What are all those numbers on the bottom of your checks and why do you need them?

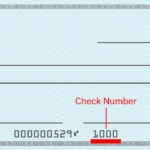

At the bottom of every check you write and every check you cash or deposit, you’ll find a long string of numbers: nine digits, then a colon followed by eight more digits, one more colon and another four digits. But what do those 21 numbers really mean?

The first nine digits

These numbers actually pre-date computers. The first nine digits are your bank’s routing numbers, originally created by the American Bankers’ Association in 1910 to make check processing easier and more secure. With the creation of the Federal Reserve Bank in [year], an additional Federal Reserve number was added to the routing number to specify the type of institution and the Federal Reserve district where the account was opened.

Routing numbers help identify the paying bank – the bank responsible for honoring the check – and ensure that the person accepting the check receives the money from the payer’s bank.

The next eight digits

These are your account number. Just as the routing number identifies the bank where the account resides, the next eight indicate which account to debit.

The final four

You’ll notice the last four digits across the bottom of your checks are sequential. They should match your check number at the top of the check.

Since these numbers pre-date computers, you may be wondering why we still need them. These numbers still identify the bank and the account for each transaction, whether it’s a physical check or not. So when you make an online bill payment through a vendor website, you’ll need those numbers. And when you receive a digital payment from a friend, you’ll need those numbers to make sure the deposit is credited to your account.

Even if you never write checks, those numbers are still important. You can find your BBVA Compass routing number here. And most other banks make theirs easily accessible online as well.