BBVA earns €1.32 billion in 4Q20, its best quarterly result in two years

BBVA earned €1.32 billion between October and December, its highest quarterly result over the past two years. In 2020 BBVA helped three million clients affected by the pandemic, with about €63 billion in government-backed credit lines and loan deferrals. The sale of the U.S. subsidiary will provide some €8.5 billion in capital to grow in a profitable way across its footprint and increase shareholder distributions. BBVA will make a gross cash payment of €0.059 per share against 2020 earnings, and expects to resume its shareholder distribution policy in 2021 with a payout of 35-40 percent of profits. Additionally, the bank is targeting a buyback of about 10 percent of the Group’s shares, after the close of the sale of the U.S. franchise. All this subject to market conditions and the required approvals.

Press kit Results 4Q20

- Statements from Carlos Torres Vila (YouTube)

- Quarterly Report 4Q20 (PDF)

- Carlos Torres Vila: "Our excess capital opens the door for extraordinary distributions for our shareholders"

- 4Q20 Results Presentation Press (PDF)

- Statements from Carlos Torres Vila - TV

- 4Q20 Results Presentation Analysts (PDF)

- Statements from Carlos Torres Vila - Radio

- Statement on BBVA 4Q20 earnings from the Chairman (Text)

- 'La Vela', main building in the 'Ciudad BBVA' (JPG)

- BBVA CEO Onur Genç and the Chairman Carlos Torres Vila (JPG)

Carlos Torres Vila: “Our excess capital opens the door for extraordinary distributions for our shareholders” - BBVA

"In 2020 we achieved excellent results in a year of great complexity. We have also announced a historic transaction for BBVA: the sale of our U.S. subsidiary. An operation that puts us in an unparalleled position of strength in the sector, which allows us to increase shareholder distributions. We look to 2021 with the same commitment to our clients and society we had last year, and thanks to our tremendous strength, we will continue to support them throughout the pandemic, as well as in the recovery phase", said BBVA Group executive chairman Carlos Torres Vila.

In 2020 BBVA’s results improved as the year progressed. For the full year, operating income fell 2.7 percent with net attributable profit standing at €3.08 billion excluding one-offs, a -36.1 percent decline as a result of provisions recorded mostly in the first half of the year due to the pandemic. Including one-offs -the €2.08 billion goodwill adjustment in the U.S. in 1Q20 and the net capital gains of €304 million on the sale of its non-life insurance business in Spain to Allianz recorded in 4Q20-, the Group's net attributable profit stood at €1.31 billion (-62.9 percent).

In order to offer a better comparison for each line of the account, variations hereafter are shown at constant exchange rates.

At the top of the income statement, it is worth noting the strength of the net interest income, which grew 3.6 percent in 2020 to €16.8 billion. In 4Q20, this line grew 1.4 percent compared to the same period of 2019, to €4.04 billion. Income from net fees and commissions added €4.62 billion to the Group's year-end earnings (-0.4 percent yoy). Between October and December, net fees and commissions increased 2.2 percent yoy, to €1.17 billion. As a whole, recurring revenues – net interest income plus fees and commissions – grew 2.7 percent in the year.

The Group's net trading income (NTI) grew 37.6 percent yoy to €1.69 billion, driven mainly by exchange rate hedging gains recorded under the Corporate Center, and the increase in earnings generated during the year by the business areas.

Gross income grew 4.5 percent yoy in 2020 to €22.97 billion on the back of a solid revenue performance. It declined 3.2 percent yoy to €5.27 billion in 4Q20, as a result of a drop in NTI in this period.

The implementation of cost containment plans across all areas throughout the year contributed to reduce operating expenses by 2.6 percent in 2020, to €10.76 billion – below the average inflation rate in BBVA’s footprint, which stood at 4.2 percent. The performance of operating expenses and the positive recurring revenue trends allowed the Group to deliver positive jaws and improve the efficiency ratio, which stood at 46.8 percent, 342 basis points below the 2019 ratio, and significantly better than the efficiency ratio of its comparable EU peer group (63.7 percent). Between October and December, operating expenses fell 2.7 percent yoy, to €2.67 billion.

Operating income stood at €12.22 billion in 2020, up 11.7 percent yoy driven by the resilience of recurring revenues in combination with cost containment efforts. In 4Q20, this item reached €2.59 billion (-3.7 percent yoy).

BBVA’s net attributable profit stood at €3.08 billion in 2020 excluding one-offs, down 27.2 percent vs the previous year due to the effort to anticipate impairments and provisions in the first half of the year. Taking into account the negative impact of the goodwill adjustment in the U.S. recorded in 1Q20 and the capital gains on the sale of the non-life insurance business to Allianz, BBVA earned €1.31 billion (-55.3 percent yoy). In 4Q20, profit - excluding one-offs - was €1.02 billion (+4.9 percent yoy). Including the capital gains from the Allianz transaction, it reached €1.32 billion.

As for shareholder distributions, the bank plans to propose to its governing bodies a gross cash payment of €0.059 per share against 2020 earnings. This proposal is in line with the recommendation from the supervisor and it is the maximum amount allowed, as it represents 15 percent of the 2020 profits¹. Regarding distributions against 2021 earnings, BBVA intends to return to its previous policy² of a cash payout of 35-40 percent of yearly profits in dividends. Additionally, the bank is targeting a buyback of around 10 percent of the Group’s shares³, once the sale of the U.S. subsidiary is closed.

In 2020, the tangible book value per share plus dividends closed the year at €6.21, the year’s highest level. BBVA also leads European banks in terms of profitability, with ROE and ROTE standing at 6.9 percent and 7.8 percent respectively, excluding one-offs. The average ROTE for comparable competitors is about 4.5 percent.

The fully loaded CET 1 capital ratio stood at 11.73 percent at the end of December, 21 basis points above the September level. BBVA has decided to increase its capital target, setting a range between 11.5 and 12 percent. The agreement to sell BBVA’s U.S. subsidiary places the pro-forma fully loaded CET1 ratio at 14.58 percent at the end of December.

Cost of risk continued improving over the course of the year, following front-loaded provisions in 1H20 related to the pandemic. At the end of the year, the ratio stood at 1.51 percent (at the lowest end of the range expected by the bank of 1.50 to 1.60 percent), compared to the 2.57 percent peak in March. The NPL and NPL coverage ratios closed the year at 4.0 percent and 81 percent, respectively.

As for the balance sheet and activity, the quarterly gross figure for loans and advances to customers closed at €378.14 billion, up 3.5 percent from the previous year. Customer funds stood at €512.10 billion as of December 2020, up 11.9 percent.

The new strategy takes off

BBVA’s strategic priorities have proven critical against the current backdrop to successfully harness the trends that have gained traction in the financial industry.

The bank has focused on advising customers on their transition toward a sustainable future. In wholesale banking, BBVA is one of the most active institutions in sustainable finance, with €11 billion in green loans and sustainable bonds. Furthermore, in 2020 BBVA launched a number of sustainable products for all segments, including mortgages for energy-efficient homes, loans for the acquisition of electrical and hybrid vehicles, or One View, a solution that allows businesses to get an estimate of their greenhouse gas emissions. As of the end of 2020, BBVA had mobilized about €50 billion in sustainable finance deals, half the amount of the 2018-2025 €100-billion pledge to fight climate change and promote inclusive growth. In 2020, BBVA rose to first place among European banks in the Dow Jones Sustainability Index (DJSI), which measures the performance of the biggest companies by market capitalization in economic, environmental and social issues. The bank also ranks third worldwide among banks.

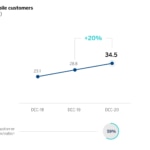

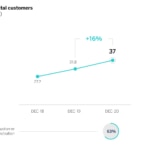

The bank added a total of 7.3 million new customers in 2020, of which 2.4 million are new digital customers (56 percent more than the ones gained in 2019). The bank's digital customer base stood at 37 million, up 16 percent compared to 2019. Mobile customers grew 20 percent in the year, to 34.5 million. These figures reveal the extent to which the pandemic has been a key driver in digitization, a trend which has reinforced BBVA’s strategy as a pioneer in the sector for over a decade. Digital sales accounted for 64 percent of total units and 48.7 percent in terms of value, compared to 57.7 percent and 41.9 percent, respectively, as of 2019 year-end.

Business Areas

In Spain, lending in 4Q20 grew 0.8 percent yoy on the back of activity in corporate banking and SME segments, which were supported by the government-backed lending scheme. Customer funds grew 8.1 percent yoy, bolstered by growth in demand deposits (+15.8 percent). As for the P&L account, it is worth noting the increase of net fees and commissions (+2.9 percent) and the decline in operating expenses (-6.6 percent), which propelled operating income by 4.7 percent yoy. With impairments on financial assets and provisions factored in, the net attributable profit for the year stood at €606 million, down 56.3 percent. The cost of risk improved throughout the year, following a first half impacted by the pandemic, closing the year at 0.67 percent. The NPL ratio improved to 4.27 percent from 4.44 percent at 2019 year-end. BBVA also boasts a leading coverage NPL ratio, which increased to 66.8 percent at the end of the year, compared to 59.7 percent a year earlier.

In the United States, lending activity remained stable in the year. It is worth noting the growth rate in the corporate and business banking segment (+7.5 percent), spurred by the government’s stimulus schemes, which helped offset the drops in other segments. Customer deposits increased 13.1 percent driven by demand deposits (+26.4 percent). In the P&L account, gross income remained unchanged compared to the previous year, although there was a significant growth in net fees and commissions (+5.5 percent) and NTI (+31.8 percent), which offset the drop in net interest income (-2.6 percent). Operating income increased 4.4 percent in 2020, thanks to lower operating expenses (-2.8 percent). The area earned €429 million, down 25.5 percent from the previous year, due to the impairments on financial assets and loan-loss provisions. The cost of risk ended at 1.18 percent at the end of December. The NPL coverage rate stood at 84.0 percent, and the NPL ratio, at 2.06 percent.

In Mexico, lending activity remained stable in the year (-0.6 percent), with significant growth in mortgages (+7.4 percent) and the public sector (+19.5 percent). Customer deposits grew 10.5 percent, driven by demand deposits (+17.3 percent) and investment funds (+4.4 percent). In the P&L account, gross income remained stable during the year (-0.5 percent). Operating income declined by 1.1 percent, with a slight increase in operating expenses (+0.7 percent). The area’s attributable profit stood at €1.76 billion, down 25.8 percent compared to the previous year. The cost of risk had a favorable performance throughout the year, following a first half impacted by COVID-19-related provisions. It ended the year at 4.02 percent. The NPL coverage ratio stood at 122.1 percent and the NPL ratio, at 3.33 percent.

In Turkey, lending in local currency grew significantly (+33.6 percent) - driven by growth in the commercial and consumer segments, while loans in foreign currency declined 5.4 percent. Customer deposits in local and foreign currencies grew 25.5 percent and 7.9 percent, respectively. Net interest income increased 25.2 percent in the year. The extraordinary performance of the operating income (+35.6 percent) was driven by the solid results in terms of net interest income, NTI and cost containment efforts. The attributable profit in 2020 grew to €563 million, up 41 percent. The cost of risk in the year reached 2.13 percent. The NPL and NPL coverage ratios closed at 6.58 percent and 79.9 percent in December, respectively.

In South America, lending activity increased 12.6 percent in the year. It is worth highlighting the performance of the wholesale portfolio, as a result of higher drawdowns of credit facilities by businesses amid the health crisis. Customer deposits grew 23.3 percent. Net interest income increased 0.9 percent, while operating expenses rose 2.8 percent. The area’s attributable profit, after impairments on financial assets and provisions, stood at €446 million, down 22.6 percent compared to 2019. The cost of risk for the year reached 2,36% percent, while the NPL ratio stood at 4.4 percent and the NPL coverage ratio closed at 110 percent.

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico, it has leading franchises in South America and the Sunbelt Region of the United States. It is also the leading shareholder in Turkey’s Garanti BBVA. Its purpose is to bring the age of opportunities to everyone, based on our customers’ real needs: provide the best solutions, helping them make the best financial decisions, through an easy and convenient experience. The institution rests in solid values: Customer comes first, we think big and we are one team. Its responsible banking model aspires to achieve a more inclusive and sustainable society.