BBVA earns €3.88 billion in first half of 2023 (+31 percent), announces intention to repurchase shares for €1 billion

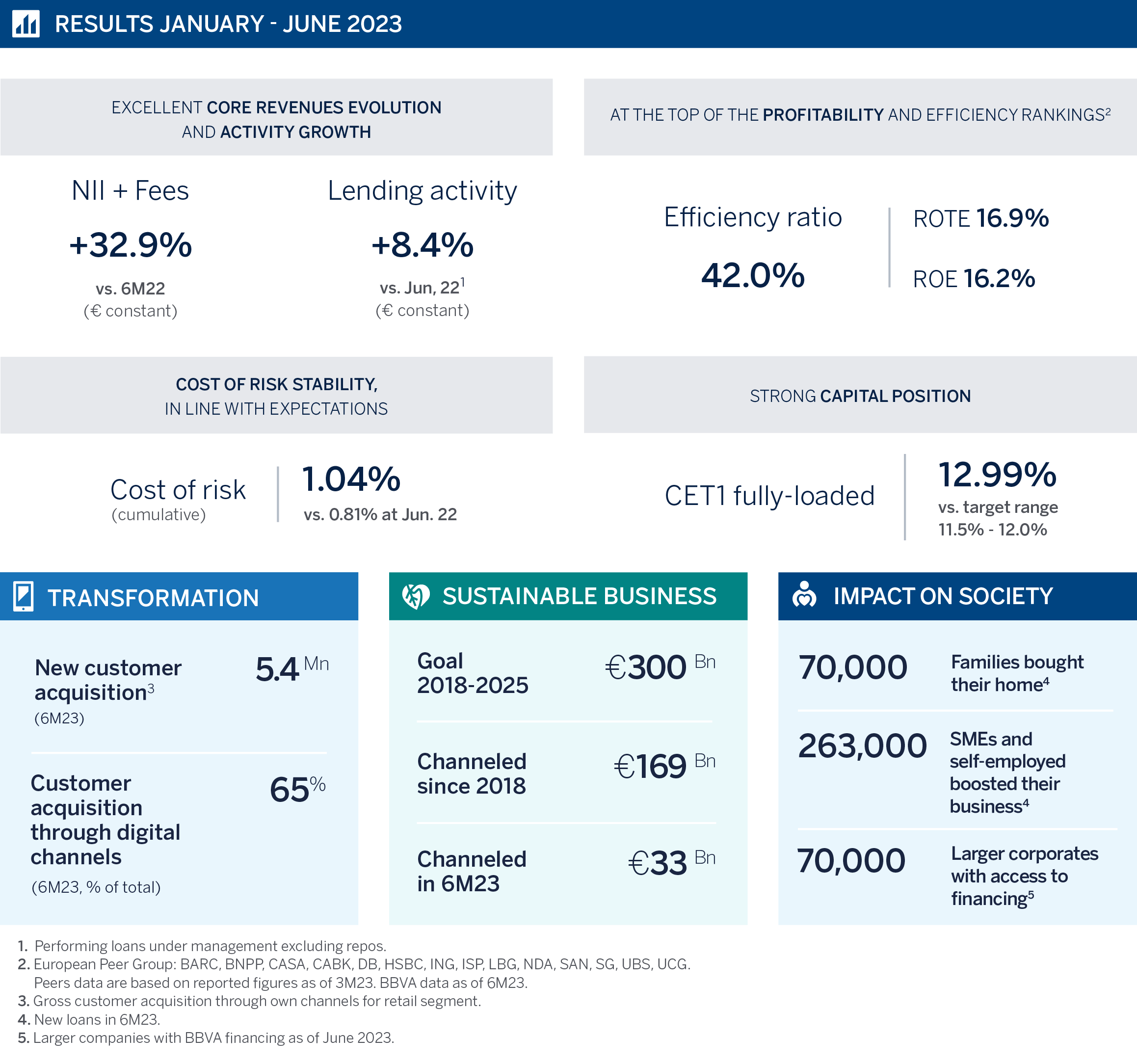

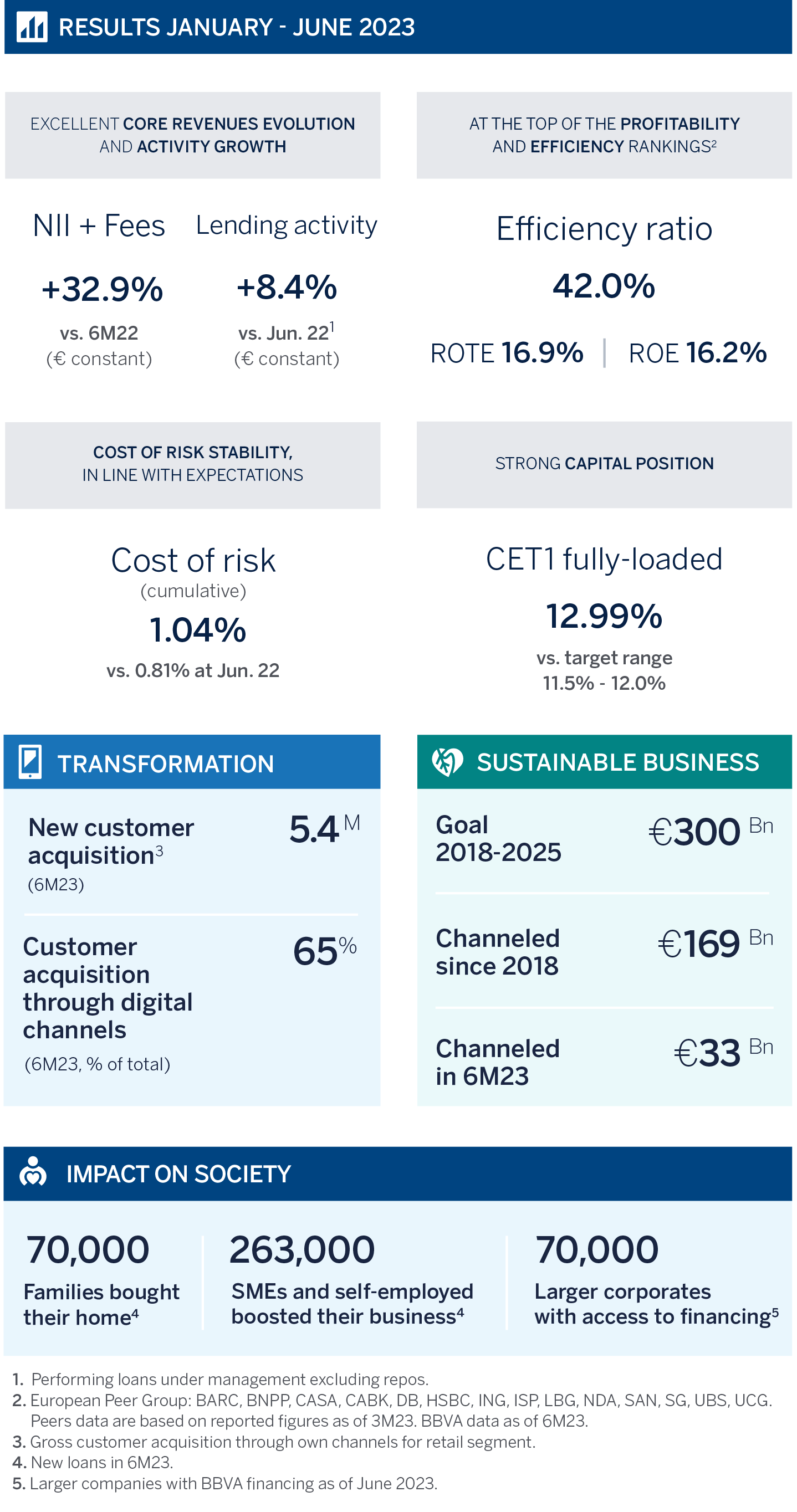

BBVA earned €3.88 billion in the first half of the year, up 31.1 percent yoy (+45.2 percent at constant exchange rates). The growth of earnings per share was even higher (41.1 percent) thanks to share buyback programs already carried out. In 2Q23, net attributable profit surpassed the €2-billion mark due to the positive performance of core revenues, amid greater activity. All of that while maintaining a solid capital position, with a fully-loaded CET1 ratio of 12.99 percent at the end of June, which will allow BBVA to proceed with a new extraordinary share buyback program of €1 billion, once the corresponding supervisory authorizations have been received¹.

At BBVA, we closed the first half of 2023 with very solid results. Furthermore, we have made significant progress in customer acquisition and sustainable business, with record figures in the semester. The positive results and the execution of our strategy allow us to have a positive impact on all our stakeholders: Customers, shareholders, employees and society as a whole; and to look to the future with great optimism,” BBVA CEO Onur Genç said.

In line with its commitment to profitable growth and attractive shareholder distributions, BBVA has requested the European Central Bank authorization to carry out a new share buyback program for €1 billion. This program is considered an extraordinary distribution and is in addition to the bank’s dividend policy. Between 2021 and 2022, BBVA distributed to its shareholders a total of €8.2 billion, including dividends and share buyback programs.

Greater activity in the first half of the year bolstered BBVA’s earnings, allowing the bank to increase the positive impact from its banking activity on society. The loan portfolio grew 8.4 percent compared to June 2022 (in constant euros). BBVA channeled approximately €7.4 billion in financing to promote inclusive growth; granted mortgages to 70,000 families; and offered loans to more than 263,000 SMEs and the self-employed. Moreover, at the end of June, BBVA provided financing to 70,000 larger companies for their growth plans.

BBVA also moved forward in the execution of its strategy. Between January and June 2023, it added 5.4 million new customers, 65 percent of which joined the bank through digital channels. The Group also channeled €33 billion in sustainable business in 1H23 - with €19 billion in 2Q23 alone, a new record. In total, the bank has channeled €169 billion since 2018.

Except where otherwise stated, the evolution of each of the main headings, and changes in the income statement described below refer to constant exchange rates. In other words, they do not take currency fluctuations into account.

At the top of the P&L account, net interest income (NII) topped €11.41 billion in the first half of the year, up 39.2 percent vs the same period a year earlier, thanks to improvements in customer spreads and greater activity. The strong performance of Mexico, South America and Spain was especially noteworthy.

Income from net fees and commissions increased to €2.91 billion, up 12.9 percent, with particularly good performance in Mexico, and to a lesser extent, in South America and Turkey. In short, core revenues (NII and net fees and commissions), posted a yoy increase of 32.9 percent, to €14.32 billion. Additionally, net trading income (NTI) saw an 18.8 percent drop, to €773 million. The line of ‘other operating income and expenses’ includes a total annual impact of €225 million from the extraordinary tax on banks in Spain (registered in 1Q23).

In total, gross income rose to €14.15 billion, 35.2 percent higher than 1H22. Operating expenses increased 21.6 percent yoy, to €5.94 billion, mostly due to high inflation rates in the BBVA Group’s footprint. (19.1 percent average over the past 12 months). Thanks to the good performance of gross income, the efficiency ratio stood at 42 percent at the end of June, a considerable improvement from the previous year (46.7 percent in constant terms). BBVA thus maintains positive jaws and remains one of the top banks in efficiency among comparable European peers.

As a result of all the above, operating income rose 47.1 percent yoy, to €8.21 billion.

At €1.99 billion, the line of impairments on financial assets was 38.2 percent higher at the end of June 2023 than a year earlier, with lower requirements in Turkey being offset by higher provisions in South America and Mexico, amid greater activity. The accumulated cost of risk in 1H23 stood at 1.04 percent, in line with the March figure and expectations. The NPL ratio remained stable at 3.4 percent (+7 bps in 2Q23) and the coverage ratio was 80 percent.

BBVA posted a net attributable profit of €3.88 billion between January and June, up 45.2 percent compared to the same period a year earlier, (31.1 percent at current exchange rates). In 2Q23, net attributable profit was €2.03 billion, up 30.5 percent. Earnings per share increased 41.1 percent during the first six months vs a year earlier, to €0.62 per share.

As for profitability indicators, ROTE and ROE continued to show improvement as in previous quarters, at 16.9 percent and 16.2 percent, respectively, the highest in 10 years, maintaining BBVA as one of the most profitable banks in Europe. Furthermore, BBVA continues to create value for its shareholders: The tangible book value per share plus dividends stood at €8.27, up 15 percent from a year earlier.

The Group maintains a solid capital position, with a fully-loaded CET1 ratio of 12.99 percent, well above the bank’s target range of 11.5-12 percent.

Business areas

In Spain, lending declined 1.4 percent yoy, mainly due to the deleverage of the mortgage portfolio, amid higher interest rates. It is noteworthy, however, the good evolution of consumer loans, credit cards and financing for mid-sized companies. Customer funds increased 2.7 percent on the back of momentum of off-balance sheet funds, mostly mutual funds. Net attributable profit stood at €1.23 billion through June, up 53.6 percent yoy, thanks to the good performance of NII (+44.7 percent). This boosted gross income and allowed for significant improvement of the efficiency, to 41.8 percent (-495 bps over the past 12 months). Risk indicators remained solid and in line with expectations: The NPL ratio increased slightly compared to figures from the end of March (+15 bps), although the accumulated cost of risk remained stable at 0.27 percent. The coverage ratio stood at 57 percent.

In Mexico, lending activity increased 11.1 percent yoy, with growth in all segments. Customer funds rose 7.3 percent due to momentum in mutual funds. Net attributable profit increased 30.1 percent yoy through June, to €2.61 billion, mainly as a result of the good performance of NII (+26.6 percent), thanks to buoyant activity and improvements in customer spreads. Growth in net fees and commissions also stood out, with an increase of 21 percent yoy. Risk indicators remained solid, with the NPL and coverage ratios at 2.5 percent and 129 percent, respectively. The accumulated cost of risk remained stable at 2.86 percent.

In Turkey, BBVA continued the de-dollarization of its balance sheet. Loans in U.S. dollars fell 7.4 percent yoy, compared to a 68.5 percent increase of loans in local currency. At the same time, customer deposits in dollars dropped 22.3 percent while those in Turkish lira rose 151.4 percent. Net attributable profit stood at €525 million in 1H23, compared to €59 million a year earlier. As for risk indicators, the accumulated cost of risk showed a significant improvement, from 0.52 percent at the end of March, to 0.23 percent in June, thanks to solid recovery and repayments in the wholesale segment. The NPL ratio also improved to 4.2 percent, while the coverage ratio stood at 97 percent.

In South America, lending increased 11.2 percent yoy. Growth in retail segments in the main countries of the region was particularly noteworthy, as well as the wholesale portfolio in Argentina and Colombia. As for customer resources, time deposits stood out, as well demand deposits and mutual funds in Argentina. Net attributable profit rose 22.6 percent yoy, to €367 million, on the back of a good evolution of gross income, and in particular, the NII. The NPL ratio stood at 4.3 percent, while the coverage ratio was 95 percent, and the cost of risk stood at 2.34 percent.

1. Subject to prior supervisory authorization and final internal approval. The execution of the €1 billion share buyback program scheme would be considered an extraordinary shareholder distribution and therefore would not be included in the scope of the ordinary distribution policy. Specific terms and conditions to be communicated before its execution.

About BBVA

BBVA is a global financial services group founded in 1857. The bank is present in more than 25 countries, has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America and Turkey. BBVA contributes with its activity to the progress and welfare of all its stakeholders: shareholders, clients, employees, providers and society in general. In this regard, BBVA supports families, entrepreneurs and companies in their plans, and helps them to take advantage of the opportunities provided by innovation and technology. Likewise, BBVA offers its customers a unique value proposition, leveraged on technology and data, helping them improve their financial health with personalized information on financial decision-making.