Earnings: BBVA’s profit nears €5 billion in first half (+29 percent), profitability reaches 20 percent

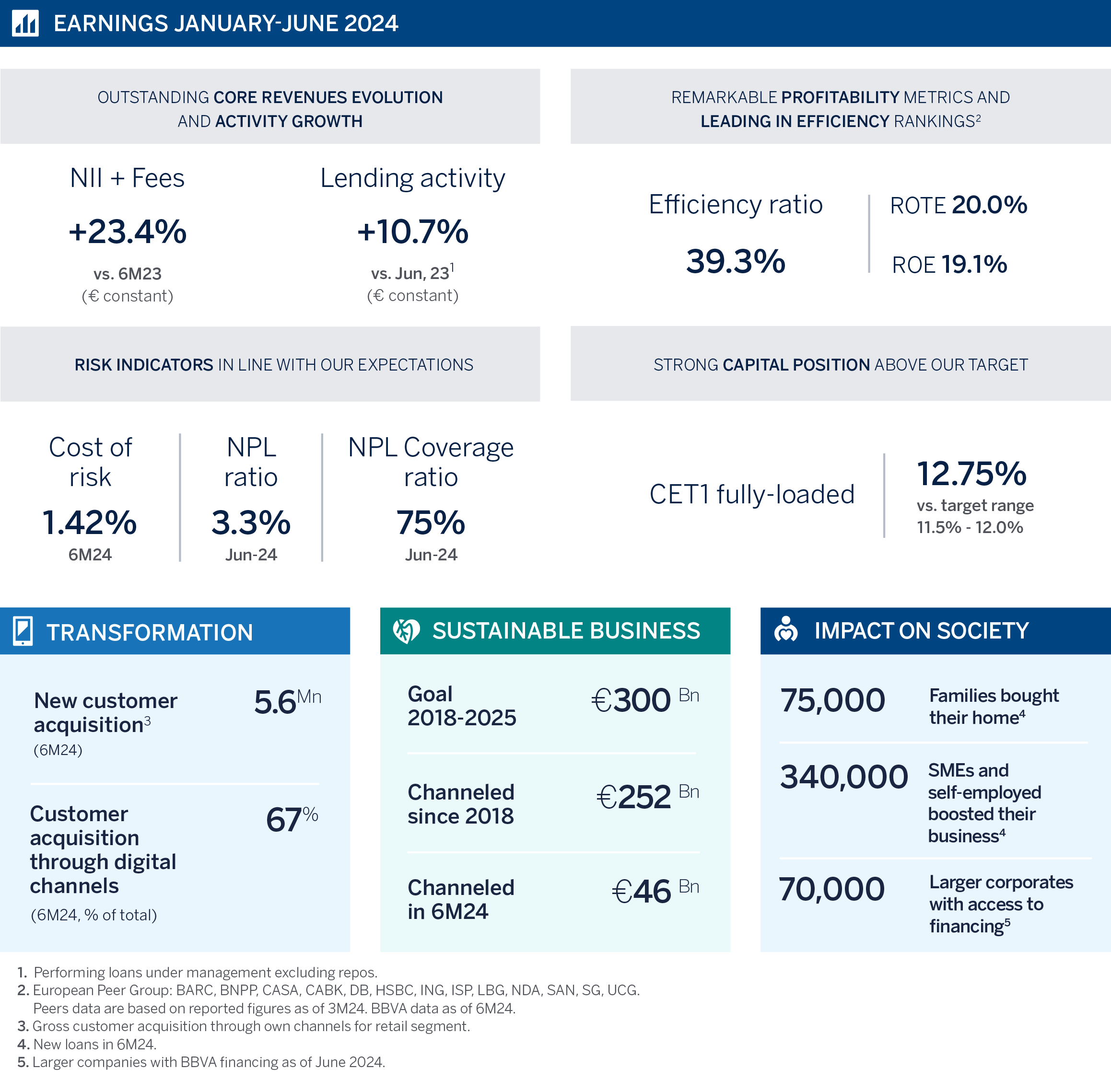

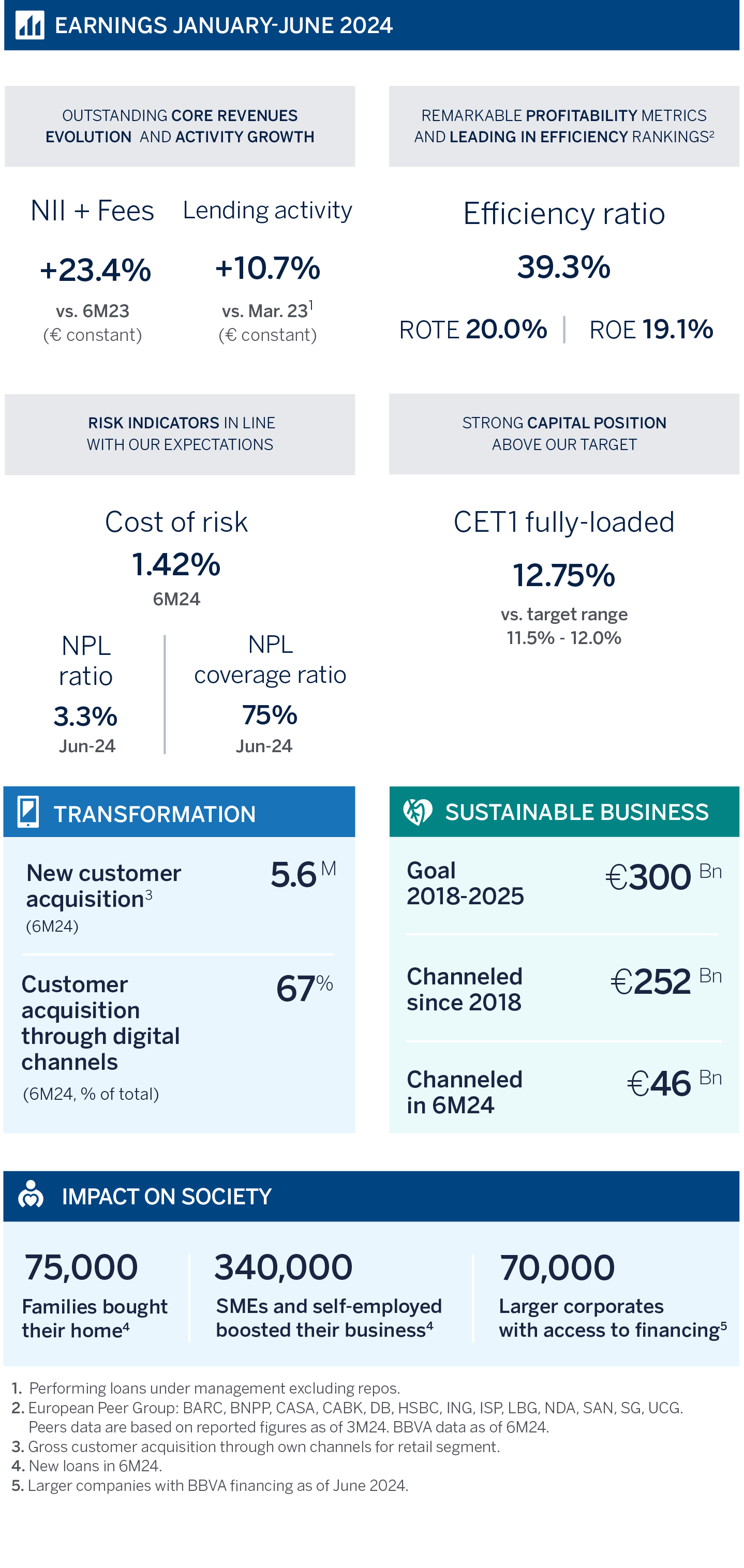

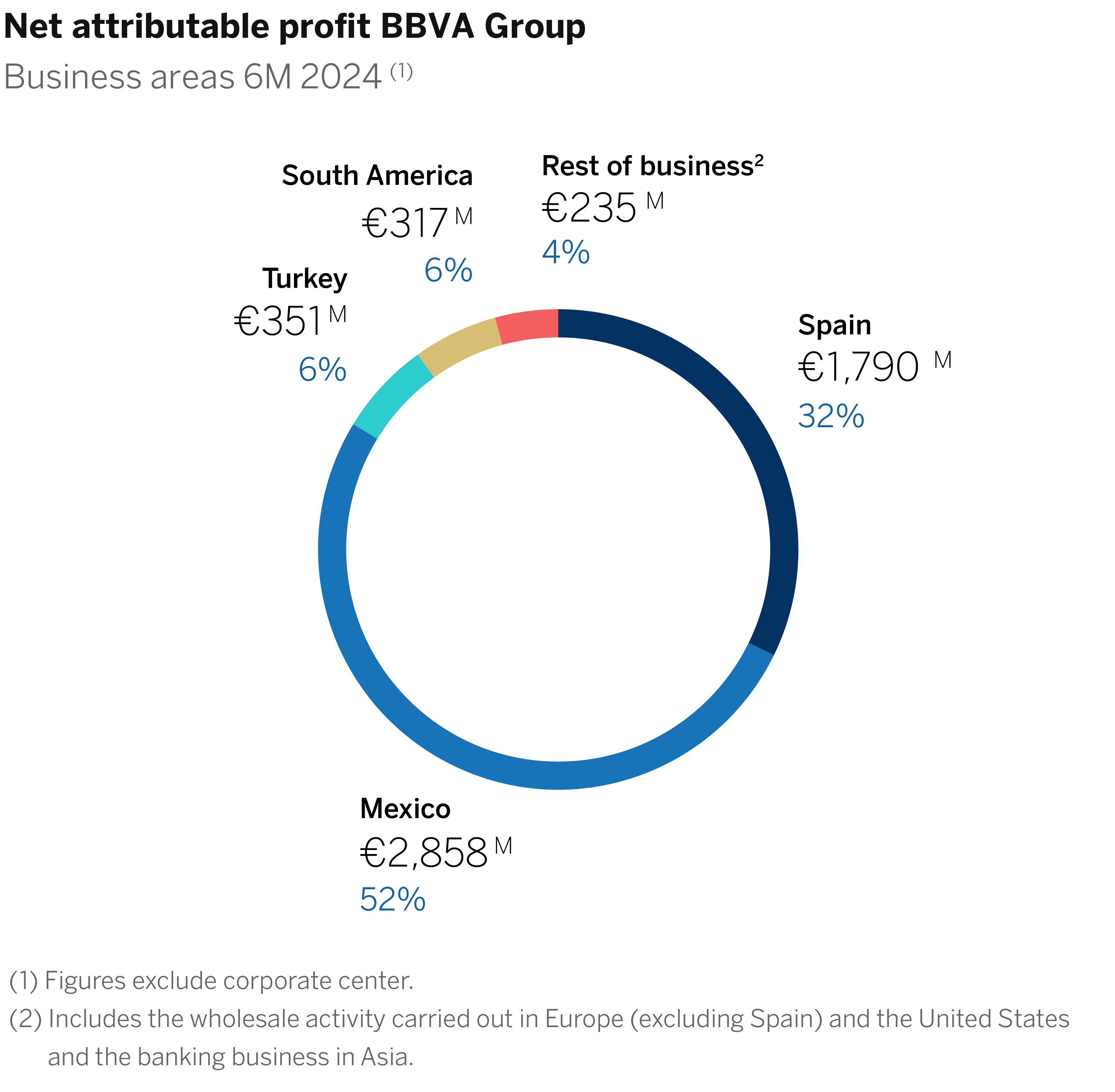

BBVA posted a net attributable profit of €4.99 billion through June 2024, up 29 percent yoy (37 percent in constant euros). Profit in 2Q24 rose 38 percent compared to the same period a year earlier (37 percent in constant euros), reaching €2.79 billion, on the back of strong activity. Lending grew by 10.7 percent yoy in constant euros, with a notable contribution from corporate loans. Furthermore, BBVA boosted the value creation for its shareholders, with a 20 percent annual increase of the tangible book value plus dividends per share. Profitability (ROTE) reached an outstanding 20 percent and the efficiency ratio stood at 39.3 percent, an all-time best.

Press kit

- Ciudad BBVA Madrid (JPG)

- Download video for TV (We Transfer)

- Download video for webs (We Transfer)

- Download audio from Onur Genç (We Transfer )

- Statement on BBVA 2Q24 earnings from Onur Genç (Text)

- BBVA CEO Onur Genç (JPG)

- BBVA CEO statement on 2Q 2024 earnings (YouTube)

- Quarterly Report 2Q24 (PDF)

- Earnings Analysts Presentation 2Q24 (PDF)

- BBVA CEO Onur Genç (JPG)

- Onur Genç during the press conference (JPG)

"This was an exceptional quarter. We achieved financial metrics that were elusive a few years ago: We reached a profitability of 20 percent and improved the efficiency ratio below the 40 percent barrier. Looking forward, we are facing an exciting future. We will comfortably surpass the ambitious goals we set for ourselves for the 2021-2024 period. Furthermore, we are fully confident in the success of the combination with Banco Sabadell, which will build a stronger, more profitable bank with a greater capacity to accompany families and businesses in their future projects," BBVA CEO Onur Genç said.

BBVA saw a dynamic first half of the year, marked by solid loan activity across all business areas. At the end of June, loans to customers grew by 10.7 percent yoy in constant euros (6.3 percent in current euros), driven by loans to companies. From January to June, the Group financed growth initiatives of more than 340,000 SMEs and self-employed individuals and more than 75,000 families were able to purchase a home with a mortgage from BBVA. At the end of June, more than 70,000 large companies had access to BBVA financing to invest in their growth. In 1H24, the Group also allocated €11 billion to finance inclusive growth initiatives such as hospitals and social housing.

Except where otherwise stated, the evolution of each of the main headings, and changes in the income statement described below refer to constant exchange rates. In other words, they do not take currency fluctuations into account.

At the top of the P&L account, net interest income (NII) from January to June was €12.99 billion, a 20 percent increase compared to the same period a year earlier, mainly driven by loan activity. The strong performance of this item in South America and Spain stood out. Net fees and commissions posted a yoy increase of 35 percent, reaching €3.84 billion, thanks to the favorable performance of payment systems and, to a lesser extent, asset management. Turkey's contribution stood out in this line, followed by Mexico. Recurring revenues (NII plus net fees and commissions) grew by 23 percent yoy, to €16.84 billion.

NTI rose 183 percent, reaching €1.89 billion, mainly on the back of a positive result of exchange rate hedges –especially the Mexican peso– and the contribution of the Global Markets unit, where Spain and Mexico's earnings stood out.

Gross income grew strongly and broadly across the main business areas, reaching €17.45 billion in 1H24, up 31 percent from the same period a year earlier.

Operating expenses rose to €6.86 billion in 1H24, 20 percent more yoy. However, this variation is below the average inflation in BBVA’s footprint (21.3 percent in the last 12 months1¹) and lower than the growth in gross income, allowing the bank to maintain positive jaws. The efficiency ratio had an impressive performance, improving by 362 basis points in the last 12 months, to 39.3 percent, an all-time best.

As a result of all the above, operating income surpassed the €10-billion mark for the first time in a six-month period (€10.59 billion, 39 percent yoy).

Impairments on financial assets were €2.84 billion from January to June, up 43 percent from the previous year, due to higher provisions associated with growth in the most profitable segments. Risk indicators remained within expectations: At the end of June the accumulated cost of risk was 1.42 percent, while the coverage ratio and the NPL ratio stood at 75 percent and 3.3 percent, respectively.

The BBVA Group posted a record net attributable profit of €4.99 billion in 1H24, up 37 percent yoy. The second quarter was also the best in the bank's history, with a profit of €2.79 billion, 37 percent higher than the same period last year (38 percent in current euros). Earnings per share for the quarter grew at an even faster pace, reaching €0.47, 42 percent yoy in current euros, thanks to share buyback programs implemented in recent months.

¹Weighted average inflation over the last 12 months by operating expenses and excluding Venezuela.

This result significantly improved the Group's profitability metrics. ROTE reached 20 percent at the end of June 2024, clearly above the average of European (13.3 percent) and Spanish (12.9 percent)² peers. ROE stood at 19.1 percent.

BBVA continued to create value for its shareholders. Tangible book value plus dividends per share stood at €9.39, 20 percent more than in June 2023.

Furthermore, the bank maintains an attractive shareholder remuneration policy, which means the distribution of between 40 percent and 50 percent of the annual profit, combining cash dividends with share buyback programs, and is firmly committed to distributing any excess capital above 12 percent³ (the upper band of the target range). As of the end of June, the fully loaded CET1 capital ratio stood at 12.75 percent.

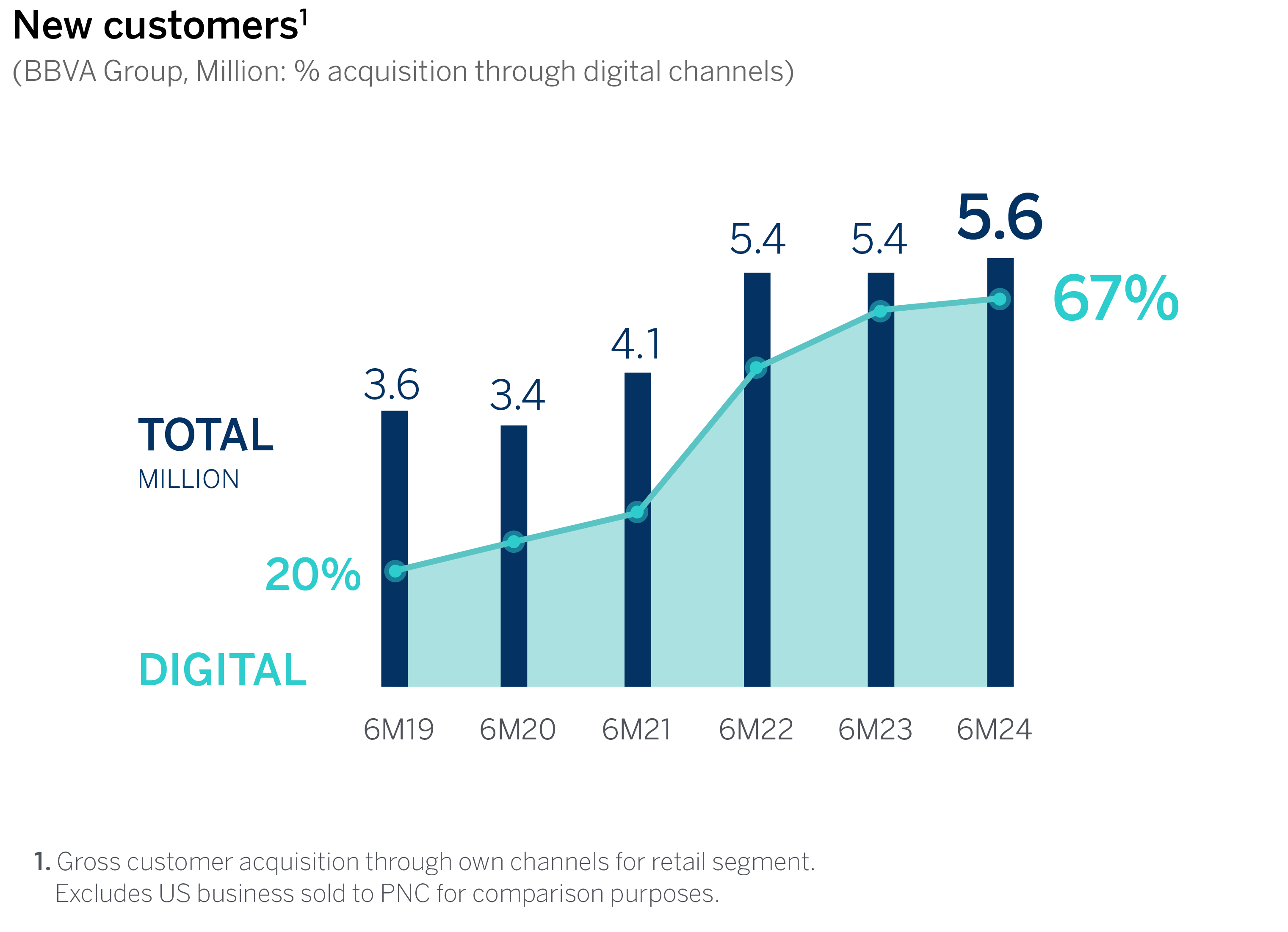

New customers

In the first half of 2024, BBVA advanced in its strategy focused on innovation, digitization, and sustainability. From January to June, the bank added 5.6 million new customers, of which 67 percent joined through digital channels.

² Data from the group of comparable Spanish and European peers as of the end of March 2024.

³ Data from the group of comparable Spanish and European peers as of the end of March 2024.

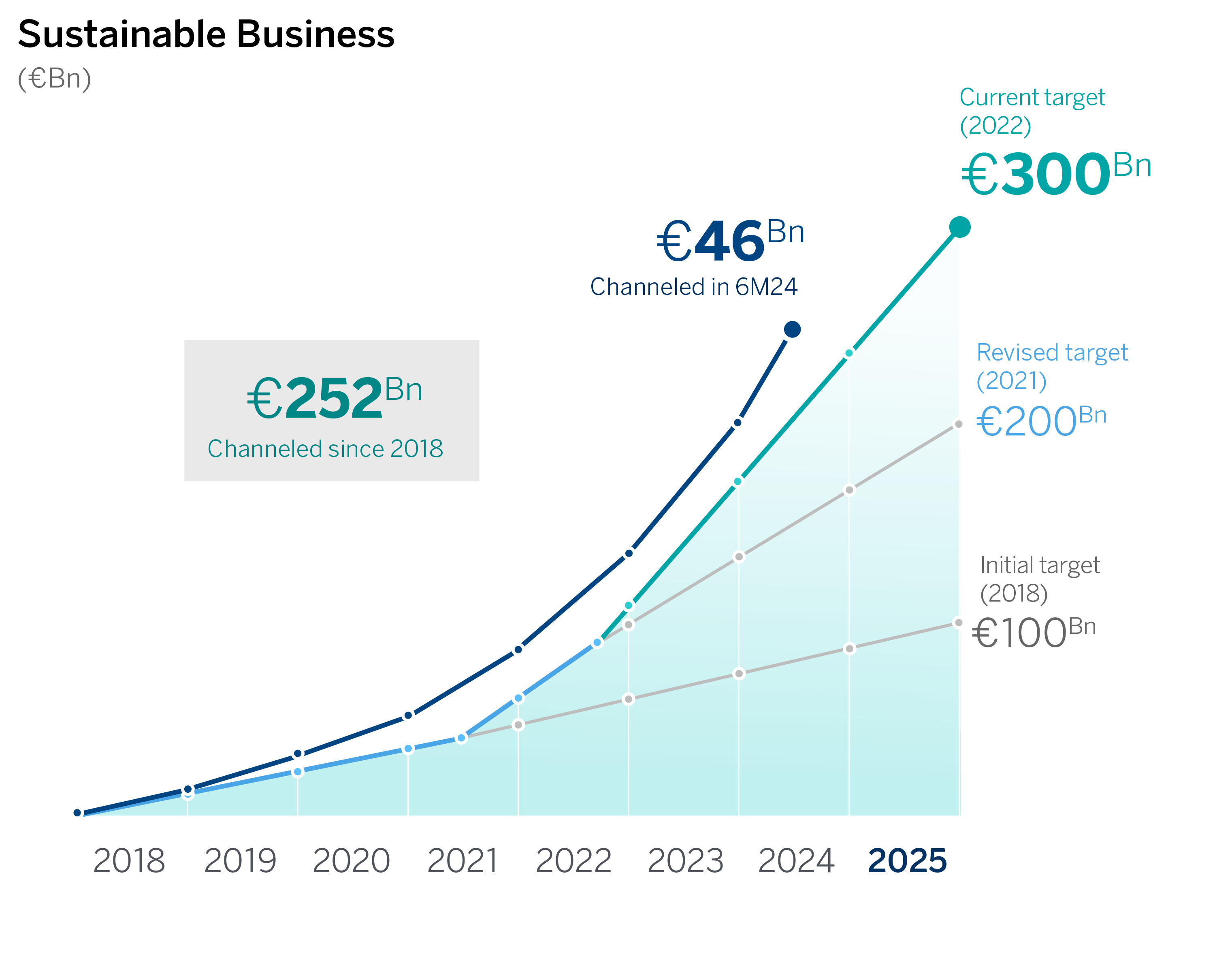

Additionally, BBVA channeled approximately €46 billion in sustainable business in 1H24, increasing to about €252 billion since 2018, thus exceeding the pace required to meet the €300 billion for the 2018-2025 period.

Business areas

In Spain, loan activity grew by 2.4 percent yoy, mainly thanks to the consumer and credit card segments, mid-sized companies, and improved new mortgage production. Customer resources rose 3.5 percent, thanks to time deposits and off-balance-sheet funds. In the P&L account, the strong growth of all revenue lines in the first six months is noteworthy, prompting a 27 percent increase in gross income yoy. The growth in expenses, slightly below 6 percent and much lower than revenues, allowed for an improvement of 719 basis points in the efficiency ratio, which stood at 35.4 percent at the end of June. Net attributable profit reached €1.79 billion through June, 47.8 percent more yoy. In 2Q24 alone, profit exceeded €1 billion, a historic milestone. Risk indicators evolved as expected: The accumulated cost of risk remained stable at 0.38 percent, while the coverage and NPL ratios eased to 54 percent and 3.93 percent, respectively.

In Mexico, the dynamism of the loan portfolio stood out, with a yoy increase of 12.6 percent. While growth over the past 12 months has been very balanced between retail and wholesale portfolios, the significant increase in commercial loans in the last quarter (9.3 percent) stood out. Customer funds yoy also grew at double digit (14.6 percent), driven by demand deposits and mutual funds. In the income statement, it is noteworthy the strong rise in recurring revenues, which lead to a yoy growth of 10 percent in gross income, above the increase in expenses (9 percent). Despite the increase in loan-loss provisions (29 percent yoy) on the back of solid momentum in the most profitable segments amid a high-interest-rate environment, net attributable profit for 1H24 reached record levels: €2.86 billion, 3.3 percent more yoy. In 2Q24, the accumulated cost of risk rose to 3.34 percent, while the NPL ratio improved to 2.62 percent and the coverage ratio stood at 120 percent.

In Turkey, growth of lending activity in local currency (51 percent yoy) stood out, very much in line with the evolution of lira-denominated resources and the strategy of de-dollarization of the bank’s balance.. In the income statement, although the net attributable profit in 1H24 (€351 million) is lower than that of the same period in 2023, the figure for 2Q24 is noteworthy for its increase compared to the 1Q24: €207 million vs. €144 million, respectively, a 44 percent increase in current euros. In this regard, it stood out the significant growth of recurring revenues and a smaller adjustment for hyperinflation in the quarter, thanks to the moderation of inflation. The accumulated cost of risk continued its normalization path, in line with expectations, and stood at 0.84 percent at the end of June. The NPL and coverage ratios slightly eased in the quarter to 3.34 percent and 94 percent, respectively.

In South America, lending (12.2 percent) and customer resources (24.5 percent) grew strongly yoy. The 1H24 net attributable profit reached €317 million, 12 percent less than a year ago (in current terms). Argentina contributed €103 million to the area's earnings, driven by growth of NII and NTI. In 2Q24, a smaller adjustment for hyperinflation was also noteworthy. In Colombia, the net attributable profit was €57 million, thanks to the strength of operating income. Peru contributed €110 million, supported by the growth of recurring revenues and improved efficiency. The NPL ratio in the region stood at 5 percent, the coverage ratio at 83 percent, and the accumulated cost of risk at 3.12 percent.

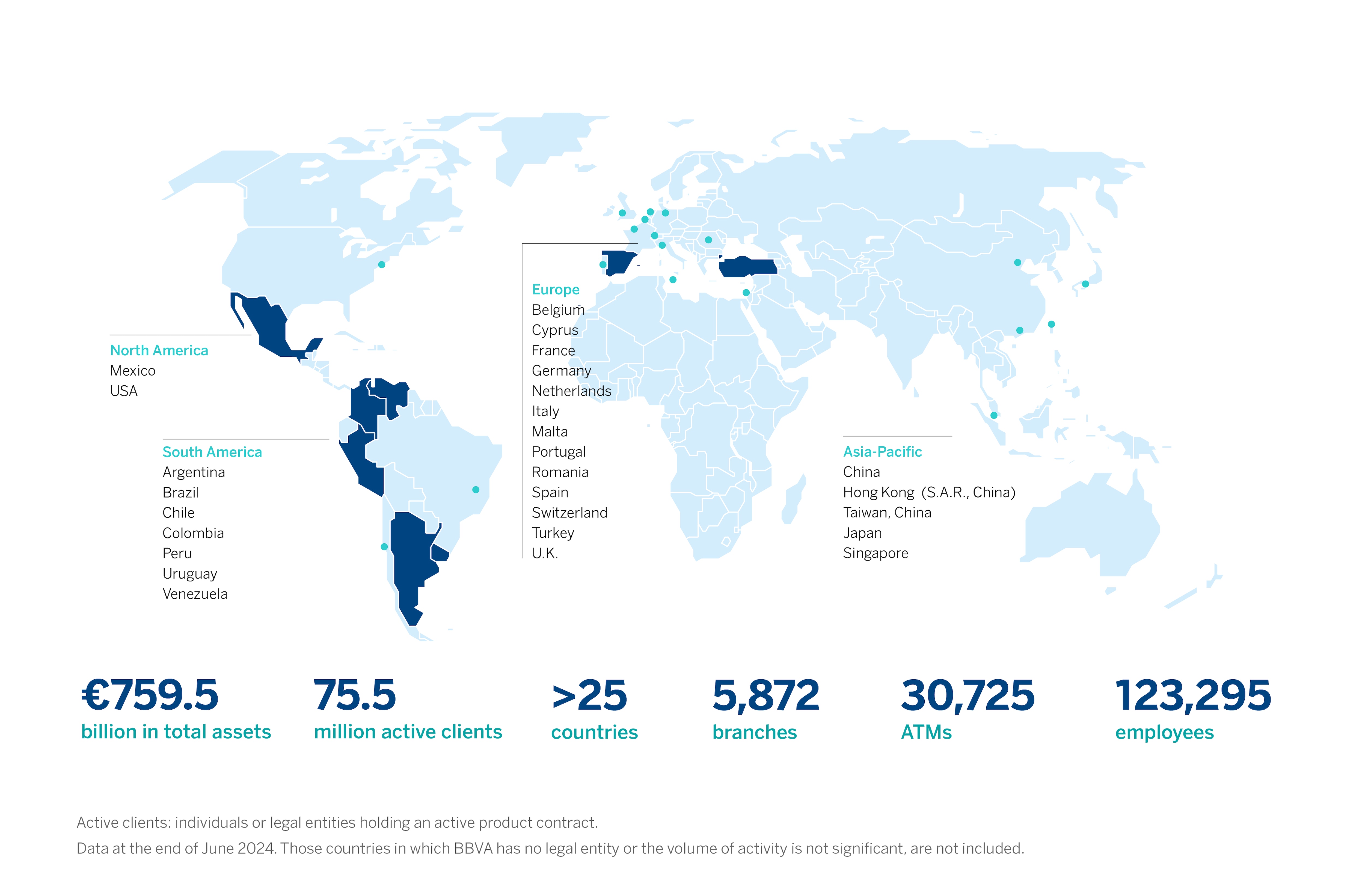

BBVA is a global financial services group founded in 1857. The bank is present in more than 25 countries, has a strong leadership position in the Spanish market, is the largest financial institution in Mexico and it has leading franchises in South America and Turkey. BBVA contributes with its activity to the progress and welfare of all its stakeholders: shareholders, clients, employees, providers and society in general. In this regard, BBVA supports families, entrepreneurs and companies in their plans, and helps them to take advantage of the opportunities provided by innovation and technology. Likewise, BBVA offers its customers a unique value proposition, leveraged on technology and data, helping them improve their financial health with personalized information on financial decision-making.