BBVA earns €2.44 billion in first half of the year

Between January and June 2019, BBVA Group earned €2.44 billion. In the second quarter, the net attributable profit reached €1.28 billion, up 10 percent qoq, and 6 percent yoy, excluding the sale of BBVA Chile, thus maintaining the same business perimeter (or +2.6 percent including Chile). The results were driven by a solid evolution of more recurring revenue items, with a double-digit growth of the net interest income, and lower impairments on financial assets.

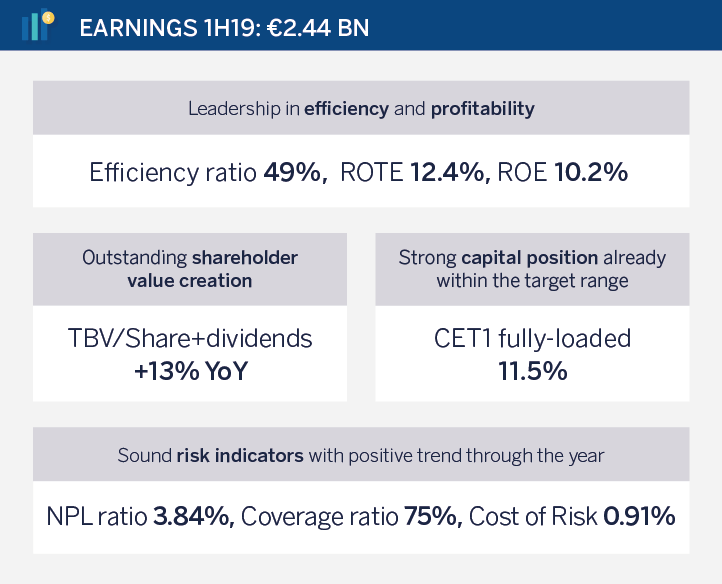

The bank continues to be a leader in efficiency and boasts solid risk and capital indicators, with a CET1 fully-loaded ratio reaching its target earlier than expected. Additionally, BBVA generated a significant value for its shareholders, with double-digit profitability, at the forefront of its European peers. BBVA continues to be ahead of the curve in transformation, with positive impacts on growth, efficiency, engagement and customer satisfaction.

In order to provide a more accurate view of the company’s performance, 1H18 figures exclude the results corresponding to BBVA Chile. (BBVA sold this unit in July 2018).

BBVA Group’s net interest income increased 7.4 percent yoy in the first half of the year in current euros (+9.9 percent in constant terms) to €8.99 billion, with positive performance in most business areas. Net fees and commissions reached €2.47 billion (+1.0 percent at current euros; +2.8 percent in constant terms). Both items combined, considered the core revenues in the banking business, grew 6.0 percent (+8.3 percent in constant terms), reaching €11.46 billion.

Despite a decline in net trading income (NTI), gross income reached €11.99 billion in the first six months of the year, up 3.7 percent from the same period a year earlier (+6.0 percent in constant terms).

“BBVA has posted excellent results in the second quarter of 2019. Furthermore, we are once again leaders in terms of profitability in Europe and we continue to see positive dynamics in our business: Net interest income is growing at a rate above 10 percent, in constant euros, and the efficiency indicators continue to improve.”

Cost control efforts have continued, with operating expenses increasing below the average inflation rate (6.3 percent) recorded across BBVA’s footprint (+2.3 percent at current exchange rates, +3.9 percent at constant rates). Consequently, the efficiency ratio continued to improve and stood at 49.0 percent, 41 basis points below the 2018 figure (in constant terms), and significantly below the average of the European peer group. Thus, operating income reached €6.12 billion in the semester, up 5.2 percent yoy (+8.2 percent in constant euros).

BBVA Group’s net attributable profit stood at €2.44 billion between January and June, down 1.2 percent from a year earlier (-0.8 percent in constant euros).

(1) Figures exclude corporate center.

In terms of value creation for the shareholder, tangible book value per share plus dividends stood at €6.36, a 12.6 percent increase from June 2018. Also, BBVA once again posted leading profitability metrics, both the Group’s ROTE (12.4 percent) and ROE (10.2 percent) stood clearly above its European peer group average.

At the end of June, the CET1 fully-loaded capital ratio stood at 11.52 percent, thanks to the Group’s organic generation capacity, and after absorbing the 24-bps regulatory impact resulting from the implementation of NIIF 16 and TRIM (Targeted Review of Internal Models). Consequently, BBVA delivered already in this quarter its target of placing the ratio in the 11.5-12.0 percent range. BBVA also maintains its shareholder remuneration policy with a cash payout of 35 to 40 percent of profit, following a €0.16 gross cash payment of a supplementary dividend in April.

Asset quality indicators improved during the quarter. Coverage ratio reached 75 percent in June, compared to 74 percent in the previous quarter, with the NPL ratio dropping to 3.8 percent vs. 3.9 percent in March. This indicator has been declining since June 2015, and reached its lowest level since September 2009. The accumulated cost of risk was 0.91 percent in June, compared to 1.06 percent three months earlier.

As for balance sheet and business activity, loans and advances to customers grew 0.8 percent at current exchange rates, compared to December 2018, reaching €377.16 billion, with increases in Mexico, South America, Rest of Eurasia and, to a lesser extent, Spain. Customer deposits remained virtually flat (-0.2 percent) in the period and stood at €375.1 billion in June 2019.

Transformation

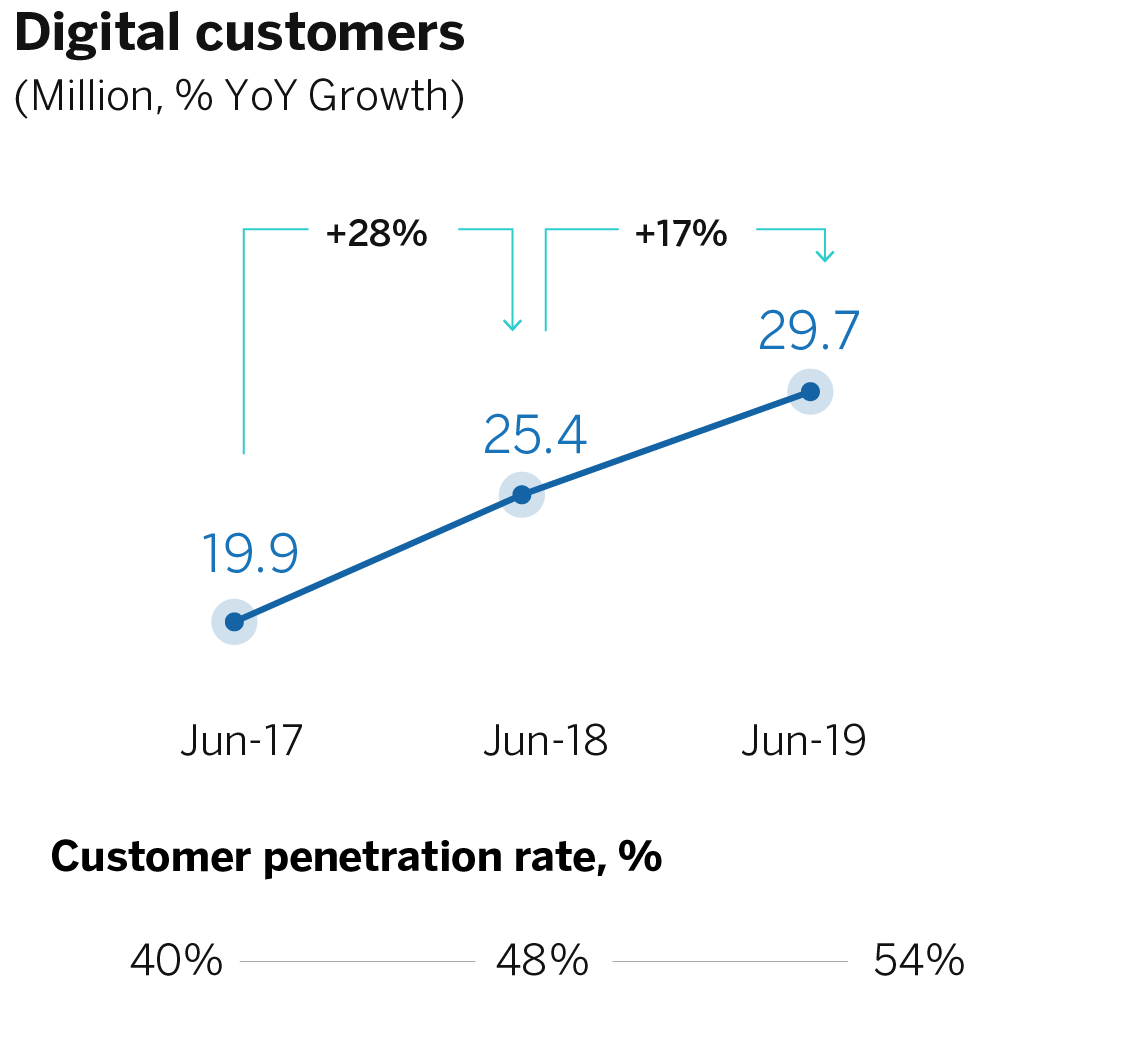

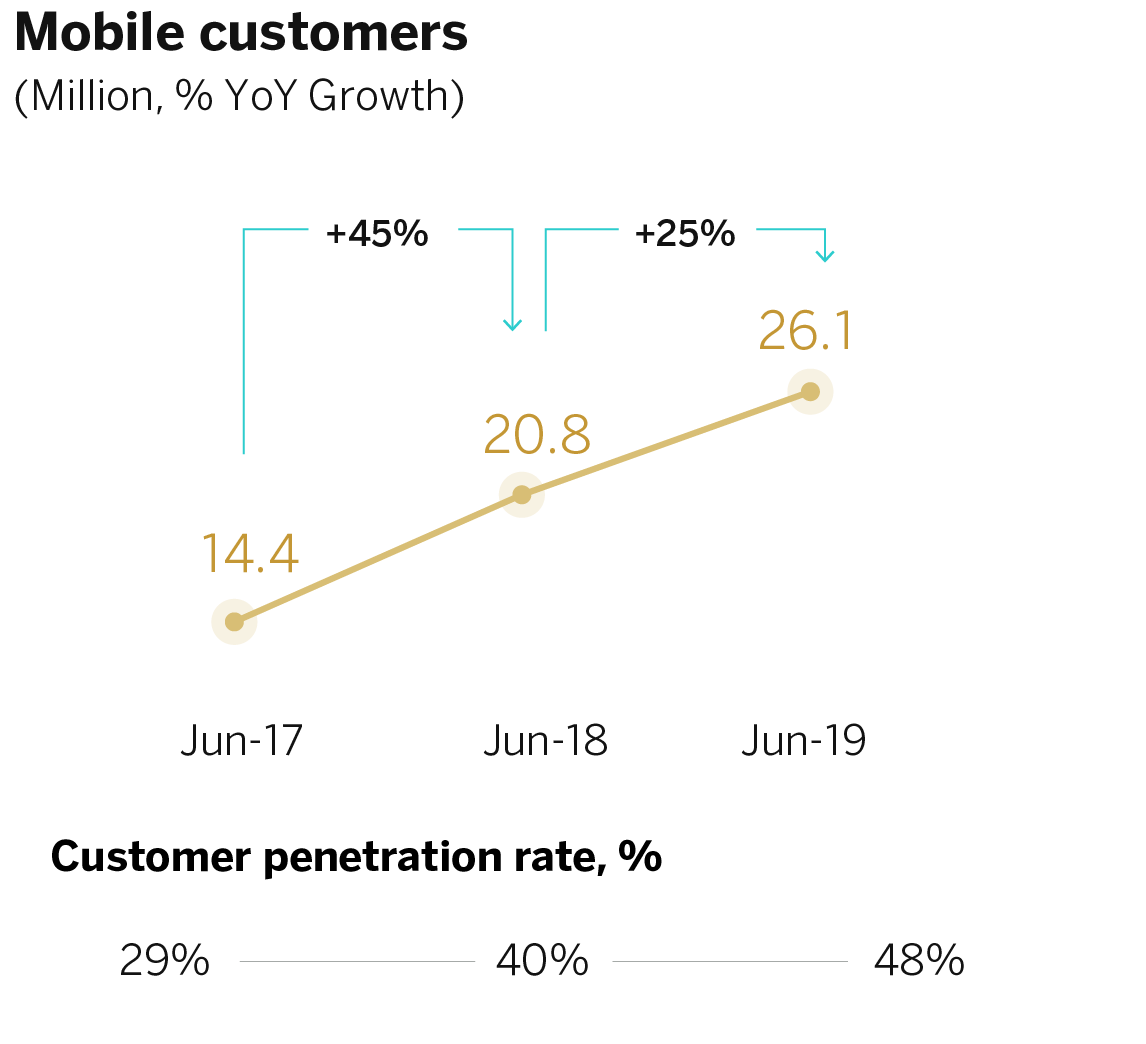

The number of digital customers increased 17 percent in the last 12 months to 29.7 million. This figure represents 54 percent of the total customer base. A 48 percent of customers (26.1 million) interact via mobile, up 25 percent from June 2018. The goal for this year is to exceed the 50 percent threshold. Unit sales through digital channels already account for 58 percent of the total.

Thanks to its transformation, BBVA has grown its customer base. For instance, in Spain, customer acquisition through digital channels grew 33 percent over the past two years. Transformation has also had a positive impact on customer satisfaction and engagement levels. Since 2017, BBVA has led the Net Promoter Score (NPS) index in Spain and customer attrition rate has dropped 18 percent. All this in the context of a new, more efficient distribution model. In fact, operating costs in Spain have dropped 8 percent over the past two years.

Finally, it is worth mentioning that BBVA Spain’s mobile app was named best in Europe by Forrester for a third consecutive year. In Turkey, Garanti BBVA’s app ranked second.

Sustainability

In the first six months of 2019, BBVA has mobilized over €10 billion in sustainable finance (about €22 billion in the last year and a half), as part of its Pledge 2025, the bank’s climate change and sustainable development strategy.

In 1H19, BBVA successfully completed the issue of its second green bond, a €1 billion in senior non-preferred debt. BBVA was also recognized as best bank for financial inclusion and best bank in sustainable finance in Latin America by Euromoney.

Business Areas

The main highlights of each business area are detailed below.

In Spain, lending activity grew 0.8 percent compared to June 2018, supported by the most profitable segments (retail, medium-sized enterprises,consumer loans and credit cards). Customer resources also grew 2.2 percent yoy, thanks to demand deposits. Spain posted a €734 million profit in 1H19, down 1.7 percent from 1H18, mainly due to a lower contribution from NTI. In the second quarter, however, it earned 13 percent more than the previous quarter, mostly thanks to the solid behavior in net interest income (+5 percent over the same period). It is also worth mentioning the positive performance in operating expenses, which fell in the quarter (-3.5 percent yoy). Asset quality improved thanks to the decline in NPLs during the quarter, as a result of the sale of portfolios of non-performing real estate developer loans in the second quarter. Consequently, the NPL ratio declined during the quarter from 4.95 percent to 4.60 percent, the lowest level since September 2009. The coverage ratio remained stable at 58 percent.

In the United States, lending grew 3.7 percent (at constant exchange rates) yoy thanks to retail and commercial segments. Customer resources increased 1.3 percent in the last 12 months. The net attributable profit stood at €297 million for the Jan.-June period, down 22.9 percent (-27.8 percent in constant euros) from 1H18. The decline was mainly the result of higher provisions during the period. However, net interest income performed favorably thanks to the focus on portfolio profitability. Risk indicators performed positively. The coverage ratio increased from 84.9 percent to 91.2 percent starting in March, while the NPL ratio dropped from 1.4 percent to 1.31 percent.

In Mexico, BBVA continues to be the market leader, with a share of more than 22 percent. Activity continued to grow, with a 4.9 percent increase in loans yoy, driven by the performance in the mortgage and consumer lending segments. Customer resources grew 5.8 percent, with positive progress across all headings. The net attributable profit grew 7.2 percent to €1.29 billion (+0.6 percent in constant euros), thanks to strong performance in net interest income, which stood at 14.9 percent at current exchange rates (+7.8 percent in constant euros). The unit posted, once again, positive jaws, with recurring revenues growing above operating expenses. The efficiency ratio improved during 1H19 to 33.1 percent. As for risk indicators, the NPL ratio stood at 2.19 percent, while the coverage ratio was 147.7 percent.

In Turkey, lira-denominated loans decreased 3.5 percent compared to June 2018, while loans in foreign currency declined by 20.5 percent. Deposits in lira increased 4.0 percent, while deposits in foreign currency dropped 2.6 percent. The area posted a net attributable profit of €282 million in 1H19, down 24.2 percent in current euros (-2.8 percent in constant euros). Despite the positive performance in net interest income terms, the net attributable profit was negatively affected by increased impairments on financial assets as a result of the current macroeconomic environment. However, lower expenses under this heading during the second quarter drove the net attributable profit to increase 6.9 percent in constant euros, compared to 1Q19. As for risk indicators, the NPL ratio stood at 6.3 percent, while the coverage ratio reached 75 percent.

In South America, customer loans increased 6.3 percent yoy, driven by activity growth in Peru (+6.3 percent), Argentina (+20.1 percent) and Colombia (+2.0 percent). Customer resources grew 11.5 percent, also driven by these countries (+10.4 percent, +45.1 percent and +2.9 percent, respectively). The area’s attributable profit stood at €404 million, plus 51.8 percent yoy in current euros (+72.4 percent in constant euros). The NPL ratio stood at 4.4 percent, while the coverage ratio reached 95 percent.

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico, it has leading franchises in South America and the Sunbelt Region of the United States. It is also the leading shareholder in Turkey’s Garanti BBVA. Its purpose is to bring the age of opportunities to everyone, based on our customers’ real needs: provide the best solutions, helping them make the best financial decisions, through an easy and convenient experience. The institution rests in solid values: Customer comes first, we think big and we are one team. Its responsible banking model aspires to achieve a more inclusive and sustainable society.