From Lehman to Brexit: the role of Central Banks

Over the past eight years, we have seen markets panic on a number of occasions. Normally, there was a good reason for the sudden market crashes. Let’s take a look at the periods of greatest market volatility and analyze the central banks’ responses to reassure investors.

September 15, 2008, the day in which U.S. investment bank Lehman Brothers filed for bankruptcy, will live in our collective memory as Wall Street’s Black Monday. One of the moments of panic during the last financial crisis, the worst since the Great Recession of 1929. Since then, until the result of referendum where the United Kingdom voted to leave the European Union (Brexit), on June 23, stock markets have undergone several phases of high volatility, which they were able to overcome partly thanks to the expansive monetary policies implemented by Central Banks.

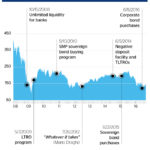

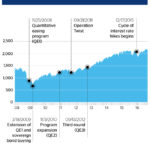

Monetary policy actions adopted by the main Central Banks during the crisis

Central banks normally implement their monetary policies by making changes to interest rates, which have an impact on the economy through different mechanisms.

A change in the reference interest rates of a central bank can affect asset prices and the expectations regarding the formation of future prices. It can also condition the investment decision of economic players, in a way such that a specific effect over inflation, growth and/or employment is achieved.

However, to ensure that the changes made to the reference interest rates have the desired effect on the economy, the monetary policy’s transmission chain needs to function properly. For that, liquidity must flow among banks, and banks must be capable of granting credit to companies and households in a way that affects the economy.

BBVA Research Financial Scenarios Chief Economist, Sonsoles Castillo, explains that “as a result of the recent financial crisis that started in 2008 and previously in Japan (2000), the transmission mechanisms of the monetary policy via interest rates were inefficient in affecting the economy to support growth, generate full employment and maintain price stability.”

The transmission mechanisms of the monetary policy via interest rates were inefficient in affecting the economy.

With near zero interest rates, the U.S. Federal Reserve (Fed), the Bank of Japan (BoJ), the Bank of England (BoE) and the European Central Bank (ECB) started considering non-conventional monetary policies to stimulate growth.

Among non-standard policies, the central banks applied quantitative policies such as asset purchase programs. More generally, the asset purchasing programs have sought to: in the case of public assets, affect the interest rate curve as a whole (not only the short end, with the fixing of interest rates of the monetary policy); in the case of private assets, the programs aimed to restore market confidence or expand the transmission of the monetary policies through channels other than the banking sector.

Besides asset purchases, in Europe the ECB relaxed up its policy regarding collaterals to increase the capacity of banks to capacity to fund their operations through the central bank. Additionally, it set up the Long-Term Refinancing Operation (TLRO) and Targeted Long-Term Refinancing Operation (TLRO) programs, allowing banks to access financing at low interest (even negative) rates, subject to the increase of lending in the real sector.

Sonsoles Castillo notes that “during the crisis, the largest central banks have implemented (and in some cases still do) quantitative policies. However, the implemented measures differ among the different central banks. Thus, while the United States and the United Kingdom pursued sovereign bond purchasing policies – because the bond markets plays a more important role as source of financing in these economies – the eurozone and Japan opted, in first instance, for credit easing programs, that improve financing to banks, as they play a more important role financing the economy in these economies.”

Throughout the financial and sovereign debt crisis, the different central banks have been forced to implement several rounds of Quantitative Easing as a strategy to support growth.

Besides the bond buying programs, some central banks – such as the ECB, Nordic countries or more recently Japan – have taken a step further regarding interest rates: fixing negative interest rates (which the ECB is charging banks on excess deposits, although, so far, this is not being passed on to customers).

In the implementation of the monetary policy, the Fed has made more progress than other central banks. The U.S. economy is already growing at moderate but sustained rates, the job market seems robust and inflation seems stable, at rates close to the inflation target. This has led the Fed to put an end to its asset purchasing program – unlike the remaining central banks – and to start increasing some interest rates, although making it clear that the interest rate increase cycle will be very gradual.

Timeline of the most relevant non-standard measures adopted by the major central banks

By the end 2008, the effects of the collapse of the real-estate bubble in the United States (in 2006) resulted in a convergence towards near-zero levels of the reference interest rates of the Fed, the BoE, the BoJ and the ECB.

Lehman’s collapse in September 2008 increased the risk premiums and iliquidity in the markets. The margin in conventional monetary policies and the huge confidence crisis inside and outside the financial system, led monetary authorities to promote emergency credit lines in dollars, both for banking institutions and businesses, to tackle liquidity problems.

The key measures adopted by central banks where the following:

On October 15, 2008, the ECB expanded its refinancing operations to banks; provided unlimited liquidity to financial institutions that requested it at a fixed interest rates. The purpose of this measure was to solve the iliquidity problems in the European interbank market and help reduce lending conditions.

On November 25, 2008, the Fed started the Quantitative Easing 1 (QE1) program, a quantitative policy program designed to boost the economy by supporting the real estate sector. The Fed announced a program to buy $100 billion in agency assets and $500 billion in mortgage-backed securities.

On December 2, 2008, the BoJ announced an unlimited lending program for banks, at near-zero interest rates (Special-Funds-Supplying Operation).

On December 19, 2008, BoJ announced that it would increase its purchases of Japanese sovereign bonds to ¥1.4 billion (the program dated back to the beginning of the Japanese crisis of 2000). These purchases would be gradually expanded, reaching ¥1.8 billion in March 2009. The BoJ continued supplying banks with liquidity and buying corporate assets.

On March 5, 2009, the bank kicked off its quantitative easing program with the announcement of £75 billion in assets, mainly corresponding to mid and long term sovereign funds. This program would expand on successive occasions through November 2009, reaching £200 billion.

On March 18, 2009, the Fed extended the programs described above, increased the amount of its initial asset buying program, and began buying long-term sovereign bonds. . In addition to supporting the real estate sector, this instrument attempted to lower the interest rate of risk-free assets (like sovereign bonds) and encourage, on the one hand, businesses to take higher risks and, on the other, improve asset valuations taking this interest rate as benchmark.

On May 7, 2009, despite the ECB’s pledge to provide unlimited liquidity, the counterparty risk remained, and the interbank market continued failing to function properly, hindering the transmission of the monetary policy. In this environment, the BCE chose to leave the reference interest rate at 1%, introduce 1-year refinancing for banks through the Long-Term Refinancing Operation (LTRO) program, and implement a covered bond-buying program, to improve financing of bakes and re-establish the functioning of the interbank market.

In April 2010, BoJ announced a financing facility for projects supporting growth, where the idea was to give money to banks based on the financing projects they presented. ¥3 billion were pledged to the program. The final details would not be made public until June 2010.

On May 10, 2010, the ECB announced a bond buying program known as the Securities Market Programme (SMP), which allowed the ECB to buy member states’ government bonds in the secondary market. The purpose of this program was to address the segmentation of eurozone markets. When it was launched, the European sovereign debt crisis led to a diversion between core and periphery countries’ sovereign debt interest rates. This prevented monetary policy from being properly transmitted across the euro zone. Through this program, the ECB improved governments’ financing conditions.

On August 27, 2010, Fed Chair Ben Bernanke reported a possible expansion of the asset buying program (QE2) due to the risk of deflation. The program was finally announced on November 3, 2010, with an additional increase of buying $600 billion of U.S. treasury bonds.

On October 4, 2010, in its fight against deflation pressure, the BoJ announced a comprehensive monetary easing program which consisted of lower benchmark rates and an asset buying program, of both sovereign bonds and private assets (sovereign bonds, ETFs, commercial paper, corporate bonds and REITs). Asset purchases increased from an initial 5 trillion yen to 20 billion yen in August 2011. In June, the BoJ also increased the amount for the program financing projects to boost growth.

On September 21, 2011, the Fed announced a program to extend maturities, the Maturity Extension Program (commonly known as Operation Twist). Recession fears in the U.S. increased financial tensions in the country. With Operation Twist, the Fed tried to lower long-term interest rates without lowering short-term rates by purchasing $400 billion in longer-term treasury bonds and selling an equal amount of treasury bonds with shorter maturities. Even though this did not increase the monetary base, it got investors to shift along the long-term yield curve, with longer maturities and more risk.

On October 6, 2011, the ECB announced a new covered bond buying program and a new line of financing for banks for a 12 month period (12 month LTRO). The rise in financial tensions from the debt crisis led the ECB to announce a new line of financing for banks for a three year period on December 8, 2011.

On October 6, 2011, risk of deflation led the BoE to increase its asset buying program to £275 million. The BoE increased this amount to £375 billion on February 9, 2012 and July 5, 2012 in order to influence the contracting GDP.

From October 2011 to the end of 2012, the BoJ increased its sovereign bond and private asset buying programs, as well as it line of financing for projects to boost growth.

On June 20, 2012, signs of economic slowdown led the Fed to extend Operation Twist from June to December 2012.

On July 13, 2012 the BoE announced the Funding for Lending Scheme, which granting financing to banks to be used to grant credit in the real economy.

On September 13, 2012, the Fed announced a third round of quantitative easing (QE3) in order to revive the labor market.

In mid-2012, the European sovereign debt crisis was deteriorating to the point where it was significantly increasing the risk of the euro breaking up.

On July 26, 2012, ECB President Mario Draghi stated that he would do “whatever it takes” and announced the Outright Monetary Transactions (OMT) program. Finally, on September 6th, the ECB replaced the Securities Market Program (SMP) with the OMT. This mechanism allows the ECB to buy sovereign bonds (normally 2-3 years) in the secondary market from eurozone countries with difficulty financing themselves in wholesale markets, provided they meet certain requirements (for example, being subject to a European financing program)

On April 4, 2012, the Bank of Japan revealed a new policy framework, the Quantitative and Qualitative Easing (QQE), which sought to curb deflation. It set an inflation objective of 2% and also required doubling the monetary base and the volume of Japanese public debt portfolios and of the central bank’s ETFs in two years. It also more than doubled the average maturity of Japan’s public debt portfolio.

On June 5, 2014, the ECB made the deposit facility interest rate negative and announced a Targeted Long-term Refinancing Operation, (TLTRO), which gave banks up to 2018 to return the money they borrowed. With these measures, the ECB aimed to reestablish the monetary policy transmission mechanism by improving banks’ financing conditions, provided they used the money to grant credit in the real economy. It also discouraged banks from depositing liquidity in the central bank. The ECB later lowered the deposit interest rates four times, reaching -0.4%.

On September 4, 2014, the ECB announced a bond purchase package with warranties and securitizations, leaving the door open to sovereign bond purchases, aimed at curbing inflationary risks.

On January 22, 2015, the ECB announced a sovereign bond purchasing program starting on March 2015.

On December 17, 2015, the Fed opened an interest rate growth cycle, with a symbolic raise, establishing a bracket of 0.25% to 0.50%, as the economic recovery was still not consolidated.

On January 29, 2016, the BoJ dropped interest rates on deposits below zero in an attempt to drive inflation to more positive levels.

On March 10, 2016, the ECB lowered interest rates to 0% and expanded the sovereign fund purchase program.

On June 8, 2016, the asset purchase program was expanded to include corporate bonds.

On August 4, 2016, the BoE decided to lower its key interest rate to by 25 basis points to 0.25%, to ward off Brexit recession risks. However, it kept its quantitative easing policy unchanged.