Results: BBVA Earns €1.83 billion in First Half of the Year

Between April and June the BBVA Group posted the highest quarterly profit of the last 12 months, with €1.12 billion, up 58.4% from the previous quarter. Net attributable profit for the first half of the year stood at €1.83 billion, down 33.6% from the same period in 2015, due to the impact of exchange rates and the lack of corporate operations. Stripping out these two factors, profit grew 5.8% y-o-y

“The profit growth rate picked up during the second quarter and we are very much on track to reach our goal of 11% capital ratio in 2017. In short, this is a solid set of results,” said BBVA CEO Carlos Torres Vila.

From this point forward, all rates of variation are affected by the change resulting from the incorporation of Catalunya Banc in April 2015 and the effects of the acquisition of an additional 14.89% stake of Turkey’s Garanti, which has been incorporated into the financial statements using the full integration method since Q3-15.

BBVA’s first-half results proved once again the group’s ability to generate high income within a context of historically low interest rates in developed markets. In the first six months of 2016, the Group saw a solid performance of recurring revenues (net interest income and fees and commissions), lower loan-loss provisions and the results of a cost-containment effort, although costs remained affected by the integration of Catalunya Banc.

Net interest income stood at €8.37 billion between January and June 2016, up 11.2% from the same period of the previous year (+26.1% at constant exchange rates). Growth was bolstered by sustained activity levels in emerging markets. On the other hand, fees and commissions grew 6.0% y-o-y (+16.2% stripping out currency impact) over the same period.

Gross income stood at €12.23 billion, up 5.9% y-o-y (+18.2% at constant exchange rates). Recurring revenues (net interest income plus fees and commissions) were the key drivers of this growth.

During the second quarter, gross income posted an all-time high of €6.45 billion, an increase of 8.8% compared to the same period of 2015 (+21.2% at constant exchange rates). NTI results grew 26.0% (+36.7% stripping out the impact of currencies) compared to Q2-15. This heading recorded gross capital gains resulting from the Visa Europe operation (€225 million). Additionally, this quarter added revenues from Telefónica and CNCB dividends, as well as the contribution to the European Single Resolution Fund (€-122 million). This last contribution was booked during the second quarter, while last year it was made in the fourth quarter.

Operating expenses in the first half of 2016 grew 10.8% y-o-y (+21.1% at constant exchange rates). Once again, this increase was due to costs related to Catalunya Banc’s integration (unlike the same period a year earlier, this affects the whole of H1-16), high inflation in certain geographies and the negative effect of the depreciation of exchange rates over cost items denominated in dollars and euros. During the second quarter, however, the cost-containment effort was noticeable. Thus, the efficiency ratio at the end of June stood at 51.8%, virtually in line with December reading and at very competitive levels compared to the average of the European peer group (70.8%). Keeping into account the effect of the acquisition of Garanti, operating income for the first half of 2016 came to €5.9 billion (+1.1% y-o-y, +15.2% at constant exchange rates).

The bank’s risk indicators continued to improve. The NPL ratio dropped for the fourth consecutive quarter and recovered December 2012 levels, ending June at 5.1%, compared to 5.3% in March. Coverage ratio remained stable at 74%.

In terms of capital adequacy, BBVA remained on track to meet its 11% CET1 fully-loaded ratio goal in 2017. During the second quarter of 2016, BBVA generated 17 basis points of capital, pushing the ratio to 10.71% at the end of June. The phased-in CET1 ratio closed at 12.03%, well above the 9.75%-level set by the regulator. BBVA’s fully-loaded leverage ratio at the end of the first-half was 6.4%, the second highest among its European peer group.

Regarding the bank’s activity, at the end of June, gross lending reached €433.27 billion, up 10.2% from a year ago. Customer deposits grew 11.7% compared to June 2015, reaching €406.28 billion.

Below you may find the y-o-y rates of change corresponding to the main items on the income statement, considering the Garanti stake in homogeneous terms (as if it had been incorporated by the full integration method since January 1, 2015). In this context, net interest income dropped 4.9% y-o-y during the first half of the year (+7.9% stripping out currency impact), while gross income fell 6.5% (+4.6% at constant exchange rates). On the other hand, operating income dropped 12.1% compared to the same period of the previous year (+0.2% excluding currency impact).

Transformation of the bank

BBVA is moving steadily in its transformation. As part of this journey, the Group has simplified its structure to accelerate its strategic project. The main changes are: geographies report to the CEO and Customer Solutions incorporates key functions related to the offering of products and services.

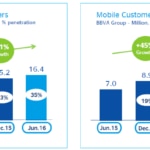

Back to the bank’s business evolution, BBVA continued growing its digital customer base. At the end of June 2016, customers engaging with the bank through digital channels topped 16.4 million (21% more than in June 2015). Of these, 10.2 million were mobile customers, up 45%.

The bank aims to boost digital sales across all franchises, a trend that is starting to show in many of them. For example, in the U.S., the percentage of transactions through digital channels over total transactions rose to 20.1% as of June 2016 vs. 9.3% in 2015. Other geographies where the boost in digital sales is evident are Spain, with digital sales representing 14.7% of total transactions, South America (+14.3%), Mexico (+12.3%) and Turkey (+23.9%).

The main highlights of each business area are detailed below.

The y-o-y comparison of the banking activity in Spain has been affected by the incorporation of Catalunya Banc in April 2015. Once again, the area showed great resilience in a complex environment. In the second quarter, the reduction in the cost of financing allowed net interest income to increase 3.4%, compared to the previous quarter. However, in cumulative terms, this heading declined 1.9% y-o-y. Cost-containment efforts between April and June helped keep this item stable compared to the first quarter. NTI results dropped 42.1% and it also added a negative impact from the contribution to the Single Resolution Fund. Impairment losses on financial assets declined 34.4% in y-o-y terms, while the NPL ratio continued to improve gradually, reaching 6% (vs. 6.4% in March), with coverage ratio of 60%. In the first six months of 2016 the area earned €619 million, down 15.3% y-o-y.

In terms of business activity, lending had a 0.4% growth between January and June. New mortgages grew 22% in y-o-y terms, while consumer lending jumped 45% and commercial loans increased 10% (figures excluding Catalunya Banc).

The real-estate activity in Spain continued to reduce its net exposure to the sector by 13.3% y-o-y to €11.4 billion at the end of June. Lower provisions helped to narrow losses by 30.6% to €-209 million from January through June.

First-half results for BBVA Spain -combining banking activity and the real estate business- came to €410 million.

To better explain the trend of business areas that use a currency other than the euro, the exchange rates described below refer to constant exchange rates.

In the United States, a solid behavior of recurring revenues in the first half of the year was a key driver of the slight improvement in gross income. It is also worth mentioning the recovery in commissions during the second quarter vs. the first quarter of 2016. Impairment losses on financial assets dropped significantly between April and June (-41.3%) compared to the first three months of the year. In Q1-16 the bank had anticipated provisions ahead of a worsening in the credit quality of the energy sector. The NPL ratio stood at 1.6% at the end of June. The U.S. business area earned €178 million during the first half of 2016, down 35.5% y-o-y. BBVA Compass passed, for third consecutive year, the Comprehensive Capital Analysis and Review (CCAR). This means that the institution boasts a solid capital plan, allowing it to operate in a scenario of economic stress.

Turkey’s earnings (in homogeneous terms) reflect the notable strength of recurring revenues (interest income plus fees and commissions). This positive trend was once again supported by buoyant activity in the quarter, with double-digit y-o-y growth rates both in lending (+12.9%) and customer funds (+14.2%). A moderate growth in expenses compared to revenues helped the operating income to grow 29.4%. The NPL ratio improved to 2.7% at the end of Q2-16. Net attributable profit in Turkey in the first half of the year jumped 31.8% y-o-y to €324 million.

Mexico continued posting high growth rates in the quarter both in lending (+14.2% year-on-year) and customer funds (+12.0%). The solid behavior in net interest income (+11.8% y-o-y) and fees and commissions (+9.7%) drove gross income growth (+10.9%). Cost-containment efforts helped keep growth in expenses below growth in revenues, boosting the operating income growth rate to 12%. In terms of credit quality, the area posted positive results, with the NPL ratio dropping to 2.5% from 2.8% a year ago. Once again, BBVA’s earnings in Mexico between January and June 2016 grew at double digit rates (+10.6% y-o-y), reaching €968 million.

Activity in South America also grew at double-digit rates, both in terms of lending and customer funds. Once again, this dynamism drove net interest income higher. Regarding other sources of income, both commissions and NTI showed a robust performance. The area recorded significant advances in gross income (14.2%) and in operating income (10.6%). The NPL ratio increased slightly, but continued at low levels (2.7%). Net attributable profit grew 7.1% y-o-y, reaching €394 million.

About BBVA

BBVA is a customer-centric global financial services group founded in 1857. The Group is the largest financial institution in Spain and Mexico and it has leading franchises in South America and the Sunbelt Region of the United States; and it is also the leading shareholder in Garanti. Its diversified business is focused on high-growth markets and it relies on technology as a key sustainable competitive advantage. Corporate responsibility is at the core of its business model. BBVA fosters financial education and inclusion, and supports scientific research and culture. It operates with the highest integrity, a long-term vision and applies the best practices. The Group is present in the main sustainability indexes. As of the end of June 2016, the total assets of the Group amounted to €746,040 million, with 67 million customers, 9,153 offices, 30,958 ATMs and 137,310 employees, and is present in 35 countries.