Results: BBVA earns €709 million in first quarter

- Income: Gross income stood at €5.79 billion (+14.9% year-on-year at constant exchange rates) driven by strong performance of recurring revenue (net interest income plus fees and commissions)

- Risks: The Group’s NPL ratio improved, closing at 5.3% at the end of the quarter, compared to 5.4% in December; coverage ratio remained stable at 74%

- Capital: BBVA reached a CET1 fully-loaded ratio of 10.54%, with 21 basis points of growth during the quarter

- Transformation: At the end of the quarter, BBVA Group’s digital customer base stood at 15.5 million (+20% y-o-y). Of these, 9.4 million are mobile clients (+45%)

The BBVA Group posted a net attributable profit of €709 million in the first quarter of 2016, down 53.8% from the same period a year earlier. Quarterly results were hindered by a number of factors, including the impact of exchange rates, lower results from NTI and the lack of corporate operations. In contrast, in Q1-15 profits were bolstered by the partial sale of the BBVA Group’s stake in Chinese bank CNCB. Excluding this factor, profit was 11.6% lower in constant exchange terms.

Speaking about these results, BBVA CEO Carlos Torres Vila pointed to “the strong capital position, the evolution of recurrent revenues, the contribution of emerging markets and lower impairment losses in Spain. This trend, together with the seasonal effect of the banking activity, indicates that results will continue to grow gradually throughout 2016,” he said.

First-quarter results where highly influenced by some of the aforementioned factors, such as the lack of corporate operations (in contrast to the previous year) and the effect of currency exchange, as well as market uncertainty, which dragged down the gains from NTI. These impacts add up to the seasonal effect of the banking business in some geographies, where business is usually slower during the first part of the year. Recurring revenues and lower impairment losses on financial assets were two of the most noteworthy items that helped drive up the quarterly results.

Speaking about the Group’s first-quarter results, BBVA CEO Carlos Torres Vila pointed to “the solid performance of typical banking revenues.” He also added that BBVA already has 15.5 million digital clients. Of these, almost 9.5 million are mobile clients.”

Net interest income increased during the quarter to €4.15 billion, up 13.3% compared to the same period of the previous year (+27.9% at constant exchange rates).

Gross income stood at €5.79 billion, up 2.8% from Q1-15 (+14.9% excluding the impact of currencies). Growth in this line was driven by a solid performance of typical banking revenues: Net interest income and commissions. These recurring revenues allowed to offset the decline in NTI resulting from the complex market situation during the quarter.

Costs increased 14.4% year-on-year (24.8% at constant exchange rates), as a result of Catalunya Banc’s integration in April 2015 and its related costs, high inflation in specific geographies, currency markets evolution and the investment plans rolled out in growing markets. At the end of March, the efficiency ratio stood at 54.8%, better than the average of BBVA’s main European competitors (68.1% in 2015).

In this context, operating income stood at €2.61 billion, up 4.9%, excluding the effect of currencies.

As for risk indicators, they continued to improve: The Group’s NPL ratio was 5.3% in the quarter, down from 5.4% in December 2015. The coverage ratio remained stable at 74%.

As regards capital adequacy, BBVA maintained its solid position. The CET1 fully-loaded ratio was 10.54% in March, which entails a capital generation of 21 basis points in the quarter. Thus, BBVA Group continued making progress towards meeting its 11% fully-loaded target in 2017.

The fully-loaded leverage ratio at the end of the quarter stood at 6.3%. Based on the information available at the end of December, BBVA has the second-highest ratio among its comparable peers in Europe, which have an average of 4.6%.

In terms of activity, during the first quarter of 2016 gross lending saw a slight decline (-1.0%), despite growth in new lending in Spain. As of the end of March, this line stood at €428.52 billion. Customer deposits grew 1.5% to €408.97 billion, with positive performance in almost all geographical regions in which BBVA operates.

Finally, in order to provide a homogeneous comparison against the previous year, below you may find the year-on-year exchange rates of key items of the income statement taking into account Turkey in proforma terms (I.e. including the stake in Garanti as if it had been incorporated by the full integration method since January 1st, 2015). In this context, net interest income dropped 3.3% (+9.7% excluding the impact of currencies), while gross income declined by 9.3% (+1.9% at constant exchange rates). Operating income dropped 20.3%, or 8.4% excluding the currency effect.

The bank’s transformation journey

As regard the bank’s transformation, “we are still pressing ahead with our plans to become a better bank for our customers,” said Carlos Torres Vila.

Yet another quarter, BBVA Group’s digital customer base continued to grow. At the end of Q1-16, the Group’s digital customer base stood at 15.5 million (up 20% compared to the same period a year earlier). Of these, 9.4 million operated mainly through their mobile phones, 45% more than in March 2015.

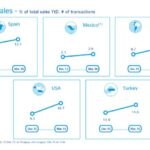

The bank aims to grow digital sales across all its franchises, a trend that is starting to become evident in many of them. For example, in the U.S. the percentage of transactions closed through digital channels stood at 18.7%, compared to 9.3% in 2015. Other geographies where growth in digital sales is becoming increasingly evident are South America (16.5% in Q1-16, compared to 8.7% in 2015), Spain (12.1% in the first quarter vs. 8.8% in 2015), Turkey (14.6% in Q1-16 compared to 13.9% in 2015), and Mexico (3.9% in Q1-16 vs. 2.1% last year).

Below are the key factors that drove the income statement in each business area.

Once again, banking activity in Spain showcased its resilience amid a particularly complex scenario with interest rates at all-time lows. The area still managed to post a slight increase (0.3% in Q1-16 y-o-y) in typical banking revenue (net interest income plus fees and commissions). The decline from NTI (-77.2% y-o-y) triggered the 12.7% gross income drop, when compared to the first quarter of 2015.

Yet another quarter, expenses increased as a result of Catalunya Banc’s integration and its related costs. All this combined led to a 35.7% operating income decline. As in previous quarters, risk indicators continued to improve. The impairment losses on financial assets declined 38.6% in year-on-year terms. On the other hand, the NPL ratio also improved slightly, closing the quarter at 6.4% (6.6% in December 2015), while coverage remained constant at 59%. The area’s first-quarter results reached €234 million, down 23.6% from the same period of the previous year.

As regards real-estate activity in Spain, net exposure to the sector was reduced by 12.5% in year-on-year terms (excluding the balance of Catalunya Banc, which became part of the BBVA Group in April 2015). Also, the drop in real-estate provisions led to a loss of €113 million (26.5% narrower compared to the first quarter of the previous year).

The result of BBVA in Spain – which combines banking and real-estate activities – recorded profits once again (€121 million).

To better explain the evolution of the business areas that have a currency other than the euro, the exchange rates stated below refer to constant exchange rates.

The United States posted, once again, positive activity, with year-on-year growth rates of 7.9% in lending and 9.0% in customer funds. This allowed a positive evolution of the net interest income (+7.7%). However, less momentum in commissions together with the impact of financial markets volatility on NTI resulted in a nearly flat gross income (up 0.9% year-on-year). On the other hand, loan quality in the area was somewhat affected by a deterioration in the exposure to the energy sector and commodities. Besides higher impairment losses, this lead to an increase of the NPL ratio, which stood at 1.4% in March (vs. 0.9% in December), and a drop in the coverage ratio to 103% (compared to 151% in December). The area’s net attributable profit was €49 million, down 63.5%.

To better understand how the business has performed in Turkey, the year-on-year rates mentioned below are based on the assumption of Garanti’s proforma participation.

Robust activity in the country drove growth in lending and deposits (14.0% and 15.8%, respectively), which helped gross income to grow by 14.3%, compared to the first quarter of 2015. Costs continued to grow, although at lower rates than during the previous quarter, which allowed the operating income to increase by 15.1% during the quarter. Regarding asset quality, the risk premium improved (0.8%, compared to 1.4% in Q4-15), while both the NPL ratio (2.8%) and the coverage ratio (129%) remained stable. 2016 first-quarter profit stood at €133 million, 13.2% more than in the first quarter of 2015.

Mexico continued to show signs of strong activity, with double-digit growth rates in lending (+12.4%), and +9.2% in customer funds. Again, the country posted double-digit growth in recurring revenue (+13.0%), gross income (+11.4%) and operating income (+12.7%). As regards asset quality, both the NPL ratio (2.6%) and the coverage ratio (119%) remained stable. As of the end of March, the area posted a profit of €489 million, up 10.1% year-on-year.

South America saw very high activity growth rates (+14.7% in lending and +19.6% in customer funds), which drove growth in recurring revenue (+14.9%), gross income (+14.1%) and operating income (+9.5%). The NPL ratio stood at 2.6%, while the coverage ratio fell to 118%. At the end of March 2016, the area’s net attributable profit stood at €182 million, up 8.7% year-on-year.

-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6

About BBVA

BBVA is a customer-centric global financial services group founded in 1857. The Group is the largest financial institution in Spain and Mexico and it has leading franchises in South America and the Sunbelt Region of the United States; and it is also the leading shareholder in Garanti. Its diversified business is focused on high-growth markets and it relies on technology as a key sustainable competitive advantage. Corporate responsibility is at the core of its business model. BBVA fosters financial education and inclusion, and supports scientific research and culture. It operates with the highest integrity, a long-term vision and applies the best practices. The Group is present in the main sustainability indexes.

BBVA