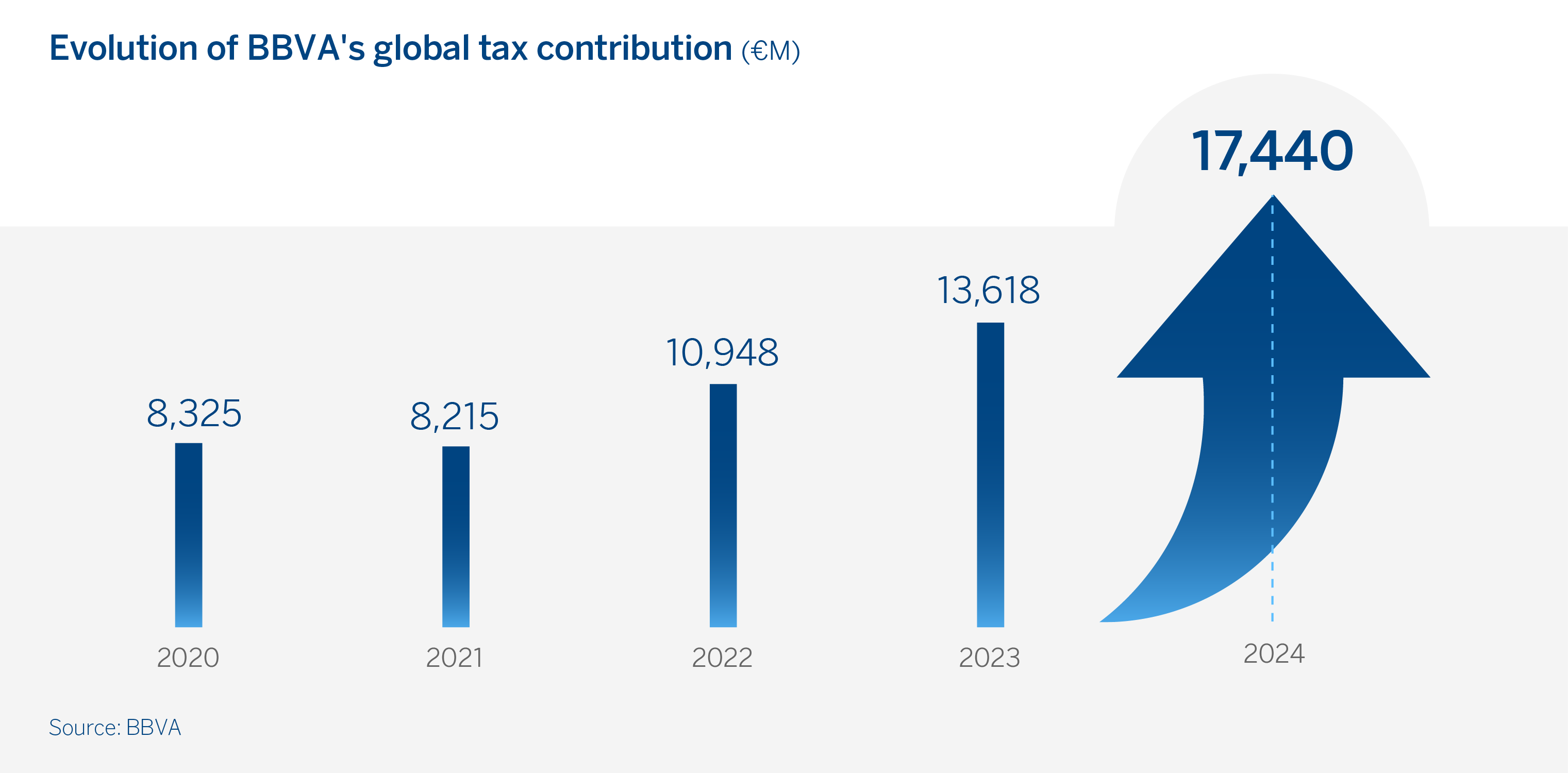

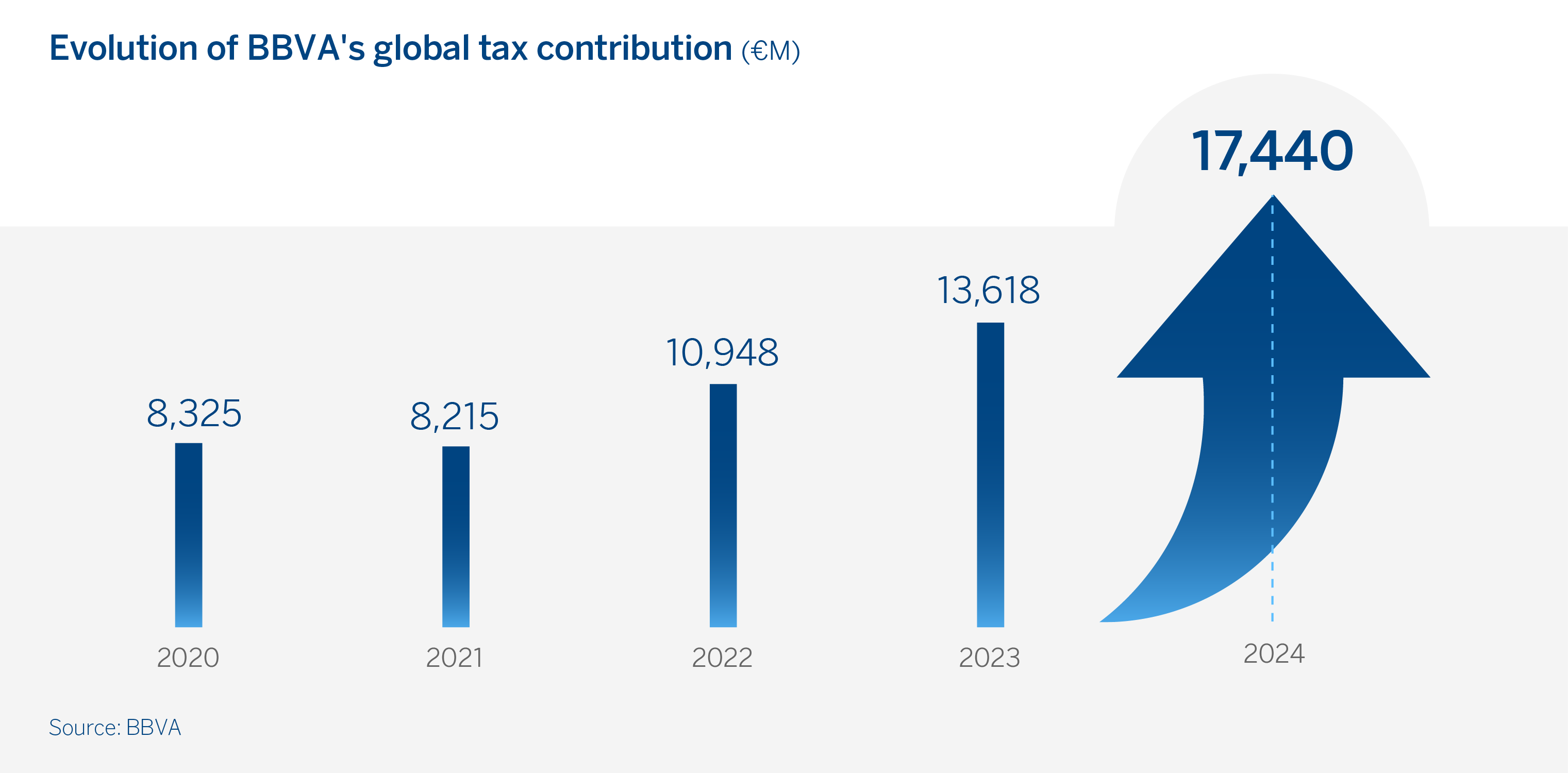

BBVA contributed a record €17.4 billion to society in 2024

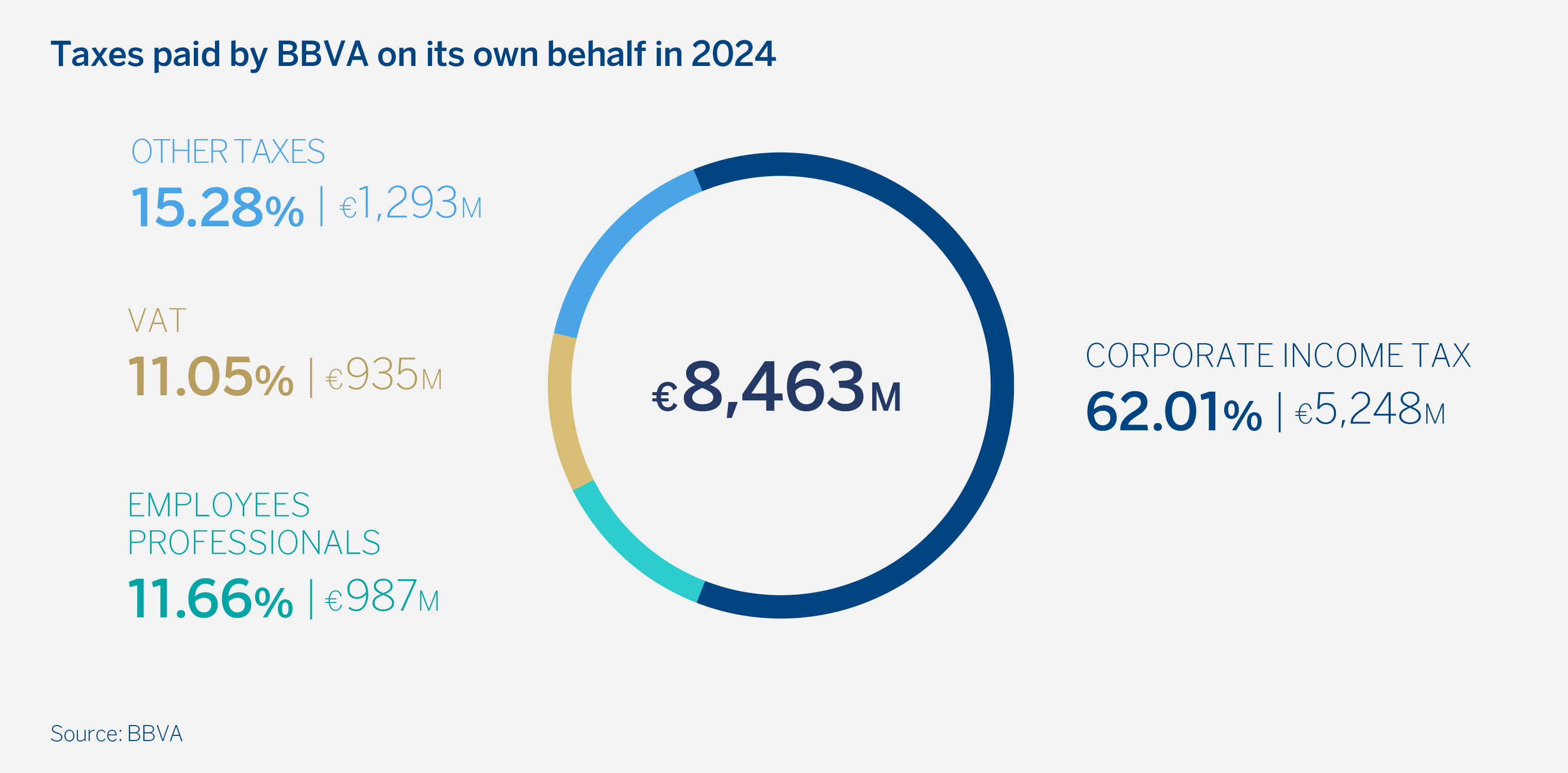

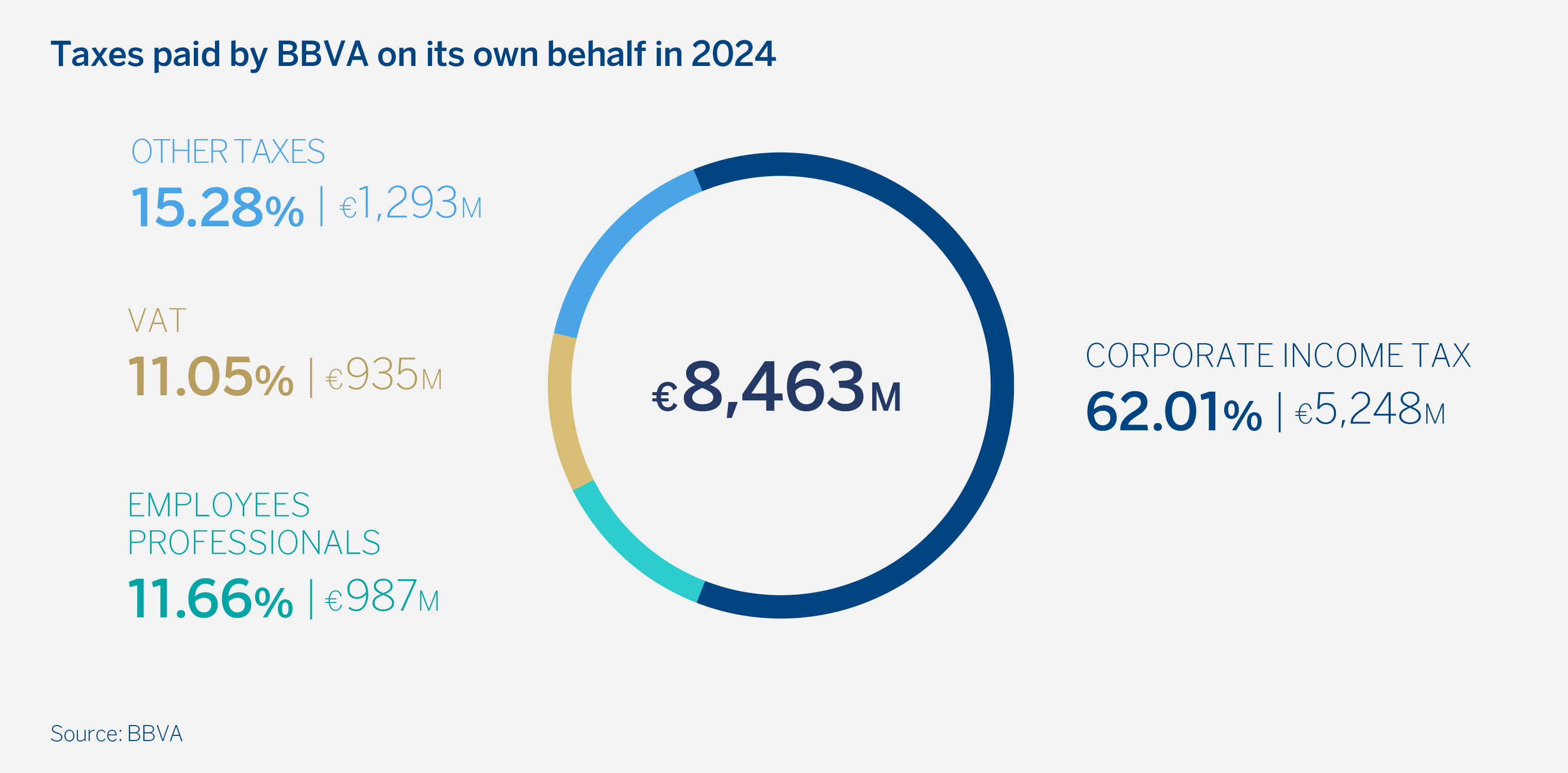

The BBVA Group paid a record-breaking €8.46 billion in own taxes in 2024 in the countries where it operates, 10 percent more than the previous year, according to the Total Tax Contribution Report. In addition to this figure, BBVA collected €8.98 billion in taxes from third parties for a total of €17.44 billion–the Group’s highest tax contribution thus far. This means that for every €100 of income generated by BBVA in 2024, the bank contributed €49 to public coffers in taxes¹.

¹Ratio between BBVA’s financial contribution to public coffers in 2024 (€17.44 billion) and the bank’s gross margin for the year (€35.48 billion). BBVA’s tax contribution includes both its own taxes (corporate tax, VAT and specific levies on the financial sector, among others), as well as taxes collected by the BBVA Group on behalf of third parties, which are paid as a result of its presence and activity with employees, customers and suppliers in over 25 countries.

Carlos Torres Vila underscored these figures, “our highest tax contribution in history, €17.44 billion around the world, with which we will contribute to social well-being.” The more a company grows and the more profitable it becomes, the greater positive impact it has on the economy and individuals. “Our activity and growing results amplify BBVA’s positive impact on society,” the BBVA Chair stressed, following a great year in which the bank put the final touch on a successful strategic cycle that began in 2019.

This notable increase in BBVA’s tax contributions is not an isolated event; it reflects continuous growth in recent years.

Among BBVA's own taxes, corporate income taxes stand out, reaching €5.25 billion overall in 2024, representing over 60 percent of the total. Dividing this payment by the BBVA Group’s pre-tax profit in 2024, €15.41 billion, results in a cash tax rate of 34.07 percent.

The next most significant tax contributions are those related to employees (Social Security contributions), representing 11.66 percent of the total, followed by the value added tax (VAT), with 11.05 percent. Other taxes, which represented 15.28 percent in 2024 (10.21 percent in 2023), grew sharply over the year (up 65 percent compared to 2023). These taxes include the levies on the financial sector specifically, such as the levy on banking and the tax on deposits in credit institutions in Spain, which amounted to €511 million in 2024.

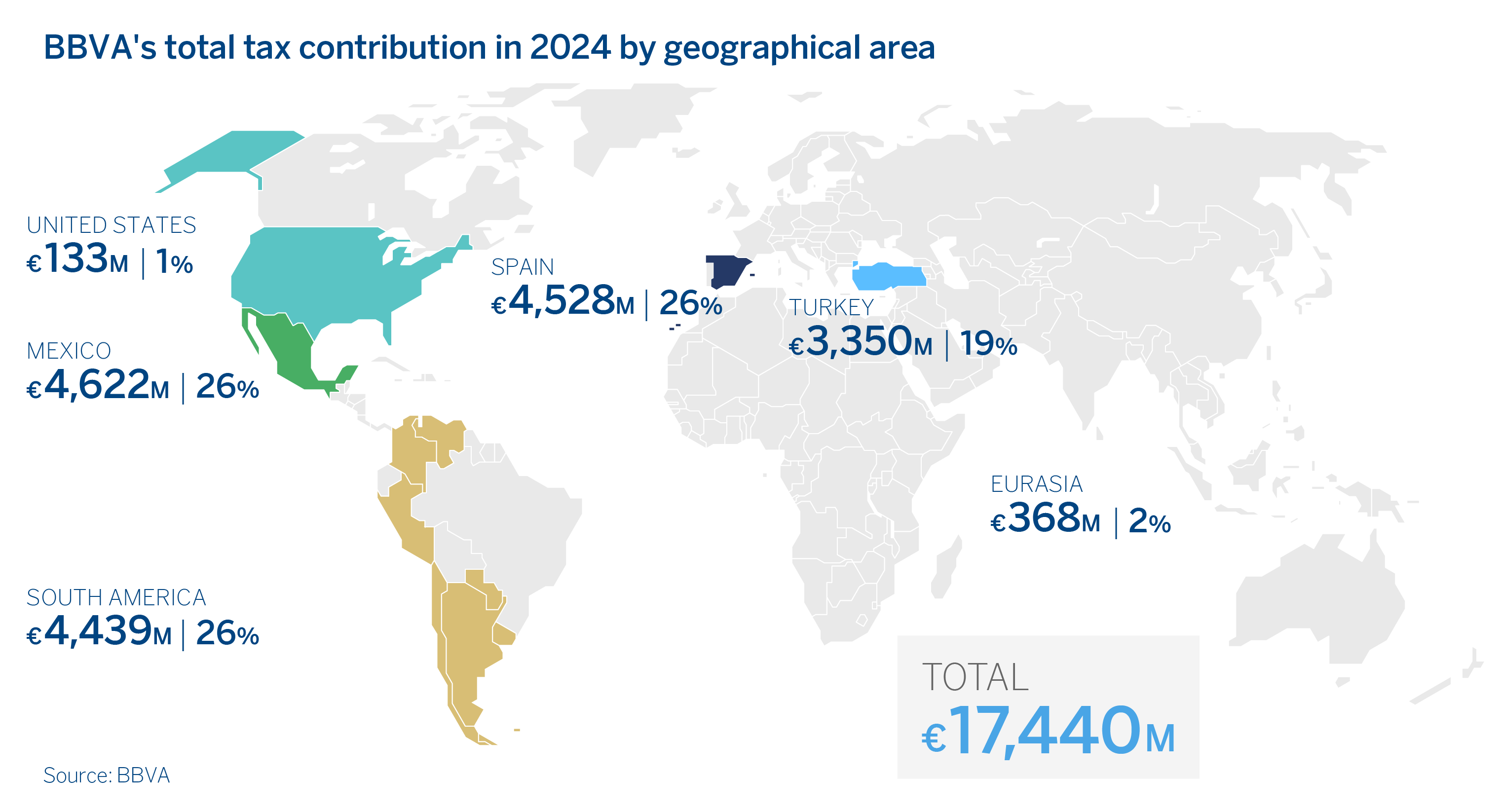

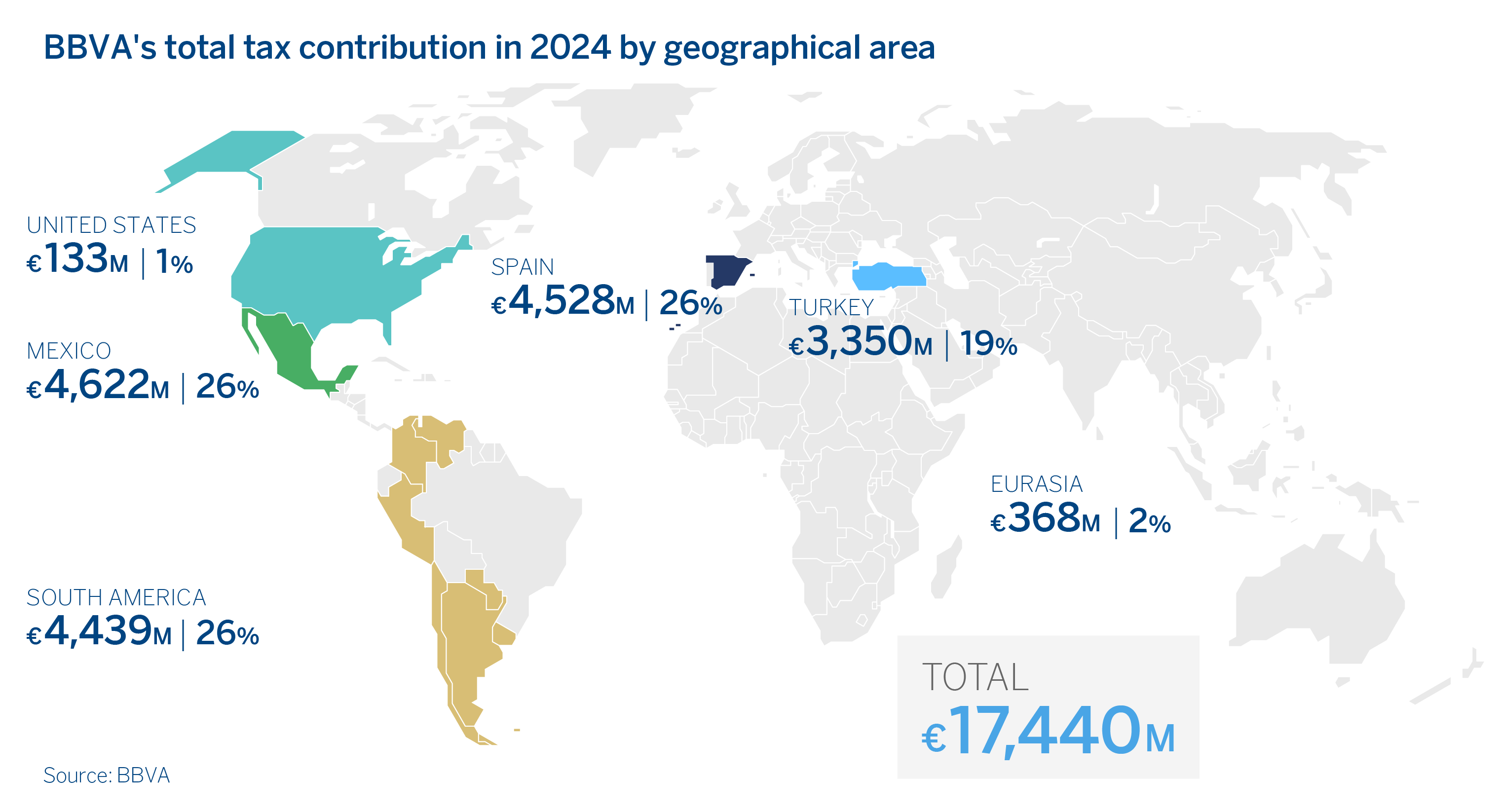

By country, taking into account both own and third party taxes, Mexico is the country with the greatest tax contributions, with €4.62 billion, closely followed by Spain and South America, with €4.53 billion and €4.44 billion, respectively (each representing 26 percent of the total). BBVA tax contributions reached €3.35 billion in Turkey (19 percent of the total), €368 million in the rest of Eurasia (two percent) and €133 million in the U.S.

Transparency and fiscal responsibility

BBVA was the first Ibex 35 company to publish its total tax contributions voluntarily 13 years ago, based on the methodology developed by PwC. It relies on the metrics and disclosures proposed by the Global Reporting Initiative (GRI 207).

The bank’s commitment to transparency once again received the recognition in 2024 by institutions like Fundación Haz, which distinguished BBVA with its t*** seal of transparency (the highest category), and the Dutch Association of Investors for Sustainable Development (VBDO), which again named BBVA the most transparent financial institution in terms of taxation.

Aware of the impact of its decisions on the sustainable development of the countries where it operates, BBVA is firmly committed to paying taxes and complying with the rest of its tax obligations. In this regard, BBVA abides by the highest international standards, such as those derived from the Base Erosion and Profit Shifting Project (BEPS) and Chapter 11 of the OECD Guidelines for Multinational Enterprises.

Furthermore, since 2023 the Group’s Fiscal Strategy has incorporated environmental, social and good governance (ESG) criteria into its fiscal decision-making, and reinforced its governance, supervision and tax control model. In fact, BBVA was the first financial institution to receive AENOR certification, which certifies that its model complies with the UNE 19-602 standards.