Earnings: BBVA returns to pre-COVID levels, earns €1.21 billion in first quarter 2021

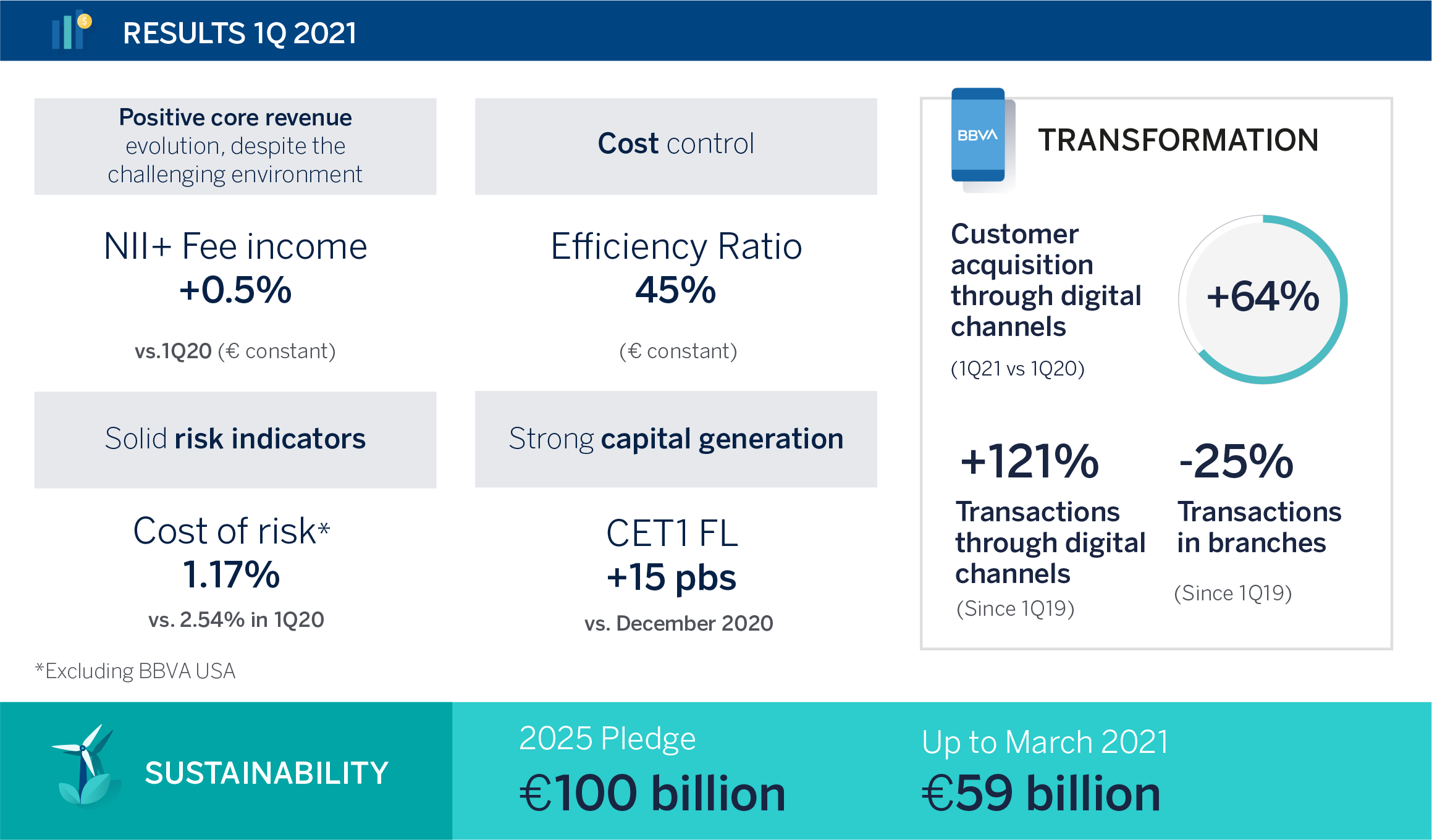

The BBVA Group earned €1.21 billion in 1Q21, in line with quarterly earnings prior to the pandemic. In the year ago period, BBVA posted a €1.79 billion loss when it recorded a goodwill adjustment in its U.S. subsidiary and higher impairments. This quarter’s result was driven by strong recurring revenue and lower impairments and provisions than in 1Q20. Thanks to these earnings, BBVA generated 15 basis points of capital in the January-March period.

Press kit Results 1Q21

- 1Q21 Results Presentation Press (PDF)

- Statements from Onur Genç (TV)

- Results Presentation Analysts – 1Q21 (PDF)

- Statements from Onur Genç (Radio)

- Quarterly Report 1Q21 (PDF)

- Statements from Onur Genç (YouTube)

- 'La Vela', main building in the 'Ciudad BBVA' (JPG)

- BBVA CEO Onur Genç (JPG)

- Statement on BBVA 1Q21 earnings from the BBVA CEO (Text) (PDF)

Onur Genç: “In the first quarter of 2021, we produced positive results in an environment that continues to be very challenging. We are also one of the strongest and best capitalized banks in Europe. The sale of our U.S. subsidiary gives us a range of strategic options to create value. In a context of profound transformation, we continue to move forward in two key areas of our strategy: sustainability and digital transformation. Our digital edge coupled with the advisory capacity of our people will continue to make the difference.”

The BBVA Group started the year with an attributable profit at pre-pandemic levels. This has been possible thanks to the positive trend in recurring revenues, driven by fees and commissions, and significantly lower impairments on financial assets and provisions compared to the previous year.

Following the announcement of the sale of BBVA’s subsidiary in the United States to PNC on November 16, 2020, the results of the unit sold will be recognized in the Corporate Center under a single line of the income statement: Profit (loss) after taxes from discontinued operations.

Unless indicated otherwise, to better understand the changes under the main headings of the Group's income statement, the yoy percentage changes provided below refer to constant exchange rates, i.e. not taking into account currency fluctuations.

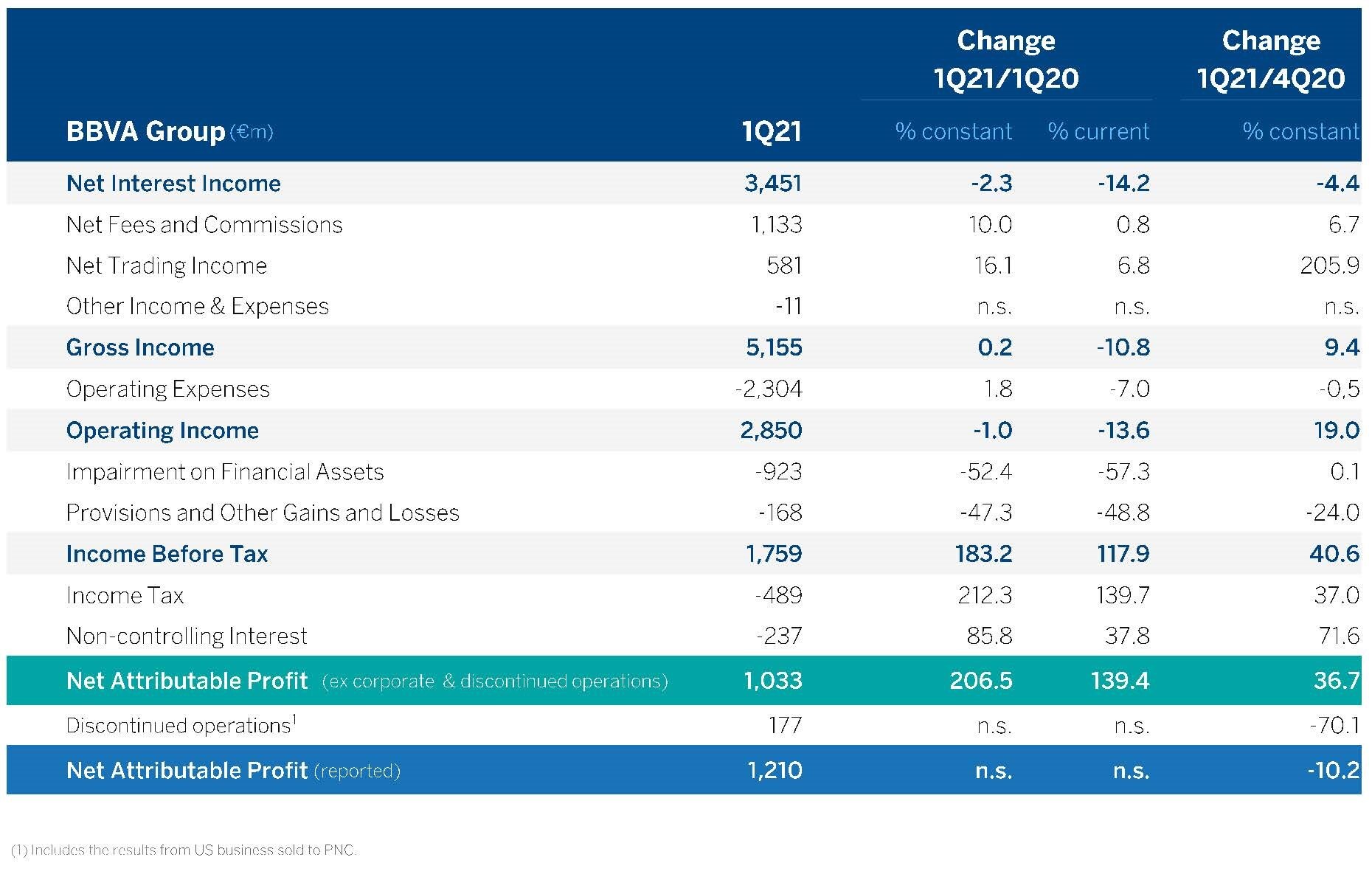

On the top of the income statement, net interest income reached €3.45 billion in 1Q21, down 2.3 percent from the same period of the previous year, due to the adverse interest rate scenario. Net fees and commissions grew strongly across most business areas, 10 percent yoy, to close at €1.13 billion. As a result, recurring revenues (net interest income plus net fees and commissions) grew by 0.5 percent yoy. Net trading income (NTI) grew by 16.1 percent yoy to €581 million.

Growth in recurring revenues and NTI allowed gross income to reach €5.16 billion (+0.2 percent yoy).

Operating expenses grew by 1.8 percent between January and March compared to the same period a year earlier, to €2.3 billion. This growth rate was significantly lower than the average inflation in BBVA’s footprint (4.7 percent). The efficiency ratio stood at 45 percent.

As a result, operating income reached €2.85 billion in the quarter (-1.0 percent yoy).

At the end of March 2021 impairments and provisions dropped significantly below the levels reached a year ago (-52.4 percent and -47.3 percent yoy, respectively) when the bank ramped up provisions to face the impact of the pandemic.

BBVA’s net attributable profit in 1Q21 stood at €1.21 billion, compared to a €1.79 billion loss recorded in 1Q20, which was impacted by the goodwill adjustment in the U.S. subsidiary and higher impairments and provisions.

As for shareholder value creation, the tangible book value per share plus dividends stood at €6.15 as of March 2021, compared to €5.78 per share one year ago.

BBVA’s fully-loaded CET-1 ratio stood at 11.88 percent at the end of March 2021, 15 basis points more than in December 2020 (11.73 percent). The current level stands 329 basis points above the minimum regulatory requirement for the BBVA Group (currently set at 8.59 percent). The fully-loaded pro forma CET1 ratio stands at 13.55 percent, taking into account the capital gains on the sale of the U.S. business, as well as the bank’s buyback¹ goal of 10 percent of its shares. This is 155 basis points above the high end of the target range –11.5 to 12 percent. This capital provides the Group with ample strategic optionality to continue creating value for shareholders and supporting the economies in the recovery phase.

BBVA plans to use this capital surplus to grow profitably and boost efficiency in its core markets, as well as to increase shareholder distributions. In this sense, in 2021 the bank intends to resume its dividend policy of a 35 to 40 percent payout in cash, once the restrictions from the European Central Bank are lifted. Likewise, BBVA shareholders backed the possibility of canceling up to 10 percent of the bank’s share capital, equivalent to 667 million shares, with the purpose of carrying out a relevant share buyback.

As for risk indicators, the NPL and coverage ratios remained virtually unchanged from December, closing the quarter at 4.3 percent and 81 percent, respectively. Cost of risk continued its downward trend and stood at 1.17 percent in 1Q21 – excluding the U.S. business unit sold to PNC– compared to 2.54 percent one year ago, and 1.55 percent for 2020 as a whole.

Regarding the balance sheet and business activity, loans and advances to customers (gross) remained virtually stable with respect to the end of 2020, reaching €322.87 billion as of March 31, 2021. Customer funds fell by 1.7 percent to €437.98 billion, due to a decline in customer deposits (-3.4 percent), although off-balance sheet resources - mainly mutual and pension funds - grew 3.9 percent during the same period. These figures do not include the results belonging to the U.S. franchise and other Group-owned companies in the U.S. included in the sale agreement with PNC.

Progress in digitization

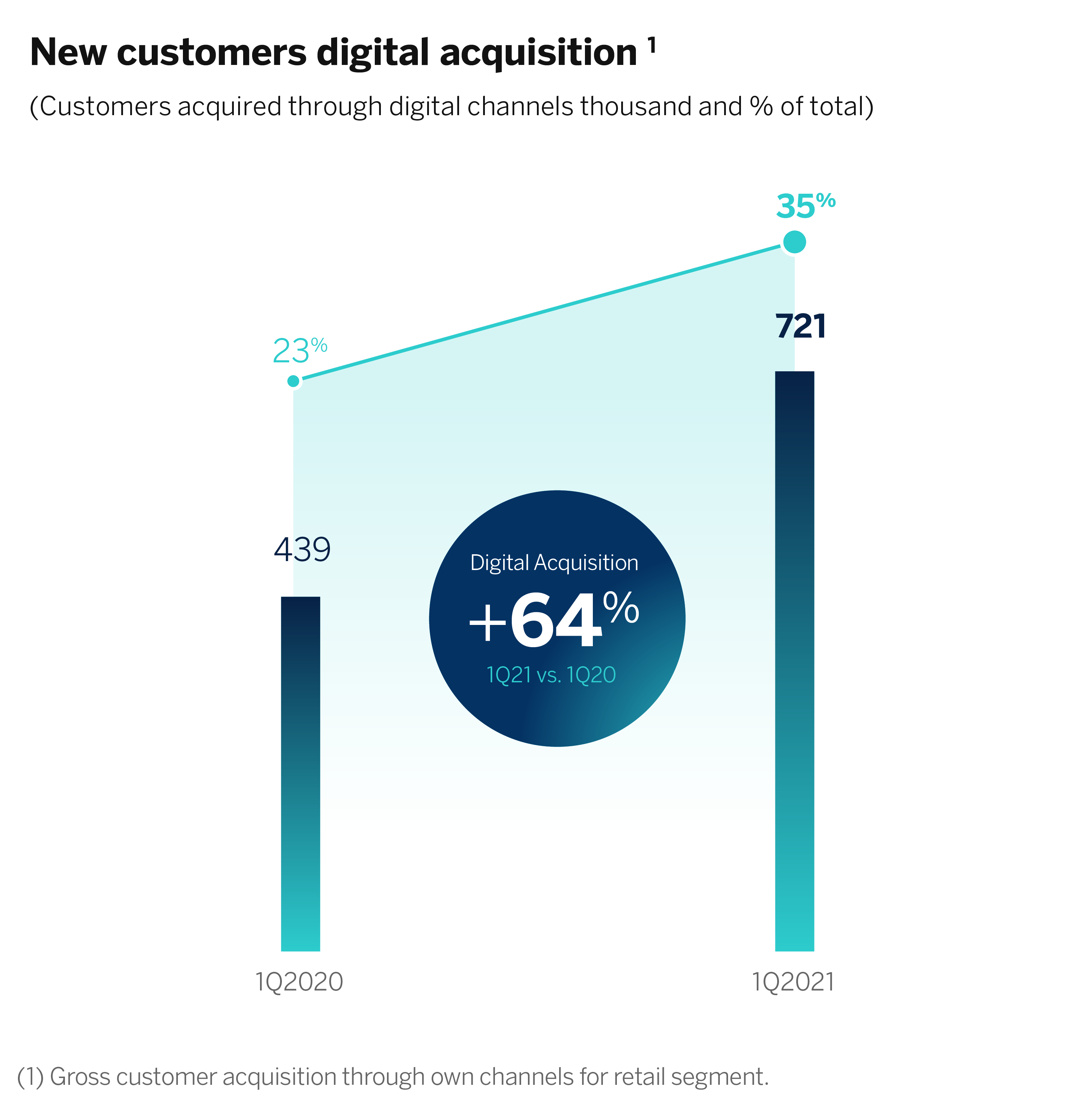

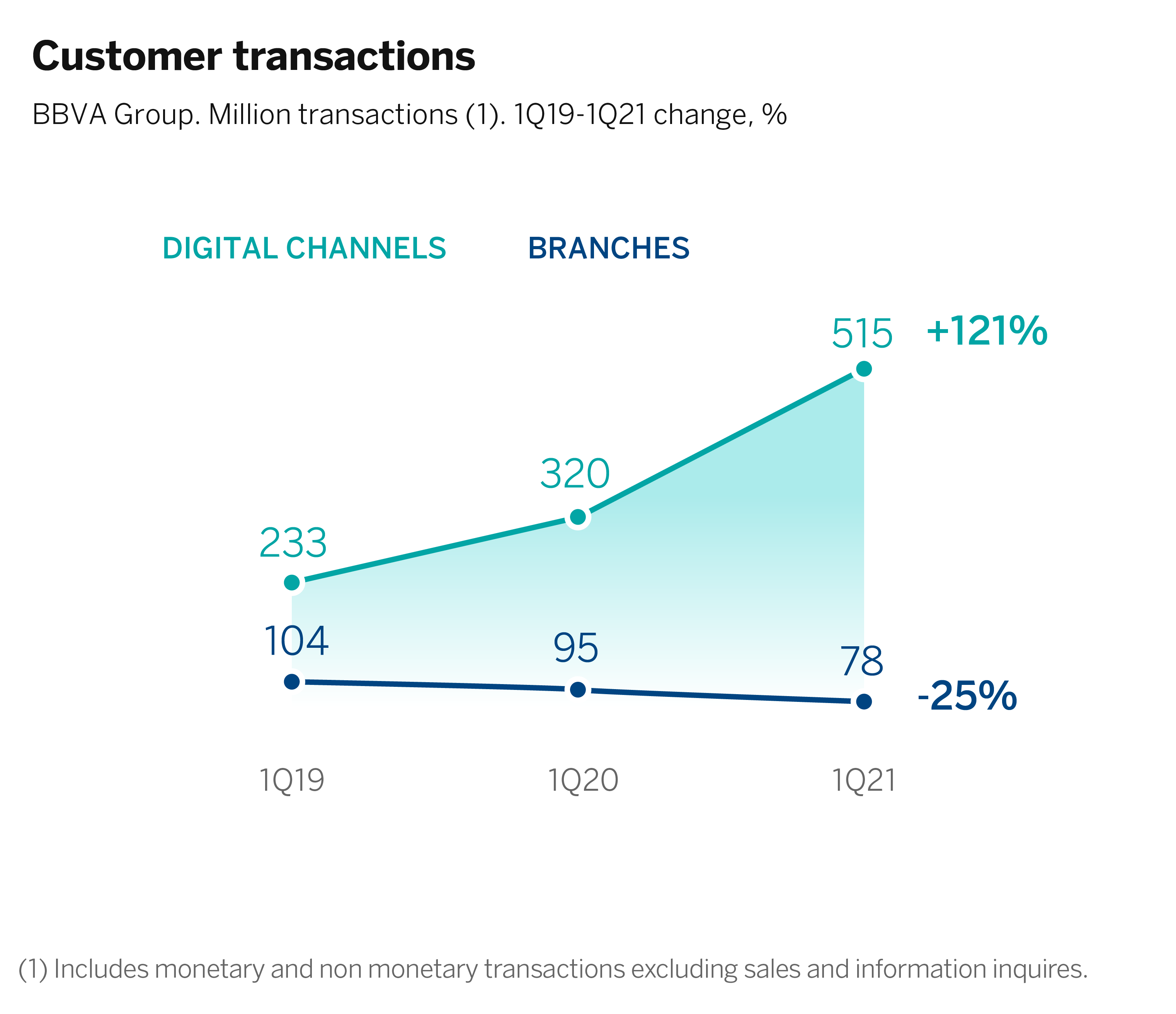

The pandemic has been a driver for digitization across the BBVA Group. Customer onboarding via digital channels increased 64 percent over the past year, while digital sales at the end of 1Q21 represented 69 percent of the total units sold. Also, as of March end, customers operating with the bank through digital channels have more than doubled over the past two years, while branch activity has dropped 25 percent in the same period (-50 percent in Spain).

Commitment to sustainability

BBVA is moving forward in its goal of supporting its customers in their transition toward a sustainable future, one of the Group's strategic pillars. The Group has already mobilized €59 billion in sustainable financing, more than half of the €100 billion it pledged for the 2018-2025 period to fight climate change and promote inclusive growth. BBVA became carbon neutral in direct emissions in 2020 and has also committed to becoming neutral in indirect emissions by 2050. The bank also announced that it would cut to zero its exposure to coal-related activities. Thanks to this and other initiatives, BBVA ranks first in Europe and second worldwide, according to the Dow Jones Sustainability index.

BUSINESS AREAS

In Spain, lending declined by 1.4 percent compared to 1Q20, mainly due to the drop in mortgage loans (-2.6 percent) and lower operations with larger companies (-6.0 percent), and public sector (-9.2 percent). Net interest income dropped by 1.3 percent yoy to €867 million, impacted by the adverse interest rate scenario. However, positive performance in net fees and commissions and NTI allowed the gross income to grow by 8.9 percent yoy, to €1.65 billion. Operating expenses fell 3.5 percent yoy, thus driving the operating income to grow by 22.2 percent to €893 million. Lower impairments and provisions compared to the same quarter of 2020 pushed the net attributable profit to €381 million, vs. a €130 million loss in 1Q20. The NPL and NPL coverage ratios remained basically stable with respect to the previous quarter, at 4.4 percent and 66 percent, respectively. Cost of risk for the quarter stood at 0.45 percent, a significant improvement over the 1.54 percent posted in the first quarter of 2020, or 0.67 percent at the end of December of 2020.

In Mexico, lending dropped by 6.5 percent yoy, mainly due to the decline in the commercial segment. Since the end of 2020, however, lending has grown by 1.5 percent driven by activity in corporate banking. The net attributable profit reached €493 million, 46.9 percent more yoy, on the back of lower impairments compared to 1Q20 (-34.2 percent yoy). As for risk indicators, they all performed favorably over the past three months, especially the NPL ratio, which dropped 37 basis points to 3 percent. The NPL coverage ratio closed at 129 percent, and cost of risk stood at 3.55 percent.

In Turkey, lending in lira grew by 35.1 percent yoy, while loans in foreign currency continued to drop (-12.5 percent yoy). Net interest income declined 14.6 percent yoy to €530 million, essentially due to the contraction of customer spreads and the increase in financing costs. The attributable profit, however, grew by 96.0 percent yoy, to €191 million, driven by the positive performance of net fees and commissions and NTI, as well as significantly lower impairments and provisions vs. the previous year. The NPL ratio stood at 6.9 percent, the NPL coverage ratio reached 78 percent and cost of risk stood at 1.34 percent.

In South America, excluding BBVA Paraguay to allow a proper comparison, lending increased by 9.6 percent compared to March 2020. In the income statement, it is worth noting the growth in net interest income to €660 million (+8.2 percent with respect to the same period of the previous year). This figure, combined with the increase in fees (+25 percent) and NTI (+18 percent) and lower impairments and provisions vs. the first quarter of 2020, drove the area’s net attributable profit to €104 million, up 150.2 percent yoy.

¹Any potential share buyback is subject to obtaining the corresponding regulatory authorizations, as well as, among other factors, the share price.

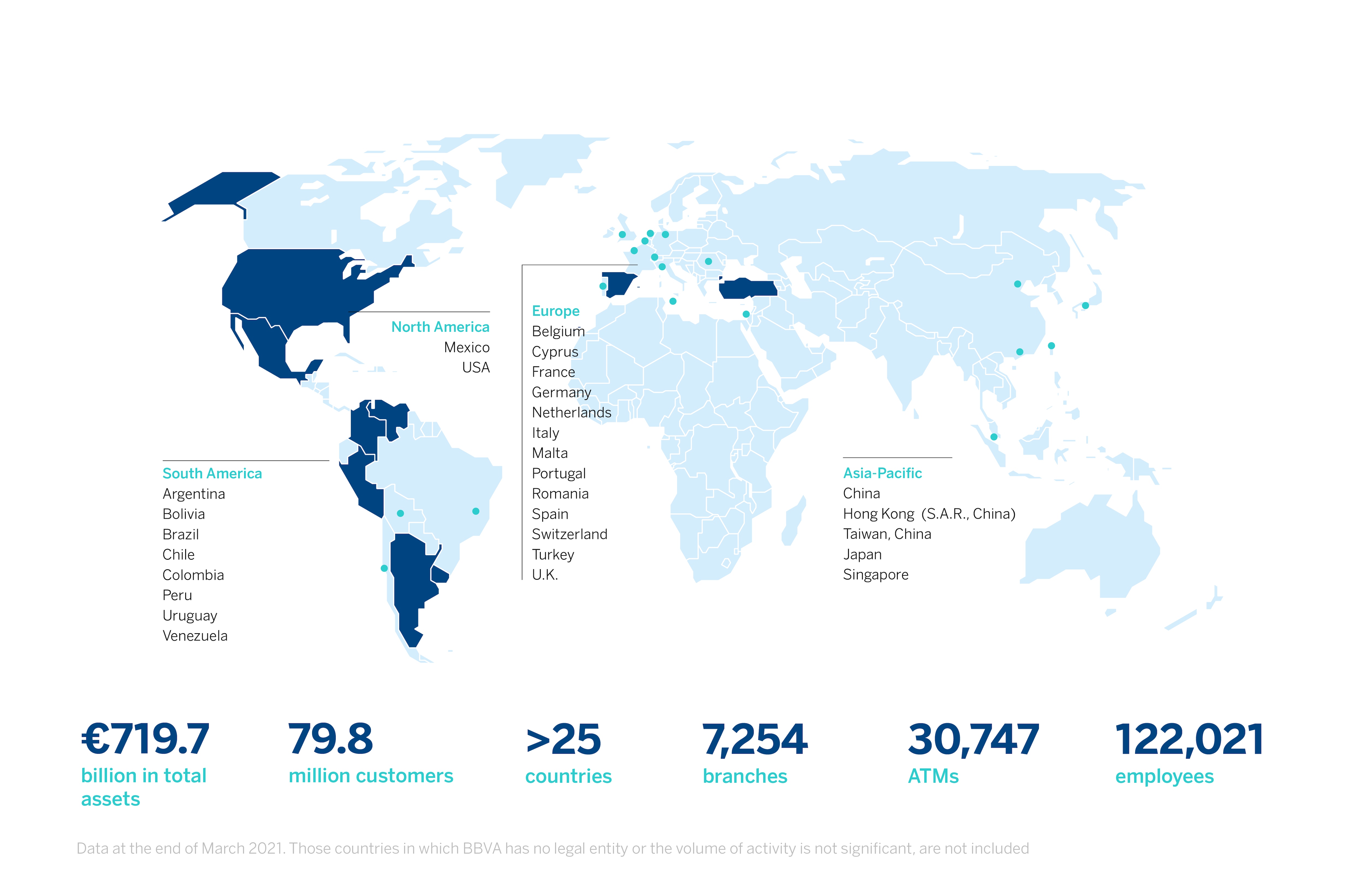

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in the Spanish market, is the largest financial institution in Mexico, it has leading franchises in South America and the Sunbelt Region of the United States. It is also the leading shareholder in Turkey’s Garanti BBVA. Its purpose is to bring the age of opportunities to everyone, based on our customers’ real needs: provide the best solutions, helping them make the best financial decisions, through an easy and convenient experience. The institution rests in solid values: Customer comes first, we think big and we are one team. Its responsible banking model aspires to achieve a more inclusive and sustainable society.