Guide on how to become a finance expert with the help of the Oscars

They say that reality is stranger than fiction and there is no doubt that the world economic situation since 2007 has exceeded what any of us could have imagined. Is there any better way to understand this than with the help of a few good movies about finance? Their number has multiplied over the last few years and some of them have made the shortlist for the Oscars. These are our six recommendations:

1. The Big Short

We begin with a nominee for the Oscar 2016 Best Picture: The Big Short. It's the most recent entry in the list but it promises to become a must-see movie for all of us who wish to understand what lies beneath the subprime crisis.

The plot follows a group of investors who detect signs of the eventual collapse of the U.S. mortgage sector. Even though the financial institutions, the media and the government refuse to acknowledge this possibility, the group decides to wage their money on the fact that the subprime sector will go down instead of maintaining its upward trend as predicted.

You may have to look up some of the terms on the internet when you watch the movie. Here is a short glossary:

*Subprime mortgage: high-risk mortgage loan with very high probability of default and no personal surety or guaranty. It's normally granted at interest rates that are above average.

**Hedge fund: mutual fund whose aim is to obtain the highest return possible while using all investment possibilities available without limits of any kind.

***CDO: asset-backed security; backed by a bond portfolio, loans or any other similar fixed-income instrument.

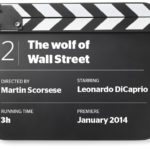

2. The Wolf of Wall Street

Another box-office hit, The Wolf of Wall Street focuses on the recent excesses of the financial sector. Based on real-life events, this movie tells the story of NY stockbroker Jordan Belfort. His huge success at the brokerage firm he works for earns him the nickname The Wolf of Wall Street. But there is temptation aplenty and no fear of the law. Jordan and his pack of wolves believe that discretion is a thing of the past. In the end, this view spells their ruin.

What you need to know to be able to understand this movie:

*Pyramid scheme: scam with no actual activity or investment behind it; the earnings of a group of investors are paid with money from other investors.

**Broker: intermediary for sales transactions involving listed stocks and shares.

***Money laundering: activity that aims to hide the true source of funds gained from illegal activities. The goal is to make it seem that the money stems from a legal economic or financial activity.

3. Too big to fail

This adaptation of Andrew Ross Sorkin's best-seller tells the story of how the economic crisis erupted in 2008 and how the economic agents reacted to it. The plot focuses on Henry Paulson, U.S. Treasury Secretary, and the conflicts between Wall Street and the government.

So that you don't miss anything, not even the title, you need to know:

*Too-big-to-fail: financial institution whose bankruptcy would be counterproductive for the economy and, consequently, would need to be rescued by the public authorities in this event.

**Collapse of Lehman Brothers: On September 15, 2008, this investment bank filed for bankruptcy due to its real estate investments through financial products. This was a peculiar case since public money was not used to bail out the bank.

***Toxic assets: poor-quality assets, i.e. there is low probability of restoring their value. Subprime mortgages are an example of toxic assets.

4. Margin Call

Released in 2011, this movie tells the story of eight workers in an investment bank for 24 hours before the start of the financial crisis in 2008. When Peter Sullivan, a junior risk analyst, uncovers data that could lead to his company's ruin, a chain of moral and financial decisions is triggered. The lives of those involved are shaken to their core in the face of the upcoming disaster. What it means exactly:

*Financial leveraging: using debt to increase the amount of money we can put in an investment.

**Mortgage-backed securities (MBS): securities backed by mortgages.

***Fire sale: sale of assets at prices below their real value. It may result from a case of bankruptcy.

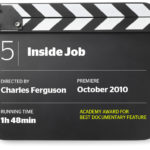

5. Inside Job

Inside Job is one of the first movies on the financial sector and its collapse in 2008. A documentary directed by Charles Ferguson, it won the Oscar for Best Documentary in 2011. It offers a very detailed explanation of how the U.S. subprime crisis was generated, expanded and exploded. Find out what it all means:

*Derivative: financial instrument that guarantees the future price of selling or buying an asset so as to prevent or pre-empt downward or upward variations.

**Credit rating agencies: agencies that assess a company's present and future solvency and its ability to pay interest, bonds or coupons of issued financial assets, and amortize the principal within a previously agreed time frame.

***Triple A rating (AAA): highest rating by a rating agency; it represents the highest credit quality and minimum credit risk.

6. Wall Street

This movie takes us back in time to the 1980s. Gordon Gekko is a multimillionaire who made his fortune from speculation and the use of networks of privileged information; in the end (spoiler warning), this gets him into prison. There was a sequel to this movie in 2010, Wall Street: Money Never Sleeps (2010).

Don't miss anything:

*Insider trading: crime that involves using privileged information to gain out-of-the-ordinary benefits from investments in financial markets.

**SEC: agency of the U.S. government responsible for enforcing federal laws on the stock market and the stock and options exchanges.

***Speculation: series of commercial or financial transactions aimed at gaining economic benefits that are exclusively based on price variations over time, and with no control over how the assets you have invested in are managed.