What kind of bank is the world calling for?

For more than a century and a half, BBVA’s attitude has remained intact. It is an attitude that pursues progress and listens closely to society’s needs, always seeking to stay ahead in order to find the best way to support people and businesses in advancing their goals. Because everyone who has a goal in mind is capable of building a better future.

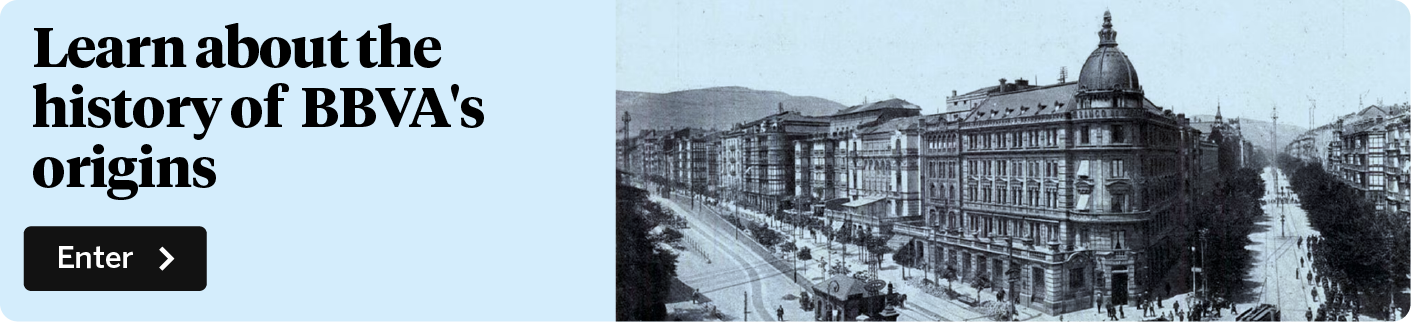

Banco Bilbao launched our country first ever credit card back in 1971. This innovative financial tool took the country’s payment system by storm, by introducing a new, cashless way of buying on credit. Its appearance on the market not only facilitated commercial transactions, but also helped to modernize the Spanish banking sector.

More than 50 years down the line, the card has come on in leaps and bounds. It now features advanced technologies, such as PIN or contactless, thus adapting to the latest demands among consumers. Since its launch, BBVA has continued to lead the way in financial solutions by relentlessly expanding its range of cards with innovative features.

In 2020, BBVA launched Aqua, the first card without visible numbering and with dynamic CVV, marking a milestone in financial security. This innovative card, designed to protect user information and reduce the risk of fraud, does away with the numbers printed on the face of the card and uses a dynamic CVV code, which changes with every online purchase. So even if the card is lost or stolen, third parties won’t be able to retrieve or use the payment data.

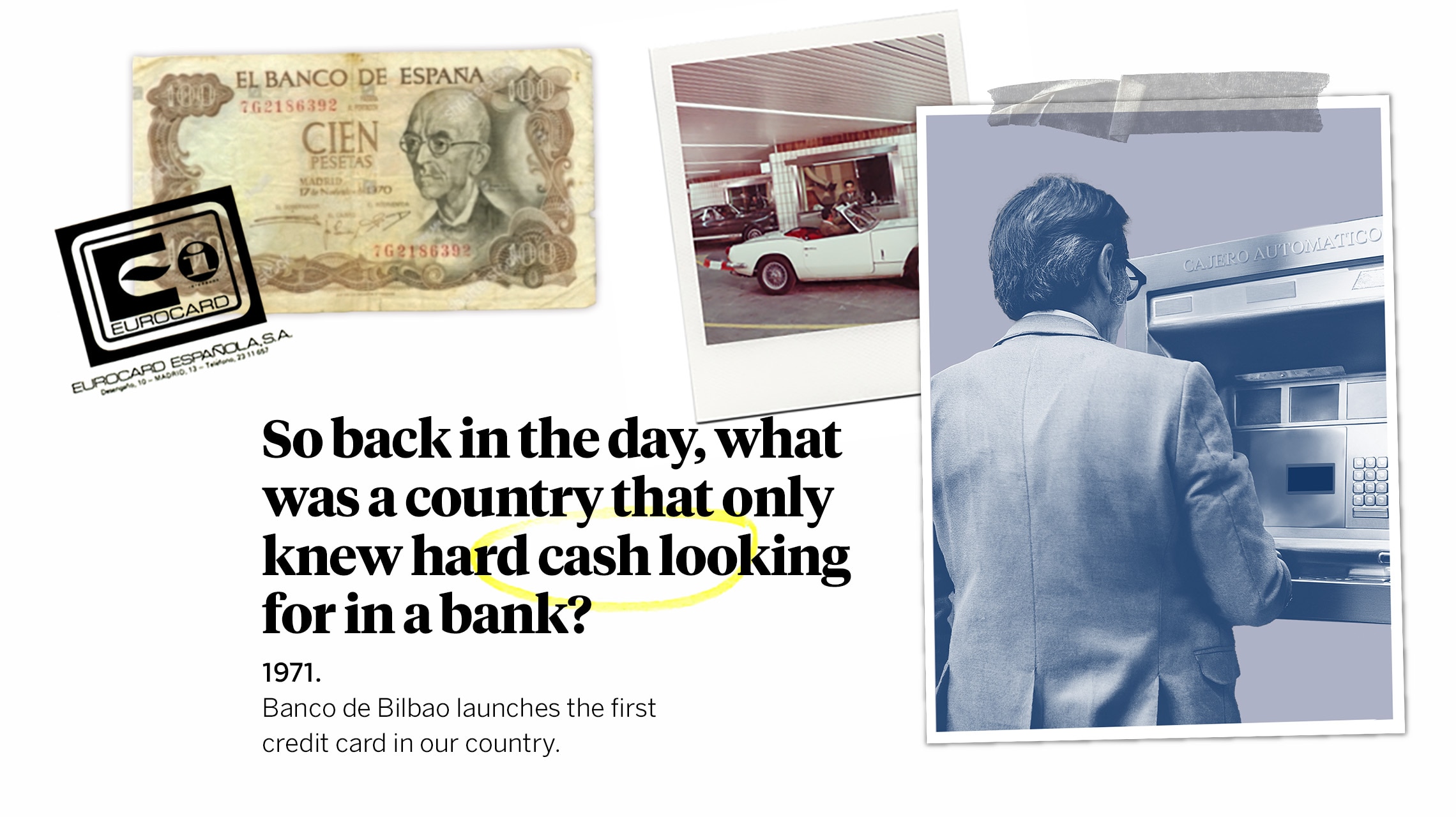

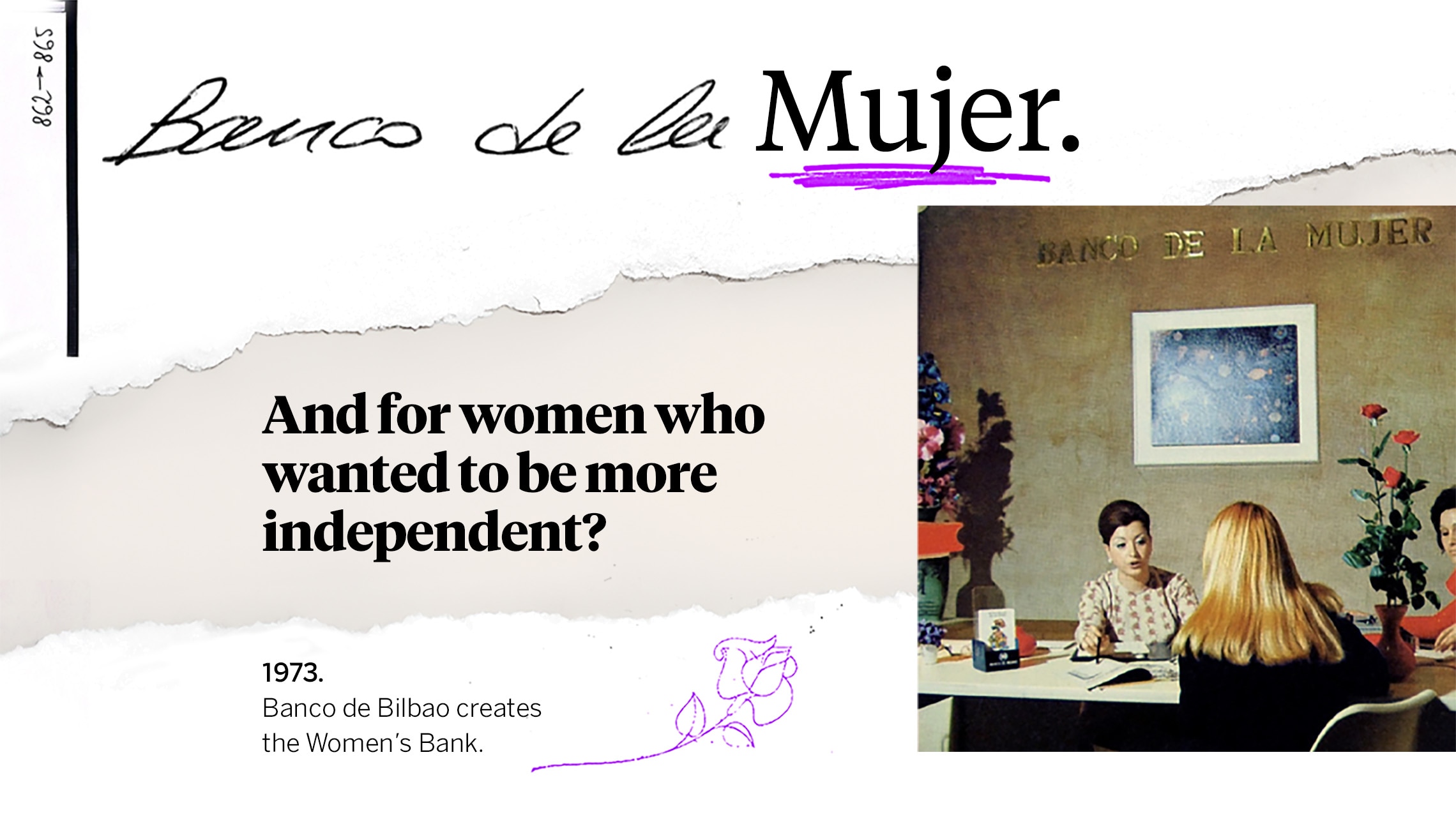

In 1975, Spain abolished the marital license; the legal authorization that every married woman needed to be able to work, travel outside the country or even manage a property. Six years earlier, Banco de Bilbao was already blazing the trail by launching a campaign aimed at women, under the slogan “A bank that cares about us women?

The so-called ‘Women’s Bank’ service was deployed at the bank’s large branches in Spain way back in 1973 and the staff of these 300 or so branches was largely made up of female employees. The aim was to offer a specific service with tailored financial and commercial advice for women, allowing them to carry out certain banking transactions without first having to obtain the consent of a legal guardian. This unwavering commitment to female inclusion has remained constant over the years, having crystallized into various internal equality policies, including the elimination of bias when it comes to hiring and promoting women within the organization.

BBVA currently maintains an active policy of nurturing female talent and promoting a healthy work-life balance, which seeks to guarantee equality at all professional levels within the company. For instance, the company has implemented various measures to foster the professional development of women by promoting equal opportunities when applying for leadership positions and encouraging diversity as an essential value within the company.

In 1902, Banco de Bilbao became the first Spanish bank to set foot outside Spain when it opened a branch in Paris. It would go on to expand its network by opening further branches in London and Tangiers, thus cementing its status as the only Spanish bank with its own international network. Spanish banks have accompanied Spanish businesses in their journey of expanding outward, first in Latin America and then into other regions. BBVA was one such companion, a task it embraced as it set about its own international expansion, which began in the 1990s in Latin America and continued throughout the early 2000s as it ventured into the United States and then Türkiye in 2011.

BBVA’s own extensive international presence makes it a reliable partner in this often complex process. In 2023, the bank accompanied more than 100,000 businesses on their international journey, through an assortment of financing products and services, guarantees for expansion in foreign markets and solutions to reduce the risks associated with international business activities. It delivered a grand total of €31.07 billion in financing, around twice the figure reported three years earlier.

To support its customers, including both SMEs and larger companies, the bank offers a wide range of digital solutions, such as payments in more than 50 currencies, online financing and exchange rate risk management, along with free tools to help them explore new markets (market reports, customer and supplier search, export cost calculators, etc.).

In 2007, BBVA embarked on a transformation process in a bid to serve its customers through digital channels. To succeed, it developed a cutting-edge platform and migrated the way we bank to a self-service model. BBVA’s app has earned international recognition, having been named best mobile banking app in the world on various occasions, thanks to its wide range of features and an unrivalled user experience.

The bank continues to innovate and improve the digital banking experience, thus demonstrating its commitment to digital transformation and customer satisfaction. Customers can carry out numerous transactions via the BBVA app, such as viewing their positions, using various tools to improve their financial health, or calculating the value of their home or car. Notably, more than 75 percent of BBVA customers around the world now use the app to manage their day-to-day finances.

BBVA has made sustainability one of its six strategic priorities in tackling three key challenges: combating climate change, conserving natural capital and driving inclusive growth.

The bank achieved a new record in sustainable business by channeling €26 billion in the second quarter of 2024 alone, bringing the total for the first half of the year to €46 billion, 37 percent more than in 2023. This growth has been driven mainly by the financing of renewable energies and clean technologies. From 2018 to 2025, the bank has set itself the ambitious target of channeling €300 billion, and as of June 2024 it had already succeeded in mobilizing €252 billion. Of this figure, 77 percent will go toward the fight against climate change and preservation of natural capital, while the remaining 23 percent will be used to promote inclusive growth.

The aim is to provide more financing for projects that champion renewable energy, carbon footprint reduction and social inclusion. BBVA also happens to support various initiatives aligned with the UN Sustainable Development Goals (SDGs).

The bank has monitoring mechanisms in place to ensure that the funds are used effectively and comply with prevailing environmental and social standards. Thus, BBVA aims to consolidate its status as a leader in the financial sector when it comes to sustainability, while playing a bigger role in building a greener and more equitable future.

In 2024, the major long-term trends transforming the economy and society are innovation and sustainability. On the one hand, we are facing an unprecedented wave of disruption. Throughout history, technological innovation has also had a significant impact on economic growth and productivity. On this occasion, the combined effect of new technologies rolled out in all sectors of the economy will be massive.

On the other hand, the current context requires us to take care of the planet. Sustainability measures are becoming increasingly urgent, as is the need to reduce carbon emissions and fight climate change. It is therefore critical to establish a connection between the business community in our country - mainly small and medium-sized companies - and the challenges posed by the energy transition. Companies and governments alike must adopt more sustainable models based on renewable energies, a circular economy and responsible practices to ensure economic growth that balances social progress and environmental protection. In this scenario of opportunities, financial institutions’ role in financing this transition is crucial, as their size and capabilities will play a key role in facilitating a more equitable and sustainable future.