BBVA posts highest quarterly profit in three years: €1.34 billion (+12 percent YoY)

- Transformation: Digital sales grew in all regions and accounted for 37 percent of total in Q1-18. Clients banking through digital channels rose 25 percent yoy, while those using mobile devices grew 43 percent. Such exponential growth contributed to the strength of recurring revenues, and the efficiency ratio reached its best reading since June 2012

- Income: Driven by strong recurring revenues and cost containment efforts, the operating income grew 5.1 percent yoy in constant terms

- Risks: Risk indicators continued to perform positively. At the end of March, the NPL ratio stood at 4.4 percent, with coverage of 73 percent

- Capital: BBVA’s pro forma fully-loaded CET1 ratio -including the already announced agreements of BBVA Chile and Cerberus, which are to be concluded later this year- stood at 11.47 percent at the end of March

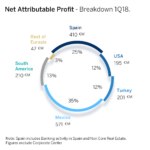

BBVA posted a net attributable profit of €1.34 billion between January and March 2018, up 11.8 percent compared to the same period of 2017 (+22.3 percent in constant terms) and the highest quarterly result in the past three years. During Q1-18, BBVA Group’s net attributable profit grew across all regions year-on-year. A solid performance of recurring revenues, moderation in operating expenses and the drop in impairment losses on financial assets and provisions were the main drivers supporting this growth.

BBVA CEO Carlos Torres Vila noted the “excellent start of the year, with solid and recurring results. The significant progress in the transformation highlights the success of our strategy.”

As in previous quarters, revenues showed great resilience. Net interest income reached €4.29 billion (down 0.8 percent yoy, +9.3 percent at constant exchange rates), while fees and commissions rose 1.1 percent yoy (+9.8 percent stripping out the currency effect). The sum of both headings – known as recurring revenues – stood at €5.52 billion (-0.4 percent yoy, +9.4 percent in constant terms).

Also, NTI contribution decreased on a yoy basis, since this heading reflected the capital gains related to the sale of a 1.7 percent stake in Chinese lender CNCB in Q1-17. Still, total revenues saw a positive trend at constant exchange rates. Gross income reached €6.1 billion (down 4.5 percent from Q1-17, +4.2 percent not taking into account currency impacts). For the period January-March 2018, operating expenses declined 5 percent yoy. In constant terms they increased 3.2 percent, below gross income figures and the average inflation rate in the geographies in which the Group operates. This resulted in a further improvement of the efficiency ratio, which stood at 48.9 percent, the best since June 2012, and far better than the average ratio of BBVA’s European peers.

In this context, operating income was €3.12 billion, (down 4.0 percent compared to the previous year, +5.1 percent excluding currency impacts).

Regarding risk indicators, the NPL ratio continued to improve and ended the quarter at 4.4 percent (vs. 4.6 percent in December). Coverage ratio rose to 73 percent (65 percent in December) and the cost of risk stood at 0.8 percent.

In terms of capital adequacy, the pro forma fully-loaded CET1 ratio stood at 11.47% at the end of March. This includes the already announced agreements of BBVA Chile and Cerberus, which are to be concluded later this year. This ratio was 13 basis points above December’s pro forma figure, which included a negative impact of 31 basis points from the first implementation of IFRS 9. The fully-loaded leverage ratio stood at 6.4 percent in March, the highest among BBVA’s peer group.

The balance sheet and business activity information reflects the impact of the implementation of IFRS 9. Between Jan.1 and March 31, loans and advances to customers fell 1.6 percent, to €367.99 billion. This decline was mainly due to the euro performance against the local currencies in the countries within BBVA’s footprint. Customer deposits, on the other hand, declined by 1.0 percent during the quarter, to €360.21 billion.

The bank’s transformation

BBVA’s transformation is driving digital sales exponentially, while improving efficiency. At the end of March, BBVA’s digital base reached 24 million customers (up 25 percent yoy), of which 19.3 million were mobile customers (up 43 percent yoy). In 2018, the Group aims for 50 percent of its customers to be digital worldwide, with 50 percent coming from mobile in 2019. Digital sales are growing consistently with this trend. Between January and March, 36.7 percent of total unit sales were made through digital channels, compared to 21.5 percent in Q1-17.

In Q1-18, lending in Banking Activity in Spain (performing loans under management) dropped 2.4 percent yoy. New consumer loan production saw a notable increase of 37.7 percent. As of March, customer deposits under management were 2.3 percent lower yoy. The drop in time deposits was offset by the increase in demand deposits and off-balance-sheet customer funds under management.

Net interest income fell 1.6 percent yoy, a decrease offset by the increase in fees and commissions (+7.8 percent compared to Q1-17). The sum of both headings grew 1.1 percent yoy, consolidating the positive evolution from Q4-17. In this context, gross income in Q1 stood at €1.6 billion. The operating expenses heading, following the trend of previous quarters, dropped 4.2 percent yoy. Lower impairment losses on financial assets caused this item to drop significantly (-57.4 percent year-on-year). On the other hand, asset quality indicators continued to improve: As of March, the area’s NPL rate stood at 5.4 percent (vs. 5.5 percent in December), with coverage ratio improving to 57 percent (50 percent in December). Net attributable profit reached €437 million, up 17.3 percent compared to Q1-17.

As for the Non-Core Real Estate area, BBVA expects to reduce almost entirely its exposure to the real estate business. The European Commission has given the green light to the agreement with Cerberus, which is expected to conclude sometime in Q3-18. Additionally, the bank’s net exposure to the real estate sector continued its decline: As of the end of March, it was €6.12 billion, 34.1 percent lower than a year ago. Losses narrowed significantly in the first quarter, to €-27 million, compared to €-106 million in Q1-17.

BBVA’s result in Spain – combining the Banking and Non-Core Real Estate activities – reached €410 million in the first quarter (up 54.2 percent from the same period a year earlier). The geography’s contribution to the business areas’ attributable profit accounted for 25.1 percent, the highest since 2011.

To better explain the business trends in the areas that use a currency other than the euro, the variation rates described below refer to constant exchange rates.

In the U.S., performing loans and advances to customers under management grew 1.6 percent from March 2017, driven by the solid behavior of consumer loans. Customer funds under management increased 5.7 percent compared to the previous year. The focus on price management and the interest rates increases drove net interest income up 15.0 percent yoy. This item contributed significantly to the growth of gross income (11.8 percent vs. Q1-17). All this, together with the region’s cost evolution, drove the operating income to grow 20.0 percent compared to Q1-17. Impairment losses on financial assets were significantly lower yoy, following last year’s impact from the hurricanes. On the other hand, the area's asset quality remained at solid levels. The NPL ratio stood at 1.2 percent in March, while coverage ratio closed at 98 percent. The area’s net attributable profit stood at €195 million, up 74.1 percent from Q1-17.

Mexico maintained its leadership position in the local banking sector. In terms of activity, lending grew 4.8 percent yoy as of March, while customer funds under management increased 7.6 percent. Regarding the P&L account, net interest income grew 8.2 percent yoy, and fees and commissions, 6.3 percent. Cost discipline helped keep expenses growth below that of gross income, driving operating income to increase 6.6 percent yoy. Regarding asset quality, the main risk indicators performed robustly: The NPL and coverage ratios closed at 2.1 percent and 153 percent, respectively. Mexico’s net attributable profit posted double-digit growth in the first quarter (12.5 percent), reaching €571 million.

In Turkey, activity was buoyant during Q1-18. As of March 31, lending was 11.8 percent higher than in the previous year, while customer funds under management grew 17.7 percent. Business activity, together with price management, helped net interest income to grow 10.4 percent yoy. Fees and commissions, on the other hand, grew 39.9 percent (compared to Q1-17). Both headings were the main drivers of gross income growth (+21.5 percent compared to the same period of the previous year). All this, on top of costs moderation, drove operating income 30.1 percent yoy. As for asset quality, it continued improving in the area. The NPL ratio stood at 3.7 percent - significantly below the sector’s average – and coverage reached 86 percent. Turkey’s net attributable profit grew 49.7 percent yoy to €201 million.

In South America activity continued growing, both in terms of lending (+11.7 percent yoy) and customer funds (+7.9 percent). Recurring revenues performed favorably: net interest income grew 14.7 percent yoy, while fees and commissions increased 10.6 percent. A solid performance of these two items explains the growth in gross income during the quarter (+15.4 percent yoy). Rigorous cost control efforts helped keep expenses growth below gross income growth, resulting in an increase of the operating income of 20.7 percent yoy. As for asset quality, the NPL ratio ended at 3.6 percent and coverage closed at 93 percent. The area’s net attributable profit in the first quarter was €210 million, up 33.4 percent from the same period a year earlier.

About BBVA

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico, it has leading franchises in South America and the Sunbelt Region of the United States; and it is also the leading shareholder in Garanti, Turkey’s biggest bank for market capitalization. Its diversified business is focused on high-growth markets and it relies on technology as a key sustainable competitive advantage. Corporate responsibility is at the core of its business model. BBVA fosters financial education and inclusion, and supports scientific research and culture. It operates with the highest integrity, a long-term vision and applies the best practices.