Photogallery: 4Q15 BBVA Results Presentation

BBVA Group Executive Chairman Francisco González said, “In 2015 BBVA showed its enormous ability to generate earnings in a complex environment, while moving ahead decisively in its transformation. We face 2016 with optimism.”

-

1

1Record income

Gross income for the full year and for the fourth quarter reached a new record: €23.68 billion (up 10.9% y-o-y) and €6.15 billion (up 6.6% on the same period last year), respectively.

-

2

2Risks

BBVA Group’s NPL ratio improved to 5.4% at year-end vs. 5.8% in 2014, with coverage ratio of 74%.

-

3

3Capital

BBVA’s CET1 ratio fully-loaded was 10.3% at the end of 2015 following a solid evolution in the last quarter. It rose 57 basis points from October to December.

-

4

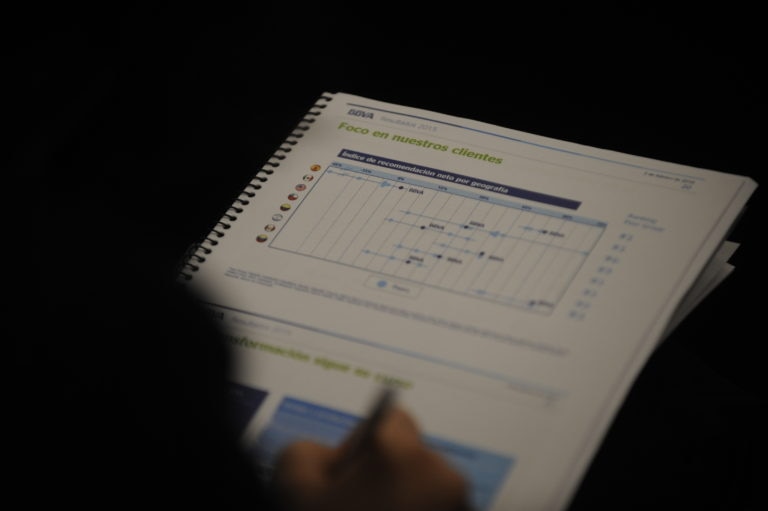

4Transformation

Digital banking is making further gains in terms of customer satisfaction and digital sales. At the end of the year 19.2% of new consumer credits in Spain were sold through digital channels. In Mexico this figure was 29.6%.

-

5

5The BBVA Group’s net profit in 2015 came to €2.64 billion, slightly more than the previous year (up 0.9%)

Without currency effects net attributable profit was up 4.4%. Excluding corporate operations in 2015, net income from ongoing operations was €3.75 billion, up 43.3% over 2014.

-

6

6BBVA confirmed its ability to generate record gross...

income in an environment of historically low interest rate in currencies such as the euro or the dollar. Other key factors driving earnings were the improved risk premium (1.06% at year-end) and the reduction in loan-loss and real-estate provisions in Spain.

-

7

7Net interest income in 2015 rose 8.7% to €16.43 billion...

an increase of 21.5% at constant exchange rates. Growth was aided by buoyant business that helped to offset pressure on customer spreads due to low interest rates.

-

8

8Gross income set new records for the fourth quarter and the full year

For the last three months of 2015 it came to €6.15 billion (up 6.6% y-o-y). The corresponding figure for the entire year rose 10.9% to €23.68 billion (up 15.7% before currency effects).

-

9

9Digital channels

In 2015 BBVA significantly extended its base of customers who interact with the bank through digital channels. At the end of 2015, with available data, there were 14.8 million such customers, an increase of 19% compared to a year earlier. Of these, 8.5 million operated mainly through their mobile devices (up 45% y-o-y).