Interactions on BBVA’s app rose 32 percent in 2023

BBVA’s app is the main channel customers use to contact the bank. Over 75 percent of customers around the world use the app. With this level of outreach, the current challenge for BBVA entails getting customers to use the new features and do more mobile transactions. To achieve this, the bank has developed a strategy to improve the digital intensity of its customers, with which it has increased interactions on the app by 32 percent in just one year, largely driven by the financial health services.

BBVA has spent the past year measuring how and to what level of depth its individual customers use its app in order to determine what is known as their ‘digital intensity’. Based on their profile, the bank offers them the services they need the most, thus increasing use of multiple tools. The results of this strategy have been very significant with an increase in interactions (check an account, transfer money, sign up for a new product, calculate the financial cushion, etc.) of 32.1 percent globally when comparing December 2022 with December 2023.

This figure was even higher in some countries like Colombia, where the number of total interactions over the past year skyrocketed 63 percent compared to 2022, coinciding with the launch of the new app and new measurement capabilities on BBVA’s global mobile banking platform. In Argentina, the increase in annual interactions reached 43 percent, and in Mexico it rose by 35 percent. Meanwhile, in Spain where the app is more mature, interaction growth stood at 20 percent in 2023.

“As BBVA’s app has grown in features, it has always been a challenge for customers to really take advantage of its full potential. In Spain alone we have over 800 features. The information we obtain with data analytics helps us to offer an increasingly customized and convenient user experience so that customers find the service they need in a very natural way, and right when they are going to do that task,” explained David Puente, Head of Client Solutions. “This has translated into greater use of other features, such as those that help to save and take care of financial health,” Puente added.

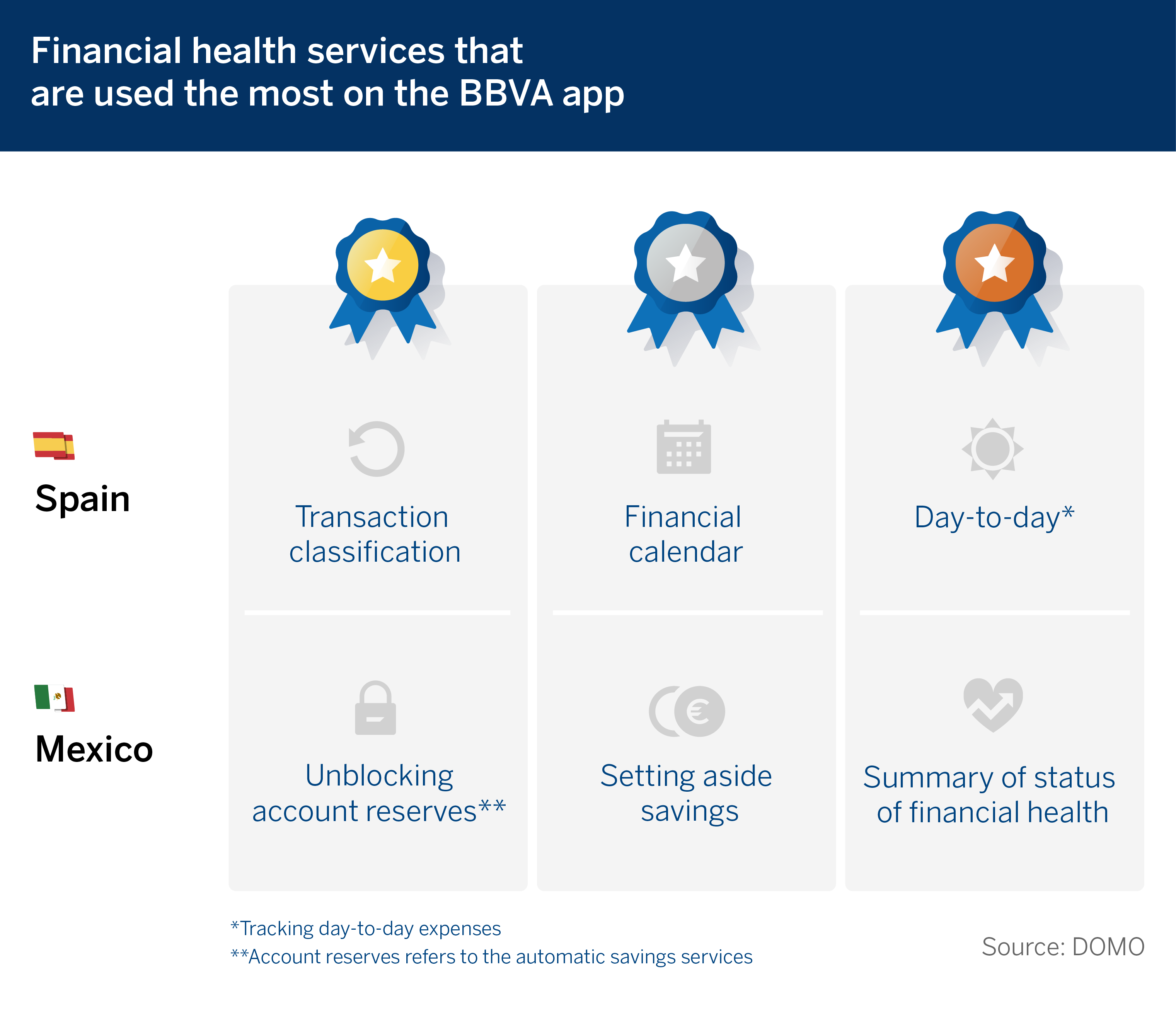

Of all of the features that BBVA’s app offers, it is precisely those related to financial health and personal finance management, such as savings rules or the financial calendar, that are among those used the most. In 2023, their use on a global scale rose by 61 percent. Some countries experienced very notable growth, such as Mexico, where these features were used 88 percent more than in 2022; Spain had a 43 percent increase, and Turkey with 32 percent.

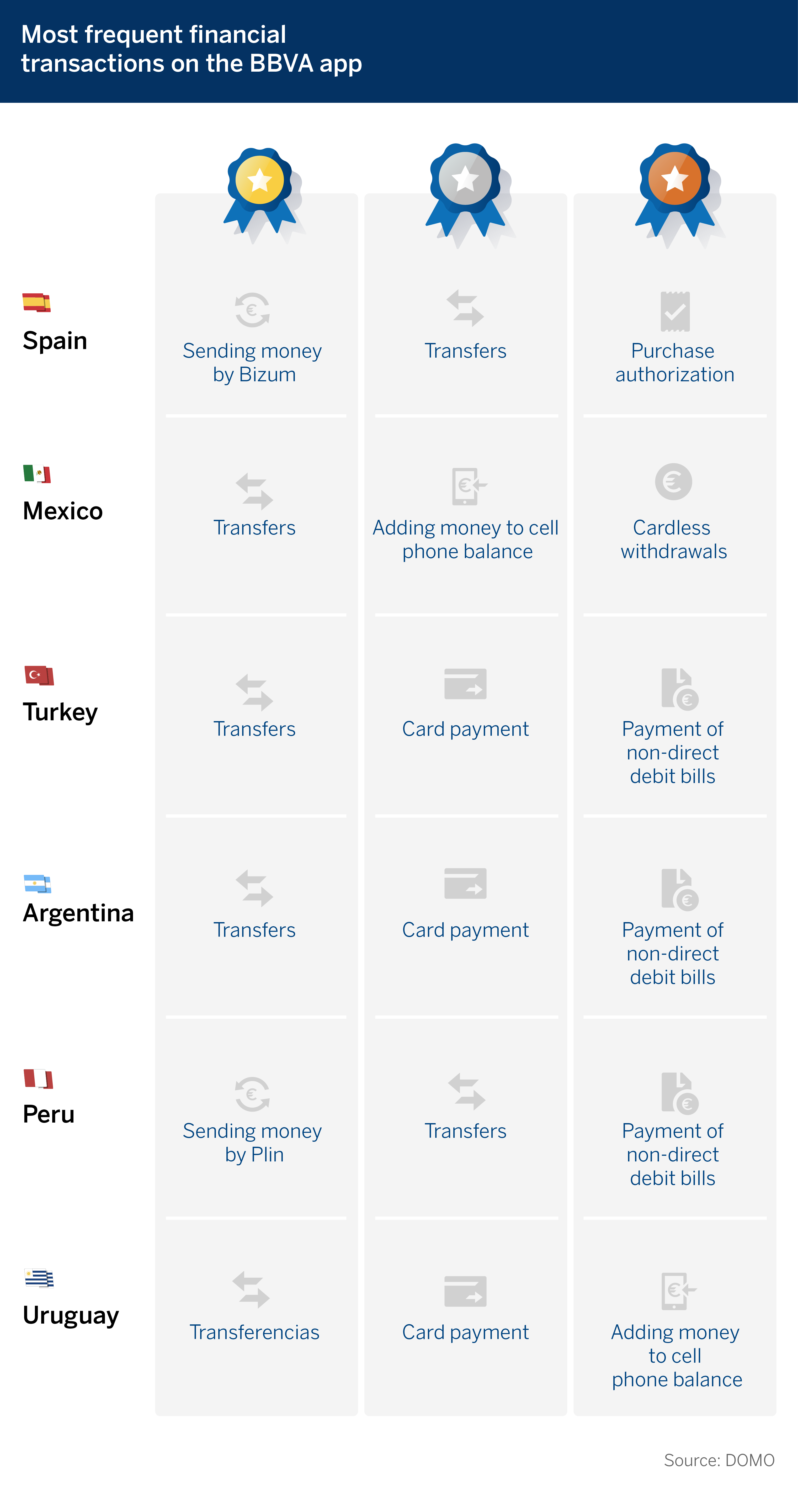

Customers also increased their number of financial transactions in 2023. In Spain, where customer transactions rose 26 percent, Bizum and money transfers stood out; Mexico saw an increase of 38 percent, with money transfers and cardless withdrawals used the most frequently; and in Turkey, with 43 percent growth, there were more transfers and card payments. This coincides with the most frequent type of transaction in Argentina, which deserves a special mention for its 74 percent increase in transactions in 2023.

“Monitoring how our customers use the app has allowed us to identify areas for improvement in order to give greater visibility to the features that are the most relevant to each customer, make the digital processes more effective and even detect technical problems in app features early on,” explained Gema Sánchez, Head of the Digital Analytics team in BBVA’s Client Solutions area.

Some examples of these improvements include the redesign of the main screen of the app in Spain in order to give greater visibility to savings and expense management features; or customer segmentation based on their degree of digital intensity in BBVA Mexico to provide customers information adapted to their actual use and guide those who are less active to discover the potential the app offers to manage their finances.

BBVA will continue exploring these techniques in order to continue promoting the digital intensity of its customers. “The more interactions we have with them, the more we will get to know them and adapt to their preferences in order to offer them more personalized recommendations,” Puente concluded.