High yield or investment grade? Different bonds based on their credit quality

A bond is a debt instrument used by companies as a source of financing. Depending on the issuer’s credit quality, a bond can be classified as investment grade or high yield. But what are their main differences?

Rating agencies are private entities that assess a company’s credit risk and qualify financial products according to the security they offer to investors. Their ratings measure issuer solvency and the probability of default on financial commitments. Ratings are used as benchmarks by investors.

The bond ratings assigned by these agencies determine whether a bond is investment grade or high-yield. Investment-grade bonds are issued by companies that are highly solvent, while high-yield bonds indicate that their issuers have a lower credit rating, due to a number of factors, including weaker competitive position in the sector, smaller size or lack of operational diversification or more aggressive dividend or indebtedness policies.

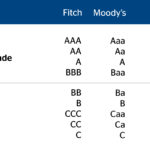

High-yield bonds are bonds issued by companies with a rating below BBB- from Standard & Poor's or Baa3 from Moody's. On the other hand, investment-grade bonds are issued by companies that with, at least, a Baa rating from Moody’s and Standard & Poor’s or BBB from Fitch.

High-yield bonds are bonds issued by companies with a rating below BBB- from Standard & Poor's or Baa3 from Moody's

The growth of the fixed income market in recent years in Europe has paved the way for large corporations, as well as small and medium sized enterprises, offering them easier access to debt markets, regardless of their rating.

Key differences

- Which bonds yield higher returns? Due to their poor credit rating, 'high yield' bonds offer higher return rates to attract investors.

- Which bonds entail higher default risks? High-yield bonds offer higher interest rates compared to investment-grade bonds due to their increased risk of default. High-yield bonds reward investors for taking additional risks with a higher coupon.

- Which bonds have longer maturity terms? Investment-grade bonds usually have longer maturity terms, because they benefit from existing interest from more conservative investor profiles and passive investors seeking long-term investment opportunities, such as insurance companies and pension fund managers.

High-yield bonds are often used as benchmarks to gauge risk appetite by investors at global level. In other words, in positive environments where the financial outlook remains optimistic, this type of product can perform optimally, as investors are willing to accept the higher risk in exchange for higher return potential. However, when risk perception increases, these bonds lose their appeal as investors choose to sell given the possibility that issuers may start defaulting on their payment obligations.