVA and has an important investment, transactional and capital markets banking business in the U.S. Its purpose is to bring the age of opportunities to everyone, based on our customers’ real needs: provide the best solutions, helping them make the best financial decisions, through an easy and convenient experience. The institution rests in solid values: Customer comes first, we think big and we are one team. Its responsible banking model aspires to achieve a more inclusive and sustainable society.