Moody’s upgrades BBVA’s rating to A3

Moody’s upgrade to A3, with a stable outlook, comes a week after BBVA announced its MREL requirement and its financing plan for the coming years.

Moody’s expects that “BBVA will complete its medium-term issuance plan -which entails the refinancing of its covered bond and senior debt redemptions amounting to approximately €9 billion as of January 1, 2018”, with new MREL eligible debt instruments, such as non-preferred senior debt. In a statement, Moody’s notes that the issuance plan will reduce the risk for other type of bank debt, such as senior unsecured debt and long-term depositors.

The ratings agency also adds that in 2018, BBVA has already issued €2.5 billion in non preferred senior debt (in two issuances in February and May), out of the €9 billion financing plan.

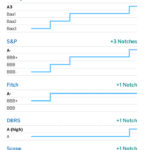

Since 2013, leading ratings agencies have upgraded BBVA’s rating, now in A category with all of them.