BBVA to propose a Dividend Option scheme of €0.13 per share in April

Annual General Meeting 2016

Executive Chairman Francisco González

- Dividend: BBVA’s goal is to “continue offering an attractive remuneration to its shareholders”

- BBVA in 2015: “In a very complex environment, we clearly increased our results, strengthened our capital base and substantially improved our risk profile”

- The future of banking: “At BBVA we are quite optimistic about it, because we know that we are headed in the right direction: fearlessly embracing change and working relentlessly to stay one step ahead of the future”

CEO Carlos Torres Vila

- The purpose of the transformation: “We want to become a better bank for our customers and offer solutions that make a difference in their lives and their businesses”

- Prospects for 2016: “We have clearly-defined ideas, a purpose and a path to achieve it. We want to continue working for our customers, offering them customized solutions that help them with their finances, to continue improving NPS scores. This will be the basis that will allow us to continue building a solid and profitable business”

BBVA held its Annual General Meeting today in Bilbao. In the event, BBVA Executive Chairman Francisco González confirmed that the payment of a Dividend Option scheme for a gross total of €0.13 per share to be executed in April will be proposed at the next meeting of the Board of Directors.

“The strength and consistency that BBVA has shown, and our results in 2015, allow us to offer a sustainable remuneration to our shareholders,” said Francisco González.

The BBVA Executive Chairman reminded the audience about the Group’s intent to progress toward a cash-only dividend policy of 35-40% of the Group's profits. In the meantime, BBVA will complement cash dividends with a Dividend Option scheme, in order to “continue offering an attractive remuneration to its shareholders”.

During the annual meeting, Francisco González also explained that “Bank stocks have suffered the impact of a very adverse environment” and in this challenging scenario, “BBVA has also been able to stand out from its competitors.” BBVA’s Total Shareholder Return (TSR) – which includes the share’s performance and dividends - over the past five years is 16.9%, 16 points more than the average of its main competitors (0.5%).

Macroeconomic environment

The Executive Chairman’s address was divided into three parts. First, he described the global and Spain’s economic scenarios; in second place, he went over BBVA’s key economic indicators for 2015 and, to conclude, he explained the steps that BBVA has taken in its transformation process, in a context of change in the banking sector.

Francisco González pointed out that in 2015 the world’s economy grew 3.1%, a rate that’s slightly below that of 2014, and clearly under the average rate for pre-crisis years. Also, he added that the forecasts for 2016 are similar.

He moved on to discuss the three corporate operations that the Group closed in 2015: in Turkey, with the increase in the stake that BBVA holds in Garanti from 25% to 39.9%; in China, with the partial sale of the investment in this country; and in the Spanish market, with the purchase of Catalunya Banc, which turned BBVA into the largest institution in Spain by assets.

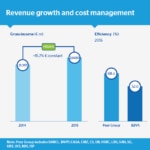

In second place, Francisco González focused on the Group’s financial performance: “Income grew in all geographies, driven by the most recurring headings: Net interest income and fees.” BBVA’s efficiency ratio, 52%, is 16 points above the average of our group of comparable European banks, he remarked. Finally, he explained how the “6.4% drop in loan-loss and real-estate provisions have contributed to the positive results, largely due to the significant improvement in Spain’s situation.”

As regards capital, Francisco González reminded that “BBVA closed 2015 with a very solid position with a “phased-in” capital ratio of over 12.1%, well above the levels required by the regulator. In “fully-loaded” terms, the capital ratio stood at 10.33%.

And, summing up the company's achievements, he added that “BBVA revalidated its standing as a leading bank among its peers in terms of efficiency and profitability.” From 2009 to 2015, BBVA maintained an efficiency ratio almost 20 points better than that of its European competitors as a whole; its return on equity (ROE) almost tripled that of the same group of competitors; and its core capital ratio increased by over 4 percentage points.

-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11

Disruption in the financial industry

The last part of his address revolved around the transformation in the banking sector. Francisco González explained how hard it is for the 20,000 conventional banks across the world to compete with hundreds of financial startups that offer products and services with maximum convenience at a fraction of the cost.

“The disruption process is going to be brutal,” he added. In the short term, he predicted a strong trend toward consolidation in the banking sector and that many banks and startups will disappear in the process. In the future, those banks that manage to aggregate the best product offering in the most convenient manner will become a trusted source that will cover the customers’ financial and non-financial needs. In the end, “customers will be the true winners of the digital revolution.”

Francisco González also went over the latest steps that BBVA has taken to compete in this new scenario. In 2015, the bank stepped up its digital transformation process launching digital products, improving processes and channels, hiring talent and promoting a cultural shift within the organization. All this aimed at “bringing the age of opportunity to everyone”, BBVA’s new purpose. Also, with the recent opening of its Madrid and Mexico City headquarters, which join the ones in Houston, London, Santiago, Buenos Aires and Lima offices -already completed or nearing completion-, the Group expects to deploy new, more agile, collaborative and enterprising ways of working.

Francisco González: "We have defined our new purpose: to bring the age of opportunity to everyone

Finally, he stressed how the Group is “managing to ensure that work is conducted with maximum transparency across the organization to earn our customers’ trust, to bring the age of opportunity to everyone.”

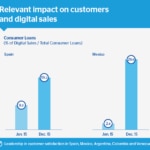

As a result of this, “we are already seeing very relevant changes in the bank’s metrics," referring to the increase of customers engaging through digital channels, especially mobile. The digital customer base has increased 19% in 2015, to 15 million. Of which 8.5 million are mobile banking customers, up 45%. Digital sales have also grown: In Spain, new consumer loan operations originating in a digital channel jumped from 9% in January 2015 to 19% in December of the same year, and from 2.4% to almost 30% in Mexico. This is also reflected in customer satisfaction, where the institution is ranked first among comparable competitors in Spain, Mexico, Colombia, Argentina and Venezuela.

The best bank for customers

In his first Annual General Meeting as CEO, Carlos Torres Vila emphasized that the purpose of BBVA’s transformation is to “become a better bank for our customers. We want our solutions to make a difference in our customers’ lives and their businesses,” he added.

To this regard, he explained that the world is currently “in the age of opportunity due to the changes we’re witnessing. And in this age of opportunities, we want to be an active agent, making these opportunities accessible to everyone,” he continued, before concluding that the company needs to “put the customer at the heart of everything we do." The ultimate purpose is to become the bank that its customers recommend the most in the countries where we are present, explained Carlos Torres Vila. “Having customers that recommend us is, without a doubt, the key to building a business that succeeds in the long term,” he assured.

Carlos Torres Vila: "We want our solutions to make a difference in our customers’ lives and their businesses

BBVA’s CEO shared some details of the changes brought about in the different business areas in 2015.

- In Spain, he emphasized the good news coming from banking activity, such as the growth in net attributable profit and lending volumes in mortgages (38%), consumer loans (40%) and business loans (26%). All this without taking into account the additional impact of incorporating CX. Moving on to the real estate activity, he discussed some of the positive prospects facing the market and the clear improvement in the P&L accounts in the area. Overall, the banking and real estate activities generated a profit of €554 million (€597 million more than in 2014).

- In the U.S., positive results (+5.2% in constant euro) reflected a buoyant activity. This trend is expected to continue in 2016, despite a slower-than-expected interest rate increase and the spike in loan-loss provisions. Carlos Torres Vila also announced that the bank plans to continue driving the transformation in a country that, despite being the most digitized in the world, has obsolete banking services, a situation that offers an opportunity.

- Regarding Turkey, the CEO said that BBVA is very satisfied with its investment in Garanti and its relationship with its partner, Dogus. “Garanti is making great strides in the transformation process, shows good business dynamics, with high activity growth levels and is undoubtedly the best franchise in a country that, despite current uncertainties, offers enormous growth potential,” he stated. The net attributable result of the area remained virtually flat in the year at constant euro, and grew 24.4% taking into account the additional stake acquired by BBVA.

- Moving on to Mexico, Carlos Torres Vila praised its excellent results (+9%), despite slower economic growth. BBVA remained the undisputed leader of the Mexican banking sector, gaining market share in loans and leading the market in terms of efficiency and profitability, while enjoying a strong capital position.

- Speaking about South America, he begun reminding the audience that all figures were affected by uneven behavior resulting from macro and market conditions in each country. In his opinion, the net attributable profit of the area (+9%) reflected the recurrence of the business in the region, with solid growth rates in net interest income and total earnings.

Carlos Torres Vila concluded with an optimistic vision for the year. “We hope our business will continue posting significant activity growth rates. This year’s results will continue to benefit from a decrease in loan-loss provisions in Spain, and growth in Mexico,” he said. He also stressed the management team’s commitment to “remain focused on our transformation journey.” And he concluded: “We have clearly-defined ideas, a purpose and a path to achieve it. We want to continue working for our customers, offering them customized solutions that help them with their finances, to continue improving NPS scores. This will be the basis on which we will continue building a solid and profitable business.”