Results: BBVA comparable profit rises 20 percent in 2017 to €4.64 billion

- Transformation: More than half of BBVA customers in Turkey, Spain, USA, Argentina, Chile and Venezuela are already digital. As a whole, the digital customer base grew 25 percent in the year (to 22.6 million), while mobile customers grew 44 percent (to 17.7 million)

- Record revenues: Income reached record highs in 2017. Recurring revenue grew 4.1 percent y-o-y, (+10.3percent excluding currency impact), and expenses dropped 2.3 percent in the year (+2.2 percent at constant exchange rates), boosting operating income to €12.77 billion

- Risks: The NPL ratio continued to improve, reaching 4.4 percent (vs. 4.9 percent in December 2016), its lowest level since June 2012. Coverage at year-end stood at 65 percent

- Capital: The fully-loaded CET1 ratio stood at 11.1 percent at the end of December, above BBVA’s target

- Dividend: A cash payment in the gross amount of €0.15 per share, to be paid in April as final dividend for 2017, is expected to be proposed for the consideration of the competent governing bodies

In 2017, the BBVA Group generated a net attributable profit of €3.52 billion (+1.3 percent). Without taking into account the impairment losses from Telefónica, net profit for 2017 stood at €4.64 billion, up 19.7 percent compared to 2016 results, excluding the provisions related to 'floor clauses’ in Spain. Record revenue and cost containment efforts in operating expenses were the main drivers of this result.

BBVA Group Executive Chairman Francisco González said that "the strength of recurring revenues and the improvement in efficiency show that we are advancing decisively in our transformation strategy. 2017 was a good year and 2018 will be an even better one."

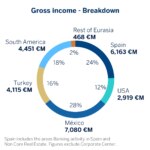

In 2017, the BBVA Group generated net interest income of €17.76 billion (+4.1 percent y-o-y, +10.6 percent in constant terms), reaching an all-time high, as it also did in the fourth quarter. Adding fees and commissions (e.g. recurring revenues), this item came to €22.68 billion, up 4.1 percent compared to 2016 (+10.3 percent stripping out currency effects). These headings drove gross income to record levels: €25.27 billion (+2.5 percent y-o-y, +7.9 percent at constant exchange rates).

Operating expenses declined 2.3 percent y-o-y in 2017 (+2.2 percent at constant exchange rates). Income and cost trends generated ‘positive jaws’ and allowed the efficiency ratio to improve for a fourth straight year, ending 2017 at 49.5 percent. These trends helped the Group’s operating income to grow 7.7 percent in y-o-y terms, (+14.1 percent at constant exchange rates) to €12.77 billion, a new record.

In the fourth quarter, BBVA posted a €1.12 billion charge linked to the decline in Telefónica’s stock price. In the fourth quarter of 2016, the company’s earnings were affected by a provision of €577 million before taxes (€404 after taxes) to cover claims linked to the “floor clauses” of mortgage loans in Spain. Excluding both adjustments, net attributable profit in 2017 stood at €4.64 billion, up 19.7 percent from 2016 results.

Regarding risk indicators, the reduction of non-performing loans resulted in a significant improvement of the NPL ratio. As of December this ratio stood at 4.4 percent, down 47 basis points from the previous year. This is the lowest NPL ratio since June 2012. The coverage ratio, on the other hand, was 65 percent, while the cost of risk remained stable at 0.9 percent.

Regarding capital adequacy, the Group’s fully-loaded CET1 ratio stood at 11.1 percent in December, above Group’s target. This ratio increases to 11.34 percent if we take into account the impact of the IFRS9 norm and the already announced corporate operations (BBVA Chile and Cerberus agreement), expected to be concluded this year. On the other hand, BBVA’s fully-loaded leverage ratio came to 6.6 percent, ranking first among its European peers.

It is expected to be proposed for the consideration of the competent governing bodies a cash payment in a gross amount of €0.15 per share to be paid in April as final dividend for 2017.

-

1

1Attributable profit

In 2017, the BBVA Group generated a net attributable profit of €3.52 billion (+1.3%). Without taking into account the impairment losses from Telefónica, net profit for 2017 stood at €4.64 billion, up 19.7% compared to 2016 results, excluding the provisions related to ‘floor clauses’ in Spain. Record revenue and cost containment efforts in operating expenses were the main drivers of this result.

-

2

2Transformation

More than half of BBVA customers in Turkey, Spain, USA, Argentina, Chile and Venezuela are already digital. As a whole, the digital customer base grew 25% in the year (to 22.6 million), while mobile customers grew 44% (to 17.7 million)

-

3

3Record revenues

Income reached record highs in 2017. Recurring revenue grew 4.1% y-o-y, (+10.3% excluding currency impact), and expenses dropped 2.3% in the year (+2.2% at constant exchange rates), boosting operating income to €12.77 billion

-

4

4Risks

The NPL ratio continued to improve, reaching 4.4% (vs. 4.9% in December 2016), its lowest level since June 2012. Coverage at year-end stood at 65%

-

5

5Capital

The fully-loaded CET1 ratio stood at 11.1% at the end of December, above BBVA’s target

-

6

6Dividend

A cash payment in the gross amount of €0.15 per share, to be paid in April as final dividend for 2017, is expected to be proposed for the consideration of the competent governing bodies

Activity remained on a similar track throughout the year in most areas: growth in emerging markets and deleveraging in Spain and the U.S., although at a slower pace during the last part of the year. At group level, gross lending to customers stood at €400.37 billion as of the end of December (up 2.7 percent compared to the previous year, at constant exchange rates). On the other hand, customer deposits reached €376.38 billion, 1.9 percent higher from Dec. 2016, in constant terms. Liquid and less costly headings increased while time deposits saw a decline.

In Spain, lending activity began showing signs of recovery at the end of the year. Customer lending (taking as a reference performing loans under management) grew 0.6 percent in the quarter. The most noteworthy developments were growth in business loans and consumer finance. Customer deposits under management remained at levels similar to December 2016, with noteworthy growth in current and savings accounts.

The bank’s transformation

The bank’s transformation process has accelerated exponentially. At year-end, BBVA had 22.6 million digital customers, an increase of 25 percent in y-o-y terms. Of these, 17.7 million were customers that bank using mobile devices, up 44 percent from last year. Also, digital customers have exceeded 50 percent of the customer base in six countries (Spain, USA, Turkey, Argentina, Chile and Venezuela).

This trend also extends to the Group’s sales. Digital sales in December accounted for one out of three, vs one out of ten only two years ago. They gained momentum in all the bank’s areas of operation in 2017. In Spain, they accounted for 28.6 percent of the total, compared to 17.1 percent a year earlier; in the U.S., they reached 22.8 percent (vs. 19.4 percent in 2016); in Mexico they increased to 21.7 percent (vs. 11.9 percent in 2016); in Turkey they accounted for 32.8 percent (vs. 25.2 percent one year earlier) and in South America, they stood at 36.9 percent of total sales, a significant increase from 15.4 percent in 2016.

In 2017, the bank earned the recognition for the best mobile banking app in the world and obtained the highest score for its online banking services in Europe, according to Forrester Research.

BBVA CEO Carlos Torres Vila pointed out that “the transformation is focused on the customer and as soon as the customer becomes digital, the satisfaction level increases, the engagement with the bank grows and it leads to more revenue.”

The key developments in each business area are detailed below:

Regarding Banking Activity in Spain, net interest income grew 2.1 percent in Q4-17, compared to the previous quarter. While the full-year figure did not show growth, lower loan volumes were partially offset by an increase in customer spreads during the year. Fees and commissions had positive growth (+5.7 percent y-o-y in 2017 as a whole). Gross income came to €6.18 billion, down 3.7 percent from 2016. One of the key drivers in this account was the 5.6 percent y-o-y drop in operating expenses. The synergies achieved as a result of the integration of Catalunya Banc and the improvements in efficiency became increasingly evident over the course of the year. Other notable factors included the decline in impairment losses on financial assets (-25.7 percent y-o-y) and lower provisions (-54.3 percent), the former due to lower loan-loss provisioning requirements and the latter to provisioning for mortgage floor clauses in 2016 in Spain. The NPLs balance declined, which improved the NPL ratio to 5.2 percent at the end of December (5.8 percent one year before). The coverage ratio stood at 50 percent. The area’s net attributable profit totaled €1.38 billion in 2017, up 52.7 percent in y-o-y terms (+5.5 percent excluding the provisions related to the floor clauses).

The Non-core Real Estate area took a crucial step forward in the strategy of reducing its real estate exposure, by signing an agreement with Cerberus that will almost entirely reduce said exposure. The transaction should be closed in the second half of 2018. At the end of 2017, net exposure to the real estate business stood at €6.42 billion, down 37.2 percent from a year earlier. The cumulative attributable result of the area stood at €-501 million, compared to €-595 million in 2016.

To better explain the business trends in the areas that use a currency other than the euro, the variation rates described below refer to constant exchange rates.

In the United States —an area that remains focused on growing in the most profitable segments and portfolios— lending activity picked up in the second half of the year, carrying the balance of lending to levels similar to December 2016. As for results, it is worth noting the solid performance of recurring revenues. The cumulative figure for net interest income grew 13 percent y-o-y, thanks to good management of customer spreads and increases in interest rates. Fees and commissions, on the other hand, grew 4.1 percent. These two items drove the growth of gross income (+10.5 percent) and operating income (+26.1 percent). Impairment losses on financial assets were 10.8 percent greater than in 2016, due mostly to the provisions allocated during Q3-17 related to natural disasters. The NPL ratio in December stood at 1.2 percent (down from 1.5 percent one year earlier), with coverage ratio reaching 104 percent. The net attributable profit for the year increased 14.6 percent in y-o-y terms, to €511 million.

Mexico maintained its leadership position, supported by activity growth: Consumer lending in December was 5.5 percent higher than a year earlier, while customer funds under management grew 11.4 percent. Recurring revenues performed strongly, growing at almost double-digit rates y-o-y. On top of solid income growth, the area’s cost containment efforts also yielded positive results, with expenses below inflation levels. All this allowed operating income to increase 9.5 percent compared to 2016. On the other hand, risk indicators remained stable: the NPL ratio stood at 2.3 percent while the coverage ratio reached 123 percent. The net attributable profit grew, yet another year, at double-digit rates (+12.7 percent y-o-y), to €2.16 billion.

In Turkey, the year was marked by buoyant activity. As of December 31, lending rose 13.9 percent in y-o-y terms, while customer resources grew 15.8 percent. As for the income statement, it is worth noting the solid growth in both net interest income (+20.6 percent y-o-y) and fees and commissions (+18.5 percent). Year-end results were also heavily influenced by the positive impact of cost containment efforts. Finally, operating income grew 27.8 percent compared to a year earlier. In terms of asset quality, the NPL ratio in December was 3.9 percent (vs. 2.7 percent in 2016), as a result of increased additions to NPLs from certain wholesale loans. The coverage ratio for the year stood at 85 percent. Finally, the acquisition of an additional 9.95 percent of Garanti bank contributed approximately €150 million in terms of year-end profit. Turkey’s net attributable profit for 2017 grew 70 percent y-o-y, to €826 million.

South America saw a milestone in the final months of 2017, as BBVA agreed to sell its Chilean franchise. The transaction is set to close in Q3-2018 and will not affect the area’s financial statements and activity for 2017. Activity grew at almost double-digit rates: lending rose 9.7 percent from one year earlier, while customer resources increased 10.5 percent. In terms of recurring revenues, performance was also solid: Net interest income grew 15.1 percent in y-o-y terms, with fees and commissions increasing 17.9 percent. Operating income rose 15.1 percent, driven not only by income items, but also by lower expenses, which grew below or in line with inflation in most countries. On the other hand, the NPL ratio in December stood at 3.4 percent, while the coverage ratio reached 89 percent. The area’s net attributable profit in 2017 was €861 million, up 14 percent.

About BBVA

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico, and has leading franchises in South America and the Sunbelt Region of the United States; it is also the leading shareholder in Garanti, Turkey’s biggest bank by market capitalization. BBVA's diversified business is focused on high-growth markets and relies on technology as a key sustainable competitive advantage. Corporate responsibility is at the core of its business model. BBVA fosters financial education and inclusion, and supports scientific research and culture. It operates with the highest integrity, a long-term vision and applies the best practices.