Carlos Torres Vila: “2023 was an excellent year for BBVA and 2024 will be even better”

BBVA’s senior leadership predicted on Tuesday that the bank has the ability to enhance its results in 2024, after publishing record-breaking profit in 2023. BBVA Chair Carlos Torres Vila underscored that “2023 was an excellent year for BBVA and 2024 will be even better.” This growth, he explained, will allow BBVA to have a greater impact on its shareholders, customers, employees and society as a whole. “Our net attributable profit will continue to grow this year,” stated CEO Onur Genç during the presentation of the bank’s annual results in Madrid.

Regarding BBVA’s outlook for this year, Onur Genç said that apart from a higher profit, the bank is also expecting ROTE to be in the range of 17 to 20 percent, above the 2023 level of 17 percent, and that the efficiency ratio at the end of 2024 will also be slightly better than the 42 percent target.

Meanwhile Carlos Torres Vila recalled BBVA’s structural strengths, beyond the economic cycle, that make the outlooks for the bank positive: the digitization, innovation and sustainability strategy; and leading franchises in Mexico, Spain, Turkey and South America.

Asked about the possibility of carrying out additional share buybacks, Carlos Torres Vila left the door open to the bank continuing to return the excess capital to its shareholders in this manner. He also indicated that since November 2021, “We have repurchased 830 million shares at an average price of €5.52 and our share price is currently above €8.00,” therefore, “the buybacks we have carried out have been a good investment for our shareholders.” In total, including the buyback programs that have already been completed and those that were announced today of an additional €781 million, BBVA will repurchase 14 percent of the total amount of its shares in the past three years.

“We have to stop viewing companies making money in a negative light”

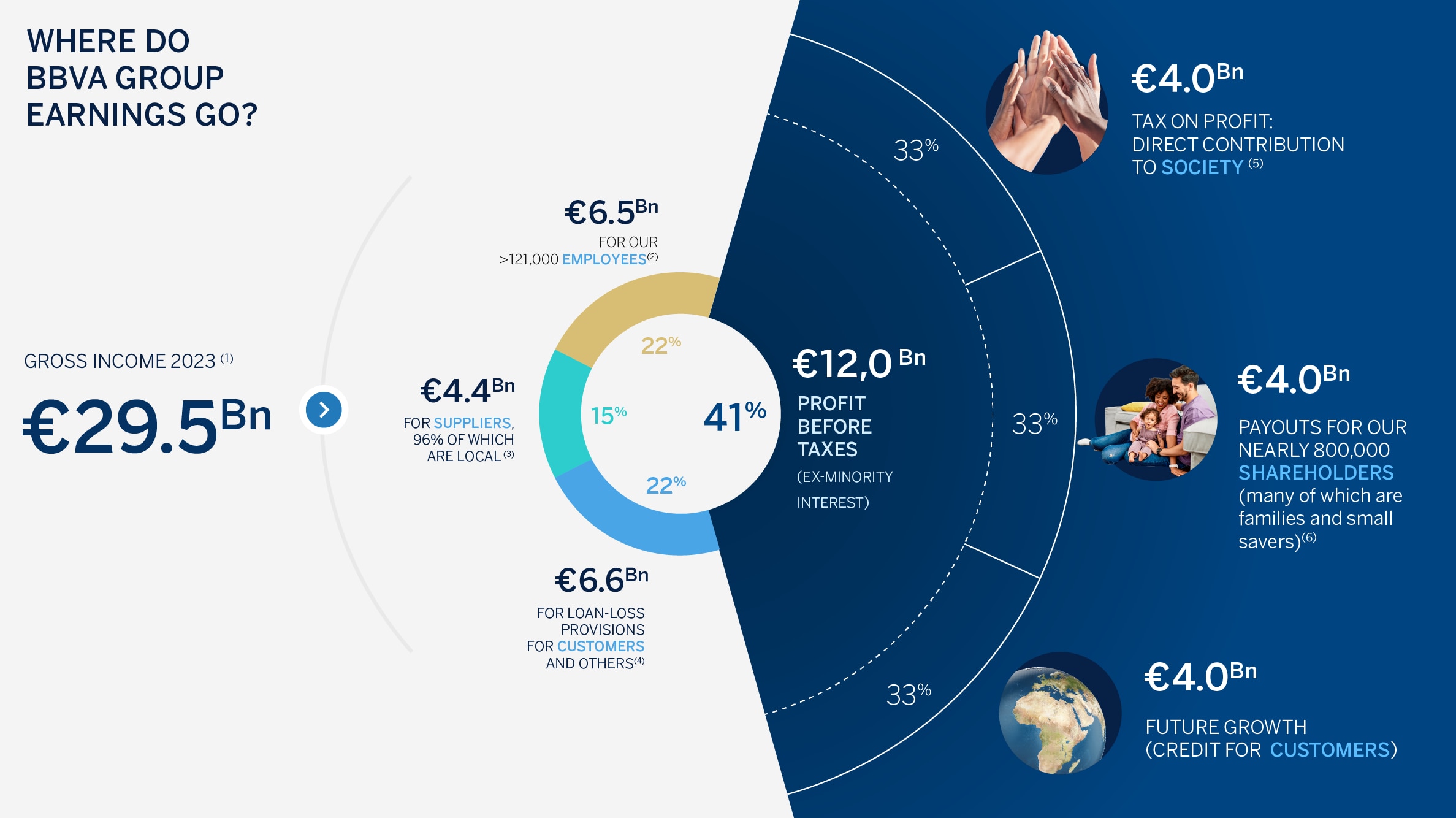

Carlos Torres Vila confirmed that “it was a good year for shareholders, but also for other stakeholders.” The BBVA Chair explained that around 60 percent of the bank’s income goes to paying its more than 120,000 employees, suppliers and covering provisions for credit related insolvency. The remaining 40 percent, which is the profit before taxes, is divided into thirds of €4 billion each: taxes on profit; shareholder distributions and future growth of credit, respectively.

In addition, he stressed that “the increase in activity translates into essential services for the everyday lives of people and companies.” Specifically, in 2023, the BBVA Group financed 140,000 families to purchase a home, financed the projects of more than half a million SMEs and the self-employed, and supported 70,000 large companies. Furthermore, “We generate inclusive growth. In 2023, specifically, we mobilized €15 billion of this kind of financing” such as for schools or hospitals.

The BBVA Chair feels that “we have to stop viewing profitable companies in a negative light because this makes it possible for the economy and society to prosper.” In his opinion, “this is especially true in the case of banks due to the central role we play in channeling savings toward productive investments. And the extent to which companies are profitable, investment will be further encouraged.”

(1) This figure already includes the negative impact of the -€215 million extraordinary tax on banking in Spain. (2) Employee costs, including social security contributions. (3) Other administrative expenses, including taxes collected in this line. (4) Includes impairment of financial assets, provisions and other results, amortizations, as well as minority interests. (5) 2023 accounting expense for corporate taxes included in the BBVA Group’s income statement. (6) These figures do not include the share buyback carried out between October 2nd and November 29, 2023 in the amount of €1 billion, as it is considered an extraordinary shareholder distribution. They do include the new €781 million share buyback program included in the ordinary shareholder distribution for 2023 (subject to relevant approval by supervisors and corresponding corporate bodies).