LCR and NSFR, banks' liquidity shield

The Basel Committee has designed two liquidity ratios to ensure that financial institutions have sufficient liquidity to meet their short-term and long-term obligations: LCR and NSFR. These two requirements are intended to reduce risks in case of episodes of financial turbulence.

The essential role of banks in society is to attract savings from families, companies and other agents and then lend it to others. A bank borrows in the short term (deposits) and lends in the long term (credits). The management of this time mismatch generates a benefit but also entails a series of risks. One of the biggest ones is keeping the necessary liquidity to meet the cash needs of those who have lent their money to the bank.

To mitigate this risk, the LCR (Liquidity Coverage Ratio) and NSFR (Net Stable Funding Ratio), which are part of the Basel III agreements, have been created. Both ratios pursue two different but complementary goals: the objective of the LCR is to promote the short-term resilience of the liquidity risk profile of banks; while the goal of the NSFR is to reduce the funding risk over a broader time horizon.

LCR, liquidity coverage ratio

The LCR measures a bank’s liquidity risk profile, banks have an adequate stock of unencumbered high-quality liquid assets that can be easily and immediately converted in financial markets, at no or little loss of value. This category would include, for example, central bank deposits, corporate promissory notes or guaranteed bonds. The goal is to ensure that the institution can meet its liquidity needs for a 30 day hypothetical financial stress scenario.

The LCR is the percentage resulting from dividing the bank’s stock of high-quality assets by the estimated total net cash outflows over a 30 calendar day stress scenario. Total net cash outflows is defined as the total expected cash outflows minus total expected cash inflows (up to an aggregate cap of 75% of total expected cash outflows).

Total expected cash outflows are calculated by multiplying the current balance of liability products (such as accounts and deposits) and off-balance sheet commitments (such as credit and liquidity lines to customers) by the rates at which they are expected to run off or be drawn down in accordance with the aforementioned stress scenario.

The minimum liquidity coverage ratio required for internationally active banks is 100%. In other words, the stock of high-quality assets must be at least as large as the expected total net cash outflows over the 30-day stress period.

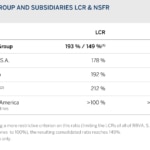

BBVA comfortably meets this requirement. As of December 31, 2023, the bank’s LCR coefficient stands at 149%. The LCR is a requirement that is only established at a consolidated level for euro area banks. However, all BBVA franchises also exceed the required minimum comfortably. The consolidated LCR is calculated without considering liquidity transferability between subsidiaries, therefore, no excess liquidity is transferred from these foreign entities to the consolidated ratio. Considering the impact of these highly liquid assets, BBVA's LCR would be 193%.

NSFR, net stable funding ratio

The NSFR requires banks to maintain a stable funding profile in relation to their off-balance sheet assets and activities. The goal is to reduce the probability that shocks affecting a bank's usual funding sources might erode its liquidity position, increasing its risk of bankruptcy. The NSFR standard seeks that banks diversify their funding sources and reduce their dependency on short-term wholesale markets.

The NSFR is defined as the ratio between the amount of stable funding available and the amount of stable funding required. Available stable funding means the proportion of own and third-party resources that are expected to be reliable over the one-year horizon (includes customer deposits and long-term wholesale financing). Therefore, unlike the LCR, which is short term, this ratio measures a bank’s medium and long term resilience. The stable funding requirements for each institution are set based on the liquidity and maturity characteristics of its balance sheet asset’s and off-balance sheet exposures.

Source: BBVA.

Basel III requires the NSFR to be equal to at least 100% on an ongoing basis. In other words, the amounts of available stable funding and required stable funding must be equal. BBVA also meets this requirement by a comfortable margin (131% as of December 31, 2023), thanks to its mainly long-term retail financing structure. As with the LCR, the NSFR in all subsidiaries is well above 100%.