BBVA profit ex items reaches €4.83 billion in 2019 - the highest in 10 years

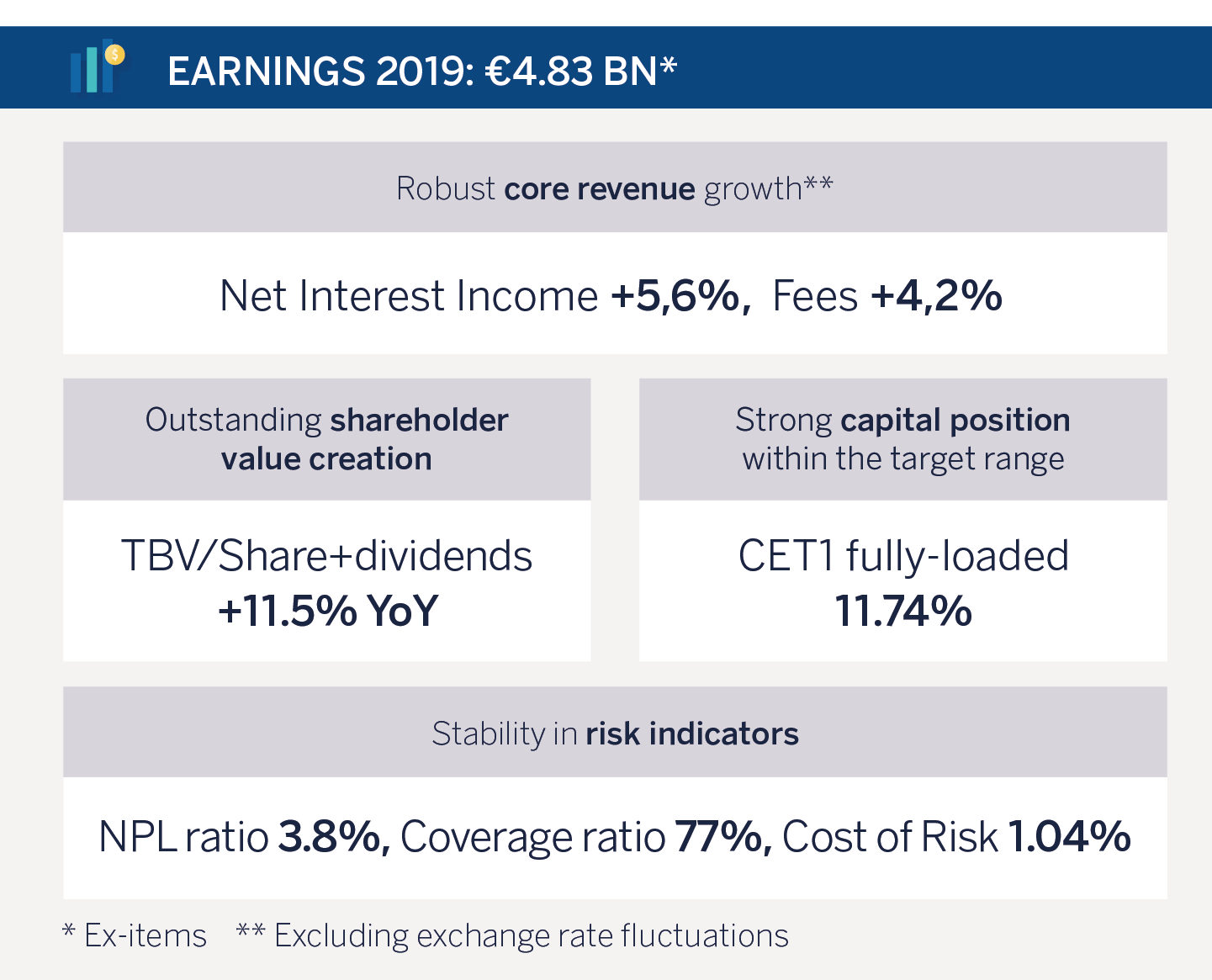

BBVA Group earned €4.83 billion excluding one-time items in 2019 (+2.7 percent from the previous year), the highest figure since 2009. The results were driven by an increase in recurring revenue and the containment in operating expenses. Including the impact of the goodwill adjustment at its U.S. franchise in 4Q19 and the capital gains from the sale of BBVA Chile in 2018, the net attributable profit declined 35 percent yoy, to €3.51 billion. The bank is to propose for the consideration of the competent governing bodies a gross cash dividend of €0.16 per share to be paid in April 2020, maintaining the same amount as the previous year.

Press Kit 4Q19 Results

- 4Q19 Results Presentation Press

- Statements from Carlos Torres Vila (YouTube)

- 4Q19 Quarterly Report

- Statements from Carlos Torres Vila

- 4Q19 Results Presentation (Analysts)

- Statements from Carlos Torres Vila - TV

- Statements from Carlos Torres Vila - Radio

- 'La Vela', main building in the 'Ciudad BBVA' (JPG)

- Carlos Torres Vila, Group Executive Chairman (JPG)

- Statements from Group Executive Chairman (Text)

- 4Q19 Financials data (XLS)

- Resource of 'Ciudad BBVA' in Las Tablas (JPG)

To better understand the yoy comparison, all figures below exclude (unless stated otherwise) BBVA Chile’s earnings through July 2018, date on which BBVA sold this franchise.

BBVA Group’s net interest income reached €18.2 billion in 2019, up 4.8 percent yoy at current rates (+5.6 percent in constant terms, i.e. excluding exchange rate fluctuations). Mexico and South America had a very positive year. Net fees and commissions grew to €5.03 billion, up 3.9 percent at current exchange rates (+4.2 percent at constant exchange rates), with notable performance in Spain and Turkey. Recurring revenue items (net interest income plus net fees and commissions) increased 4.6 percent yoy (+5.3 percent at constant exchange rates), to €23.24 billion, an all-time high.

Net trading income (NTI) grew 16.6 percent yoy (+18.9 percent at constant rates), to €1.38 billion, with a positive evolution in 4Q19, mainly explained by the results in Spain and Turkey. Gross income reached €24.54 billion, (+4.7 percent in current terms, +5.4 percent at constant euros).

Operating expenses remained at bay, growing 3.0 percent (+3.5 percent at constant rates), and below the average inflation rate across BBVA’s footprint (+5.4 percent in the last twelve months). Successful operating cost containment efforts and positive recurring revenue trends allowed the Group to deliver positive jaws and improve the efficiency ratio by 92 bps compared to a year earlier, to 48.5 percent at the end of 2019. This ratio remains noticeably better than the average of comparable European peers (63.6 percent as of September 2019, the latest available figure).

Operating income stood at €12.64 billion in 2019, up 6.2 percent yoy (+7.4 percent at constant exchange rates).

BBVA Group’s net attributable profit for 2019 stood at €3.51 billion, down 35 percent yoy in constant and current euros, due to capital gains from the sale of BBVA Chile in 2018 and the goodwill adjustment in the U.S. in 4Q19 (€1.32 billion). The adjustment was driven by the country’s interest rate trends and economic slow down and does not have impact on tangible net equity, capital, liquidity, the ability to distribute dividends nor the amount of the dividend payment of BBVA Group. This is included in the Corporate Center under the Other Gains (losses) item.

[1] This variation includes the results generated by BBVA Chile until its sale on July, 6, 2018, the capital gains from the transaction, and the impact for the goodwill adjustment in its U.S. franchise.

Excluding ex items, BBVA’s net attributable profit grew 2.7 percent in 2019, to €4.83 billion (+2 percent at constant exchange rates). This is the highest net attributable profit ex items since 2009.

Net attributable profit in 4Q19 was negative: €-155 million. Excluding the U.S. goodwill impairment, the quarter’s attributable profit stood at €1.16 billion, up 14.9 percent yoy (+14.5 percent at constant exchange rates). It is worth noting that this result is 10 percent above analysts’ consensus estimates for this quarter, as a result of higher income and lower loan-loss provisions.

In terms of value creation for shareholders, tangible book value per share plus dividends stood at €6.53 as of December 2019, a figure that represents an 11.5 percent increase compared to the same period a year earlier. Excluding the impact of the U.S. goodwill adjustment, BBVA posted near double-digit profitability metrics, with ROE of 9.9 percent (compared to 5.9 percent in average for comparable European peers as of September 2019), and ROTE of 11.9 percent (vs. a 7.0 percent average for European peers, also as of Sept. 2019). The bank is to propose for the consideration of the competent governing bodies a gross cash dividend of €0.16 per share, to be paid in April 2020, maintaining the same amount as the year before. Last October, BBVA paid an interim gross dividend of €0.10 per share, which would result in a total dividend for 2019 of €0.26 per share.

The fully loaded CET1 capital ratio stood at 11.74 percent at the end of 2019, growing 40 basis points during the year, driven by the Group’s ability to generate organic capital. This allowed it to absorb 25 basis points resulting from regulatory impacts. The ratio thus remains within the Group’s target range of 11.5-12 percent.

Asset quality indicators remained solid during the quarter: The NPL ratio stood at 3.8 percent at the end of the year (the lowest of the past ten years), while the coverage ratio reached 77 percent (the highest during the same period).

As for the balance sheet and business activity, loans and advances to customers grew 2.2 percent in 2019, to €382.36 billion, with significant growth in Mexico, and, to a lesser extent, in the U.S. and South America. Customer funds had a good performance in 2019, growing 2.2 percent to €384.22 billion, driven by a solid evolution of demand deposits (+7.6 percent yoy, +2.8 percent in the quarter). Off-balance sheet funds increased 9.8 percent compared to the previous year, driven by a positive evolution of both mutual and pension funds.

Progress in transformation and sustainability

BBVA has achieved significant progress in its transformation over the past few years, including a much broader customer base. Customers are also more satisfied and engaged. This has resulted in better earnings, both in absolute and relative terms, allowing BBVA to reach leadership positions in profitability and efficiency among comparable European peers.

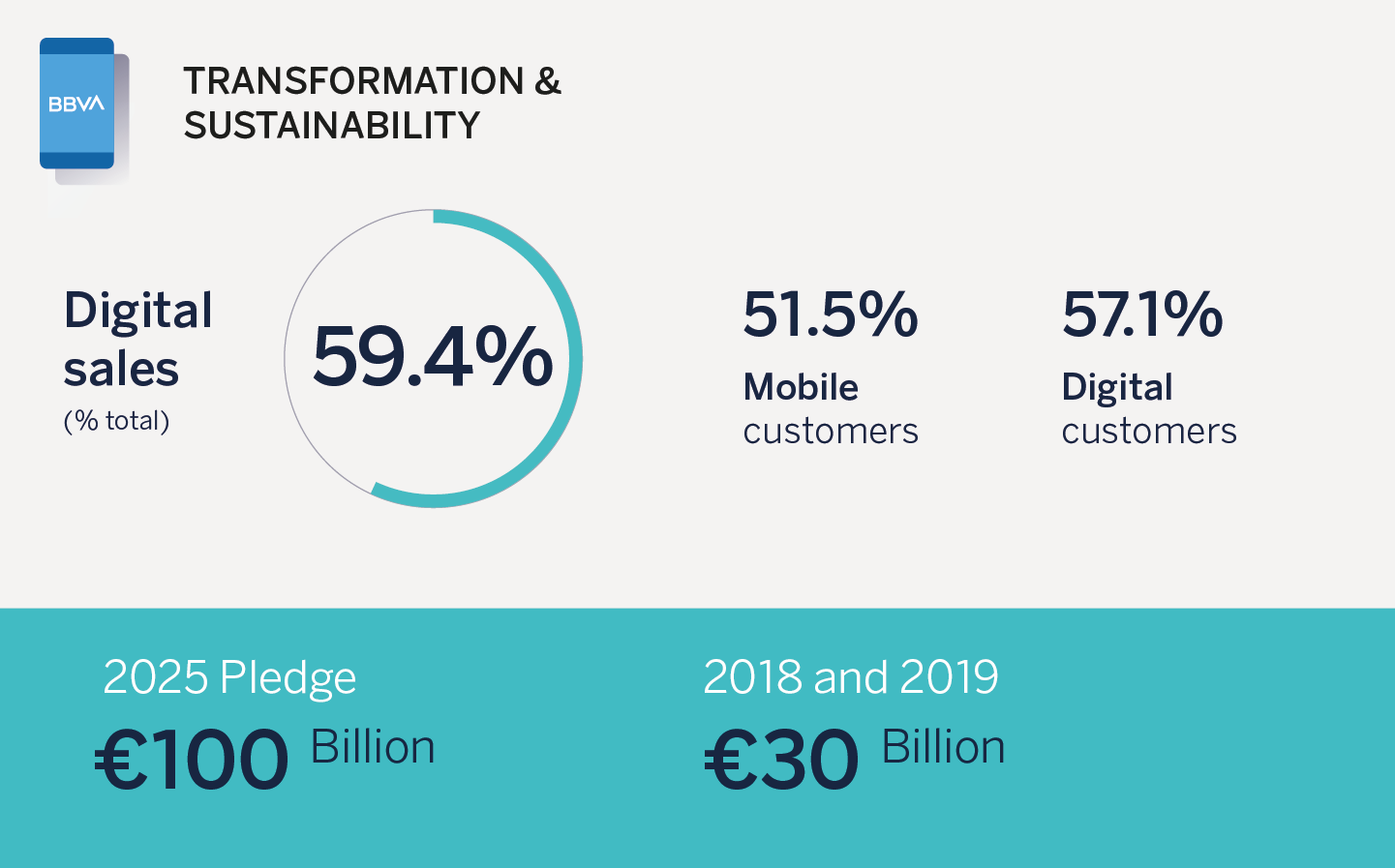

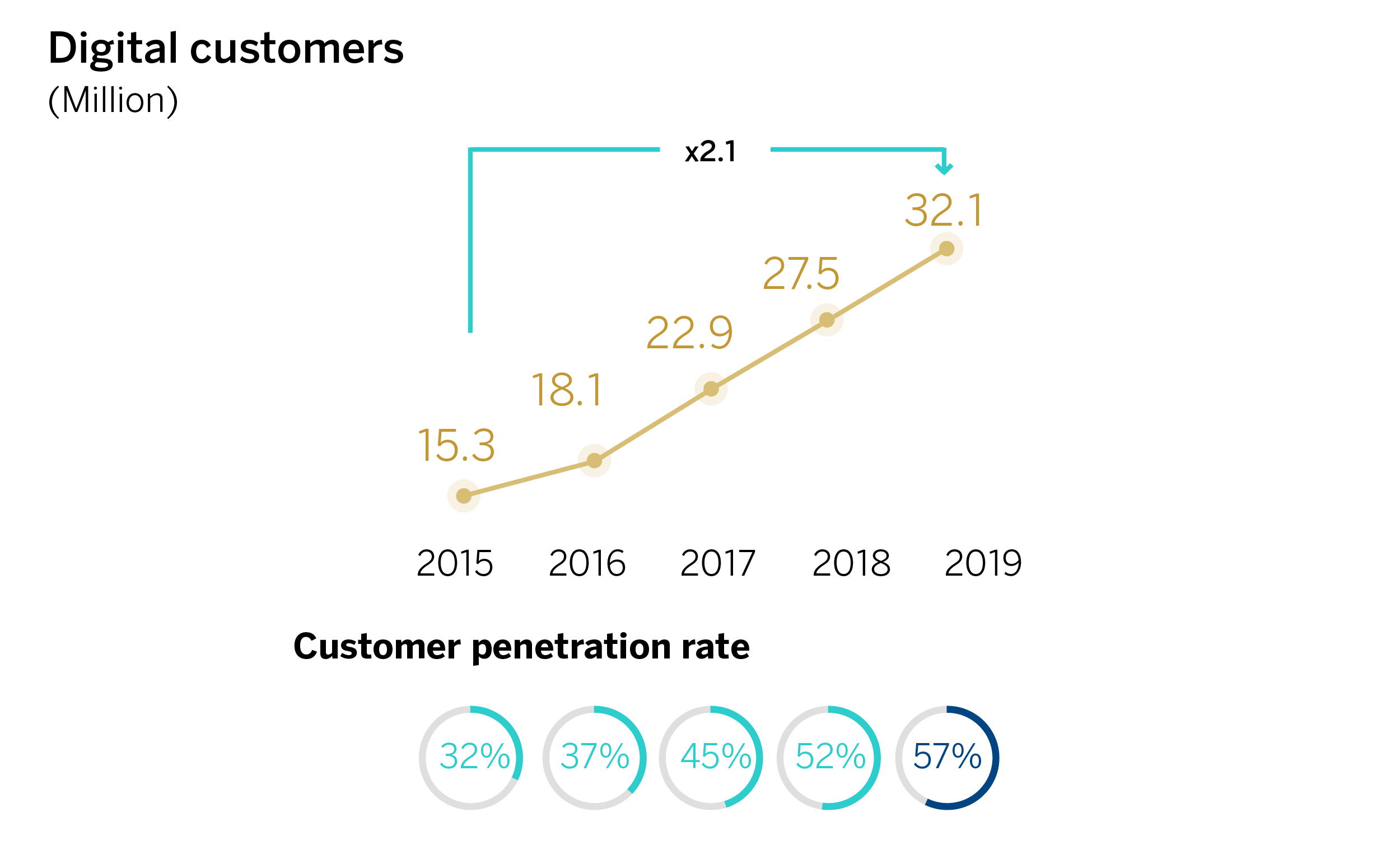

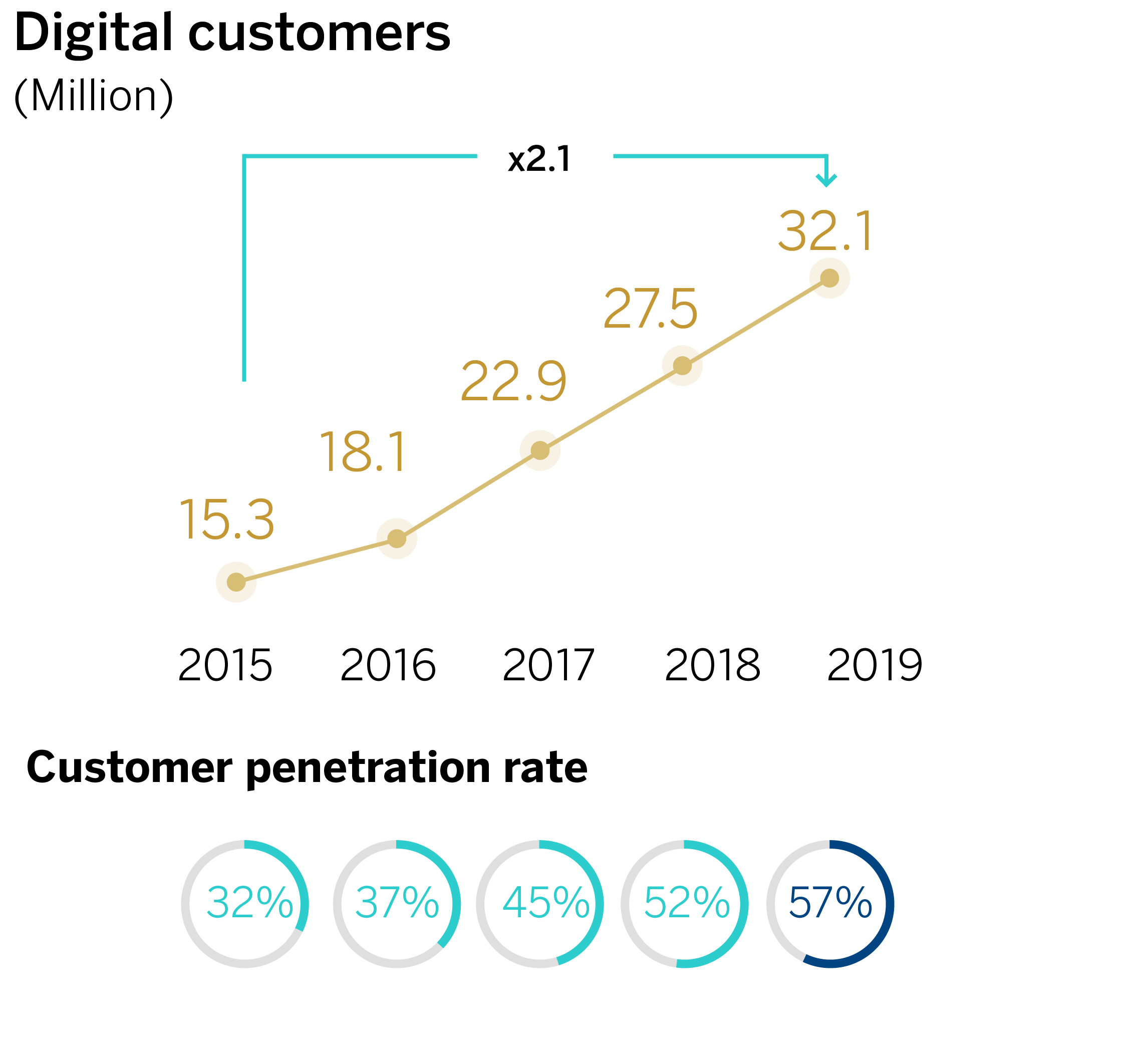

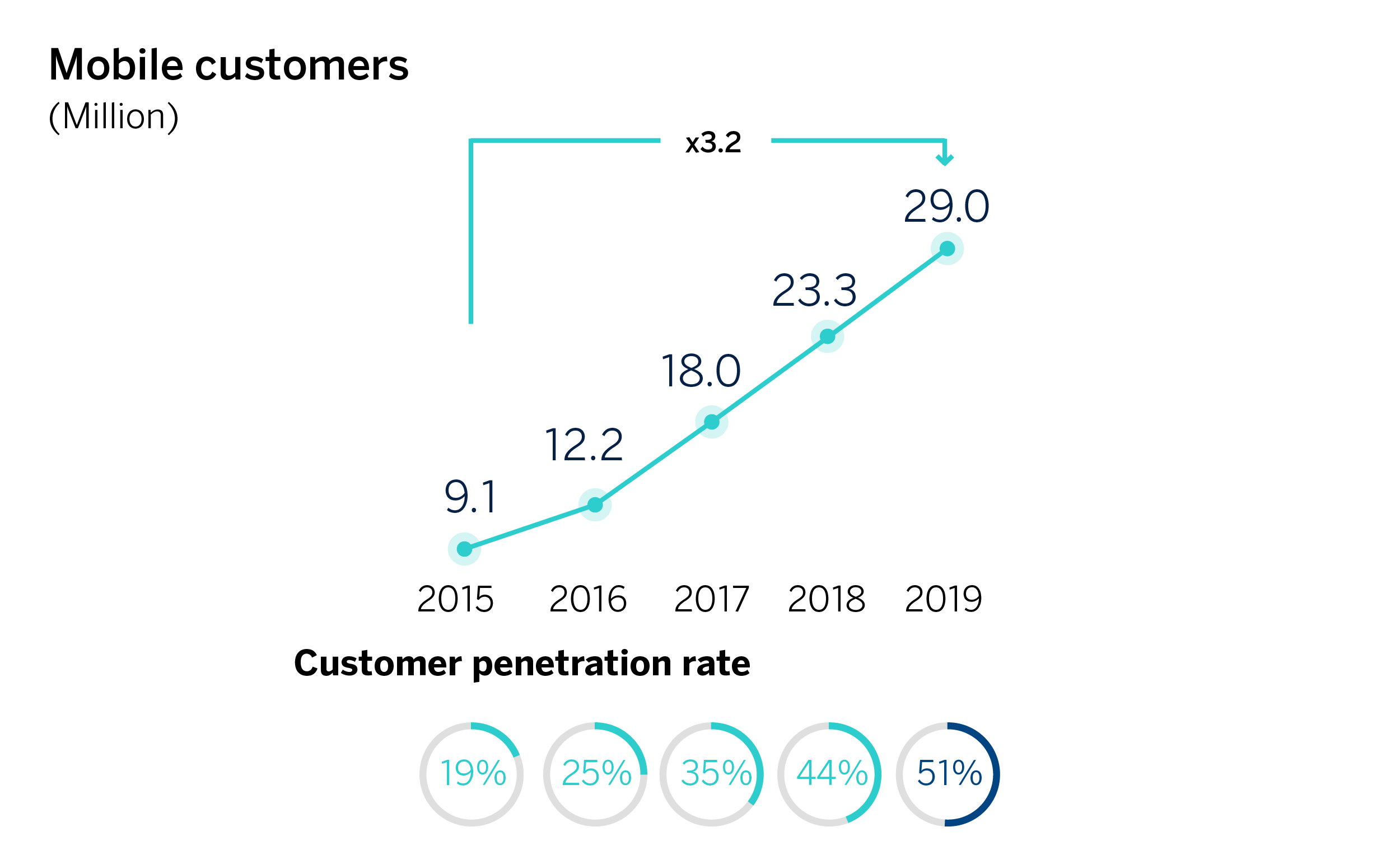

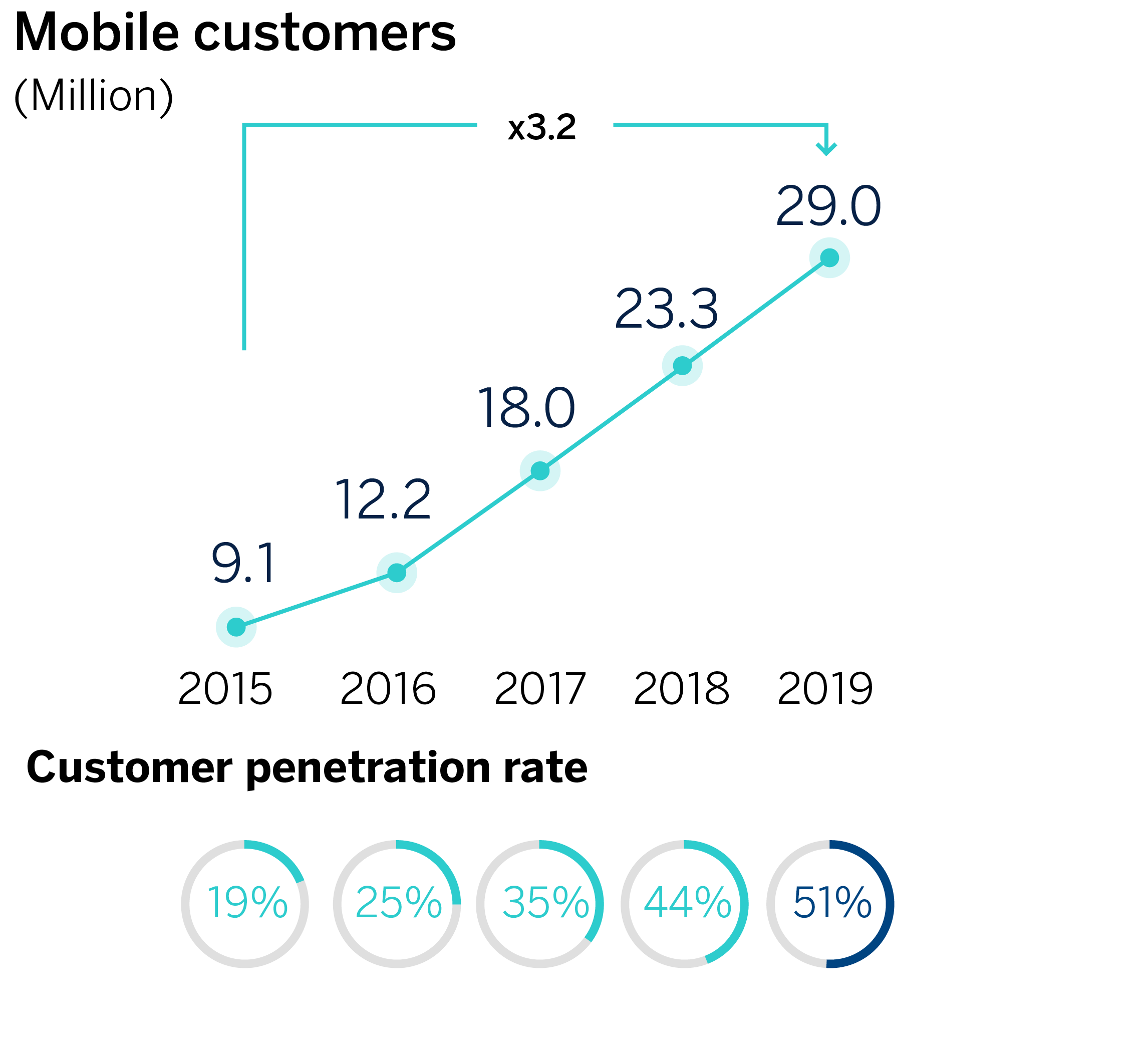

For the third year running, BBVA Spain’s banking app was named the world’s best by consulting firm Forrester Research. At the end of 2019, the Group had 32.1 million digital customers (57 percent of the total customer base) and 29.0 million mobile customers (51 percent), surpassing the goal for the year. As for digital sales, they already account for 59 percent of total unit sales, and 45 percent of total sales by value (PRV).

Regarding sustainability, BBVA mobilized €30 billion in sustainable finance in the 2018-19 period, almost a third of the €100 billion envisaged in its Pledge 2025, which represents a significant achievement. The first year, the Group mobilized €11.8 billion, and in 2019, the figure stood at €18 billion, which represents a growth of more than 50 percent in just one year.

In 2019, BBVA signed the Principles for Responsible Banking, promoted by the United Nations Environment Programme Finance Initiative (UNEP FI). Starting this year, BBVA is assigning an internal price to its carbon emissions, thus incorporating this factor into decision-making processes, as part of the goal to become carbon neutral in direct CO2 emissions.

New strategic priorities

BBVA embarked in 2019 on a strategic review process to give new momentum to its transformation and adapt to the overarching trends that are reshaping the world and the financial industry: A complex economic environment, the increasingly relevant role of digital players, the sector’s commoditization, the role of data in the economy of the future. Also of relevance, the growing focus on sustainability issues.

In this context, BBVA’s strategy has evolved toward three blocks of new strategic priorities that aim to accelerate and deepen the Group’s transformation. The first block defines what we stand for: improving customers’ financial health, and helping customers in the transition toward a sustainable future; the second block is made up of the drivers to achieve an exceptional performance: reaching more customers and achieving operational excellence; and the third one contains the accelerators to reach our goals: having the best and most engaged team while leveraging data and technology.

Business Areas

In Spain, lending declined 1.4 percent yoy, although the area saw growth in consumer loans, retail businesses and medium-sized businesses. Customer deposits remained flat during the year. Off-balance sheet funds grew 5.6 percent, driven by solid growth in mutual and pension funds. Net interest income stood at €3.65 billion (-1.4 percent yoy), in line with expectations due to the negative impact of the phase-in of IFRS16 among others, in January 2019. This, together with a decline in net trading income, explains the 3.9-percent drop in gross income. Net fees and commissions grew 4.1 percent to €1.75 billion, driven mainly by a good performance in corporate banking and asset management. Recurring revenues in Spain increased 0.3 percent yoy in 2019. Additionally, cost containment efforts continued to yield positive results, with a 2.4 percent decline in operating expenses. It is also worth noting lower impairments on financial assets compared to the previous year, following the sale of non-performing loan portfolios in the year. Net attributable profit stood at €1.39 billion, down 1 percent yoy. The NPL ratio improved significantly, from 5.1 percent at 2018 year-end to 4.4 percent in December 2019. The coverage ratio increased from 57 percent to 60 percent.

In the United States, lending increased 2.1 percent (at constant exchange rates), driven by a strong performance in the corporate banking and commercial portfolio. Customer deposits increased 3.7 percent yoy, on the back of strong growth in demand deposits, which helped offset the decline in time deposits. The U.S. franchise posted a net attributable profit of €590 million in 2019, down 19.9 percent yoy (-23.9 percent at constant exchange rates). The result was impacted by an increase in the impairment of financial assets of 144.9 percent (+132.3 percent at constant exchange rates), mainly linked to provisions for specific commercial portfolio customers, more write-offs in the consumer portfolio and an adjustment in the macro scenario. The comparison was also affected by the release in 2018 of hurricane-related provisions from a year earlier. The net interest income remained stable during the year (-0.2 percent at constant exchange rates), despite the Fed rate cuts in 2H19. It is worth noting a significant increase in net trading income (+58.8 percent at current exchange rates, +51.6 percent at constant rates).

As for risk indicators, the NPL ratio improved from 1.3 percent to 1.1 percent, and the coverage ratio increased from 85 percent to 101 percent during the year.

In a context of stagnation of the local GDP, lending in Mexico showed a strong dynamism, growing a remarkable 6.6 percent (at constant exchange rates). This result was driven mainly by the solid performance of retail segments, especially consumer and mortgage loans, where BBVA increased its market share in 2019 by 212 and 26 basis points, respectively. Total customer funds grew 8.2 percent thanks to the increase of demand deposits (which account for 80 percent of customer deposits) and mutual funds. Net attributable profit stood at €2.70 billion, up 14 percent compared to the previous year (+8.2 percent at constant exchange rates), with net interest income growing 11.5 percent (+5.9 percent at constant exchange rates) to €6.21 billion. These results were also driven by a good performance of net trading income, which grew 38.7 percent (+31.7 percent at constant exchange rates) with gains coming from portfolio sales and a strong performance of the Global Markets unit. Gross income grew 11.6 percent (+6.0 percent at constant exchange rates), above operating expenses (+10.6 percent at current, +4.9 percent at constant exchange rates), thus keeping operating jaws in positive territory. The efficiency ratio improved to 32.9 percent.

Risk indicators remained stable in 4Q19, with an NPL ratio of 2.4 percent (vs. 2.1 percent a year earlier) and a coverage ratio at 136 percent (vs. 154 percent as of December 2018).

In Turkey, lira-denominated loans grew 9.9 percent in constant euros, while loans in foreign currency dropped 14.0 percent. Customer deposits remained the main source of funding for the balance sheet. Deposits in lira and foreign currency increased 10.7 percent and 8 percent, respectively, both at constant exchange rates. Turkey’s net attributable profit was €506 million, down 10.7 percent from the previous year. Excluding exchange rate impacts (the Turkish lira depreciated over 10 percent on average in 2019), the result is similar to that of the previous year, with a slight decline of 0.5 percent. Net interest income remained stable despite a lower contribution from inflation-linked bonds, and thanks to the successful price management that led to an increase of both Turkish lira and foreign currency spreads. It is also worth noting the positive trend in fees and commissions (+16.5 percent in constant euros), with a solid performance of those linked to payment systems.

The NPL ratio stood at 7.0 percent, while the coverage ratio reached 75 percent.

In South America, the Group saw a positive performance in the main countries: Argentina, Colombia and Peru. Lending grew 7 percent at constant exchange rates, driven mainly by credit cards and consumer loans. Deposits and off-balance resources grew a combined 7.2 percent during the year. The net attributable profit was €721 million. Excluding the BBVA Chile business from the yoy comparison (sold in July 2018), this figure represents a 40.4 percent increase compared to the previous year (+64 percent in constant terms), with solid performance of net interest income in leading countries. There was also a higher contribution of net trading income, which grew on the back of the sale of Prisma in Argentina in 1Q19 y and the positive contribution of foreign exchange transactions, especially in 4Q19.

As for risk indicators, the region’s NPL ratio stood at 4.4 percent, and the coverage ratio increased to 100 percent.

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico, it has leading franchises in South America and the Sunbelt Region of the United States. It is also the leading shareholder in Turkey’s Garanti BBVA. Its purpose is to bring the age of opportunities to everyone, based on our customers’ real needs: provide the best solutions, helping them make the best financial decisions, through an easy and convenient experience. The institution rests in solid values: Customer comes first, we think big and we are one team. Its responsible banking model aspires to achieve a more inclusive and sustainable society.