BBVA earns €1.85 billion in first quarter (+39.4 percent)

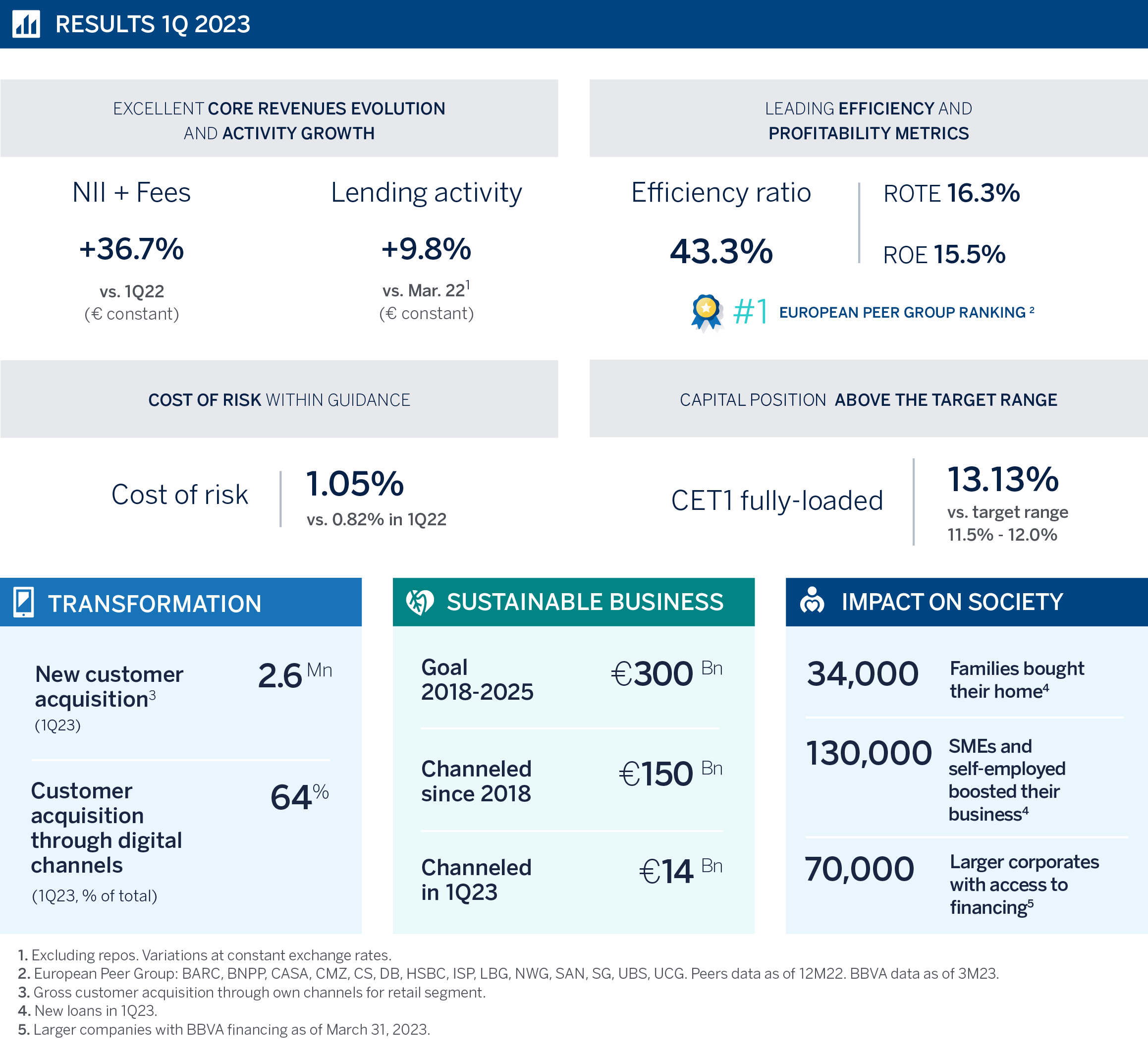

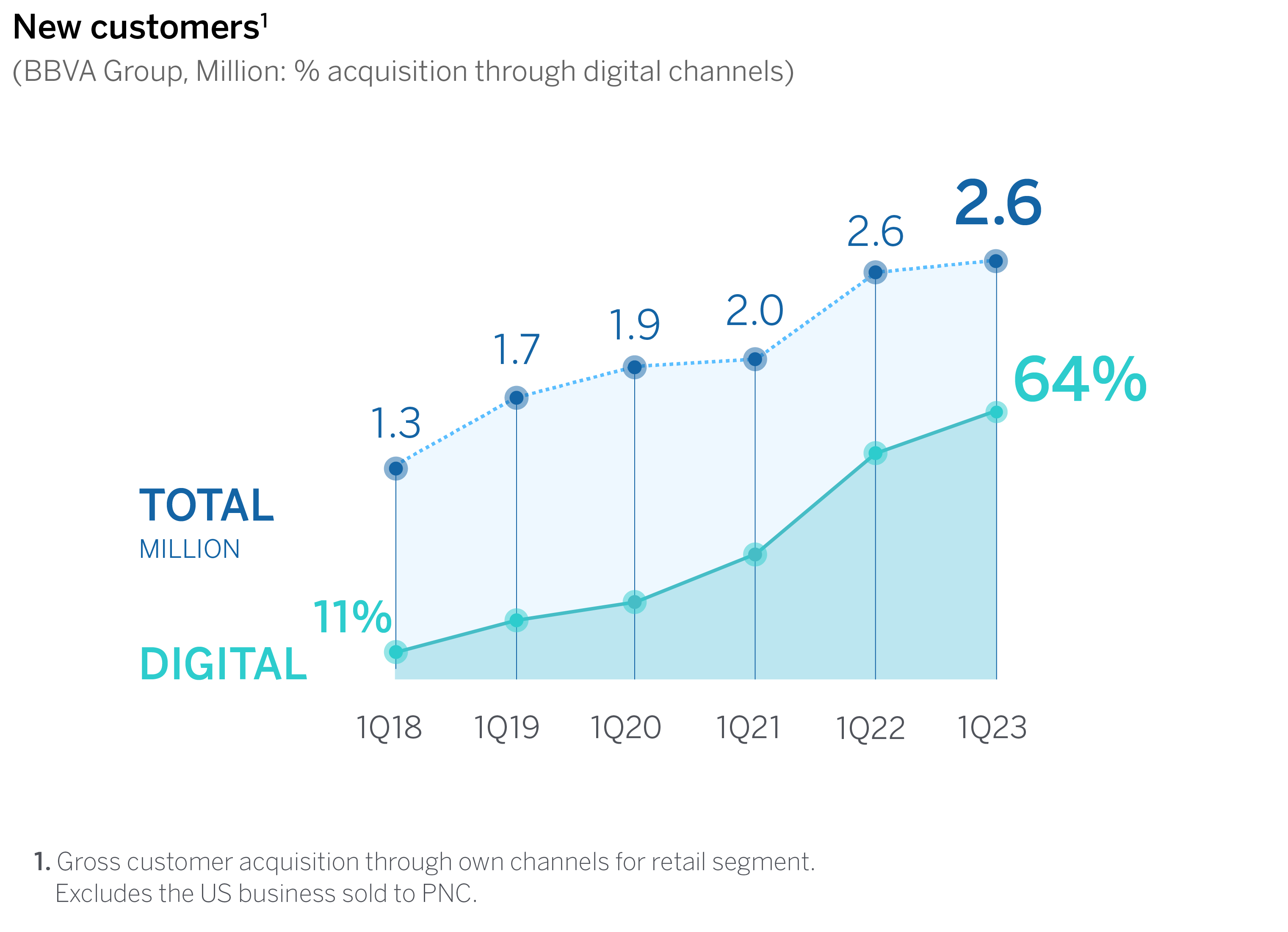

BBVA posted a net attributable profit of €1.85 billion in the first quarter of 2023 (+39.4 percent at current exchange rates, +40.5 percent in constant euros). These results were fueled by strong core revenue performance (net interest income and net fees and commissions) especially in Mexico and Spain, and higher activity. The loan portfolio grew 9.8 percent in constant euros vs. March last year, amplifying the impact of BBVA on society through financing of future projects for families and companies. In 1Q23, BBVA added 2.6 million new customers and channeled €14 billion in sustainable business. All of that while maintaining stable risk indicators in line with expectations, and a comfortable liquidity and CET1 capital position, which stood at 13.13 percent at the end of March.

Press kit Results 1Q2023

“Once again we have presented very strong quarterly results, highlighting the value of BBVA’s strength at times of increased volatility, as we recently experienced. We remain leaders among European banks in both efficiency and profitability, with the highest Return on Tangible Equity of the past 10 years. We look ahead with optimism, thanks to our robust financial position, our business model and the strategic focus on digitization, innovation and sustainability,” BBVA CEO Onur Genç said.

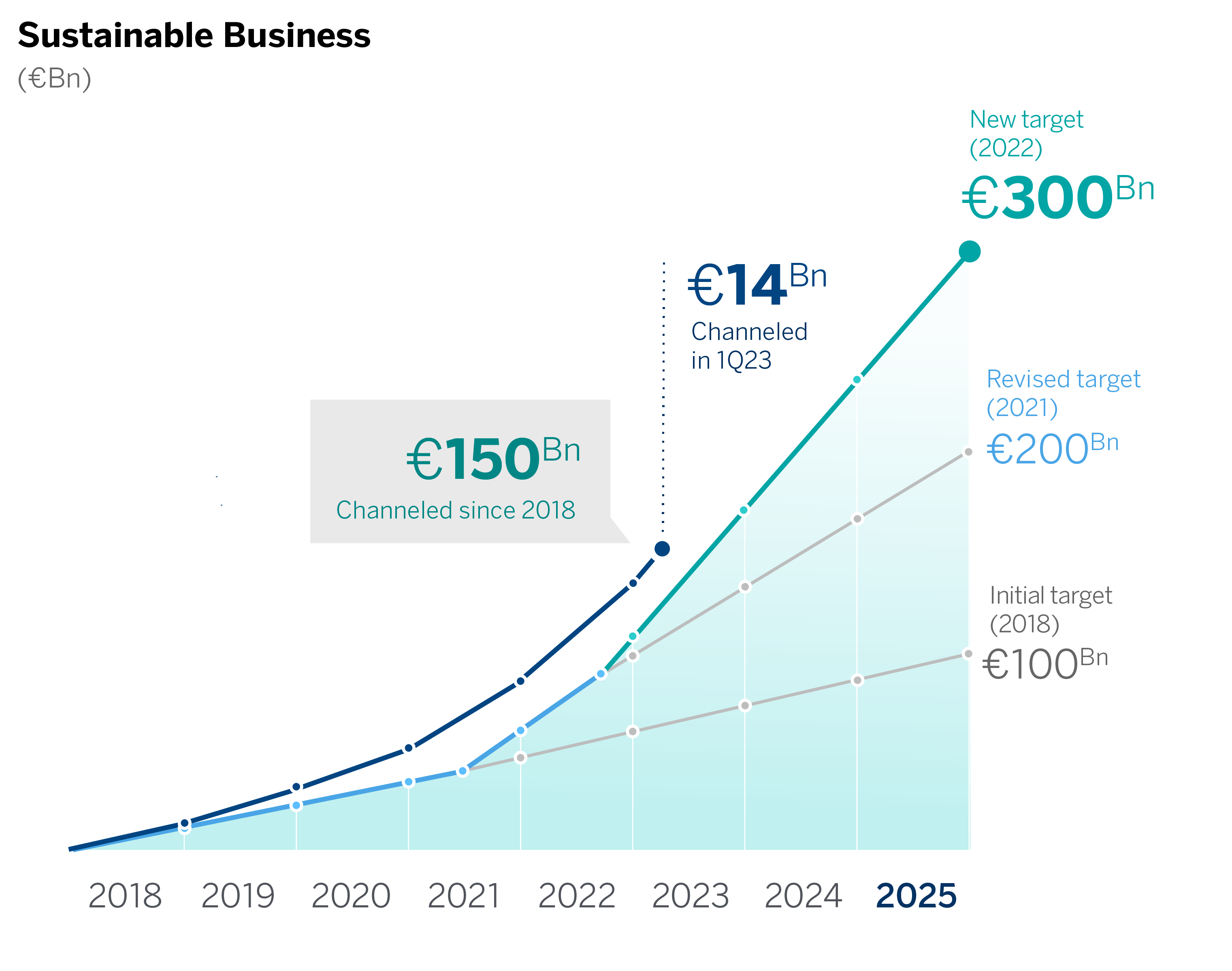

In the first quarter of 2023, BBVA made progress in its strategy. From January through March, the bank added 2.6 million new customers (64 percent through digital channels) and channeled €14 billion in sustainable business, raising the total amount since 2018 to €150 billion - 50 percent of its 2025 goal. In addition, BBVA remains the leading European bank in the Dow Jones Sustainability Index for the third consecutive year.

Except where otherwise stated, the evolution of each of the main headings, and changes in the income statement described below refer to constant exchange rates. In other words, they do not take currency fluctuations into account.

Customer growth has allowed the bank to amplify the impact of its lending activity. The BBVA Group increased lending by 9.8 percent over the past year (as of March 31, 2023), which helped 34,000 families to purchase a home, and provided financing for 130,000 SMEs and the self-employed, and for 70,000 larger companies. Furthermore, as of March 2023, BBVA devoted €3.3 billion to finance projects related to inclusive growth, such as the construction of hospitals and schools, social mortgages and insurance policies, and financing for low-income customers.

At the top of the P&L account, the increase in lending activity, together with the improvement in customer spreads, explains the Group’s positive net interest income (NII) performance from January to March, which rose to €5.64 billion. This figure is 43.3 percent higher than the same period a year earlier.

Net fees and commissions reached €1.44 billion (+15.8 percent yoy). Good performance of this line particularly stood out in Mexico and Turkey. In total, core revenues (NII and net fees and commissions) increased 36.7 percent yoy, reaching €7.08 billion. In addition, net trading income (NTI) saw a drop of 18.7 percent in the same period, to €438 million. The line of ‘other operating income and expenses’ included a negative impact of €225 million from the extraordinary tax on banks in Spain. In total, gross income rose to €6.96 billion in 1Q23, up 32.7 percent yoy.

Operating expenses grew 25.7 percent to reach €3.02 billion on the back of high inflation rates in all BBVA countries. Personnel expenses also increased due to measures implemented in 2023 to offset the loss of purchasing power among employees, as a consequence of rising prices. Nevertheless, BBVA continues to be Europe’s most efficient bank among comparable financial institutions. The strength of gross income helped the bank maintain positive jaws, with the efficiency ratio standing at 43.3 percent at the end of March 2023.

Due to all the above, operating income rose to €3.94 billion, up 38.6 percent yoy.

Impairments on financial assets stood at €968 million at the end of March, up 28.9 percent from a year earlier. The quarterly cost of risk was 1.05 percent, in line with expectations and at levels similar to those of 4Q22. The NPL ratio stood at 3.3 percent (vs. 3.4 percent in December 2022), and the coverage ratio rose to 82 percent, compared to 81 percent three months earlier.

BBVA posted a net attributable profit of €1.85 billion in the first quarter of 2023, up 40.5 percent from a year earlier.

These earnings drove BBVA’s profitability, with ROTE of 16.3 percent and ROE of 15.5 percent - the highest figures in the past ten years and leading once again among comparable European peers-, while continuing to strengthen its capital. At the end of March, the fully loaded CET1 ratio stood at 13.13 percent, well above the regulatory requirement (8.75 percent) and its target range of 11.5-12 percent.

In regards to liquidity, having ample buffers in each of the geographic areas where the BBVA Group has a presence and the way in which they are managed have made it possible to maintain internal and regulatory ratios well above the minimum requirements.

Contribution to the advancement of society

Through its activity, BBVA contributes to the progress and well-being of all its stakeholders: shareholders, customers and clients, employees, providers, and society as a whole.

First, the positive performance of earnings has made it possible to accelerate value creation for shareholders. The net tangible book value per share plus dividends stood at €8.08 at the end of March, 2023, up 22 percent from a year ago. In October 2022, the bank paid an interim dividend of €0.12 per share and in April 2023, a final dividend of €0.31 per share against 2022 earnings. Additionally, BBVA completed a €422 million share buyback program in April. In total, BBVA devoted more than €3 billion of its 2022 results (47 percent of its profit) to shareholder remuneration, while devoting the rest of the resources to strengthen its position and reinvest in its core activity.

Second, in order to cater to the needs of senior customers, BBVA hired an additional 340 employees in Spain to help serve such customers. Similarly, BBVA implemented measures to meet the specific needs of this group in Spain, such as extended hours and preferential service at both branches and via telephone, and adaptation of the mobile app and the entire ATM network. Following these measures, satisfaction among customers 65 and older has improved by six percentage points based on the Net Promoter Score (NPS) since December 2021. Furthermore, at the end of last year, BBVA agreed to join the Spanish Code of Good Practice to support customers with difficulties paying their mortgage.

Third, in relation to its employees, over the past few months BBVA has focused its efforts on mitigating the impact of inflation on its workforce throughout its footprint. In Spain, BBVA went beyond the measures agreed by the banking sector to guarantee that salary increases would benefit all employees. Additionally, it raised the minimum contribution to employees pension plans by 48 percent, and created a new savings plan, ‘Ahora es futuro’ (The future is now). 46 percent of the employees in Spain have joined this initiative, in which the bank matches the employees’ contribution, to a maximum of 3 percent of their total fixed compensation.

Four, BBVA is reinvesting in society from different angles. One of them is through fiscal contribution. In 2022, BBVA paid a record of €11 billion in taxes, its own and those of third parties. Furthermore, between 2021 and 2022, BBVA, directly or through its Foundations, devoted €237 million to social and community investment programs.

Business areas

In Spain, lending remained stable yoy (+0.1 percent). The performance of the most profitable segments stood out in the quarter: commercial, consumer loans and cards. Customer funds increased 2.2 percent thanks to time deposits. Net attributable profit reached €541 million in 1Q23, down 9.5 percent from a year earlier, due to the impact of the extraordinary tax on banks in Spain (€-225 million). Risk indicators remained stable: Both the NPL ratio (3.9 percent) and the cost of risk (0.27 percent) were in line with the figures from the end of last year. The coverage ratio eased slightly to 59 percent.

In Mexico, lending showed strength in 1Q23, with an increase of 13.9 percent yoy, boosted by all segments. Customer funds also grew 6.2 percent yoy mainly due to activity in mutual funds. BBVA posted a record net attributable profit of €1.29 billion at the end of March (+44.2 percent), driven primarily by higher lending activity and its impact on NII. The efficiency ratio saw a significant improvement (346 bps in the past 12 months to reach just under 30 percent). As for risk indicators, the NPL ratio and the coverage ratio both improved, standing at 2.3 percent and 137 percent, respectively. The cost of risk stood at 2.88 percent in line with expectations.

In Turkey, the bank continued the de-dollarization of its balance sheet. Lending activity in Turkish lira (TL) increased 70.2 percent yoy and customer funds grew 143.5 percent, while loans and deposits in foreign currency continued its downward trend. Turkey posted a net attributable profit of €277 million in 1Q23, compared to a result of €-76 million in the same period last year. Both quarters include the impact of hyperinflationary accounting. As for credit quality, the cost of risk fell to 0.52 percent. The NPL ratio also improved to 4.3 percent, and the coverage ratio rose to 99 percent.

In South America, lending increased by 14.3 percent yoy, mostly thanks to activity in retail portfolios. Customer funds rose 17.9 percent, with a higher contribution from time deposits. The net attributable profit stood at €184 million (+57.2 percent) yoy, boosted mainly by growth in recurring revenue and NTI, which offset higher costs. The NPL ratio for the entire unit stood at 4.3 percent, the coverage ratio was 99 percent, and the cost of risk 2.18 percent.

About BBVA

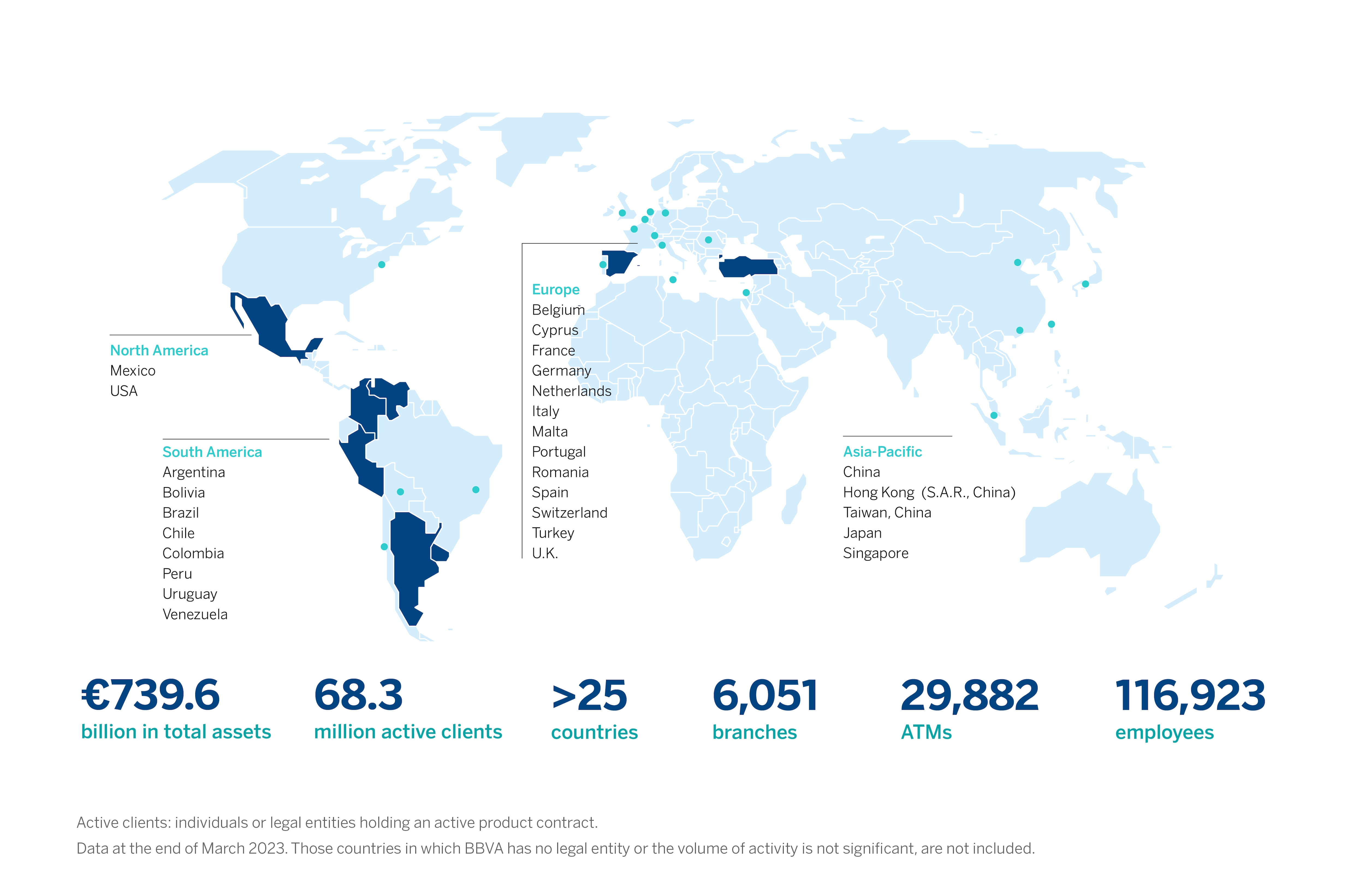

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America. It is also the leading shareholder in Turkey’s Garanti BBVA and has an important investment, transactional and capital markets banking business in the U.S. Its purpose is to bring the age of opportunities to everyone, based on our customers’ real needs: provide the best solutions, helping them make the best financial decisions, through an easy and convenient experience. The institution rests on solid values: Customer comes first, we think big and we are one team. Its responsible banking model aspires to achieve a more inclusive and sustainable society.