BBVA earns €2.65 billion in first half of the year (+15 percent YoY)

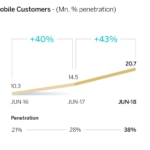

- Transformation: At the end of June, BBVA’s digital customer base stood at 25.1 million (+26 percent yoy). Of these, 20.7 million were mobile customers (+43 percent yoy). Digital sales increased in H1-18 and now account for 39 percent of total sales. All this contributed to strengthen recurring banking revenues and to keep efficiency at 49.2 percent

- Income: Solid trends in recurring revenues and cost containment efforts drove operating income growth in the first six months of 2018 (+6.8 percent in constant terms). Profitability has also improved significantly. ROE stood at 11.7 percent, while ROTE was 14.3 percent

- Risks: Risk indicators continued to perform robustly. At the end of June, the NPL ratio stood at 4.4 percent, with coverage of 71 percent

- Capital: A pro-forma fully-loaded CET ratio of 11.40 percent was reached in June. It includes the sale of BBVA Chile (finalized in July) and the Cerberus agreement to reduce its exposure to the real estate business. The tangible book value per share grew in the quarter

BBVA reported net attributable profit of €2.65 billion for the first six months of 2018, up 14.9 percent from the same period a year earlier (+29.5 percent in constant terms). Upbeat revenue trends, containment in operating expenses, and lower loan-loss impairments and provisions were the key drivers of growth.

“Thanks to the progress achieved in the bank’s transformation, recurring revenues grew strongly during the first half of the year,” BBVA CEO Carlos Torres Vila said. “This has been a very good quarter with significant improvements in profitability and value creation for our shareholders.”

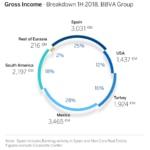

Net interest income totaled €8.64 billion in the six-month period (down 1.8 percent yoy, +9.4 percent at constant exchange rates), while fees and commissions grew 1.5 percent yoy (+11.3 percent stripping out currency effects). Both line items -recurring revenues- saw growth virtually across all regions, reaching €11.14 billion (-1.1 percent yoy, +9.8 percent in constant terms). This was the main catalyst of the trend in gross income, which, from January through June, reached €12.07 billion (-5.1 percent compared to the same period of the previous year, +4.8 percent excluding currency impacts).

Cost discipline continued bearing fruit, resulting in a 5.8 percent drop in operating expenses (+2.9 percent in constant terms). All regions generated positive jaws (core revenues growth exceeding expense growth). The efficiency ratio stood at 49.2 percent, 82 basis points below the figure for 2017 at constant exchange rates.

In this context, operating income reached €6.13 billion, (down 4.3 percent compared to H1-17, +6.8 percent excluding currency impacts.)

Net attributable profit during the first six months of 2018 maintained its favorable performance (+14.9 percent, +29.5 percent at constant exchange rates). This had a notable impact on the company’s profitability ratios. The ROE at the end of June stood at 11.7 percent, while the ROTE reached 14.3 percent.

Risk indicators remained at solid levels. The NPL ratio was stable at 4.4 percent. Coverage ratio stood at 71 percent and cost of risk was 0.8 percent.

In terms of capital adequacy, BBVA’s capital position remained solid. The pro forma fully-loaded CET1 ratio – which includes the sale of BBVA Chile (finalized in July) and the agreement with Cerberus to reduce its exposure to the real estate business– stood at 11.40 percent at the end of June. The fully-loaded leverage ratio stood at 6.4 percent, the highest among BBVA’s European peer group. Despite the uncertainty in some markets, the quarter saw value creation for shareholders, with an increase of the tangible book value per share to €5.63 in June, compared to €5.58 in March.

As for balance sheet and business activity, in net terms, loans and advances to customers increased 0.8 percent between January and June, to €377.18 billion. Customer deposits grew by 1.0 percent during the same period, to €367.31 billion.

Transformation of the bank

The BBVA Group is approaching its goal of having 50 percent of its worldwide customer base made up of digital customers this year, with 50 percent of mobile clients in 2019. As of June 30, 46 percent of its customers (25.1 million, +26 percent yoy) banked through digital channels. Mobile customers (20.7 million, +43 percent yoy) accounted for 38 percent of the overall customer base. This growing trend is also reflected in digital sales across all regions. Between January and June, 38.6 percent of total unit sales were made through digital channels, compared to 22.4 percent a year earlier, and just 14.6 percent two years ago.

The key developments in each business area are detailed below.

In Banking Activity in Spain, lending grew in the second quarter, with loans increasing 1.6 percent. On a portfolio basis, consumer loans and credit cards had a good performance (+12.6 percent in the six-month period) and in the very small businesses (+4.4 percent). Customer deposits grew 2.6 percent between April and June. Net interest income remained stable in Q2-18, compared to the previous quarter (-0.5 percent). This, together with fees and commissions (recurring revenues) grew 1.5 percent in H1-18 yoy. In this context, gross income for the period stood at €3.05 billion. Operating expenses continued to decline and dropped 4.1 percent yoy. Lower impairment losses on financial assets caused this item to drop significantly (-42.2 percent yoy). On the other hand, asset quality indicators continued to improve: As of June, the area’s NPL rate stood at 5.2 percent (vs. 5.5 percent in December 2017), with coverage ratio improving to 57 percent. Net attributable profit reached €793 million, up 19.2 percent compared to the same period of the previous year.

As for the Non-Core Real Estate area, BBVA will almost entirely reduce its exposure to the real estate business once the agreement with Cerberus is finalized, predicted for Q3-18. Apart from this, the bank’s net exposure to the real estate sector continued to decline: As of the end of June, it was €5.86 billion, down 33.2 percent from a year earlier. Losses narrowed significantly in the first half of 2018, to €-36 million, compared to €-186 million in H1-17.

BBVA’s result in Spain – combining the Banking and Non-Core Real Estate activities – reached €757 million in H1-18, up 57.8 percent, compared to €480 million in the same period a year earlier.

To better explain the business trends in the areas that use a currency other than the euro, the variation rates described below refer to constant exchange rates.

In the U.S., loans grew 4.1 percent compared to June 2017, driven mainly by solid performance of consumer loans. Customer funds increased 6.0 percent yoy. Net interest income growth between January and June (+12 percent yoy) drove gross income growth (+10.7 percent). All this, combined with cost containment efforts, drove the 20.2 percent growth in operating income. Impairment losses on financial assets were significantly lower (-38.1 percent) than those of the first half of 2017. On the other hand, the area’s asset quality was solid. The NPL ratio was 1.2 percent in June, while the coverage ratio closed at 93 percent. The area’s net attributable profit was €387 million, up 51.2 percent from H1-17.

Mexico maintained its leadership position in the local banking sector. In terms of activity, lending grew 8.6 percent yoy as of June, while customer funds increased 10 percent. Regarding the P&L, the area’s recurring revenue trends remained solid: Net interest income grew 7.8 percent yoy, and fees and commissions were up 8.2 percent. Cost discipline helped keep expenses growth below that of inflation, driving operating income growth to 9.4 percent. Regarding asset quality, the main risk indicators continued to improve: As of June, the NPL and coverage ratios were 2.0 percent and 155 percent respectively. Mexico’s net attributable profit grew significantly during the first half of the year (+21.2 percent) to €1.21 billion.

In Turkey, activity remained buoyant in H1-18: As of June 30, lending was 14.9 percent higher compared to the previous year, while customer funds grew 20.1 percent. The area’s performance in terms of recurring revenues was also positive. Net interest income grew 17.9 percent yoy, while fees and commissions grew 32.8 percent compared to the first half of 2017. Both were the main drivers of gross income growth for the first half of the year, which increased +21.2 percent yoy. All this, on top of cost moderation, drove operating income 27.5 percent yoy. The NPL ratio stood at 4.5 percent and coverage stood at 76 percent. Turkey’s net attributable profit grew 25.6 percent yoy to €373 million.

In South America, activity continued to grow at a good pace, both in terms of lending (+11.2 percent yoy) and customer funds (+9.5 percent). Net interest income grew 15.0 percent during the first half of the year, while fees and commissions increased 12.7 percent in the same period. A solid performance of these two items supported the growth in gross income during the first half (+14.3 percent). Rigorous cost control efforts helped boost operating income 18.7 percent yoy. As for asset quality, the NPL ratio ended at 3.7 percent and coverage closed at 91 percent. The area’s net attributable profit in the first half was €452 million, up 30.6 percent from the same period of 2017.

About BBVA

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico, it has leading franchises in South America and the Sunbelt Region of the United States; and it is also the leading shareholder in Garanti, Turkey’s biggest bank for market capitalization. Its diversified business is focused on high-growth markets and it relies on technology as a key sustainable competitive advantage. Corporate responsibility is at the core of its business model. BBVA fosters financial education and inclusion, and supports scientific research and culture. It operates with the highest integrity, a long-term vision and applies the best practices.