Generative AI: customer service, SMEs and fraud detection stood out at the BBVA Bot Talent competition

The Bot Talent internal competition has demonstrated the creativity of BBVA employees to come up with innovative and secure uses of generative AI for their daily work. The bank will study the viability of three winning projects from Peru, Mexico and Spain, which propose using ChatGPT Enterprise to enhance customer service for sales agents, streamline the process of granting loans to SMEs, and detect official communications, supposedly from BBVA, that are actually hiding fraudulent messages to steal users’ financial data.

Having an idea to use generative AI to improve your workflow and your company not only gives an award for creativity, but develops it to make the benefits real. That is what is happening at BBVA. The bank didn’t stop at providing employees 3,000 ChatGPT licenses and training them on how to use it. It is now encouraging them to come up with creative uses through the BBVA Bot Talent internal competition, some of which will be developed to be used by the organization.

A suite for sales agents that enhances customer service won first prize in the competition. In this platform created in ChatGPT, the agent can find all the latest information on passive products such as accounts, cards or deposits, which helps them answer user questions more thoroughly with minimal wait time. They can also practice telephone customer service with simulated calls: the agents give ChatGPT the specific profile of a customer (for example a student with no financial experience that does not trust banks, or an older person looking to maximize their savings through a term deposit across different financial institutions) and the system adopts this role to offer a fictitious conversation. It then assesses the quality of the responses given by the agent, indicating their correct answers and areas for improvement. Finally, they can also use the platform to manage their sales objectives and obtain recommendations to achieve them.

The idea came from Bryan Chivigorri, Jordan Rodríguez and Christian Taipe from the Advanced Analytics area of BBVA in Peru. Their prize will be to go to Spain to work hand-in-hand with the global AI Adoption team to develop and fine-tune the solution. “Our suite aims to empower agents in various aspects, with the goal of saving them time and ensuring they have all the tools needed to provide a unique customer experience,” Jordan Rodríguez explained. “With a simple prompt, an agent can immediately locate the project that best meets the needs of the user they are serving at the time. And the simulation of customer roles allows them to face common situations in a safe and controlled environment. This makes them better prepared to address users’ real questions.”

The team estimates that this solution could reduce the time agents spend on training by 40 percent, increase their productivity by 25 percent, and increase the personalization of customer service by 30 percent.

“The planning of how to fragment and execute the different stages is essential, and can only be done by a human.”

Getting such a complex platform off the ground took a month of intense work, with the team working hand-in-hand with sales agents and product managers. “We are the face of the project, but bringing it to fruition would not have been possible without them,” Jordan Rodríguez stressed. In addition, they had to create several virtual ChatGPT agents that advised them on various aspects of the project, such as the architecture the platform should have, branding, and the best way to tackle each step of the entire process. The team emphasizes the importance of human creativity in completing a product of this magnitude. “All of this planning of how to fragment and execute the different stages is essential, and can only be done by a human,” Rodríguez said, concluding: “We are very grateful to the organizing team from Bot Talent for this opportunity to spend part of our time on implementing an initiative that could have taken years without AI.”

SME service

The second award was given to an idea from BBVA Mexico to digitize an in-person process for SME managers. When a small of mid-sized Mexican company applies for a loan, its manager must present a report responding to over 100 questions that certify that the business remains active. This can take several hours of travel to the company’s headquarters, the time it takes to collect the information, and nearly another hour to write the report. To make the process more efficient, Erick Gómez, Jennifer Núñez and Pedro Iván Vázquez of the SME Risk area proposed a bot that uses a guides conversation that allows the client to send the required information directly online. The report is automatically generated to be sent to the agent at the bank.

This virtual solution would allow the client to begin the process themselves, thus streamlining the loan application process, without having to wait for the bank agent to visit their headquarters. Meanwhile, the bank agent could dedicate the time they currently spend on travel and report preparation to their sales targets. “In addition, the project is scalable to other countries and other areas here in Mexico that could use the virtual report proposal,” explained Jennifer Núñez. “From mortgages to corporate banking or insurance… the possibilities are endless.”

“When you have a good, highly motivated team, you can do countless things.”

Due to its usefulness, BBVA Mexico’s SME Risk area has shown interest in developing this tool. “We are working on a proof of concept to see possible improvements to the tool and begin the implementation of the virtual report,” said Jennifer Núñez, who greatly appreciated the support the team received while working on the solution. “Many colleagues encouraged and supported us. There was great synergy, which is what I think motivates people to do creative things. When you’re having fun, it doesn’t feel like work. When you have a good, highly motivated team, you can do countless things.”

For their award, the members of the team received a postgraduate course in artificial intelligence at a prestigious international business school.

Fraud detection

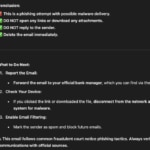

The third selected idea aims to teach how to detect attempted fraud using social engineering, harnessing this technology’s ability to process natural language. The virtual agent focuses on fraudulent messages that impersonate BBVA through email or SMS (‘phishing’ and ‘smishing’) to try to get the user to click on a link to a website that will capture their financial data. The agent is trained to analyze the language of the suspicious SMS or email, even from a screenshot, and explain the likelihood that it is fraudulent, and the reason. Decisive factors include the presence of a link and its reputation (whether or not it is already registered as malicious), the sense of urgency in the message and the tone used. If the message is likely fraudulent, the virtual agent automatically offers a series of recommendations, such as not clicking on the link and reporting it to the cybersecurity team.

The project emerged from a team in the Engineering area in Spain, comprised of Miguel Amaris, Ignacio Martínez and Fernando Palacios, and it consists of two main components: one is designed for bank employees, offering analysis with a more didactic approach; and the other is a more technical assessment for analysts on the cybersecurity team. “A virtual agent like ours, which conducts a rigorous analysis in seconds, greatly supports the everyday work of an analyst that has to assess hundreds of fraudulent messages per day,” explained Ignacio Martínez. Due to its ability to streamline the process, the cybersecurity area will develop the tool so that the entire workforce can use it.

“Our tool helps users avoid falling for scams.”

In addition, the team would like to find a way for customers to also benefit from the didactic analysis. “When someone reports an email or SMS, they do not receive immediate information on the possible fraud because it is being manually analyzed,” Martínez continued. “This tool provides this knowledge instantly, which helps users identify the possible risks and prevents them from falling for scams.” As a reward for placing third in the competition, Miguel, Ignacio and Fernando will attend an advanced PowerAI course in artificial intelligence at the business school, ThePower Education.

Another 170 ideas like these were presented at BBVA Bot Talent, whose final was held in Mexico City and featured two members of OpenAI on the jury, and a third who gave a talk on the tool to the 1,500 people in attendance, both in-person and remotely. Anouk Muis, from OpenAI, who took part in the competition as a member of the jury, said: “The BBVA Bot Talent Hackathon was testament to the bank's commitment to innovation and specifically using AI to drive real-world impact . The creativity, technical depth, and problem-solving skills displayed by all of the teams was truly impressive. Congratulations to the winning team, which showcased how ChatGPT can be used to enhance support for all commercial teams at the bank. We can't wait to see future AI innovations from BBVA .”

“Bot Talent helped us to identify great ideas to use generative AI in the bank’s internal processes,” said Guillermo Vieira, of BBVA’s global AI Adoption team, and an organizer of the competition. “The three winners have great growth potential, and the AI Adoption area will advise them on developing the suite for sales agents. But we shared all of the proposals we found most interesting with the areas that can make the most of them.”

Therefore, BBVA integrates artificial intelligence into its teams as another member, helping human members automate more mechanical tasks so they can focus on offering higher-value proposals to their areas.