Madrid tourists spend more near monuments and museums than those in Barcelona. People living in Vila de Gràcia in Barcelona have the same lifestyle as those in the Madrid neighborhood of Malasaña. Sant Antoni and Poble Sec are places that are popular to go out to dinner and then for a drink, and in Madrid, the Lavapies neighborhood is undergoing a transformation toward more cultural activity.

These are just of some of the conclusions offered by Urban Discovery, a BBVA Data & Analytics project that analyzes urban dynamics based on aggregate and anonymized bank card transaction data, providing a detailed snapshot of both cities from a commercial standpoint.

Urban development

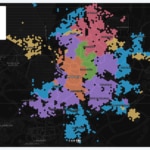

The Urban Discovery maps show how Madrid and Barcelona have grown in very different ways.

Madrid’s growth throughout the different stages and its pronounced concentric structure is evident in the commercial footprint of each of its zones. Thus, there is a notable difference between the center and the outskirts, where more working-class areas are located, with lower spending levels.

In Madrid, the new residential areas are located in the outskirts of the city.

In Barcelona, the difference between the center are working-class areas also exists, but they are closer to the mountains in neighborhoods like Horta, el Carmel and Nou Barris. Meanwhile, the new residential areas - with large developments, low levels of commercial activity and most spending taking place on the weekends – are primarily located in the high part of the city, in the Villa Olímpica and Diagonal Mar areas.

In Madrid, on the other hand, these types of areas are located in the outskirts like PAUs de Vallecas and Las Tablas, but also in places previously developed areas like Villaverde Alto and Campamento.

In Barcelona they are located in Villa Olímpica and Diagonal Mar.

Avenues that divide and unite

BBVA Data & Analytics’ analysis uses two levels of division: macro-communities and communities. Macro-communities are comparable to the official districts and communities to neighborhoods. Both levels show that the municipalities’ administrative divisions do not always correlate to the way residents and visitors use the cities. This can be seen through the digital footprint of their consumption and movement patterns.

La Castellana acts as a dividing line for the commercial activity in the city.

These maps show interesting aspects about the nature of the main avenues in both cities: la Diagonal in Barcelona and el Paseo de la Castellana in Madrid. While in Madrid the southern part of La Castellana (approximately up to Gregorio Marañon) acts as a dividing line for commercial activity. From there to the north, this division disappears. In Barcelona, on the other hand, La Diagonal acts as a division between the coastal macro-communities and the city area, with the exception of the section closest to the water, where the division cannot be perceived.

Diagonal avenue connects the high part of the city with Diagonal Mar and 22@ areas.

Spending patterns also reveal La Diagonal’s role as a connector, as demonstrated by those who live in the high part of the city and work in the Diagonal Mar and 22@ areas. Their expenditure connects both ends of this axis and as a result, they are considered part of the same spatial community (one of the few that are not next to each other, according to the study). On the other hand, Gran Vía de las Cortes Catalanas does not separate zones, but is fragmented and its different sections belong to different macro-communities.

On the other hand, many sections of Madrid’s Avenida de América or M-30 are insurmountable barriers, although where the M-30 was buried along its southeastern section has closed a gap, as the study shows.

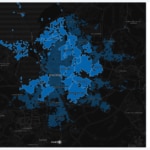

Purchases by age

The analysis shows how shoppers under the age of 30 in Madrid prefer the Bravo Murillo, Ciudad Universitaria and Moncloa areas, and those over the age of 45 are more common to the east of La Castellana in an area that goes from the Salamanca neighborhood to Nuevos Ministerios, but also in the developments from the second half of the 20th Century, which accommodated those emigrating from the countryside to the city.

Clients over 45 are more common in the area that goes from the Salamanca neighborhood to Nuevos Ministerios.

In Barcelona, those under the age of 45 primarily spend money in Gràcia, el Raval and the places closest to the beach, including Poble Sec, which was historically a working-class neighborhood that is becoming more affluent. However, the youngest segment of the population prefers to spend money in the so-called Gótico neighborhood. Those over 45 years old appear in Sants, Les Corts, Pedralbes, Sarrià, Sant Gervasi, Vallcarca and Guinardó.

In Barcelona, clients between 30 and 45 spend more money in Gràcia, the Raval and Poble Sec.

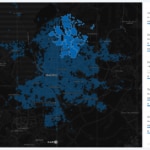

Activity

In Madrid, corporate activity (and business districts) have been concentrating in the northern part of the city, starting in Chamartín and continuing beyond Las Tablas. Here most spending takes place during the week, especially at lunch time.

The areas with the highest concentration of corporate activity in Madrid are in the northern part of the city.

Barcelona is different due to the geographic limitations (rivers on both sides, the sea and the mountains), meaning that urban terrain ran out earlier. As a result, the large buildings that were built for offices afterwards had to find a place in a consolidated city. They therefore are more distributed within residential areas, with the exception of the concentration in Poble Nou and Diagonal Mar, which houses the newer companies.

In Barcelona, Poble Nou and Diagonal Mar areas have the highest concentration of new companies.

Entertainment

Nightlife and weekend activity have two well defined places in both cities that encompass most of their most central areas. For example, in Barcelona, if we filter the interactive map to see the places where weekend activity in restaurants and nightlife are concentrated, the Sant Antoni, Poble Sec, and also Vila Olímpica are activated.

The weekend activity in Barcelona is concentrated in Sant Antoni, Poble Sec and Vila Olímpica.

On the other hand, in Madrid the areas of Lavapiés and la Latina are merged together as they share the same consumers, who have a mixed profile with a tendency to spend money on culture, but also on restaurants on the weekend. The characteristic of cultural entertainment flourishes in the merger of Gótico and el Born/Santa Caterina in Barcelona.

Whereas the main nightlife areas in Madrid are Chamberí, Malasaña, La Latina and Lavapiés.

Tourism

BBVA Data & Analytics’ analysis also shows the differences between Madrid and Barcelona. In Madrid, all the areas with cultural attractions are connected and go from the area surrounding the Matadero to the heart of the Chamberí district. They also all have a large amount of businesses in the area, with highly dense commercial zones – something that doesn’t happen in touristic center in the Catalan capital.

The most touristic areas in Madrid are also commercial hot spots.

Both Montjuïc and the Parc Güell area have major cultural attractions (Parc Güell, Fundació Miró, Caixa Forum, etc.) but they are separate from the cultural center by places that lack this characteristic. Also, the number of businesses in both places is much lower than in the rest of the city. This is in part caused by the city’s terrain, which leads to a lower transactional presence of tourists. Even though the cultural attractions bring tourists to these areas, they don’t stay there after the visit. In Madrid, however, the areas surrounding all cultural attractions are associated with a high level of spending by tourists.

In Barcelona some of the main touristic atractions are separated from highly dense commercial zones.

Twin neighborhoods

The tool leads to the conclusion that the Madrid neighborhoods of Chueca and Malasaña are equivalent to the Barcelona neighborhood of Gràcia. Both places appear as search results for areas with culinary attractions, fashion retailers and most spending taking place on the weekend, confirming the gentrification that is underway.

Malasaña and Chueca are the most active areas during the weekend in Madrid.

The equivalent for this in Barcelona is the neighborghood of Gràcia.

These are just some of the insights drawn using Urban Discovery’s open-access tool and datasets, which are also available for download. The aim is to let users come up with new tags to describe different areas, even to allow them to use the tool to look for a neighborhood that’s similar to the one they currently live in if they are planning on moving to the from one city to the other, or to find the right area to open a business.

Urban Discovery is a project developed by the BBVA applied research center BBVA Data & Analytics within the context of its commitment to the betterment of society through the application of new methodologies and sources of information.