BBVA presents offer to Banco Sabadell shareholders

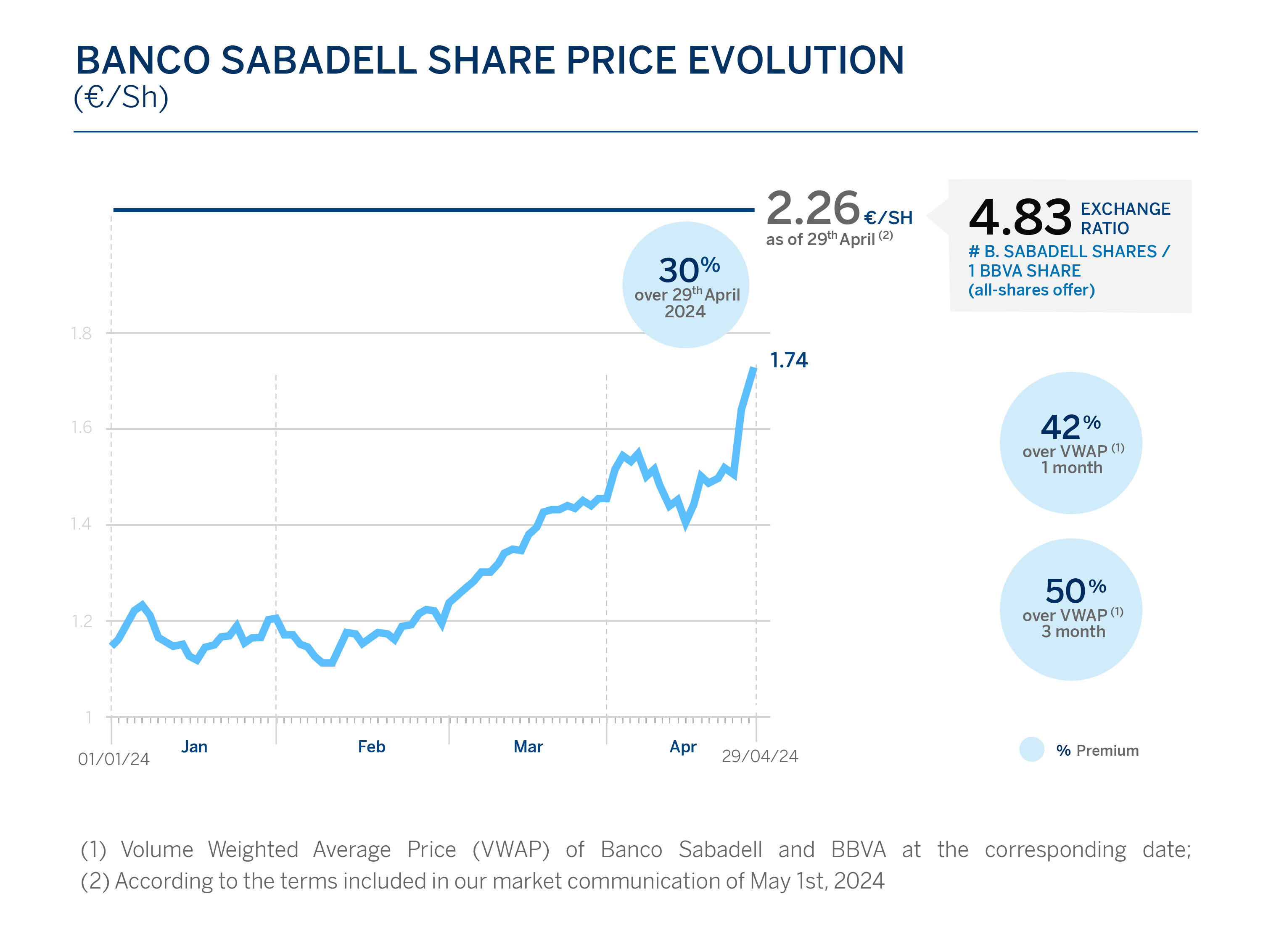

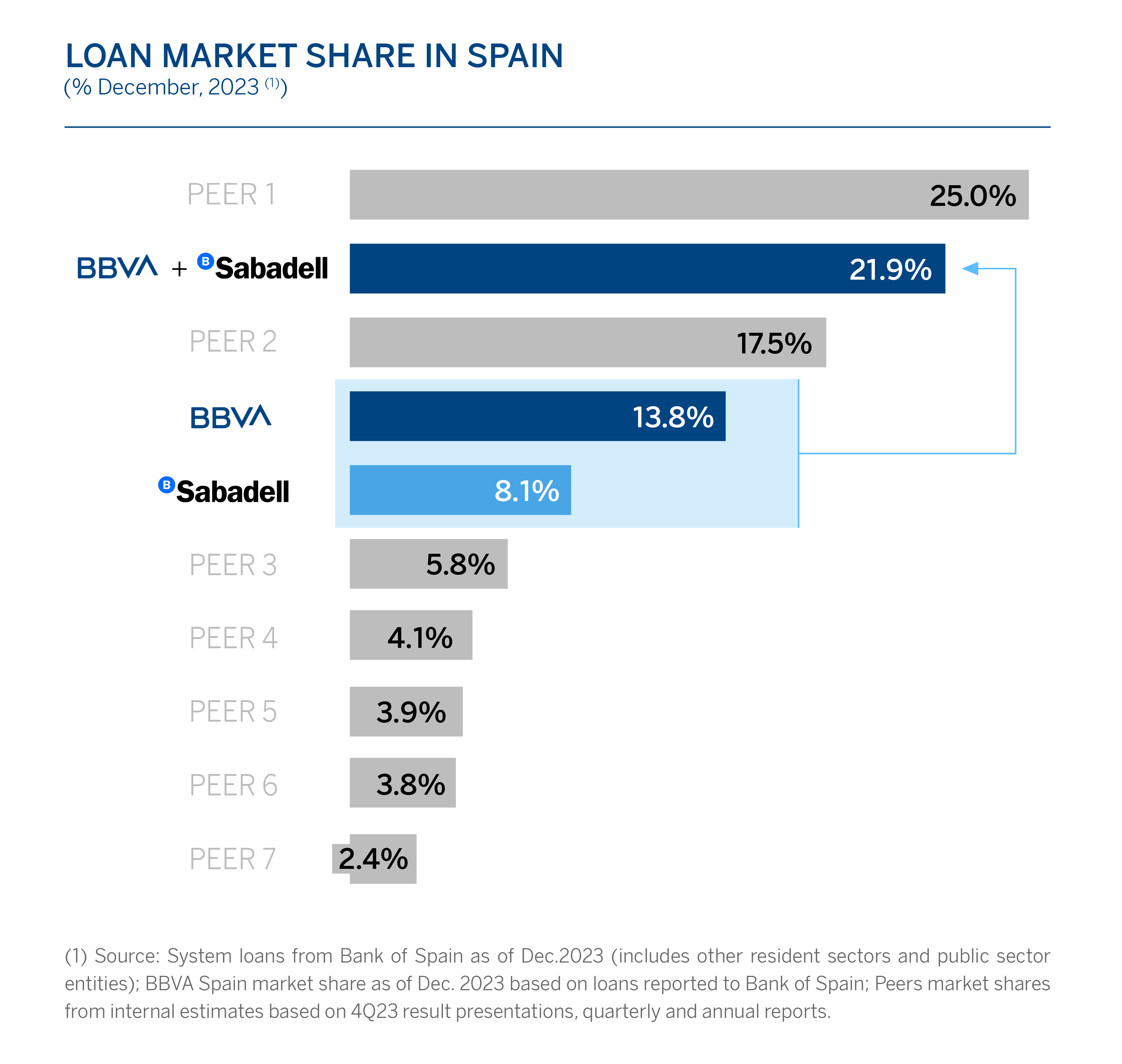

BBVA’s Board of Directors is presenting an offer to Banco Sabadell shareholders so they can benefit from an exceptionally favorable proposal. The deal offers one BBVA share for every 4.83 of Sabadell, representing a 30 percent premium over the closing price of both banks on April 29th, and a 50 percent premium over the weighted average prices of the past three months. The transaction has very positive financial impacts thanks to relevant synergies and the complementarity and excellence of both banks. The operation will create one of the best banks in Europe, with a loan market share close to 22 percent in Spain. Furthermore, BBVA will maintain its current shareholders distribution policy and its commitment to distribute any excess capital above 12 percent.

“We are presenting to Banco Sabadell’s shareholders an extraordinarily attractive offer to create a bank with greater scale in one of our most important markets," said BBVA Chair Carlos Torres Vila. "Together we will have a greater positive impact in the geographies where we operate, with an additional €5 billion loan capacity per year in Spain.”

BBVA's attractive offer to Banco Sabadell shareholders contains the same financial terms of the merger that was offered to its Board of Directors on April 30th: an exchange of one newly issued BBVA share for every 4.83 of Banco Sabadell, which represents a premium¹ of 30 percent over the closing prices of both banks on April 29th; 42 percent over the weighted average prices of last month; or 50 percent over the weighted average prices of the past three months. Furthermore, Banco Sabadell shareholders will hold a 16.0 percent stake in the resulting entity, benefiting from the value generated by the deal.

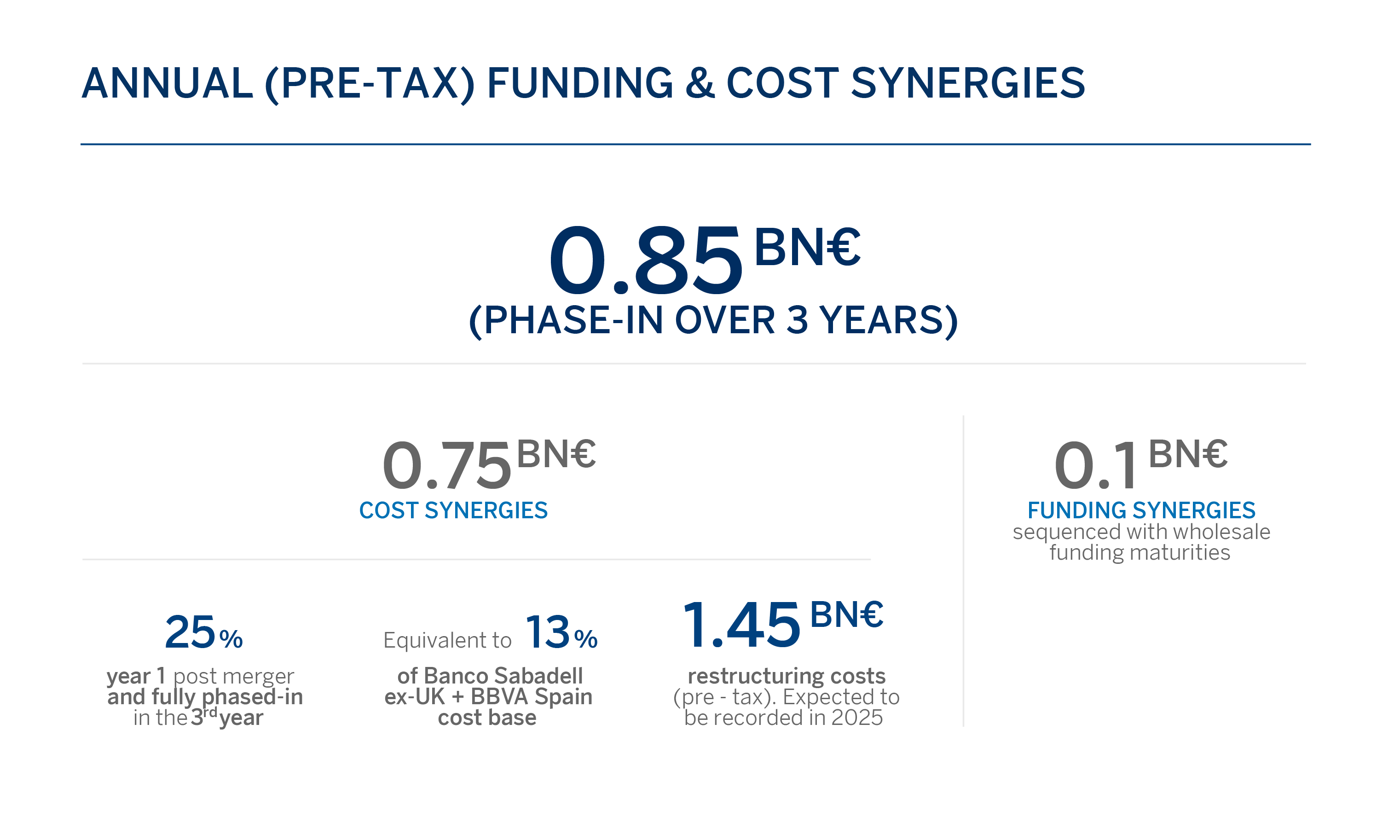

The transaction also represents a clear value creation for BBVA shareholders. According to BBVA's estimates, this transaction is positive in earnings per share (EPS) from the first year after the subsequent merger of both entities, with an improvement of about 3.5 percent once the savings associated with the merger are materialized, which are estimated at around €850 million before taxes. Additionally, the tangible book value per share improves around 1 percent on the date of the merger. The operation offers a high return on investment (ROIC² close to an incremental 20 percent for BBVA shareholders). All of this, with a limited impact on the CET1 capital ratio, of approximately -30 basis points³. BBVA will maintain a growing and attractive shareholder distributions’ policy, which currently involves distributing between 40 percent and 50 percent of profit, combining cash dividends and buybacks. The bank will also remain committed to distributing any excess capital above 12%⁴.

The transaction will also benefit all remaining stakeholders. Customers will have access to a unique value proposition, thanks to the complementarity of the franchises, a greater product offering and the bank's global reach. Employees will benefit from new professional opportunities to grow in a global bank. The creation of a stronger, more profitable institution will also result in more financing for companies and families and a greater contribution via taxes. All of this will translate into greater economic and social progress.

“All stakeholders will benefit from this operation,” said BBVA CEO Onur Genç. “Banco Sabadell has done an excellent job, with remarkable progress in recent years, and now its shareholders can join an entity with an unparalleled combination of growth and profitability in Europe.”

BBVA maintains its commitment in all the markets where it operates and from a position of greater strength, it will increase its support to businesses, as well as cultural, scientific and social sectors through its banking activity and foundations. The new bank will have double operational headquarters in Spain: one in the Banco Sabadell corporate center in Sant Cugat del Vallès (Barcelona) and the other in Ciudad BBVA, in Madrid. BBVA considers that the integration of both entities also increases the potential of Barcelona as a European hub for startups. The use of the Sabadell brand will remain in use together with the BBVA brand in those regions or businesses in which it may have a relevant commercial impact.

Following the closing of the deal, BBVA will be Spain’s second largest financial institution, one of the most relevant markets for the Group, and with good future prospects. In this sense, expected growth for Spanish GDP stands above that of the average of the eurozone countries (2.1 percent expected growth in 2024 and 2 percent in 2025, compared to an average eurozone growth of 0.7 percent and 1.4 percent, respectively). Furthermore, there has been a significant deleveraging of families and companies since the 2008 crisis, with current debt levels lower than those of the eurozone. All of this, together with an environment in which interest rates, although with an expected decline, will maintain reasonable levels for the banking business, constitute growth levers for the financial system. Spain is also a market with an attractive profitability. BBVA Spain had a profitability⁵ of 19 percent at the end of 2023.

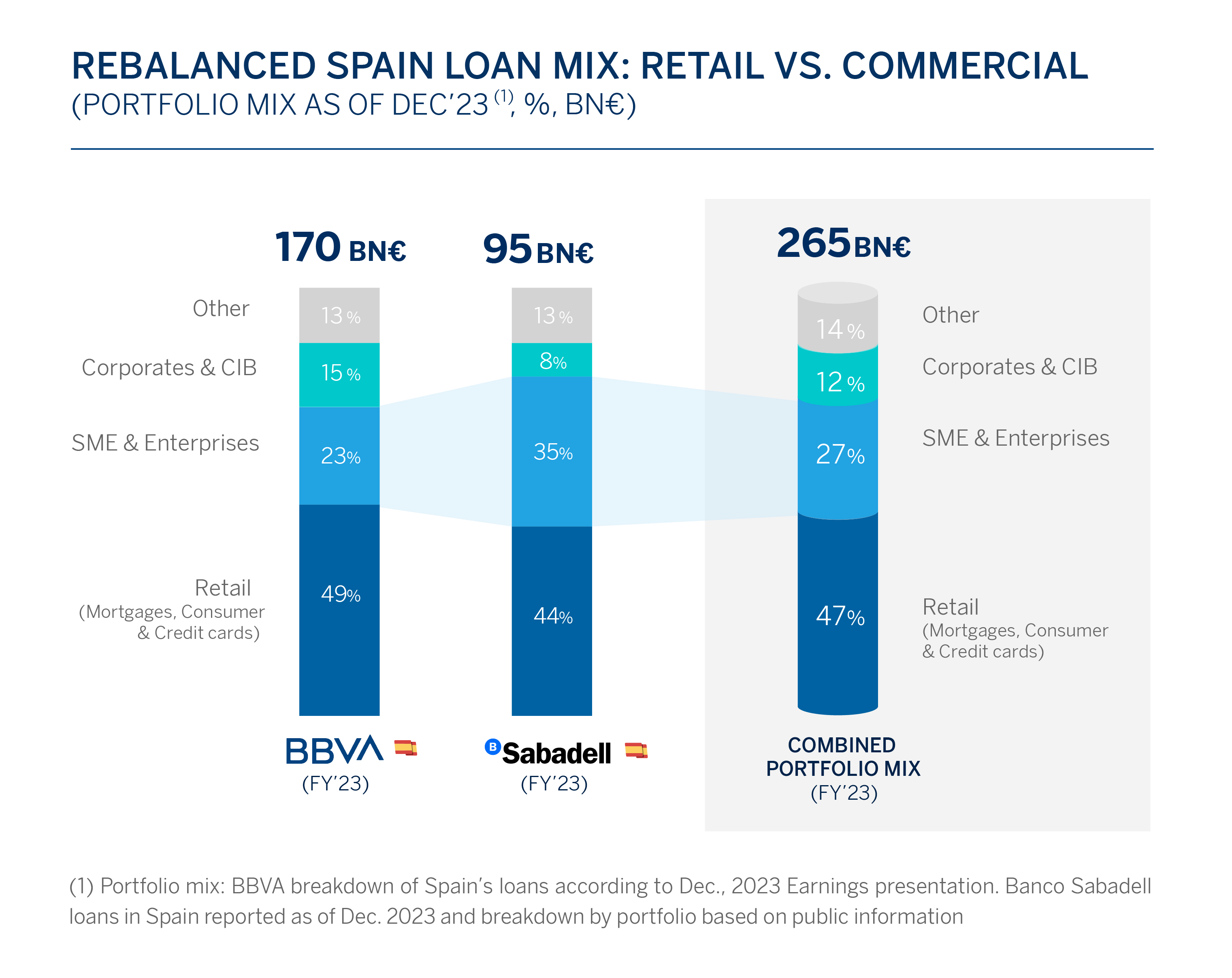

With data at the end of 2023, the resulting entity shows a credit investment of €265 billion and a market share in loans close to 22 percent in the Spanish market (13.8 percent for BBVA and 8.1 percent for Banco Sabadell).

These are two very complementary banks, both for their geographical diversification and their strengths in customer segments. In Spain, Banco Sabadell is a leader in SMEs, with a share of 12.7 percent versus 11.5 percent for BBVA, while BBVA is stronger in retail banking, with a share of 14.7 percent, compared to 6.3 percent for Banco Sabadell.

One of BBVA's priorities in this integration is to preserve the best talent of both institutions. All decisions to integrate the workforce will be guided by principles of professional competence and merit, without adopting traumatic measures and with all guarantees. Additionally, BBVA expects the technological integration to take between 12 and 18 months.

The offer is subject to acquiring more than 50.01 percent of Banco Sabadell, the approval of the Shareholders’ General Meeting, and the approvals of the Spanish Market and Competition regulator (CNMC) and the U.K.’s Prudential Regulation Authority. The closing of the operation is expected to take between six to eight months, once regulatory authorizations have been obtained. JP Morgan SE, UBS Europe SE, Rothschild & Co, Garrigues and DWP are BBVA’s advisors for the operation.