What will BBVA do with its 2024 profit?

The more a company grows and increases its profitability, the greater its positive impact on the economy and people. During the presentation of the 2024 results, BBVA Chair Carlos Torres Vila explained how the bank will allocate its revenue and profit, with a greater social impact.

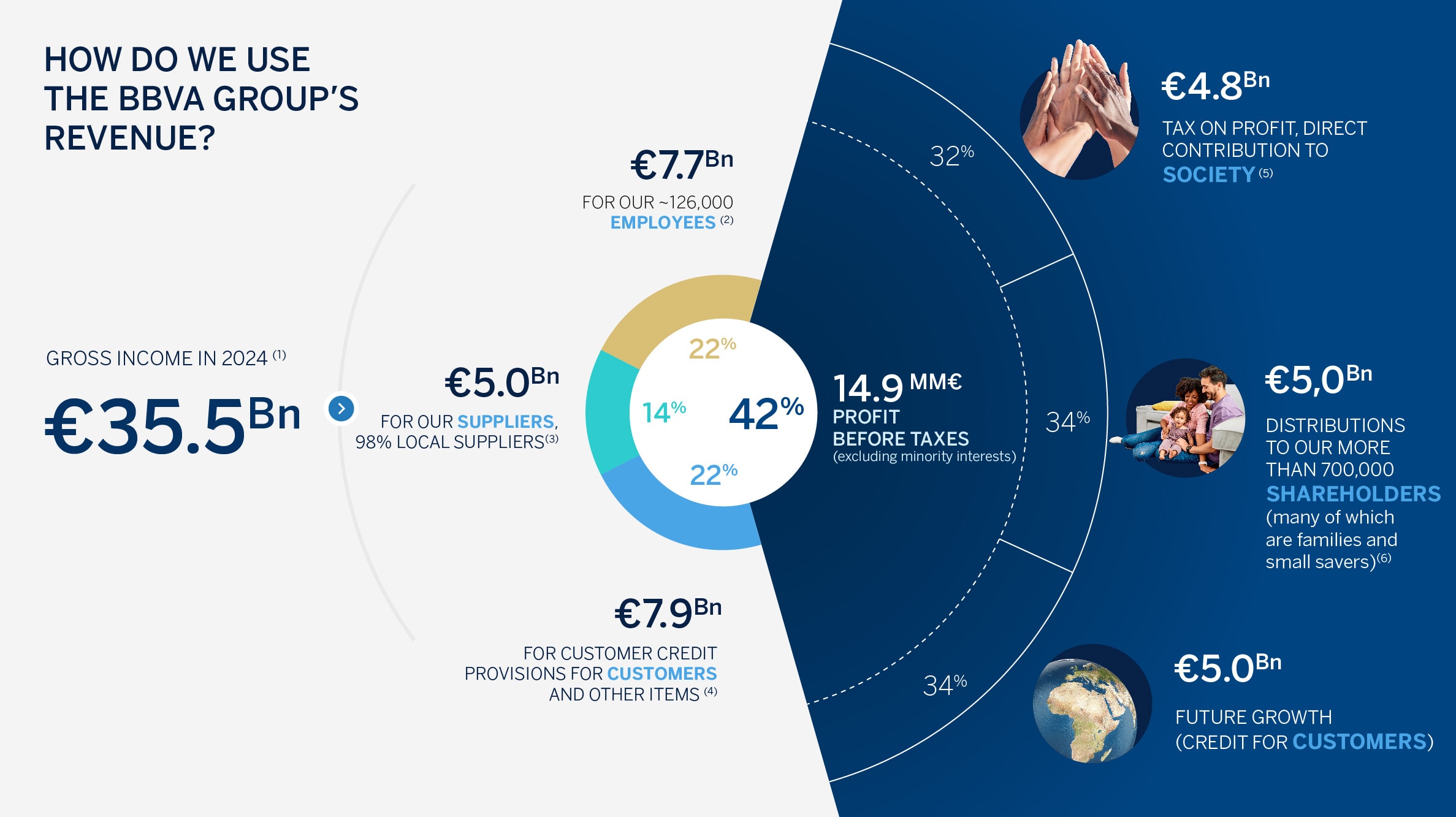

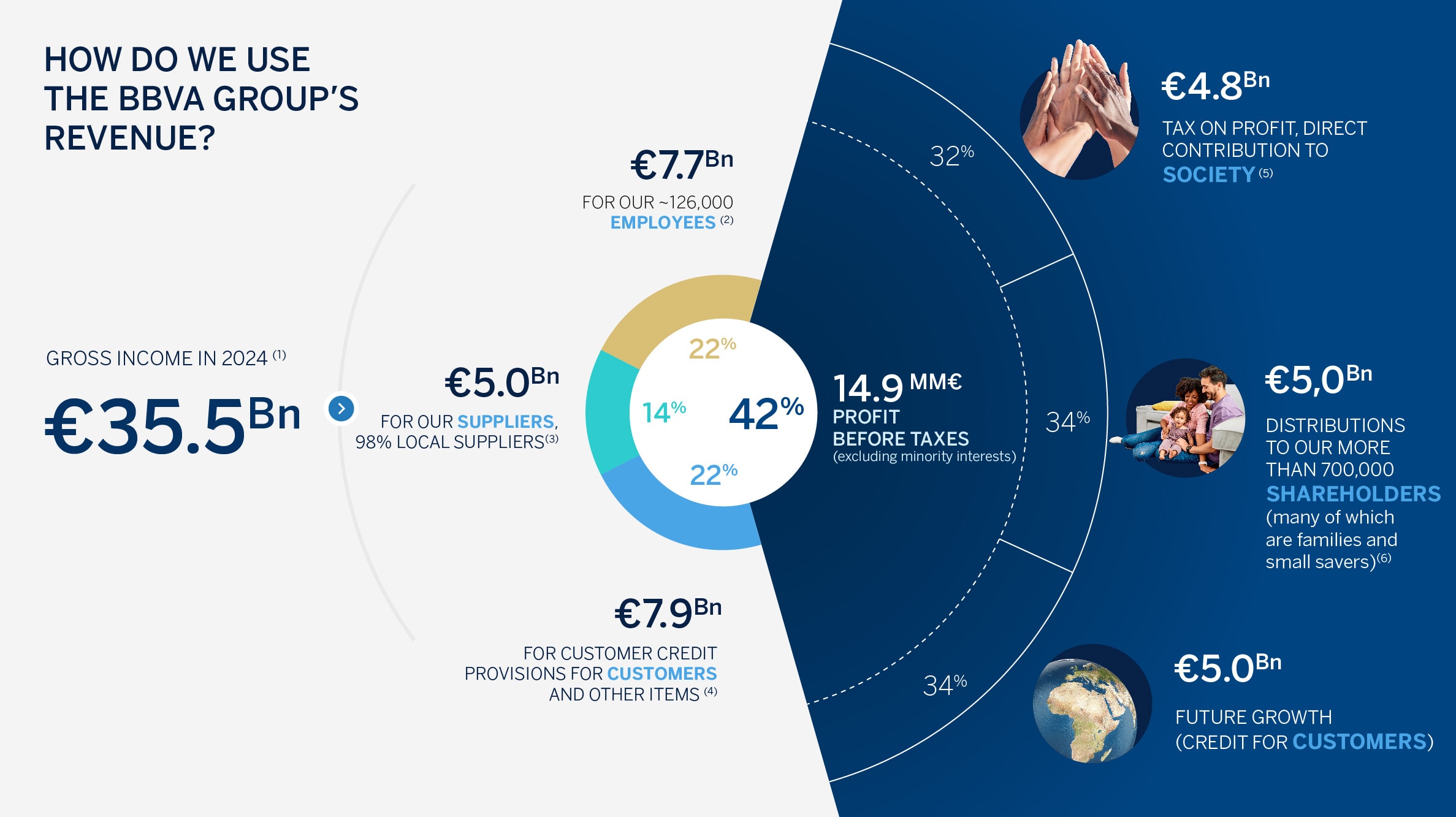

Nearly 60 percent of BBVA’s income is largely allocated to three main areas: employees, suppliers and credit costs.

First, BBVA dedicates 22 percent of its revenue, or around €7.7 billion, to pay its employees and cover the taxes associated with social security contributions. BBVA is a major job creator, with nearly 126,000 employees across the Group, and around 29,000 in Spain.

Second, the bank covers provisions for the risks associated with its activities, mainly the credit it provides its customers, as well as the depreciation of other assets. This represents an additional 22 percent of the bank’s revenue, or around €7.9 billion.

Third, it handles a series of general expenses, which largely correspond to payments to suppliers, primarily local suppliers, creating jobs. Specifically, 14 percent of revenue is allocated to this concept, or €5 billion.

(1)This figure includes the negative impact of -€285 million from the extraordinary tax on banks in Spain. (2) Personnel costs, including social contributions. (3) Other administrative costs, including taxes covered in this line. (4) Includes impairment of financial assets, provisions and other results, amortizations, as well as minority interests. (5) 2024 accounting expense for corporate income taxes included in the BBVA Group income statement. (6) These figures include the new €993 million share buyback program under the ordinary shareholder distributions for 2024 (subject to approval by relevant supervisors and corresponding governing bodies).

After deducting these three large lines, the remaining amount corresponds to the profit before taxes, which is slightly over 40 percent of the bank’s revenue. It is allocated to three areas:

- One third goes to taxes, specifically to taxes on earnings, which exceed €4.8 billion and is one of the primary ways the bank contributes to social wellbeing.

- BBVA reinvests another third, around €5 billion, in the future growth of the business. In other words, it puts the money toward credit for customers.

- The remaining third - another €5 billion - is allocated to distributions for the bank’s more than 700,000 shareholders, many of whom are small savers and families.