BBVA to start its €781 million share buyback program

BBVA is to start on Monday, March 4th, a new share buyback program for €781 million, having received the necessary clearance from the European Central Bank. The buyback is part of shareholders’ regular distributions for 2023. In total, BBVA will distribute €4.01 billion (50 percent of the net attributable profit from last year) to its shareholders, including the dividend and this share buyback program.

At the annual earnings presentation on Jan. 30th, BBVA announced its intention to launch this share buyback for a total of €781 million. The acquired shares will go to reduce the bank’s social capital through redemption.

The maximum number of shares that BBVA will be able to acquire stands at 557,285,609. The program will end at the latest on February 8th, 2025 and, in any case, once the maximum monetary amount or the maximum number of shares is reached. Specifically,

Citigroup will be in charge of executing the buyback in the Spanish Continuous market, and in trading platforms Cboe Europe and Turquoise Europe, with the bank setting a daily target to purchase 1,875,000, 1,000,000 and 175,000 shares, respectively.

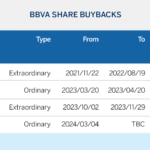

BBVA’s share buyback calendar

This is the second share buyback included in the ordinary shareholder distribution, made by the bank over the past two years. On April 21st, 2023, BBVA completed a share buyback for €422 million, representing about 1.07 percent of the bank’s social capital. This had the consideration of ordinary shareholder distribution for the year 2022.

Furthermore, BBVA has executed two other share buyback programs with the consideration of extraordinary distribution for shareholders, in addition to dividends distribution. First, in August 2022, BBVA completed a framework buyback program for €3.16 billion, one the largest in Europe. Later, in November 2023, it also successfully executed another extraordinary buyback program for €1 billion.

In total, when adding the share buyback programs already executed together with the one that starts on Monday 4th of February, BBVA will have repurchased approximately 14 percent of all its shares over the past three years*.

*Taking into consideration the closing price of BBVA shares on January 29, 2024 for an amount of 781 million euros.