Millennials lag other generations in key economic variables but slowly gaining ground

Millennials are perhaps the most overanalyzed and overgeneralized generation in history, and the myths surrounding them are endless. From “clueless” to “brainiest” and “self-obsessed” to “socially conscious,” the stereotypes of those born between 1982 and 1995 are often contradictory and range from flattering to derogatory. But just like any other generation, Millennials are by no means homogenous.

With this in mind, we developed a Generational Opportunity Index (GOI) that analyzes seven factors to measure how Millennials’ performance compares to other generations’, and if and how their prospects have improved. We chose variables that capture potential economic opportunity: unemployment rate, participation rate, personal income, educational attainment, home ownership rate, home value and vehicle ownership. The index reflects important factors in U.S. economic opportunity, weighting labor market access, education and income opportunity higher than wealth proxies such as housing and vehicle ownership.

Generational Opportunity Index

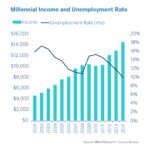

Millennials have made significant progress over the last 10 years, but lag other cohorts in terms of opportunity. Millennials are above average in areas such as labor force participation and educational attainment. But their unemployment rate is above average, and they come in below average in terms of income, vehicle ownership, home ownership and home value. A recent study by Pew Research found that living with a parent is now the most common living arrangement among Millennials (32.1%); while a smaller share are living in their own household with a spouse (31.6%) or alone (14%) — compared to 62% and 5%, respectively, in 1960.

Student debt is one often-blamed culprit for falling homeownership, but studies have found that college graduates with student debt in their late 20s are more likely to own a home than non-debtors. Rather, Millennials’ delay in getting married is the primary reason for the decline in homeownership. The median age for first marriage in 2014 was 27 for women and 29 for men, up from 20 and 22, respectively, in 1960. Young potential homebuyers also face a widening gap between income and home prices, as incomes have failed to keep pace with home price appreciation for the last 15 years.

On a positive note, almost all of the variables for Millennials in our GOI show an upward trajectory, indicating that Millennials’ opportunity is showing broad-based improvement. On a year-over-year basis, Millennials’ biggest gains were in homeownership and income, rising 33 percent and 13 percent, respectively. Income also ranks amongst the most improved compared to 10 years ago. But unemployment trended away from the average in 2014.

When looking at other generations, Gen X (1965-1982) is doing the best, followed by Baby Boomers (1946-1965), although the Baby Boomers are on the decline and were eclipsed by Gen Xers in 2013. Like Millennials, the Silent (1928-1946) and Greatest (before 1928) generations both come in below average. These results are consistent with recent surveys that suggest that older generations feel disfranchised and frustrated with economic conditions.

The story is very different when looking at 10-year improvement, as Gen X tops the list, with Millennials following. As Millennials are currently entering the life-cycle phase that Gen Xers have enjoyed over this period, the pace of improvement for Millennials could pick up over the next decade. However, similar to other generations that faced deep recessions, it is not easy to make up for those “lost” years, suggesting that Millennials may never reach the level of relative opportunity of previous generations. If economic conditions improve, though, Millennials could reach or surpass average living standards prior to what current projections suggest — 2034.

Which cities are best for Millennials?

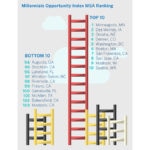

Another important aspect of generational opportunity is identifying which metropolitan statistical areas (MSAs) provide the greatest potential for Millennials. To measure how attractiveness varies across the country, we narrowed our focus to those MSAs that have populations over 100,000. Using the same methodology as the generational index, we rank these MSAs in order of the opportunities they offer to Millennial residents.

Of the bottom five MSAs, three are in California — Bakersfield, Fresno, and Modesto, all of which suffered from unemployment rates above 9 percent in 2015, in addition to well below-average income levels for Millennials. The remaining two MSAs in the bottom five are McAllen, Texas, and Gainesville, Fla., which have per capita income levels well below their respective state averages. For the cities ranked at the bottom, the key challenge to remain competitive in an increasingly global economy will be to attract high-skilled jobs and thus educated employees to their cities.

On the flip side, Millennials fare better than the U.S. average in 16 MSAs. Minneapolis, Minn., takes the country’s top spot, buoyed by its Millennial residents’ educational attainment and participation rate in the labor force. Minneapolis also boasts one the lowest unemployment rates among the country’s large MSAs — 3.4 percent in 2015. Des Moines, Omaha, Denver and Washington, D.C., round out the top five, having some of the same strengths as Minneapolis — high educational attainment coupled with strong labor force participation.

The remaining five MSAs in the top 10 — Boston; San Francisco; San Jose, Calif.; Madison, Wis.; and Seattle — are closely linked to the technology sector and offer attractive urban lifestyles. California’s representation in both the top and bottom is consistent with its size and diversity.

The bottom line is that MSAs that are not well prepared to face the challenges of the knowledge economy will become less attractive and struggle to see their population and economies grow. Cities that excel in providing access to education, strong job markets and upward mobility, like Minneapolis, Denver and Seattle, will become magnets for Millennials.

Any statement or opinion of a BBVA Compass economist is that economist’s own statement or opinion and does not represent a statement or prediction by BBVA Compass, its parent companies or management.